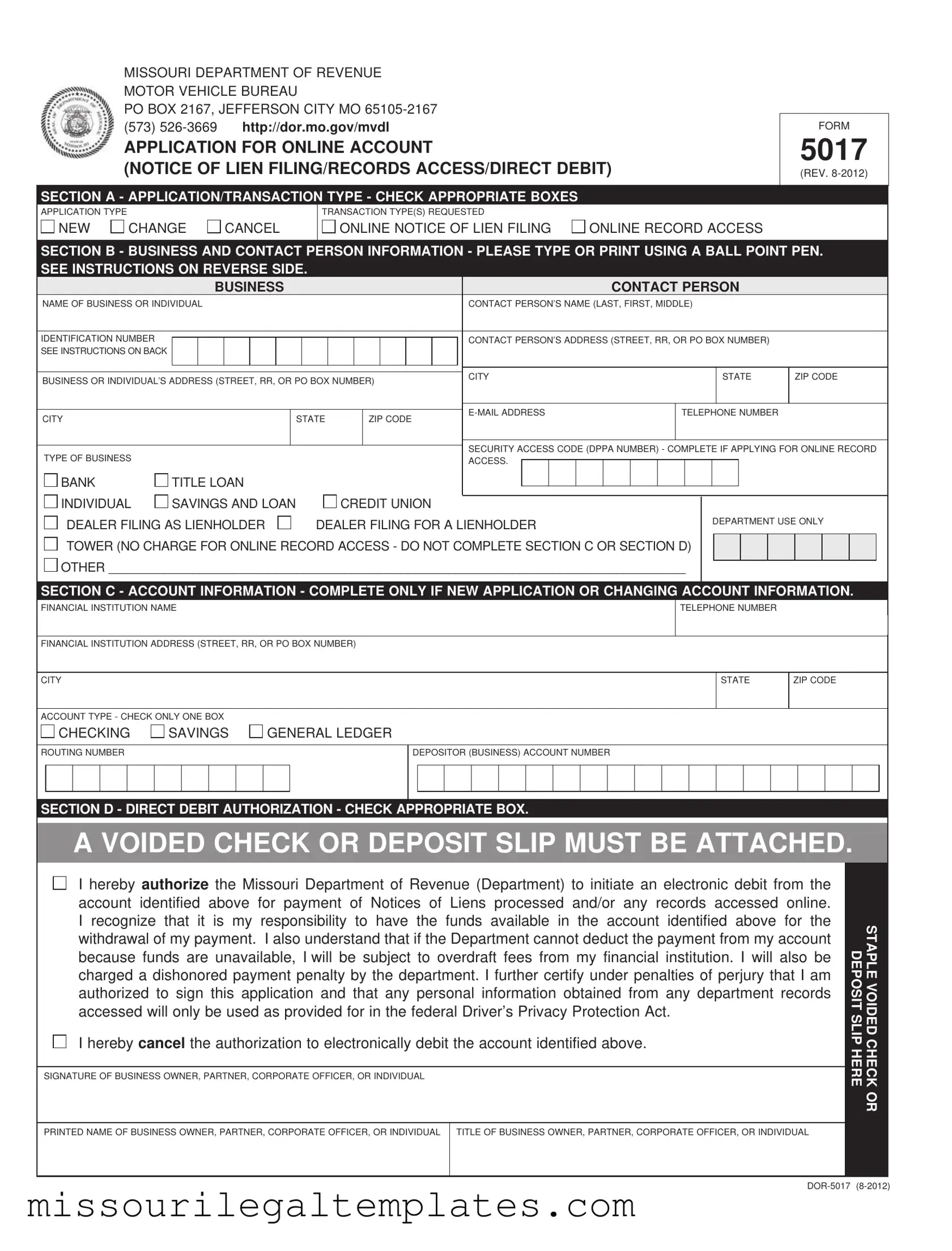

Fill in a Valid 5017 Missouri Template

The 5017 Missouri form, officially titled the Application for Online Account (Notice of Lien Filing/Records Access/Direct Debit), is an essential document for individuals and businesses seeking to manage lien filings and access motor vehicle records online. This form serves multiple purposes, including the initiation of a new account, changes to existing account information, or the cancellation of a debit authorization. It is divided into several sections, each designed to collect specific information. Section A focuses on the type of application and transaction requested, allowing users to indicate whether they are applying for a new account, making changes, or cancelling an existing authorization. Section B requires detailed business and contact information, ensuring that the Missouri Department of Revenue can effectively communicate with the applicant. For those applying for online record access, a security access code is necessary, which is issued under the Driver’s Privacy Protection Act. Sections C and D pertain to account information and direct debit authorization, respectively, requiring details about the financial institution and the applicant's account. The completion of this form is crucial for facilitating efficient transactions and maintaining compliance with state regulations.

5017 Missouri Preview

MISSOURI DEPARTMENT OF REVENUE

MOTOR VEHICLE BUREAU

PO BOX 2167, JEFFERSON CITY MO

(573)

APPLICATION FOR ONLINE ACCOUNT

(NOTICE OF LIEN FILING/RECORDS ACCESS/DIRECT DEBIT)

SECTION A - APPLICATION/TRANSACTION TYPE - CHECK APPROPRIATE BOXES

FORM

5017

(REV.

APPLICATION TYPE |

|

|

NEW |

CHANGE |

CANCEL |

TRANSACTION TYPE(S) REQUESTED |

|

ONLINE NOTICE OF LIEN FILING |

ONLINE RECORD ACCESS |

SECTION B - BUSINESS AND CONTACT PERSON INFORMATION - PLEASE TYPE OR PRINT USING A BALL POINT PEN.

SEE INSTRUCTIONS ON REVERSE SIDE.

|

|

BUSINESS |

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT PERSON |

|

|

|

|

|

|||||||||||||

NAME OF BUSINESS OR INDIVIDUAL |

|

|

|

|

|

|

|

|

CONTACT PERSON’S NAME (LAST, FIRST, MIDDLE) |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT PERSON’S ADDRESS (STREET, RR, OR PO BOX NUMBER) |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

SEE INSTRUCTIONS ON BACK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS OR INDIVIDUAL’S ADDRESS (STREET, RR, OR PO BOX NUMBER) |

CITY |

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

TELEPHONE NUMBER |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECURITY ACCESS CODE (DPPA NUMBER) - COMPLETE IF APPLYING FOR ONLINE RECORD |

||||||||||||||||||

TYPE OF BUSINESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCESS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK |

TITLE LOAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

INDIVIDUAL |

SAVINGS AND LOAN |

|

|

CREDIT UNION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

DEALER FILING AS LIENHOLDER |

|

DEALER FILING FOR A LIENHOLDER |

|

|

|

|

|

|

|

|

|

DEPARTMENT USE ONLY |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

TOWER (NO CHARGE FOR ONLINE RECORD ACCESS - DO NOT COMPLETE SECTION C OR SECTION D) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

OTHER ___________________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION C - ACCOUNT INFORMATION - COMPLETE ONLY IF NEW APPLICATION OR CHANGING ACCOUNT INFORMATION.

FINANCIAL INSTITUTION NAME

TELEPHONE NUMBER

( )

FINANCIAL INSTITUTION ADDRESS (STREET, RR, OR PO BOX NUMBER)

CITY

STATE

ZIP CODE

ACCOUNT TYPE - CHECK ONLY ONE BOX |

|

|

CHECKING |

SAVINGS |

GENERAL LEDGER |

ROUTING NUMBER

DEPOSITOR (BUSINESS) ACCOUNT NUMBER

SECTION D - DIRECT DEBIT AUTHORIZATION - CHECK APPROPRIATE BOX.

A VOIDED CHECK OR DEPOSIT SLIP MUST BE ATTACHED.

I hereby authorize the Missouri Department of Revenue (Department) to initiate an electronic debit from the account identified above for payment of Notices of Liens processed and/or any records accessed online. I recognize that it is my responsibility to have the funds available in the account identified above for the withdrawal of my payment. I also understand that if the Department cannot deduct the payment from my account because funds are unavailable, I will be subject to overdraft fees from my financial institution. I will also be charged a dishonored payment penalty by the department. I further certify under penalties of perjury that I am authorized to sign this application and that any personal information obtained from any department records accessed will only be used as provided for in the federal Driver’s Privacy Protection Act.

I hereby cancel the authorization to electronically debit the account identified above.

SIGNATURE OF BUSINESS OWNER, PARTNER, CORPORATE OFFICER, OR INDIVIDUAL

PRINTED NAME OF BUSINESS OWNER, PARTNER, CORPORATE OFFICER, OR INDIVIDUAL TITLE OF BUSINESS OWNER, PARTNER, CORPORATE OFFICER, OR INDIVIDUAL

STAPLE VOIDED CHECK OR DEPOSIT SLIP HERE

PLEASE READ THIS INFORMATION CAREFULLY

COMPLETION INSTRUCTIONS

1.To apply for an online account to file Notices of Lien and/or access motor vehicle and marine records and have the payment for such transactions direct debited, complete this form as follows:

General Instructions

•Complete Sections A, B, C, and D if you are enrolling for the first time,

•If you are cancelling your debit authorization, complete Sections A, B, and D only.

Section A - Application/Transaction Type

•Application Type - Check the appropriate box.

1.New - Complete for new enrollment or

2.Change - Complete to change type of account, financial institution or branch routing number, depositor (business) account number, or other information.

3.Cancel - Complete to cancel your debit authorization.

•Transaction Type(s) Requested - Check the appropriate box(es).

Section B - Business and Contact Person Information

•Complete all blocks for both the business or individual and contact person information.

•Security Access Code - This code is issued by the Motor Vehicle Bureau to entities who qualify under the Driver’s Privacy Protection Act to receive personal information contained in the department’s vehicle and marine records. If you indicate you would like online record access in Section A - Transaction Type(s) Requested, you must enter the Security Access Code. If you do not have a Security Access Code, you may apply by completing a Request for MV/DL Record(s)/Security Access Code

•Identification Number - Please record the FDIC number (bank), NCUA number (credit union), Dealer number (licensed motor vehicle/boat dealer), FEIN (any other type of business), or SSN (individual) as the identification number. The last six blocks are for Department of Revenue use only.

•Type of Business - Check the appropriate box.

Section C - Account Information

•Financial Institution Information - Record the financial institution’s name, telephone number, address, city, state, and zip code.

•Account Type - Check the appropriate box.

•Routing Number - Your financial institution’s routing number is printed on the bottom

•Depositor (Business) Account Number - Your depositor account number is printed on the bottom of your business or personal

checks following the routing number. It may be the first series of digits after the routing number followed by the check number

(example 1), or it may be the series of digits which follow the check number (example 2). NOTE: Check number is not included in the depositor account number.

|

Example 1 |

|

|

|

Example 2 |

|

|

|

|

XYZ BUSINESS |

|

CHECK NO. 4444 |

|

XYZ BUSINESS |

|

CHECK NO. |

|

|

HOMETOWN, USA |

|

|

HOMETOWN, USA |

|

|

|

|

|

PAY TO THE ORDER OF ___________________________________ |

|

PAY TO THE ORDER OF ___________________________________ |

|

||||

|

121456789 |

8765432109812 |

4444 |

|

R121456789 |

4444 |

8765432109812 |

|

|

|

|

|

|

|

|

|

|

|

Routing No. |

Dep. Acct. No. |

Ck. No. |

|

Routing No. |

Ck. No. |

Dep. Acct. No. |

|

|

|

|

|

|

|

|

|

|

NOTE: Credit unions and savings and loan associations may differ from the above examples. Please verify your depositor account number and electronic routing number with your financial institution.

Section D - Direct Debit Authorization

•Check appropriate box. Attach a voided business or personal check or deposit slip to the front

2.Submit the completed application to the following address:

MOTOR VEHICLE BUREAU

PO BOX 2167

JEFFERSON CITY MO

CHANGE FINANCIAL INSTITUTION OR DEPOSITOR ACCOUNT INFORMATION

Debits (withdrawals) will continue to be made from the designated account at your financial institution until the Missouri Department of Revenue is notified that you wish to redesignate your account and/or financial institution. To redesignate, complete and submit a new Application for Online Account (Notice of Lien Filing/Records Access/Direct Debit) with the new information.

Common PDF Templates

Missouri Farm Tax Exemption Requirements - Ensure that the description of the project is detailed for clarity and verification purposes.

For those navigating the application process, it's important to utilize resources that provide clarity on the California DMV DL 44 form requirements. One such resource can be found at smarttemplates.net, which offers helpful templates and guidelines to ensure that all necessary information is filled out correctly, thus streamlining the procedure for obtaining or renewing a driver's license or identification card.

Why Sign Hipaa Privacy Form - This form authorizes healthcare providers to share your medical information.

Dos and Don'ts

When filling out the 5017 Missouri form, follow these guidelines to ensure a smooth process.

- Do complete all required sections clearly and accurately.

- Do provide a valid identification number relevant to your business type.

- Do attach a voided check or deposit slip as required for direct debit authorization.

- Do check the appropriate boxes for application and transaction types.

- Do submit the completed form to the correct address: Motor Vehicle Bureau, PO Box 2167, Jefferson City, MO 65105-2167.

- Don't leave any sections blank; incomplete forms may delay processing.

- Don't use a pencil; fill out the form using a ballpoint pen only.

- Don't forget to verify your financial institution's routing and account numbers.

- Don't submit the form without the required attachments.

- Don't ignore the instructions on the reverse side of the form; they contain important information.

Key takeaways

When filling out and using the 5017 Missouri form, consider the following key takeaways:

- Application Type: Select the correct application type—new, change, or cancel—based on your specific needs.

- Transaction Type: Indicate whether you are requesting online notice of lien filing or online record access.

- Accurate Information: Ensure that all business and contact person information is complete and accurate to avoid delays.

- Security Access Code: If you require online record access, include your Security Access Code, which is essential for accessing personal information.

- Account Information: Provide detailed information about your financial institution, including the routing number and depositor account number.

- Direct Debit Authorization: Attach a voided check or deposit slip to authorize direct debit payments for any fees associated with lien filings or record access.

- Submission: Send the completed application to the specified address to ensure it is processed efficiently.

Misconceptions

Understanding the 5017 Missouri form can be challenging, especially with the many misconceptions that surround it. Here are nine common misunderstandings, along with clarifications to help clear the air.

- Only businesses can apply using the 5017 form. Many individuals can also use this form, especially if they are applying for lien filing or accessing vehicle records.

- The form is only for new applications. In reality, the 5017 form can be used for changes to existing accounts or to cancel debit authorizations as well.

- You do not need a security access code. This code is essential for those who want to access personal information in vehicle and marine records. Without it, the application cannot be processed for online access.

- Filling out the form is optional for lienholders. Lienholders must complete the 5017 form to ensure their lien filings are processed correctly and to maintain access to necessary records.

- There is no need to attach a voided check. A voided check or deposit slip is required to verify account information when setting up direct debit. This step is crucial for accurate processing.

- All sections of the form must be completed every time. If you are only changing specific information, you may only need to fill out the relevant sections, not the entire form.

- Once submitted, the application cannot be changed. You can submit a new application at any time if you need to update your information or change your account.

- Direct debit is mandatory. While many choose this option for convenience, it is possible to apply without selecting direct debit if you prefer to manage payments differently.

- The 5017 form is only for lien filings. This form also allows access to motor vehicle and marine records, providing more functionality than just lien management.

By understanding these misconceptions, applicants can navigate the 5017 Missouri form with greater confidence and clarity.

Similar forms

- Form 1099: Similar to the 5017 Missouri form, the 1099 is used to report various types of income other than wages. Both forms require accurate information about the individual or business involved, ensuring proper documentation for tax purposes.

- Form W-2: Like the 5017, the W-2 is a tax form used to report wages paid to employees. Both forms help in tracking financial transactions and ensuring compliance with tax regulations.

- Form 1040: This is the standard individual income tax return form in the U.S. It shares a common purpose with the 5017 in that both require detailed information about financial activities for proper reporting and compliance.

- Texas Bill of Sale: This document is essential for the legal transfer of ownership of personal property and serves as proof of sale. For more information, visit topformsonline.com/texas-bill-of-sale.

- Form 4506: This form is used to request a copy of a tax return. Similar to the 5017, it involves accessing official records and requires personal identification information to ensure security and privacy.

- Form SS-4: This is an application for an Employer Identification Number (EIN). Like the 5017, it requires detailed business information and serves as an official request for access to government records.

- Form 8862: This form is used to claim the Earned Income Credit after a disallowance. Both the 5017 and 8862 require careful attention to detail and accurate reporting to ensure compliance with federal guidelines.