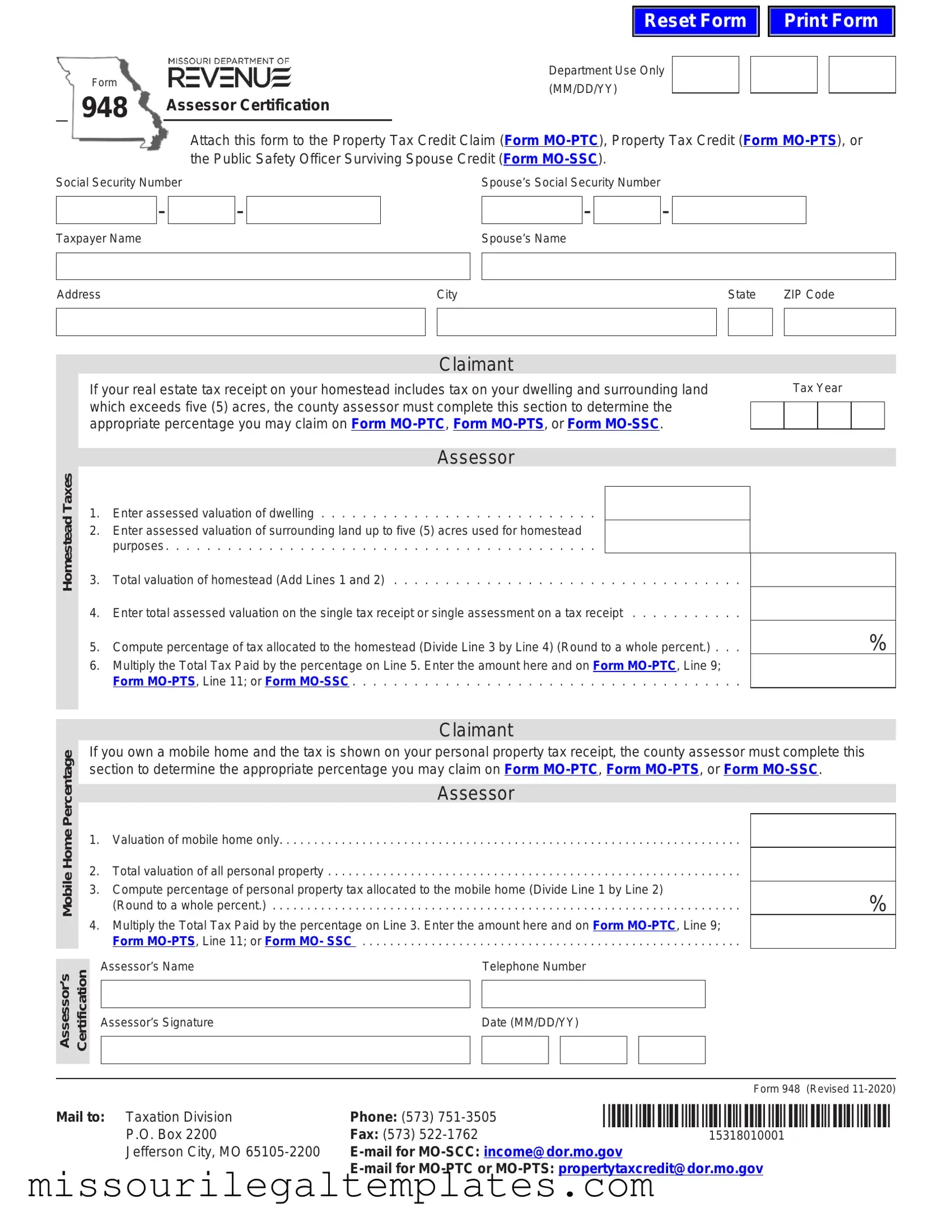

Fill in a Valid 948 Missouri Template

The 948 Missouri form plays a crucial role in helping residents claim property tax credits, particularly for those who own homesteads or mobile homes. This form is attached to several other important documents, such as Form MO-PTC, Form MO-PTS, and Form MO-SSC, all of which are designed to facilitate the Property Tax Credit and the Public Safety Officer Surviving Spouse Credit. When filling out the 948 form, claimants must provide personal information, including names and Social Security numbers for both themselves and their spouses. The form also requires the county assessor to certify the assessed valuations of the claimant's dwelling and surrounding land, ensuring that the tax credits are accurately calculated based on the property’s value. For those with mobile homes, the form includes specific sections to determine the appropriate percentage of property tax that can be claimed. By breaking down the assessed valuations and calculating the percentages, the 948 Missouri form ensures that residents receive the tax relief they are entitled to while adhering to state regulations. This structured approach helps to clarify the often-complex process of claiming property tax credits, making it more accessible for all eligible homeowners.

948 Missouri Preview

Reset Form

Print Form

Form |

|

Department Use Only |

|

|

|

|

|

|

|

(MM/DD/YY) |

|

|

|

|

|

||

948 |

|

|

|

|

|

|

||

Assessor Certification |

||||||||

|

||||||||

|

|

|

|

|

|

|

|

|

|

Attach this form to the Property Tax Credit Claim (Form |

|||||||

|

the Public Safety Officer Surviving Spouse Credit (Form |

|||||||

Social Security Number

-

Taxpayer Name

-

Spouse’s Social Security Number

-

-

Spouse’s Name

AddressCityState ZIP Code

|

|

|

|

|

|

Claimant |

|

|

|

|

|

|

|

|

|

||

|

|

|

If your real estate tax receipt on your homestead includes tax on your dwelling and surrounding land |

|

Tax Year |

||||||||||||

|

|

|

which exceeds five (5) acres, the county assessor must complete this section to determine the |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

appropriate percentage you may claim on Form |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxes |

|

|

|

|

Assessor |

|

|

|

|

|

|

|

|

|

||

|

|

1. |

Enter assessed valuation of dwelling |

. |

. . |

. |

. 對 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||||||

|

Homestead |

|

|

|

|

|

|

|

|||||||||

|

|

2. |

Enter assessed valuation of surrounding land up to five (5) acres used for homestead |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

purposes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Total valuation of homestead (Add Lines 1 and 2) . . |

. |

. . . |

. |

. |

. . |

. |

. 對 |

|

|

|

|

|

|

|

|

|

4. |

Enter total assessed valuation on the single tax receipt or single assessment on a tax receipt |

|

|

|

|

|

||||||||

|

|

|

5. |

Compute percentage of tax allocated to the homestead (Divide Line 3 by Line 4) (Round to a whole percent.) . . |

% |

||||||||||||

|

|

|

6. |

Multiply the Total Tax Paid by the percentage on Line 5. Enter the amount here and on Form |

|

|

|

|

|

||||||||

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Claimant |

|

|

|

|

|

|

|

|

|

||

|

Percentage |

|

If you own a mobile home and the tax is shown on your personal property tax receipt, the county assessor must complete this |

||||||||||||||

|

|

section to determine the appropriate percentage you may claim on Form |

|||||||||||||||

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Assessor |

|

|

|

|

|

|

|

|

|

||

|

Home |

|

1. |

Valuation of mobile home only |

. |

. . . |

. |

. . |

對 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||

|

Mobile |

|

2. |

Total valuation of all personal property |

. |

. . . |

. |

. . |

. . |

. |

對 |

|

|

|

|

|

|

|

|

3. |

(Round to a whole percent.) |

. |

. . . |

. |

. 對 . |

. |

. |

. . . . . . . . . . . . . . |

% |

||||||

|

|

|

Compute percentage of personal property tax allocated to the mobile home (Divide Line 1 by Line 2) |

|

|

|

|

|

|||||||||

|

|

|

4. |

Multiply the Total Tax Paid by the percentage on Line 3. Enter the amount here and on Form |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Form |

. |

. . . |

. |

. . |

. |

. |

. . . 對 |

|

|

|

|

|

|

Assessor’s Certification

Assessor’s Name

Assessor’s Signature

Telephone Number

Date (MM/DD/YY)

|

|

Form 948 (Revised |

Mail to: Taxation Division |

Phone: (573) |

*15318010001* |

P.O. Box 2200 |

Fax: (573) |

15318010001 |

Jefferson City, MO |

||

|

||

Common PDF Templates

Missouri Real Estate Purchase Agreement - Casualty loss procedures are established if the property is damaged before closing.

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for recording the sale of items such as vehicles, furniture, and equipment. Using this document helps protect both the buyer and seller, ensuring that the transaction is clear and legally binding. For more information, you can visit topformsonline.com/texas-bill-of-sale/.

Jefferson City Dmv - This form reflects Missouri's commitment to updating and maintaining accurate records.

Missouri Personalized Plates - Less common configurations for personalized plates must still comply with the regulations set by the Department of Revenue.

Dos and Don'ts

When filling out the 948 Missouri form, it’s crucial to follow certain guidelines to ensure accuracy and compliance. Here are six essential dos and don’ts:

- Do provide accurate personal information, including your name and Social Security number.

- Do ensure the assessor completes the required sections for your homestead and mobile home.

- Do calculate the percentages carefully to avoid errors in your claim.

- Do review the entire form for completeness before submission.

- Don’t include taxes for land exceeding five acres on your homestead.

- Don’t forget to sign the form and include the date to validate your submission.

Adhering to these guidelines will help streamline the process and increase the likelihood of a successful claim.

Key takeaways

When filling out the 948 Missouri form, consider the following key takeaways:

- Understand the Purpose: The form is essential for claiming the Missouri Property Tax Credit and the Public Safety Officer Surviving Spouse Credit. It helps determine the percentage of tax you may claim based on your homestead or mobile home.

- Accurate Information is Crucial: Ensure that all personal information, including names and social security numbers, is entered correctly. Mistakes can lead to delays or denial of your claim.

- Follow Instructions for Assessors: The assessor must complete specific sections of the form. Provide them with the necessary information regarding your property to ensure accurate calculations of your tax credits.

- Know What Can Be Claimed: Only taxes paid on your homestead dwelling (up to five acres) or mobile home can be included. Be aware that taxes for larger properties or personal property like vehicles cannot be claimed.

Misconceptions

- Misconception 1: The 948 Missouri form is only for homeowners.

- Misconception 2: I can claim the entire amount of real estate tax I paid.

- Misconception 3: The assessor does not need to complete any sections for mobile homes.

- Misconception 4: I can include personal property tax from my car in my claim.

- Misconception 5: The assessor's calculations are optional.

- Misconception 6: I can submit the form without the assessor's signature.

This form is applicable not just to homeowners but also to mobile home owners. Both groups can claim property tax credits based on specific criteria outlined in the form.

You cannot claim the full amount. The credits are based only on the tax for your homestead dwelling, which is limited to five acres. Taxes paid on additional land or farms do not qualify.

That is incorrect. If you own a mobile home, the assessor must complete a section to determine the percentage of tax allocated specifically to your mobile home.

This is a misunderstanding. The Missouri Property Tax Credit and Public Safety Officer Surviving Spouse Credit cannot be based on personal property tax for vehicles. Only the tax related to your mobile home is considered.

They are not optional. The assessor's calculations are crucial for determining the correct percentage of tax that can be claimed, whether for a homestead or a mobile home.

You must have the assessor's certification and signature for your claim to be valid. This ensures that the information provided is accurate and verified.

Similar forms

- Form MO-PTC: This form is used for claiming the Property Tax Credit in Missouri. Similar to the 948 Missouri form, it requires information about the assessed value of the property and the taxes paid. Both forms aim to assist individuals in receiving tax credits based on property ownership.

- Florida Firearm Bill of Sale Form: For an accurate transfer of firearm ownership, be sure to utilize the required Florida firearm bill of sale documentation to protect both parties involved in the transaction.

- Form MO-PTS: This form is for the Property Tax System. Like the 948 Missouri form, it involves calculations regarding property taxes and assessed values. Both forms help taxpayers determine their eligibility for credits based on specific property assessments.

- Form MO-SSC: The Public Safety Officer Surviving Spouse Credit form is designed for the spouses of deceased public safety officers. It shares similarities with the 948 Missouri form by requiring details on property valuation and taxes paid, ensuring eligible spouses can access tax credits.

- Form 1040: The standard federal income tax form includes sections for reporting property taxes. While it serves a broader purpose, it also captures information about property ownership and taxes, similar to the 948 Missouri form, which focuses specifically on property tax credits in Missouri.