Blank Deed Template for Missouri

The Missouri Deed form plays a crucial role in the transfer of property ownership within the state, serving as a legal document that outlines the details of the transaction. This form includes essential information such as the names of the parties involved—the grantor and the grantee—as well as a clear description of the property being transferred. Additionally, it often specifies any conditions or restrictions that may apply to the property, ensuring that both parties have a clear understanding of their rights and responsibilities. The Missouri Deed form can take several variations, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes based on the nature of the transaction. It is important to ensure that the form is properly executed, which typically involves signatures from both the grantor and grantee, as well as notarization to validate the document. Understanding the key components and requirements of the Missouri Deed form is essential for anyone looking to navigate the complexities of real estate transactions in the state.

Missouri Deed Preview

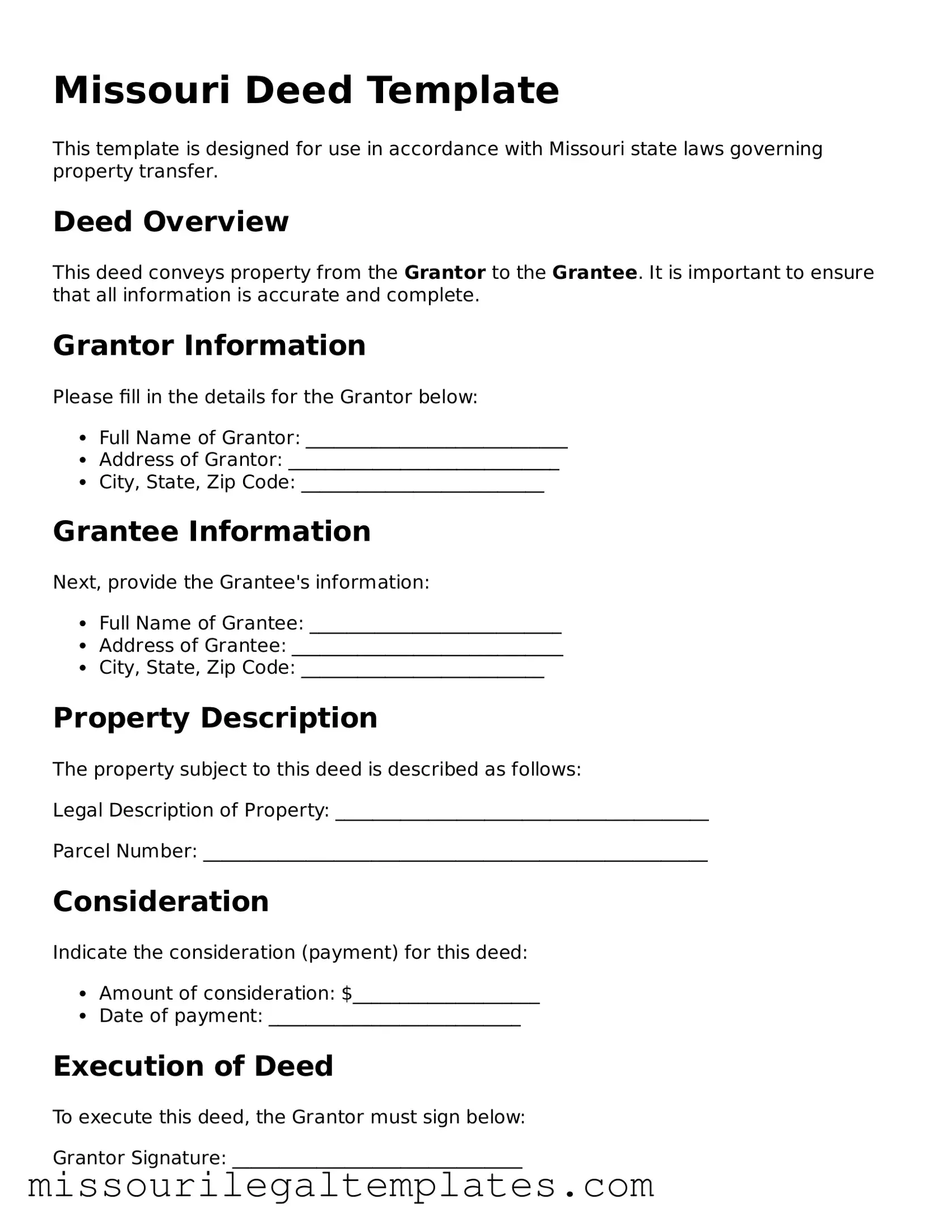

Missouri Deed Template

This template is designed for use in accordance with Missouri state laws governing property transfer.

Deed Overview

This deed conveys property from the Grantor to the Grantee. It is important to ensure that all information is accurate and complete.

Grantor Information

Please fill in the details for the Grantor below:

- Full Name of Grantor: ____________________________

- Address of Grantor: _____________________________

- City, State, Zip Code: __________________________

Grantee Information

Next, provide the Grantee's information:

- Full Name of Grantee: ___________________________

- Address of Grantee: _____________________________

- City, State, Zip Code: __________________________

Property Description

The property subject to this deed is described as follows:

Legal Description of Property: ________________________________________

Parcel Number: ______________________________________________________

Consideration

Indicate the consideration (payment) for this deed:

- Amount of consideration: $____________________

- Date of payment: ___________________________

Execution of Deed

To execute this deed, the Grantor must sign below:

Grantor Signature: _______________________________

Date Signed: ____________________________________

Witness Information

It is advisable to have a witness sign the deed:

Witness Signature: ________________________________

Date: ____________________________________________

Notary Acknowledgment

The following section is for notarization:

State of Missouri

County of ________________________

On this _____ day of __________, 20__, before me, a Notary Public, personally appeared _____________, known to me (or proved to me on the oath of __________) to be the person whose name is subscribed to the within instrument, and acknowledged to me that he (or she) executed the same.

Notary Public Signature: _________________________

My Commission Expires: _________________________

Other Missouri Templates

30 Day Notice to Vacate Missouri - The notice may provide a specific timeframe for the tenant to address any issues before eviction.

It is important to utilize a Texas Bill of Sale when conducting transactions involving personal property, as this document provides vital legal protection for both parties involved. For more information on how to properly create and execute this form, you can visit https://topformsonline.com/texas-bill-of-sale/.

Hold Harmless Waiver - The form can help foster trust between parties by clarifying expectations and responsibilities.

Dos and Don'ts

When filling out the Missouri Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do double-check the names of all parties involved. Ensure that they are spelled correctly and match official identification.

- Don't leave any required fields blank. Each section must be completed to avoid delays in processing.

- Do provide a clear and accurate legal description of the property. This information is crucial for identifying the property in question.

- Don't use abbreviations or shorthand when filling out the form. Clarity is essential for legal documents.

- Do sign the form in the presence of a notary public. This step is necessary to validate the document.

- Don't submit the form without reviewing it for errors. A thorough review can prevent complications later on.

Key takeaways

Filling out and using the Missouri Deed form requires attention to detail and an understanding of the process. Here are some key takeaways to keep in mind:

- Understand the Purpose: A deed serves as a legal document that transfers ownership of real property from one party to another. Knowing this helps clarify the importance of accuracy in the form.

- Gather Necessary Information: Before filling out the deed, collect all required information, including the names of the grantor (seller) and grantee (buyer), property description, and any relevant legal descriptions.

- Complete All Sections: Ensure that every section of the deed form is filled out completely. Incomplete forms can lead to delays or legal complications in the transfer process.

- Sign and Notarize: Both the grantor and grantee must sign the deed. Additionally, having the document notarized is essential for its validity, as it provides an official verification of the signatures.

- File with the County Recorder: After completing and notarizing the deed, it must be filed with the county recorder's office where the property is located. This step is crucial for making the transfer of ownership official.

By following these guidelines, individuals can navigate the process of using the Missouri Deed form more effectively, ensuring a smoother transaction and protecting their legal interests.

Misconceptions

Understanding the Missouri Deed form is crucial for anyone involved in real estate transactions. Here are six common misconceptions:

- All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds. Each has specific implications for ownership and liability.

- A deed must be notarized to be valid. While notarization is a common practice, not all deeds require it to be legally binding. Some deeds may be valid without a notary, depending on the circumstances and local laws.

- Filing a deed is optional. Some individuals think that they can simply hand over a deed without filing it. However, for a deed to be enforceable and to protect ownership rights, it must be properly filed with the county recorder’s office.

- All parties must be present to sign the deed. It is a misconception that all parties involved must be physically present to sign the deed. In many cases, signatures can be obtained separately, provided the necessary requirements are met.

- Once a deed is signed, it cannot be changed. Some believe that a deed is final and unchangeable once signed. However, deeds can be amended or revoked through legal processes, depending on the situation.

- Using a deed is only necessary for large transactions. Many think that deeds are only needed for significant real estate transactions. In fact, any transfer of property ownership, regardless of size, typically requires a deed to ensure proper documentation and legality.

Clearing up these misconceptions can help ensure a smoother real estate process in Missouri.

Similar forms

The Deed form is a vital document in real estate and legal transactions. It shares similarities with several other documents. Here’s a list of nine documents that are similar to the Deed form and an explanation of how they relate:

- Title Deed: Like the Deed form, a Title Deed transfers ownership of property. It serves as proof of ownership and includes details about the property and the parties involved.

- Bill of Sale: This document also transfers ownership but is typically used for personal property rather than real estate. Both documents require signatures and often need to be notarized.

- Lease Agreement: A Lease Agreement outlines the terms under which one party rents property from another. While it does not transfer ownership, it establishes rights and responsibilities similar to a Deed.

- Mortgage Agreement: This document secures a loan against real property. It complements the Deed by detailing the lender's rights in the event of default, much like how a Deed outlines ownership rights.

- Quitclaim Deed: A Quitclaim Deed transfers interest in property without guaranteeing that the title is clear. It is similar to a standard Deed but offers less protection to the buyer.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property. Like a Deed form, it is essential for confirming ownership and protecting the buyer's interests.

- Trust Deed: A Trust Deed involves three parties: the borrower, the lender, and the trustee. It secures a loan on real estate and functions similarly to a mortgage but with a different legal framework.

- Power of Attorney: This document grants one person the authority to act on another's behalf. While not a property transfer document, it can be used to execute a Deed, making it relevant in property transactions.

BBB Complaint Form: The BBB Complaint Form allows consumers to formally document grievances against businesses, ensuring that their concerns are addressed. For more information, visit OnlineLawDocs.com.

- Affidavit of Title: This document is a sworn statement confirming the seller's ownership and the absence of liens. It is often used alongside a Deed to assure the buyer of the seller's title.

Understanding these documents can help clarify the nuances of property transactions and ensure that all parties are aware of their rights and responsibilities.