Blank Durable Power of Attorney Template for Missouri

In the state of Missouri, the Durable Power of Attorney (DPOA) form serves as a vital legal document that empowers individuals to designate a trusted person to manage their financial and medical decisions in the event they become incapacitated. This form is not merely a precaution; it is a proactive measure that ensures that your wishes are honored when you cannot advocate for yourself. The DPOA can cover a wide range of responsibilities, from handling bank transactions and paying bills to making healthcare decisions. It is essential to understand that this document remains effective even if the principal becomes incapacitated, which distinguishes it from a standard power of attorney. Furthermore, the form allows the principal to specify the extent of authority granted to the agent, whether it be broad or limited. By carefully considering the selection of an agent and the powers bestowed upon them, individuals can create a tailored approach that reflects their personal values and preferences. In Missouri, the DPOA must be signed in the presence of a notary public or two witnesses to ensure its validity, thus adding a layer of security and formality to the process. Understanding the nuances of this form is crucial for anyone looking to safeguard their interests and ensure that their affairs are managed according to their wishes in times of need.

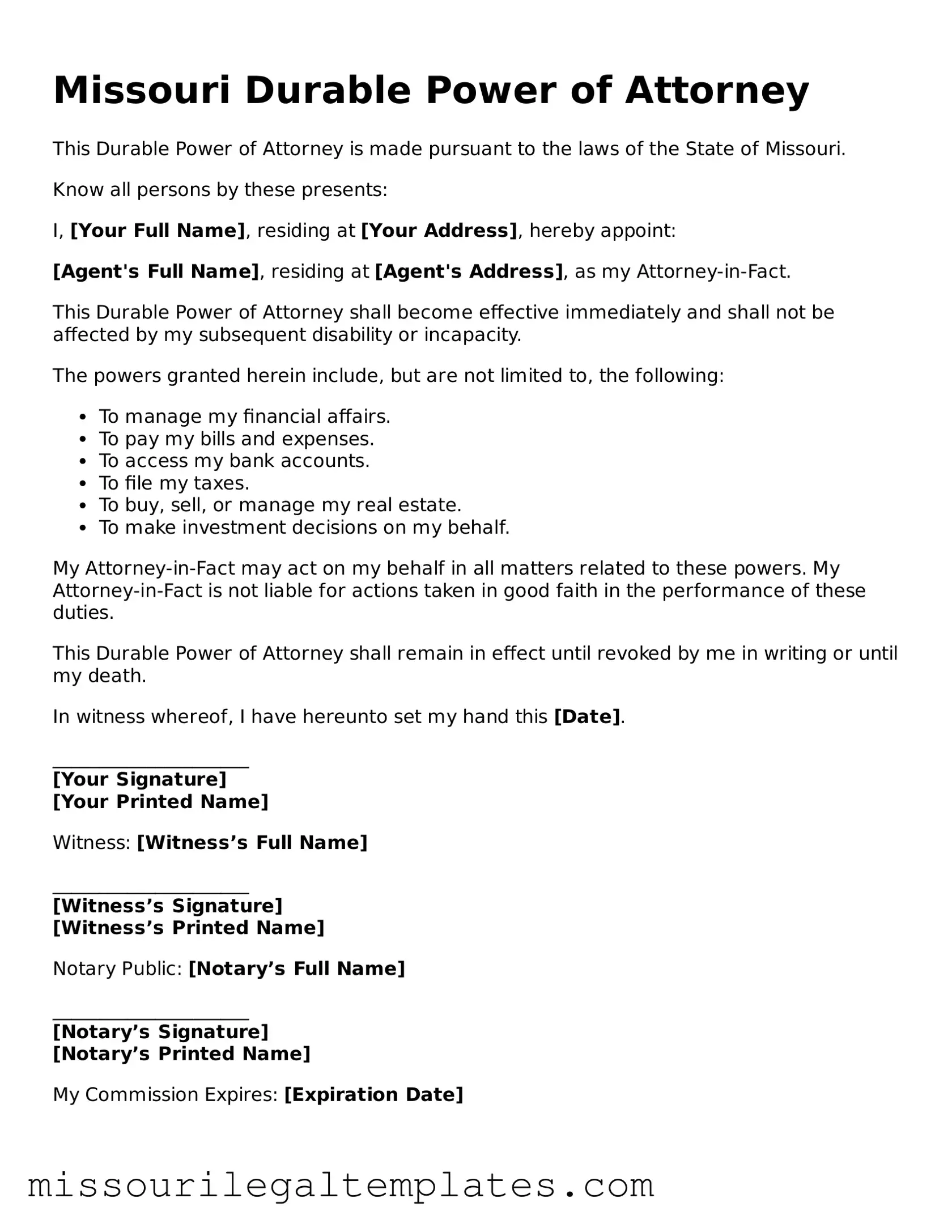

Missouri Durable Power of Attorney Preview

Missouri Durable Power of Attorney

This Durable Power of Attorney is made pursuant to the laws of the State of Missouri.

Know all persons by these presents:

I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address], as my Attorney-in-Fact.

This Durable Power of Attorney shall become effective immediately and shall not be affected by my subsequent disability or incapacity.

The powers granted herein include, but are not limited to, the following:

- To manage my financial affairs.

- To pay my bills and expenses.

- To access my bank accounts.

- To file my taxes.

- To buy, sell, or manage my real estate.

- To make investment decisions on my behalf.

My Attorney-in-Fact may act on my behalf in all matters related to these powers. My Attorney-in-Fact is not liable for actions taken in good faith in the performance of these duties.

This Durable Power of Attorney shall remain in effect until revoked by me in writing or until my death.

In witness whereof, I have hereunto set my hand this [Date].

_____________________

[Your Signature]

[Your Printed Name]

Witness: [Witness’s Full Name]

_____________________

[Witness’s Signature]

[Witness’s Printed Name]

Notary Public: [Notary’s Full Name]

_____________________

[Notary’s Signature]

[Notary’s Printed Name]

My Commission Expires: [Expiration Date]

Other Missouri Templates

How to Write a Will Missouri - This document represents your right to make decisions about your own medical treatment.

Promissory Note Template Missouri - This document can help preserve relationships by providing a clear repayment plan.

Dos and Don'ts

When filling out the Missouri Durable Power of Attorney form, it's essential to follow certain guidelines to ensure that the document is valid and meets your needs. Here’s a list of things to do and avoid:

- Do clearly identify the principal and the agent. Make sure their names and addresses are accurate.

- Do specify the powers granted to the agent. Be as detailed as possible about what decisions they can make.

- Do sign the document in the presence of a notary. This step is crucial for the form to be legally binding.

- Do keep a copy of the completed form for your records. This ensures you have access to it when needed.

- Don't leave any sections blank. Incomplete forms can lead to confusion or disputes later.

- Don't assign powers that you are not comfortable with. Consider what decisions you want your agent to make.

- Don't forget to review the form regularly. Changes in your situation may require updates to the document.

- Don't ignore state-specific requirements. Ensure you comply with Missouri laws regarding Durable Power of Attorney.

Key takeaways

- Understand the Purpose: A Durable Power of Attorney (DPOA) allows you to appoint someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and wishes. This person will have significant authority over your affairs.

- Be Specific: Clearly outline the powers you are granting to your agent. You can limit their authority or make it broad, depending on your needs.

- Consider Alternatives: If you have more than one person in mind, think about naming an alternate agent in case your first choice is unavailable.

- Sign and Date: Make sure to sign and date the DPOA form in the presence of a notary public. This step is crucial for the document’s validity.

- Notify Your Agent: After completing the form, inform your agent about their responsibilities and ensure they are willing to accept the role.

- Review Regularly: Periodically review your DPOA to ensure it still reflects your wishes. Life changes may require updates to the document.

- Keep Copies: Store the original document in a safe place and provide copies to your agent, family members, and any relevant institutions.

- Understand the Limitations: A DPOA typically ends upon your death, so it’s important to have other estate planning documents in place.

- Seek Legal Advice: If you have questions or concerns, consider consulting a legal professional to ensure your DPOA meets your needs and complies with Missouri law.

Misconceptions

Understanding the Missouri Durable Power of Attorney form is essential for anyone considering designating someone to make decisions on their behalf. However, several misconceptions often arise regarding this important legal document. Below are seven common misunderstandings, along with clarifications.

- It only applies to financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also encompass health care decisions, depending on how it is drafted.

- It becomes invalid upon the principal's incapacitation. A Durable Power of Attorney is specifically designed to remain effective even if the principal becomes incapacitated. This is a key feature that distinguishes it from a standard Power of Attorney.

- Any adult can be designated as an agent. While it is true that most adults can serve as agents, there are restrictions. For example, individuals who are not legally competent or those who have a conflict of interest may not be suitable choices.

- It must be notarized to be valid. Although notarization is highly recommended for a Durable Power of Attorney in Missouri, it is not a strict requirement. However, having it notarized can help prevent disputes about its validity.

- It can only be revoked in writing. While revoking a Durable Power of Attorney in writing is advisable, it can also be revoked verbally in certain situations. Nevertheless, written revocation provides clearer evidence of the intent.

- Once created, it cannot be changed. This is a common misconception. The principal has the right to modify or revoke the Durable Power of Attorney at any time, as long as they are competent to do so.

- It is the same as a Living Will. A Durable Power of Attorney and a Living Will serve different purposes. A Living Will outlines specific medical preferences, while a Durable Power of Attorney designates someone to make decisions on behalf of the principal.

By addressing these misconceptions, individuals can make more informed decisions regarding their Durable Power of Attorney and ensure their wishes are honored in times of need.

Similar forms

The Durable Power of Attorney (DPOA) is an important legal document that allows an individual to appoint someone else to make decisions on their behalf, especially in matters related to finances and healthcare. Several other documents share similarities with the DPOA, each serving specific purposes in the realm of legal representation and decision-making. Here are nine documents that are comparable to the Durable Power of Attorney:

- General Power of Attorney: Like the DPOA, this document grants authority to another person to act on your behalf. However, it typically becomes invalid if you become incapacitated, unlike the durable version.

- Healthcare Power of Attorney: This document specifically allows someone to make medical decisions for you if you are unable to do so. It focuses solely on healthcare matters.

- Living Will: While not a power of attorney, a living will outlines your wishes regarding medical treatment in situations where you cannot express your preferences. It complements the healthcare power of attorney.

- Advance Healthcare Directive: This combines a living will and a healthcare power of attorney. It provides instructions for medical care and designates someone to make decisions on your behalf.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specifies how they should be distributed after your death. It can serve a similar purpose in asset management as a DPOA.

- Financial Power of Attorney: This document focuses on financial matters, granting authority to someone to manage your financial affairs. It can be durable or non-durable, depending on your preferences.

- Guardianship or Conservatorship: If you become incapacitated and have not appointed a DPOA, a court may appoint a guardian or conservator to manage your affairs. This process can be more time-consuming and invasive.

- Property Management Agreement: This document allows a designated person to manage real estate or other property on your behalf. It is similar to a DPOA in that it grants authority over specific assets.

- Business Power of Attorney: For business owners, this document grants authority to someone to make business-related decisions on your behalf. It can be essential for ensuring continuity in business operations.

Each of these documents plays a vital role in ensuring that your wishes are respected and that your affairs are managed according to your preferences, especially in times of incapacity or unavailability.