Fill in a Valid Hotel Tax Exemption Missouri Template

The Hotel Tax Exemption Missouri form serves as a crucial tool for individuals and organizations seeking to navigate the complexities of hotel occupancy taxes. This certificate allows eligible guests to claim exemption from hotel taxes when traveling on official business for certain exempt entities. To utilize this form, hotel operators must verify the guest's affiliation with the exempt organization by requesting identification or documentation. Employees of exempt entities can pay for their stay using any payment method, while non-employees must ensure that the hotel is paid using the exempt entity's funds. The form includes sections for the name and address of the exempt organization, as well as a guest certification statement affirming the accuracy of the information provided. Various categories of exemptions are outlined, including those for federal agencies, state officials, charitable organizations, educational institutions, and religious entities. Notably, the form also addresses permanent resident exemptions for guests staying for 30 consecutive days. It is essential for hotels to maintain records of completed exemption certificates for four years, although the form itself does not need to be submitted to the Comptroller of Public Accounts. Understanding these details is vital for both guests and hotel operators to ensure compliance with state tax regulations.

Hotel Tax Exemption Missouri Preview

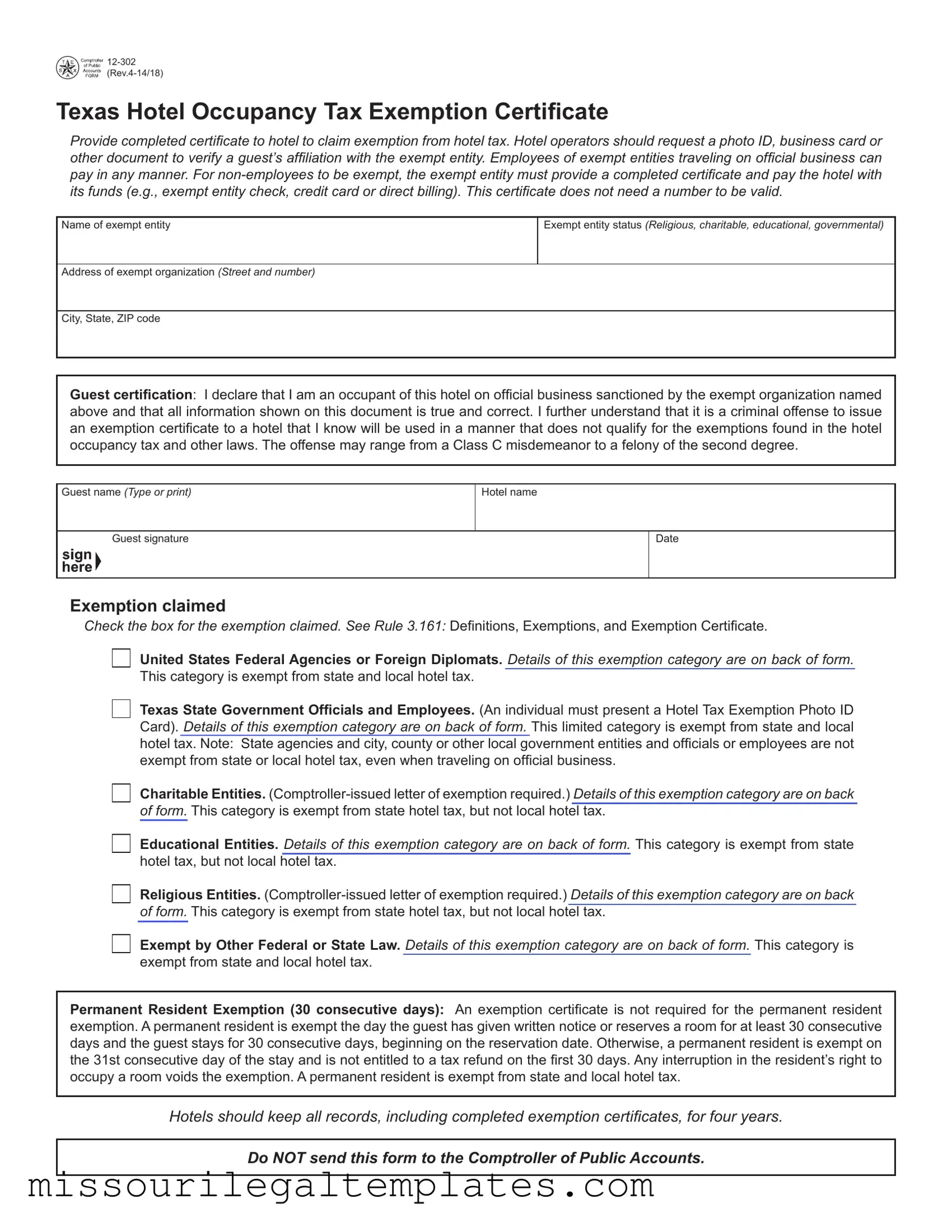

Texas Hotel Occupancy Tax Exemption Certificate

Provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo ID, business card or other document to verify a guest’s affiliation with the exempt entity. Employees of exempt entities traveling on official business can pay in any manner. For

Name of exempt entity

Exempt entity status (Religious, charitable, educational, governmental)

Address of exempt organization (Street and number)

City, State, ZIP code

Guest certification: I declare that I am an occupant of this hotel on official business sanctioned by the exempt organization named above and that all information shown on this document is true and correct. I further understand that it is a criminal offense to issue an exemption certificate to a hotel that I know will be used in a manner that does not qualify for the exemptions found in the hotel occupancy tax and other laws. The offense may range from a Class C misdemeanor to a felony of the second degree.

Guest name (Type or print)

Hotel name

Guest signature

Date

Exemption claimed

Check the box for the exemption claimed. See Rule 3.161: Definitions, Exemptions, and Exemption Certificate.

United States Federal Agencies or Foreign Diplomats. Details of this exemption category are on back of form. This category is exempt from state and local hotel tax.

Texas State Government Officials and Employees. (An individual must present a Hotel Tax Exemption Photo ID Card). Details of this exemption category are on back of form. This limited category is exempt from state and local hotel tax. Note: State agencies and city, county or other local government entities and officials or employees are not exempt from state or local hotel tax, even when traveling on official business.

Charitable Entities.

Educational Entities. Details of this exemption category are on back of form. This category is exempt from state hotel tax, but not local hotel tax.

Religious Entities.

Exempt by Other Federal or State Law. Details of this exemption category are on back of form. This category is exempt from state and local hotel tax.

Permanent Resident Exemption (30 consecutive days): An exemption certificate is not required for the permanent resident exemption. A permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive days and the guest stays for 30 consecutive days, beginning on the reservation date. Otherwise, a permanent resident is exempt on the 31st consecutive day of the stay and is not entitled to a tax refund on the first 30 days. Any interruption in the resident’s right to occupy a room voids the exemption. A permanent resident is exempt from state and local hotel tax.

Hotels should keep all records, including completed exemption certificates, for four years.

Do NOT send this form to the Comptroller of Public Accounts.

Form

Texas Hotel Occupancy Tax Exemptions

See Rule 3.161: Definitions, Exemptions, and Exemption Certificate for additional information.

United States Federal Agencies or Foreign Diplomats (exempt from state and local hotel tax)

This exemption category includes the following:

•the United States federal government, its agencies and departments, including branches of the military, federal credit unions, and their employees traveling on official business;

•rooms paid by vouchers issued by the American Red Cross and the Federal Emergency Management Agency; and

•foreign diplomats who present a Tax Exemption Card issued by the U.S. Department of State, unless the card specifically excludes hotel occupancy tax.

Federal government contractors are not exempt.

Texas State Government Officials and Employees (exempt from state and local hotel tax)

This exemption category includes only Texas state officials or employees who present a Hotel Tax Exemption Photo Identification Card. State employees without a Hotel Tax Exemption Photo Identification Card and Texas state agencies are not exempt. (The state employee must pay hotel tax, but their state agency can apply for a refund.)

Charitable Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes entities that have been issued a letter of tax exemption as a charitable organization and their employees traveling on official business. See website referenced below.

A charitable entity devotes all or substantially all of its activities to the alleviation of poverty, disease, pain and suffering by providing food, clothing, medicine, medical treatment, shelter or psychological counseling directly to indigent or similarly deserving members of society.

Not all 501(c)(3) or nonprofit organizations qualify under this category.

Educational Entities (exempt from state hotel tax, but not local hotel tax)

This exemption category includes

A letter of tax exemption from the Comptroller of Public Accounts as an educational organization is not required, but an educational organization might have one.

Religious Organizations (exempt from state hotel tax, but not local hotel tax)

This exemption category includes nonprofit churches and their guiding or governing bodies that have been issued a letter of tax exemption from the Comptroller of Public Accounts as a religious organization and their employees traveling on official business. See website referenced below.

Exempt by Other Federal or State Law (exempt from state and local hotel tax)

This exemption category includes the following:

•entities exempted by other federal law, such as federal land banks and federal land credit associations and their employees traveling on official business; and

•Texas entities exempted by other state law that have been issued a letter of tax exemption from the Comptroller of Public Accounts and their employees traveling on official business. See website referenced below. These entities include the following:

•nonprofit electric and telephone cooperatives,

•housing authorities,

•housing finance corporations,

•public facility corporations,

•health facilities development corporations,

•cultural education facilities finance corporations, and

•major sporting event local organizing committees.

For Exemption Information

A list of charitable, educational, religious and other organizations that have been issued a letter of exemption is online at www.window.state.tx.us/taxinfo/exempt/exempt_search.html. Other information about Texas tax exemptions, including applications, is online at www.window.state.tx.us/taxinfo/exempt/index.html. For questions about exemptions, call

Common PDF Templates

What Paperwork Do I Need to Sell My Car Privately in Missouri - Form 5092 can streamline the process of reporting sales for dealerships.

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for recording the sale of items such as vehicles, furniture, and equipment. Using this document helps protect both the buyer and seller, ensuring that the transaction is clear and legally binding. For more information, you can visit https://topformsonline.com/texas-bill-of-sale.

Laboratory Analysis Request Missouri - There are sections to describe evidence and whether it has been examined by another lab.

Dos and Don'ts

When filling out the Hotel Tax Exemption Missouri form, it is essential to follow certain guidelines to ensure the process is completed correctly. Below is a list of recommended actions and common pitfalls to avoid.

- Do provide accurate information about the exempt entity, including its name, status, and address.

- Do ensure the guest certifies their official business by signing the form and providing truthful information.

- Do check the appropriate exemption category that applies to the stay, as outlined on the form.

- Do present a photo ID or other documentation to verify the guest’s affiliation with the exempt entity.

- Do keep a copy of the completed form for your records, as hotels should retain these documents for four years.

- Don't forget to submit the form to the hotel operator, as it is required to claim the tax exemption.

- Don't assume all guests are exempt without verifying their affiliation with the exempt entity.

- Don't use the exemption certificate if the stay does not qualify under the specified exemptions.

- Don't send the form to the Comptroller of Public Accounts, as it is not necessary.

Key takeaways

When filling out and using the Hotel Tax Exemption Missouri form, keep the following key takeaways in mind:

- Complete the Certificate: Provide the completed certificate to the hotel to claim exemption from hotel tax.

- Verification Required: Hotel operators should request a photo ID or business card to verify the guest’s affiliation with the exempt entity.

- Payment Methods: Employees of exempt entities can pay in any manner. Non-employees must use the exempt entity’s funds for payment.

- No Number Needed: The exemption certificate does not need a number to be valid.

- Guest Certification: The guest must declare they are on official business and that the information is accurate.

- Understand Criminal Penalties: Issuing an exemption certificate falsely can lead to serious criminal charges.

- Types of Exemptions: Familiarize yourself with different exemption categories, such as federal agencies, state officials, and charitable organizations.

- Permanent Resident Exemption: No certificate is needed for permanent residents staying for 30 consecutive days.

- Record Keeping: Hotels should retain all records, including completed exemption certificates, for four years.

Do not send the form to the Comptroller of Public Accounts. For additional information, consult the relevant rules and guidelines.

Misconceptions

Understanding the Hotel Tax Exemption form in Missouri can be confusing. Here are five common misconceptions that can lead to misunderstandings:

- All travelers are exempt from hotel taxes. Many people believe that simply being on a business trip qualifies them for an exemption. However, only specific entities, such as government officials or recognized charitable organizations, qualify for tax exemptions. Individual travelers must meet certain criteria to be exempt.

- A photo ID is not necessary. Some assume that providing the exemption certificate is sufficient. In reality, hotel operators often require a photo ID or business card to verify the guest's affiliation with the exempt entity. This step is crucial to ensure compliance.

- Exemptions apply to both state and local hotel taxes. It's a common misconception that all exemptions apply universally. In fact, some exemptions, like those for charitable and educational entities, only apply to state hotel taxes and not local taxes. Travelers should be aware of this distinction.

- Only employees can claim exemptions. While employees of exempt entities can claim exemptions easily, non-employees must follow stricter guidelines. They need a completed certificate from the exempt entity and must pay using the entity's funds, such as a company check or credit card.

- Once exempt, travelers remain exempt indefinitely. Some believe that once they qualify for an exemption, they are always exempt. This is not the case. For example, permanent residents must stay for at least 30 consecutive days to qualify for an exemption. Any interruption in their stay voids this exemption.

By understanding these misconceptions, travelers can navigate the hotel tax exemption process more effectively and avoid unnecessary complications.

Similar forms

- Texas Hotel Occupancy Tax Exemption Certificate: Similar in purpose, this form allows guests to claim exemption from hotel tax in Texas. It requires verification of the exempt entity's status and is used primarily by employees on official business.

- California Hotel Tax Exemption Form: This document serves a similar function in California, allowing specific exempt organizations to avoid hotel taxes. It also requires proof of affiliation and details about the guest's official business.

- New York State Hotel Tax Exemption Certificate: Like the Missouri form, this certificate is used to exempt certain entities from hotel tax. It mandates the presentation of identification and a completed form to validate the exemption.

- Florida Hotel Tax Exemption Certificate: This form is utilized in Florida for exempt organizations, requiring similar documentation to substantiate the guest's affiliation and the nature of their travel.

- Illinois Hotel Tax Exemption Form: This form allows exempt entities to claim hotel tax exemptions in Illinois. It shares the same requirement for proof of the exempt status of the organization and the purpose of the visit.

- BBB Complaint Form: This standardized document enables consumers to lodge complaints about businesses efficiently while promoting resolution and accountability. For more information, visit OnlineLawDocs.com.

- Virginia Hotel Tax Exemption Certificate: This document functions similarly by allowing certain exempt groups to avoid hotel taxes. It requires a declaration of the official business and documentation supporting the exemption claim.