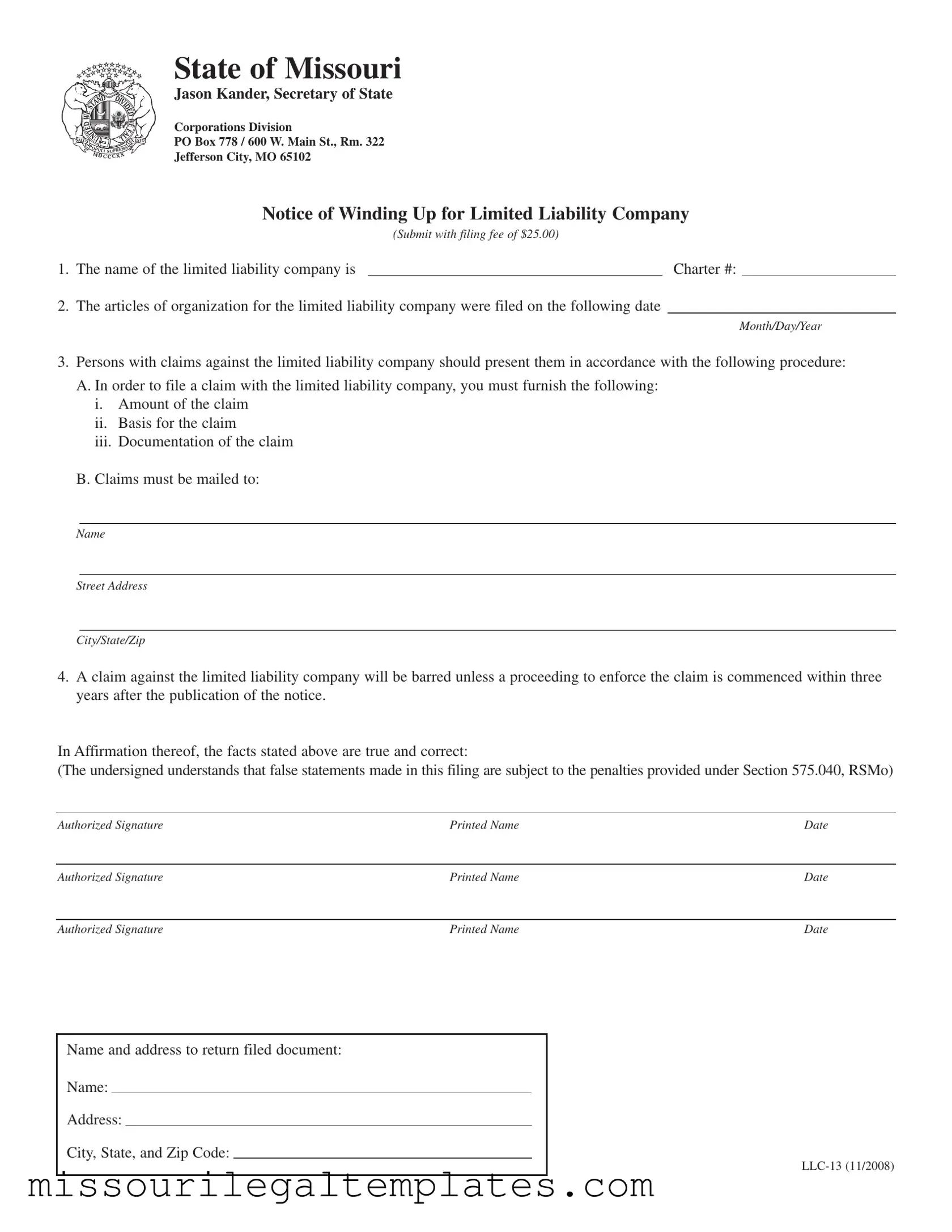

Fill in a Valid Llc 13 Missouri Template

The LLC 13 Missouri form serves as a crucial document for limited liability companies (LLCs) that are in the process of winding up their business affairs. This form must be submitted to the Missouri Secretary of State along with a filing fee of $25.00. It requires the LLC to provide its name and charter number, along with the date when its articles of organization were initially filed. Additionally, the form outlines the procedure for creditors to submit claims against the LLC, specifying that claims must include the amount, basis, and supporting documentation. Importantly, the form also highlights a three-year deadline for any claims to be enforced after the notice is published, ensuring that all parties are aware of their rights and responsibilities. The form must be signed by authorized individuals, affirming that the information provided is accurate and true. This filing is not just a formality; it plays a vital role in the orderly dissolution of the company, protecting both the LLC and its creditors during the winding-up process.

Llc 13 Missouri Preview

|

|

|

|

D |

DI |

|

|

|

|

N |

|

||

|

|

A |

|

V |

|

|

|

|

|

I |

|

||

|

S |

T |

|

|

D |

|

E |

|

|

|

E |

||

|

|

|

|

D |

||

W |

|

|

|

|

|

W |

D |

|

|

|

|

||

E |

|

|

|

E |

||

T |

|

|

A |

F |

||

|

I |

|

|

|

||

|

|

N |

|

L |

|

|

SALUS |

|

|

U |

|

L |

EX ESTO |

|

P O |

|

|

L |

||

|

P U L I |

A |

|

|||

|

|

|

SUPREM |

|

||

|

|

M D C C CXX |

|

|||

State of Missouri

Jason Kander, Secretary of State

Corporations Division

PO Box 778 / 600 W. Main St., Rm. 322

Jefferson City, MO 65102

Notice of Winding Up for Limited Liability Company

(Submit with filing fee of $25.00)

1. The name of the limited liability company is |

|

Charter #: |

2. The articles of organization for the limited liability company were filed on the following date

Month/Day/Year

3.Persons with claims against the limited liability company should present them in accordance with the following procedure:

A.In order to file a claim with the limited liability company, you must furnish the following:

i.Amount of the claim

ii.Basis for the claim

iii.Documentation of the claim

B.Claims must be mailed to:

Name

Street Address

City/State/Zip

4.A claim against the limited liability company will be barred unless a proceeding to enforce the claim is commenced within three years after the publication of the notice.

In Affirmation thereof, the facts stated above are true and correct:

(The undersigned understands that false statements made in this filing are subject to the penalties provided under Section 575.040, RSMo)

Authorized Signature |

Printed Name |

Date |

|

|

|

Authorized Signature |

Printed Name |

Date |

|

|

|

Authorized Signature |

Printed Name |

Date |

Name and address to return filed document:

Name:

Address:

City, State, and Zip Code:

Common PDF Templates

Judgment of Possession Form - It includes details such as the plaintiff and defendant's names, case number, and judgment amount.

Missouri Sales Tax Filing Frequency - Follow the instructions carefully to avoid penalties for incomplete filings.

Dos and Don'ts

When filling out the LLC 13 Missouri form, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure your submission is correct and timely.

- Do provide the complete name of the limited liability company as registered.

- Do include the correct Charter number for your LLC.

- Do specify the date the articles of organization were filed.

- Do clearly outline the procedure for filing claims against the LLC.

- Do ensure all claims include the amount, basis, and documentation.

- Do sign and date the form where indicated.

- Do provide the name and address for returning the filed document.

- Don't leave any sections of the form blank; complete all required fields.

- Don't forget to include the $25 filing fee with your submission.

- Don't submit false information; this can lead to penalties.

By adhering to these guidelines, you can help ensure a smooth filing process for your LLC in Missouri.

Key takeaways

When filling out and using the LLC 13 Missouri form, it is essential to pay attention to several key details. Here are nine important takeaways:

- The form serves as a Notice of Winding Up for a limited liability company in Missouri.

- A filing fee of $25.00 is required when submitting the form.

- The first section requires you to provide the name of the limited liability company and its Charter Number.

- It is necessary to include the date when the articles of organization were filed.

- Claims against the limited liability company must be presented according to specific procedures outlined in the form.

- Documentation must accompany any claims, including the amount, basis, and relevant documentation.

- Claims must be sent to the designated name and address provided in the form.

- Be aware that a claim will be barred unless legal action is initiated within three years of the notice publication.

- All authorized signatures must be included, along with printed names and the date of signing.

Ensure that all information is accurate, as false statements can lead to penalties under Missouri law.

Misconceptions

When it comes to the LLC 13 Missouri form, there are several misconceptions that can lead to confusion. Here are nine common misunderstandings:

- Filing the form means the LLC is automatically dissolved. Many believe that submitting the LLC 13 form instantly dissolves the company. In reality, this form is a notice of winding up, which is a step in the dissolution process but not the final act.

- Anyone can file a claim against the LLC. Some think that any individual can file a claim without following specific procedures. However, claims must be presented according to the guidelines outlined in the form, including documentation and a clear basis for the claim.

- The filing fee is optional. There is a misconception that the $25.00 filing fee can be waived. This fee is mandatory for processing the LLC 13 form.

- Claims can be filed indefinitely. Many believe there is no time limit for filing claims against an LLC. In fact, claims must be enforced within three years of the notice publication date, or they will be barred.

- All claims will be honored. Some people think that submitting a claim guarantees it will be accepted. Each claim is evaluated based on its merit and adherence to the required documentation.

- Only the owner can file the LLC 13 form. There is a belief that only the LLC owner can submit this form. However, any authorized representative can file it, provided they have the necessary permissions.

- Filing this form is the same as filing for bankruptcy. Some individuals confuse the winding-up process with bankruptcy proceedings. They are distinct processes, and the LLC 13 form does not imply insolvency.

- The form does not need to be filed if the LLC has no debts. There is a misconception that if an LLC has no outstanding debts, the form is unnecessary. Regardless of the financial status, the LLC 13 must be filed to formally wind up the company.

- There is no need for multiple signatures. Some think that one signature is sufficient for the form. However, multiple authorized signatures may be required to validate the filing, depending on the LLC's structure.

Understanding these misconceptions can help ensure a smoother process when dealing with the LLC 13 Missouri form. Always verify the requirements and procedures to avoid complications.

Similar forms

- Articles of Organization: This document establishes the formation of a limited liability company (LLC). Similar to the LLC 13 form, it requires basic company information, including the name and registered agent. Both documents are essential for the legal recognition of an LLC in Missouri.

- Notice of Dissolution: This document is filed when an LLC is formally dissolving its operations. Like the LLC 13, it includes details about the company and outlines the procedure for settling claims against the company, ensuring transparency and compliance with state laws.

- Certificate of Good Standing: This document verifies that an LLC is compliant with state regulations. It is similar to the LLC 13 form in that both serve as official records regarding the status of the LLC, providing assurance to creditors and stakeholders about the company’s legal standing.

- Annual Report: This document provides updated information about the LLC, including its management and financial status. The LLC 13 form also requires updates regarding claims and operations, making both documents vital for maintaining an accurate and current record with the state.

- Claim Form: When individuals or entities have claims against an LLC, they must submit a claim form. This is akin to the requirements outlined in the LLC 13 form, which specifies the process for presenting claims against the LLC, ensuring that all claims are properly documented and addressed.