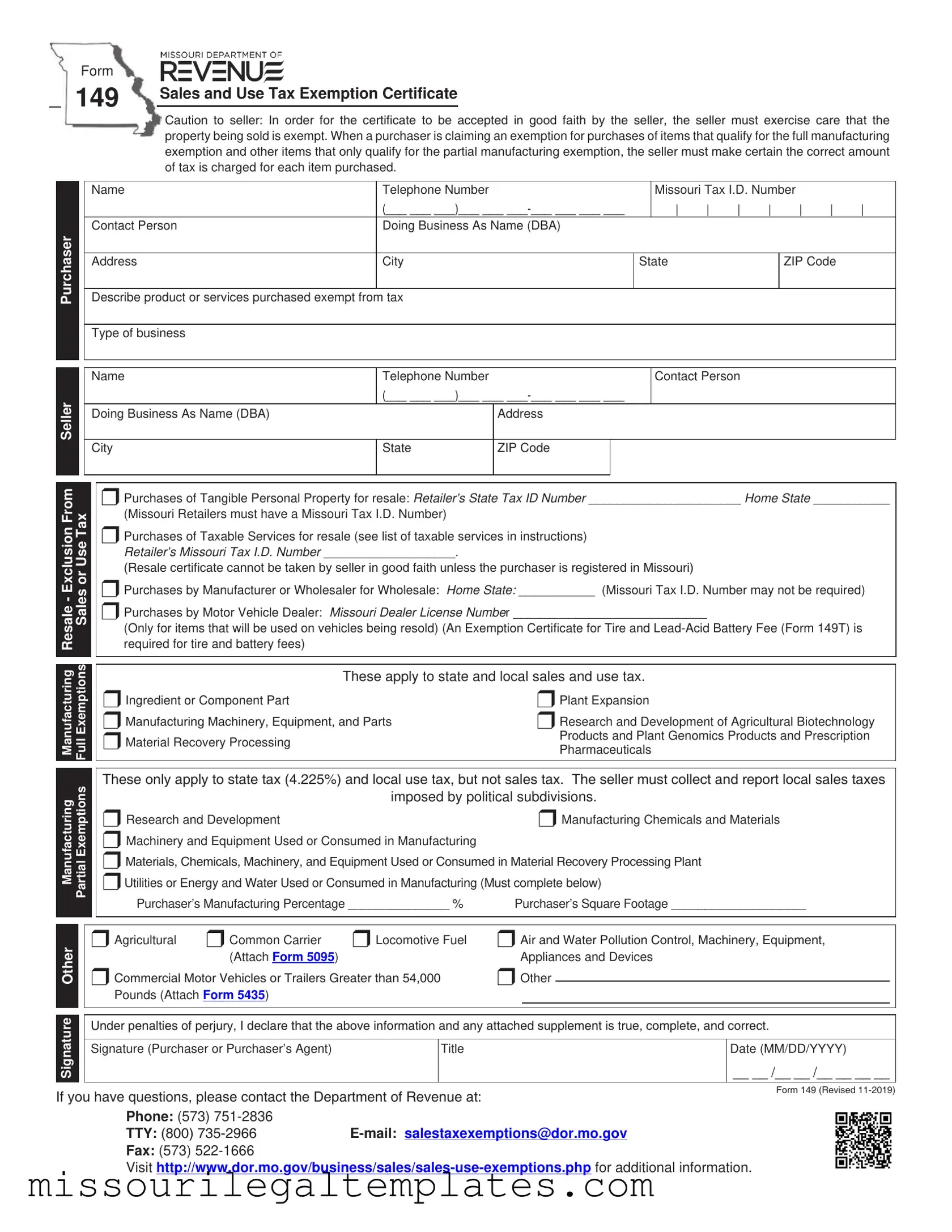

Fill in a Valid Missouri 149 Template

The Missouri 149 form, also known as the Sales and Use Tax Exemption Certificate, plays a crucial role in the purchasing process for various businesses and individuals in Missouri. This form allows purchasers to claim exemptions from sales and use tax for specific items and services, ensuring that they are not overcharged during transactions. It is essential for sellers to accept this certificate in good faith, which means they must verify that the items being sold indeed qualify for the stated exemption. The form covers a wide range of exemptions, including full and partial manufacturing exemptions, as well as specific categories like agricultural equipment, common carrier vehicles, and air and water pollution control devices. By clearly outlining the required information—such as the purchaser's contact details, tax identification numbers, and descriptions of the exempt products or services—the Missouri 149 form helps streamline the sales process while ensuring compliance with state tax regulations. Understanding the various exemptions available, along with the correct usage of the form, is vital for both purchasers and sellers to navigate Missouri's tax landscape effectively.

Missouri 149 Preview

Form

149 |

Sales and Use Tax Exemption Certificate |

|

Caution to seller: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the

property being sold is exempt. When a purchaser is claiming an exemption for purchases of items that qualify for the full manufacturing exemption and other items that only qualify for the partial manufacturing exemption, the seller must make certain the correct amount

|

|

|

|

|

|

of tax is charged for each item purchased. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Name |

|

|

Telephone Number |

|

|

|

|

|

|

Missouri Tax I.D. Number |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

(___ ___ ___)___ ___ |

|

|

| |

| |

| |

| |

|

| |

| |

| |

|

|||||

|

|

|

|

|

Contact Person |

|

|

Doing Business As Name (DBA) |

|

|

|

|

|

|

|

|

|

||||||||

|

Purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Address |

|

|

City |

|

|

|

|

State |

|

|

|

|

ZIP Code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Describe product or services purchased exempt from tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

Telephone Number |

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

||||

|

Seller |

|

|

|

|

|

|

|

(___ ___ ___)___ ___ |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Doing Business As Name (DBA) |

|

|

|

Address |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resale - Exclusion From |

|

|

|

|

r Purchases of Tangible Personal Property for resale: RETAILER’S STATE TAX ID NUMBER ______________________ HOME STATE ___________ |

|||||||||||||||||||

|

Sales or Use Tax |

|

(Missouri Retailers must have a Missouri Tax I.D. Number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

r Purchases of Taxable Services for resale (see list of taxable services in instructions) |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

RETAILER’S MISSOURI TAX I.D. NUMBER ___________________. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

(Resale certificate cannot be taken by seller in good faith unless the purchaser is registered in Missouri) |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

r Purchases by Manufacturer or Wholesaler for Wholesale: HOME STATE: ___________ (Missouri Tax I.D. Number may not be required) |

|||||||||||||||||||||||

|

|

r Purchases by Motor Vehicle Dealer: MISSOURI DEALER LICENSE NUMBEr ____________________________ |

|

|

|

|

|

|

|

||||||||||||||||

|

|

(Only for items that will be used on vehicles being resold) (An Exemption Certificate for Tire and |

|||||||||||||||||||||||

|

|

required for tire and battery fees) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

Full Exemptions |

|

|

|

These apply to state and local sales and use tax. |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

r Ingredient or Component Part |

|

|

|

|

r Plant Expansion |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

r Manufacturing Machinery, Equipment, and Parts |

|

r Research and Development of Agricultural Biotechnology |

|||||||||||||||||||||

|

|

r Material Recovery Processing |

|

|

|

|

|

Products and Plant Genomics Products and Prescription |

|||||||||||||||||

|

|

|

|

|

|

|

Pharmaceuticals |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Partial Exemptions |

|

These only apply to state tax (4.225%) and local use tax, but not sales tax. The seller must collect and report local sales taxes |

|||||||||||||||||||||

|

Manufacturing |

|

|

|

|

imposed by political subdivisions. |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

r Research and Development |

|

|

|

|

r Manufacturing Chemicals and Materials |

|

|

|

|

||||||||||||||

|

|

r Machinery and Equipment Used or Consumed in Manufacturing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

r Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

rUtilities or Energy and Water Used or Consumed in Manufacturing (Must complete below) |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Purchaser’s Manufacturing Percentage _______________ % |

Purchaser’s Square Footage ____________________ |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Other |

|

|

|

r Agricultural |

r Common Carrier |

r Locomotive Fuel |

r Air and Water Pollution Control, Machinery, Equipment, |

|

|

|

||||||||||||||

|

|

|

|

|

|

(Attach Form 5095) |

|

|

|

Appliances and Devices |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

r Commercial Motor Vehicles or Trailers Greater than 54,000 |

r Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Pounds (Attach Form 5435) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Signature |

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Signature (Purchaser or Purchaser’s Agent) |

|

|

Title |

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__ __ /__ __ /__ __ __ __ |

|

||||||

If you have questions, please contact the Department of Revenue at: |

Form 149 (Revised |

|

Phone: (573)

TTY: (800)

Fax: (573)

Visit

Sales or Use Tax

Manufacturing - Full Exemptions

Resale - Exclusion From

Manufacturing - Partial Exemptions

Other

Sales or Use Tax Exemption Certificate (Form 149) Instructions

Select the appropriate box for the type of exemption to be claimed and complete any additional information requested.

•Purchases of Tangible Personal Property for resale: Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax.

The purchaser’s state tax ID number can be found on the Missouri Retail License or out of state registration for retail sales.

•Purchases of Taxable Services for resale: Purchasers for resale must have a Missouri retail license in order to claim resale of taxable services in Missouri. A taxable service includes sales of restaurants, hotels, motels, places of amusement, recreation, entertainment, games and athletic events not at arms length, and sales of telecommunications and utilities (see Section 144.018, RSMo).

•Purchases by Manufacturer or Wholesaler for Wholesale: A Missouri Tax I.D. Number is not required to claim this exclusion.

•Purchaser’s Home State: Provide the state in which purchaser is located and registered.

•Purchases by Motor Vehicle Dealer: A motor vehicle dealer who is purchasing items for the repair of a vehicle being resold is exempt from sales or use tax. The dealer’s license is issued by the Missouri Motor Vehicle Bureau or by the out of state registration authority that issues such licenses.

Check the appropriate box for the type of exemption to be claimed. All items selected in this section are exempt from state and local sales and use

tax under Section 144.030, RSMo.

•Ingredient or Component Parts: This exemption includes materials, manufactured goods, machinery, and parts that become a part of the final product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Manufacturing Machinery, Equipment and Parts: This exemption includes only machinery and equipment and their parts that are used directly in manufacturing a product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

•Material Recovery Processing: This exemption includes machinery and equipment used to establish new or to replace existing material recovery processing plants. See Sections 144.030.2(5) and (32), RSMo, for a definition of, and exemptions for, material recovery processing.

•Plant Expansion: This exemption includes machinery, equipment, and parts and the materials and supplies solely required for installing or constructing the machinery and equipment, used to establish new or to expand existing Missouri manufacturing, mining, or fabricating plants. To qualify, the machinery must be used directly in manufacturing, mining or fabricating a product that is ultimately subject to sales or use tax, or its equivalent, in Missouri or other states.

•Research and Development of Agricultural Biotechnology Products and Plant Genomics Products and Prescription Pharmaceuticals: This exemption is specifically authorized in Section 144.030.2(34), RSMo, and exempts any tangible personal property used or consumed directly or exclusively in research and development of agricultural, biotechnology, and plant genomics products and prescription pharmaceuticals consumed by humans or animals.

Check the appropriate box for the type of exemption to be claimed according to Section 144.054, RSMo. All items in this section are exempt from state sales and use tax and local use tax, but are still subject to local sales tax. Section 144.054, RSMo, exempts electrical energy and gas (natural, artificial and propane), water, coal, energy sources, chemicals, machinery, equipment and materials used or consumed in manufacturing, processing, compounding, mining or producing any product. These same items are exempt if used or consumed in processing recovered materials. To qualify for this exemption, the item must be used or consumed and does not have the same requirement of direct use that is required in Section 144.030, RSMo. Additionally, the manufactured product is not required to be ultimately subject to tax.

•Research and Development: Check this box if the exemption is for the research and development related to manufacturing, processing, compounding or producing a product.

•Manufacturing Chemicals and Materials: Check this box if the exemption is for chemicals or materials used or consumed in manufacturing, processing, compounding or producing a product.

•Machinery and Equipment Used or Consumed in Manufacturing: Check this box if the exemption is for machinery or equipment used or consumed in manufacturing, processing, compounding or producing a product.

•Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant: Check this box if the exemption is for material recovery processing.

•Utilities or Energy and Water Used or Consumed in Manufacturing: If claiming utilities (electrical energy, gas or water), record account numbers, meter numbers, or other information as required by the vendor. All purchasers who are claiming an exemption for energy use must provide the amount of energy use which is related to manufacturing in the space provided and also select the method by which this percentage was obtained.

•Agricultural: Farm machinery and equipment are exempt from tax if used exclusively for agricultural purposes, used on land owned or leased for the purpose of producing farm products, and used directly in the production of farm products to be ultimately sold at retail. The sale of grains to be converted into foodstuffs or seed, and limestone, fertilizer, and herbicides used in connection with the growth or production of crops, livestock or poultry is exempt from tax. The sale of livestock, animals or poultry used for breeding or feeding purposes, feed for livestock or poultry, feed additives, medications or vaccines administered to livestock or poultry in the production of food or fiber, and sales of pesticides and herbicides used in the production of aquaculture, livestock or poultry are exempt from tax. All sales of fencing materials used for agricultural purposes and the purchase of motor fuel are exempt from tax.

•Common Carrier: Materials, replacement parts and equipment purchased for use directly upon, and for the repair and maintenance or manufacture of, motor vehicles, watercraft, railroad rolling stock or aircraft engaged as common carriers of persons or property. See Section 144.030.2(3), RSMo. Attach completed Form 5095.

•Locomotive Fuel: Fuel purchased for use in a locomotive that is a common carrier is exempt from sales and use tax.

•Air and Water Pollution Control Machinery, Equipment, Appliances and Devices: Machinery, equipment, appliances and devices purchased or leased and used solely for the purpose of preventing, abating or monitoring water and air pollution, and materials and supplies solely required for the installation, construction or reconstruction of such machinery, equipment, appliances and devices. See Sections 144.030.2(15) and (16), RSMo.

•Commercial Motor Vehicles or Trailers Greater Than 54,000 Pounds: Motor vehicles registered for and capable of pulling in excess of 54,000

pounds and their trailers actually used in the normal course of business to haul property on the public highways of the state are exempt from tax. The purchase of materials, replacement parts, and equipment used directly on, for the repair of and maintenance or manufacture of these vehicles is also exempt. See Section 144.030.2(4), RSMo.

•Other: Exemptions not listed on this sheet, but are provided by statute. Provide explanation of exemption being claimed. See Chapter 144 of the Missouri Revised Statutes for exemption http://www.moga.mo.gov/mostatutes/statutesAna.html#T10.

Form 149 (Revised

Common PDF Templates

Missouri Baptist University Rl007 - Once approved, the form will be processed by the Resident Life Office.

Completing the California Department of Motor Vehicles (DMV) DL 44 form correctly is paramount for applicants, ensuring that all necessary personal and licensing information is accurately represented. For those looking for additional resources or templates to assist with the process, smarttemplates.net offers valuable tools that can help streamline the application experience and reduce potential errors during submission.

How to Gift a Car in Missouri - The form includes sections for both individual applicants and commercial entities seeking permits.

St Louis County Local Rules - The Missouri 68-B form is aligned with state law regarding child custody matters.

Dos and Don'ts

When filling out the Missouri 149 form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here are six key do's and don'ts to keep in mind:

- Do provide accurate and complete information, including your name, address, and tax identification number.

- Do select the appropriate exemption box that applies to your purchase to avoid confusion.

- Do double-check the details before submission to prevent any errors that could delay processing.

- Don't claim an exemption unless you are registered in Missouri, as this can invalidate your certificate.

- Don't leave any required fields blank; incomplete forms may be rejected or require additional follow-up.

- Don't forget to sign and date the form, as a missing signature can lead to complications.

By adhering to these guidelines, you can facilitate a smoother process and ensure that your exemption claim is valid and accepted.

Key takeaways

When using the Missouri 149 form, it is essential to understand its purpose and requirements. Here are key takeaways to guide you:

- Purpose: The Missouri 149 form serves as a Sales and Use Tax Exemption Certificate, allowing eligible purchasers to claim tax exemptions on certain purchases.

- Seller's Responsibility: Sellers must verify that the property sold qualifies for exemption. They should exercise care to ensure the correct tax amount is charged for each item.

- Types of Exemptions: The form allows for full and partial exemptions, depending on the nature of the purchase. Full exemptions apply to manufacturing-related items, while partial exemptions cover specific services and utilities.

- Information Required: Fill out the form with accurate details, including the purchaser's name, address, tax ID number, and the description of the exempt products or services.

- Signature Requirement: The form must be signed by the purchaser or their agent, affirming that the provided information is true and complete under penalty of perjury.

- Contact Information: If questions arise, contact the Missouri Department of Revenue via phone or email for clarification on the form or exemption process.

- Specific Exemptions: Certain exemptions, like those for agricultural products or common carriers, have unique criteria. Ensure you check the appropriate box for the type of exemption claimed.

- Record Keeping: Maintain copies of the completed form for your records. This documentation may be necessary for future reference or audits.

- Deadline Awareness: Be mindful of any deadlines associated with filing the form or claiming exemptions to avoid potential tax liabilities.

Misconceptions

- Misconception 1: The Missouri 149 form is only for manufacturers.

- Misconception 2: Completing the form guarantees tax exemption.

- Misconception 3: All items purchased with the Missouri 149 form are fully exempt from tax.

- Misconception 4: Only in-state purchasers can use the Missouri 149 form.

- Misconception 5: The Missouri 149 form is only for tangible personal property.

- Misconception 6: The seller does not need to verify the information on the form.

This form is not limited to manufacturers. It can also be used by wholesalers, retailers, and motor vehicle dealers. Any entity purchasing items for resale or specific exempt purposes can utilize this certificate.

While the form is essential for claiming an exemption, it does not automatically guarantee that the seller will accept it. Sellers must ensure that the items being sold are genuinely exempt and that the purchaser qualifies for the exemption.

Not all items qualify for a full exemption. Some items may only qualify for partial exemptions. The form requires specific details to determine the correct exemption type.

Out-of-state purchasers can also use this form, but they must have a valid Missouri Tax I.D. number. This is crucial for any entity claiming resale or exemption in Missouri.

This form is applicable to both tangible personal property and certain taxable services. It’s important to specify the type of exemption being claimed to ensure compliance.

Sellers are required to exercise due diligence when accepting the Missouri 149 form. They must verify the purchaser's information and ensure that the claimed exemption is valid to avoid potential tax liabilities.

Similar forms

The Missouri 149 form, known as the Sales and Use Tax Exemption Certificate, serves a specific purpose in tax exemption claims. Several other documents share similarities with this form, mainly in their function of providing tax exemptions or declarations. Below is a list of nine documents that are comparable to the Missouri 149 form, along with their specific similarities:

- Form ST-3 (Sales Tax Resale Certificate): This form allows retailers to purchase goods without paying sales tax, similar to how the Missouri 149 form allows for tax exemption on resale purchases.

- Form ST-4 (Sales Tax Exempt Use Certificate): This document is used by exempt organizations to claim exemption from sales tax on purchases made for exempt purposes, akin to the Missouri 149's exemption claims for specific purchases.

- Form ST-5 (Sales Tax Exemption Certificate for Nonprofit Organizations): Nonprofit organizations use this form to claim sales tax exemptions on purchases, paralleling the exemption claims made on the Missouri 149 form.

- Form ST-6 (Sales Tax Exemption Certificate for Government Entities): Government entities utilize this form to assert their tax-exempt status, much like how the Missouri 149 form is used by qualifying businesses.

- Form ST-7 (Sales Tax Exemption Certificate for Educational Institutions): Educational institutions can use this form to claim sales tax exemptions, similar to how the Missouri 149 form allows for exemptions in educational-related purchases.

- Form ST-8 (Sales Tax Exemption Certificate for Agricultural Products): This form provides exemptions for agricultural purchases, reflecting the agricultural exemptions available on the Missouri 149 form.

- Form ST-9 (Sales Tax Exemption Certificate for Manufacturing): This document is specifically for manufacturers claiming exemptions, aligning closely with the manufacturing exemptions outlined in the Missouri 149 form.

Firearm Bill of Sale: To properly document the transfer of firearm ownership, utilize the comprehensive Firearm Bill of Sale form to ensure all transactions are legally recognized.

- Form ST-10 (Sales Tax Exemption Certificate for Utility Services): Used for claiming exemptions on utility services, this form shares similarities with the utility exemptions claimed on the Missouri 149 form.

- Form ST-11 (Sales Tax Exemption Certificate for Contractors): Contractors may use this form to claim exemptions for materials used in construction, paralleling the exemptions claimed on the Missouri 149 form for specific types of purchases.