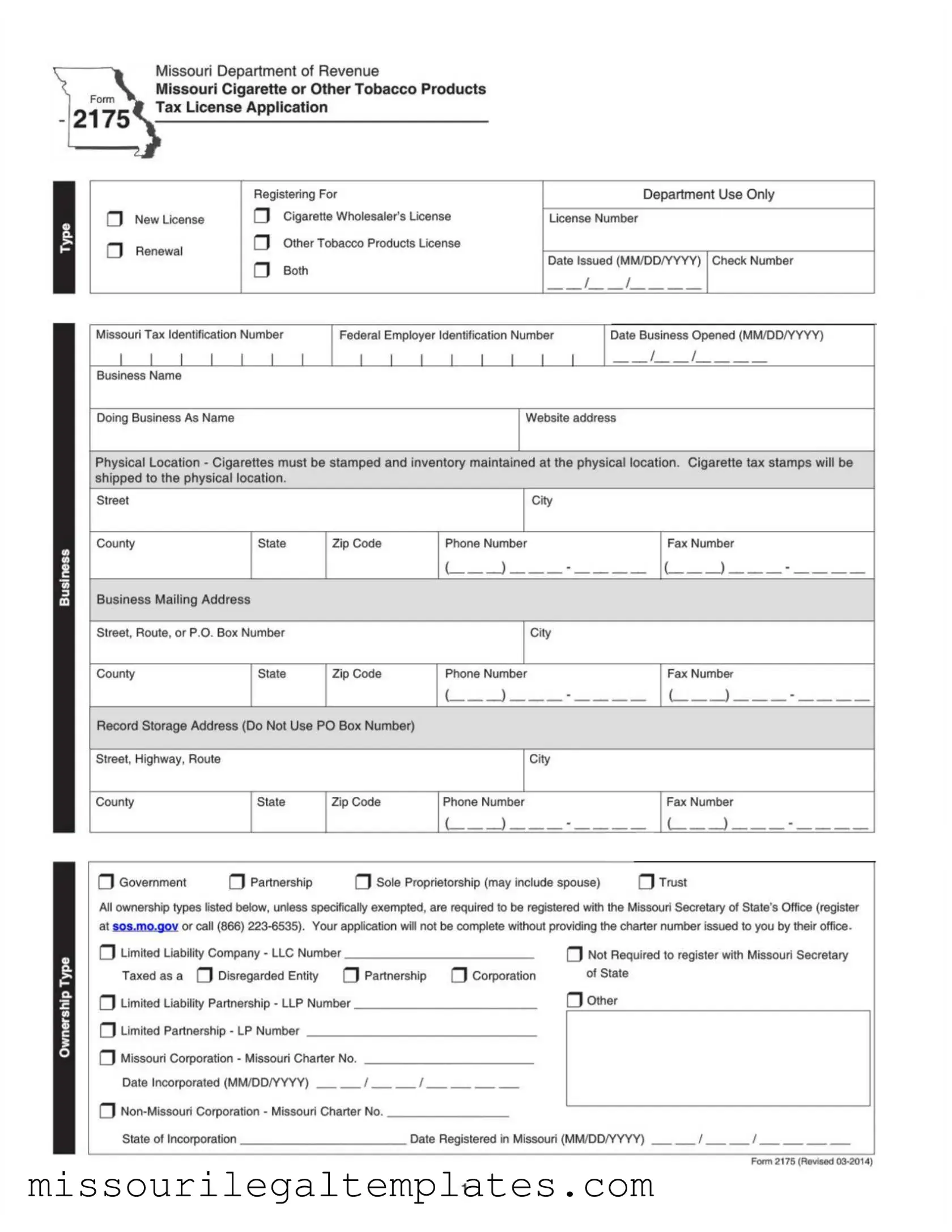

Fill in a Valid Missouri 2175 Template

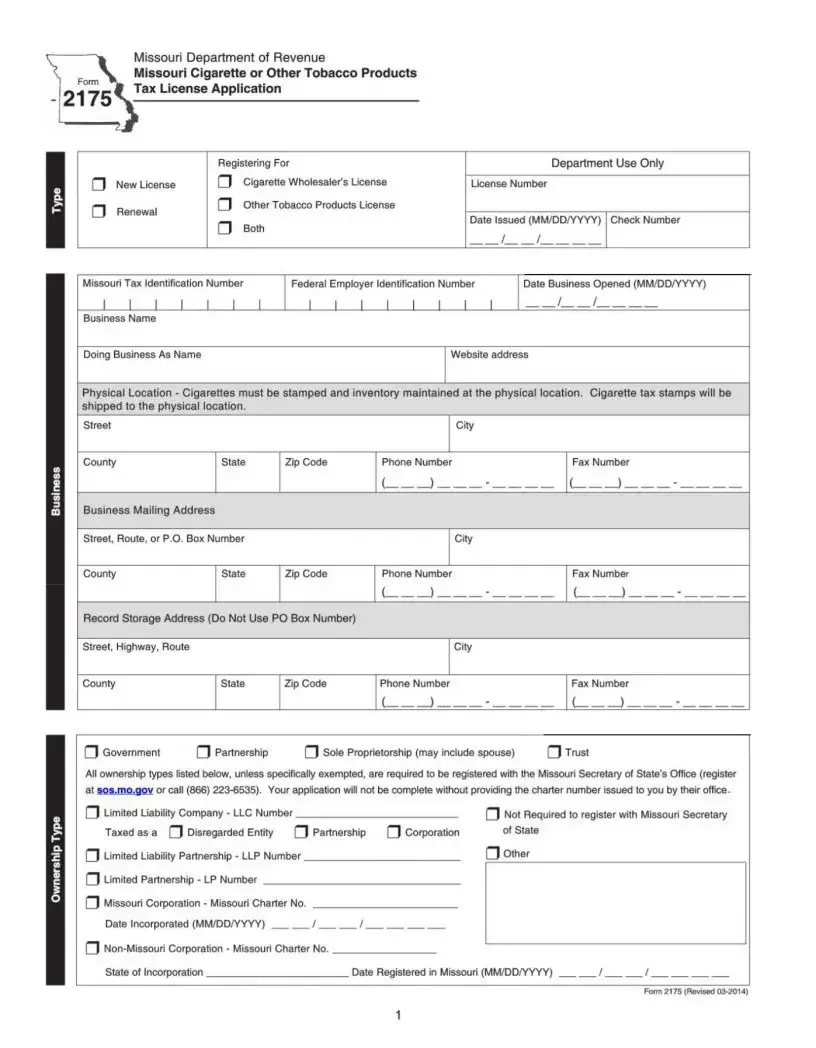

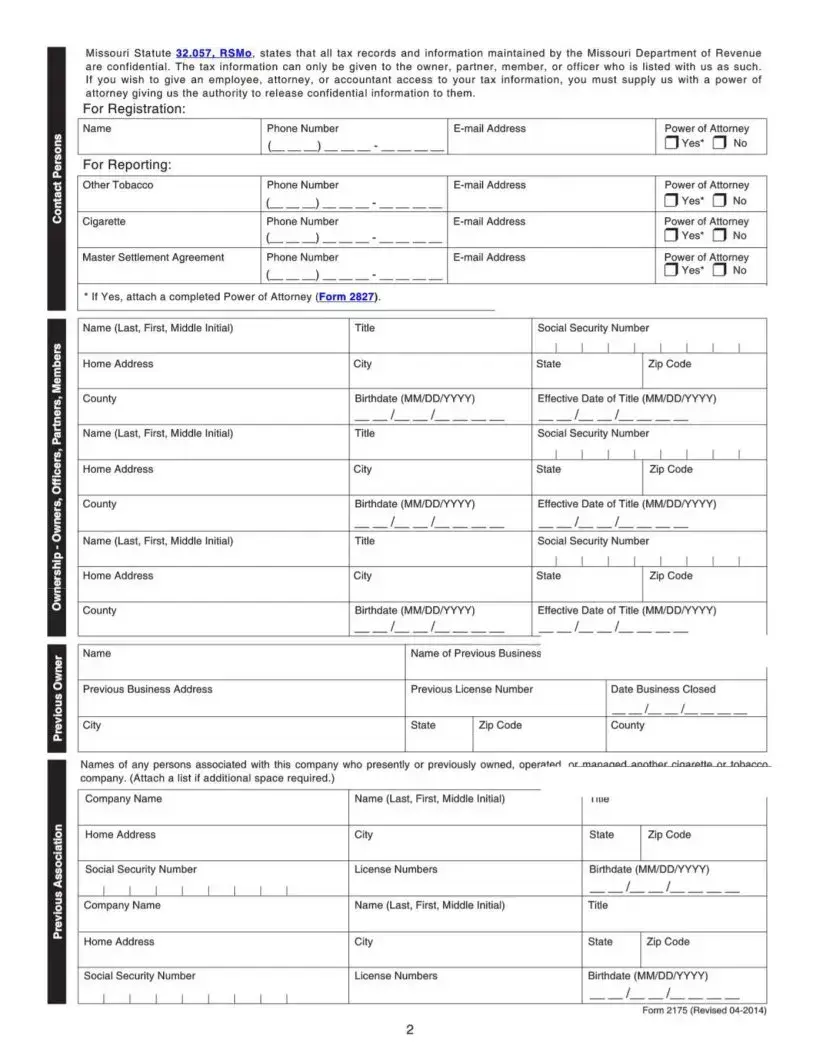

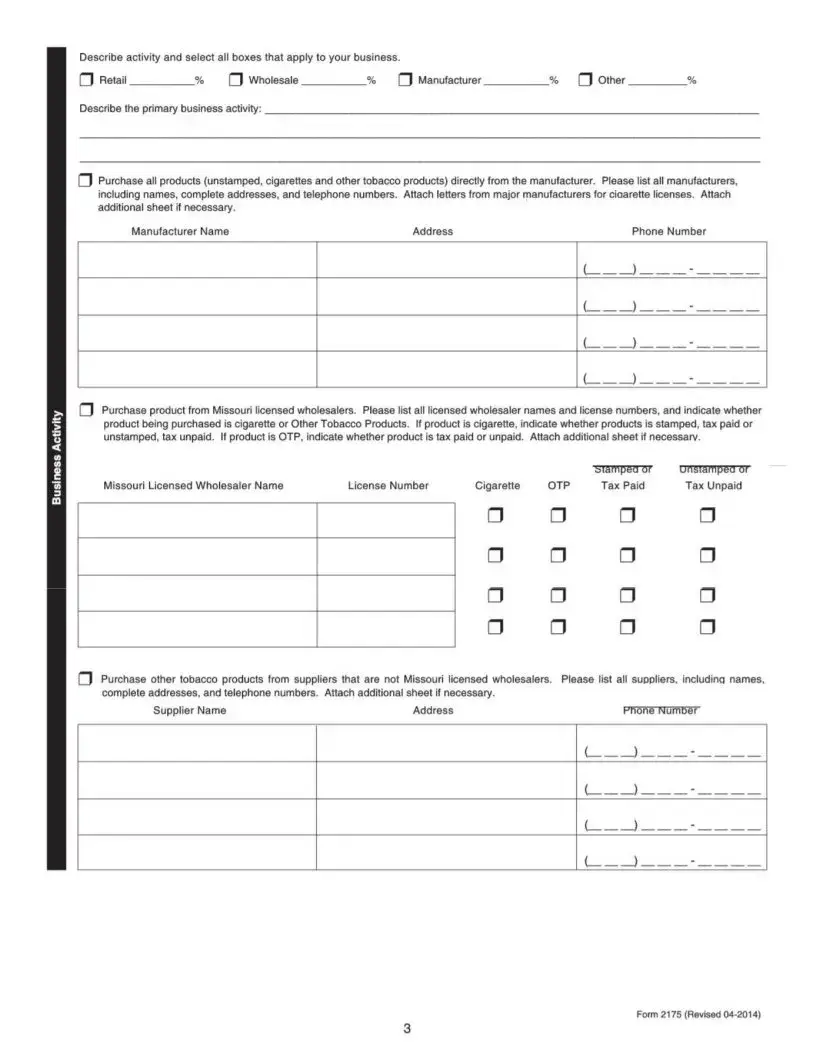

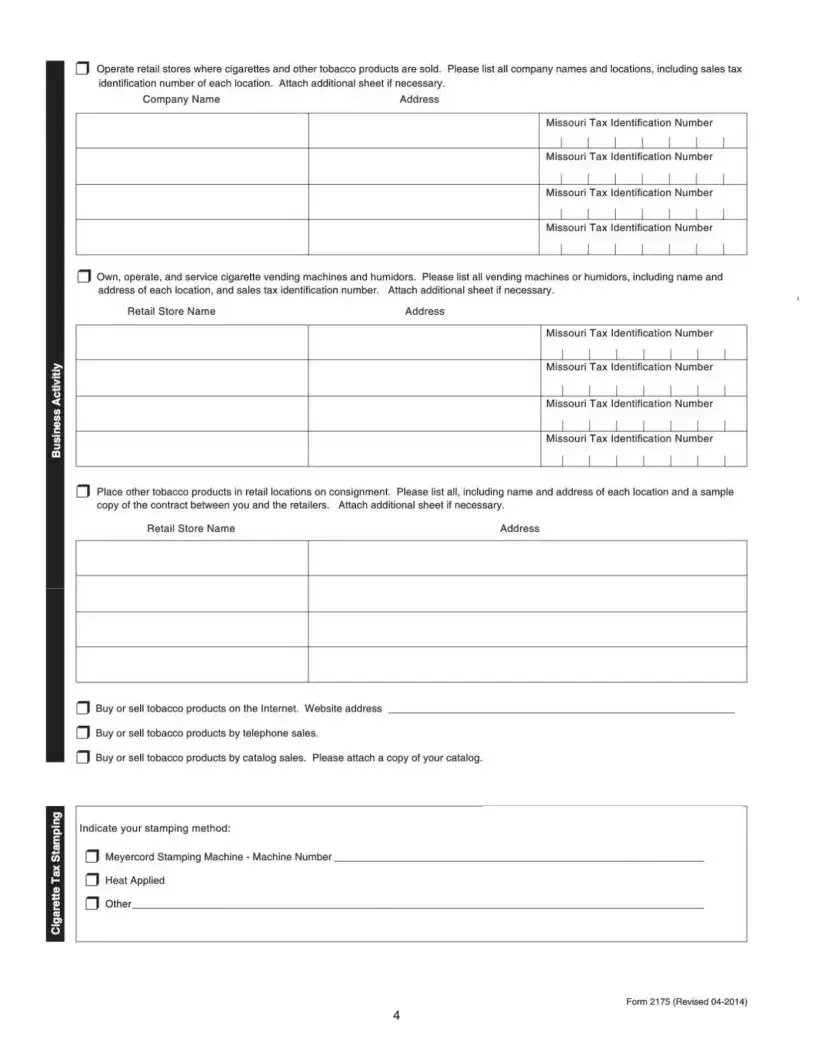

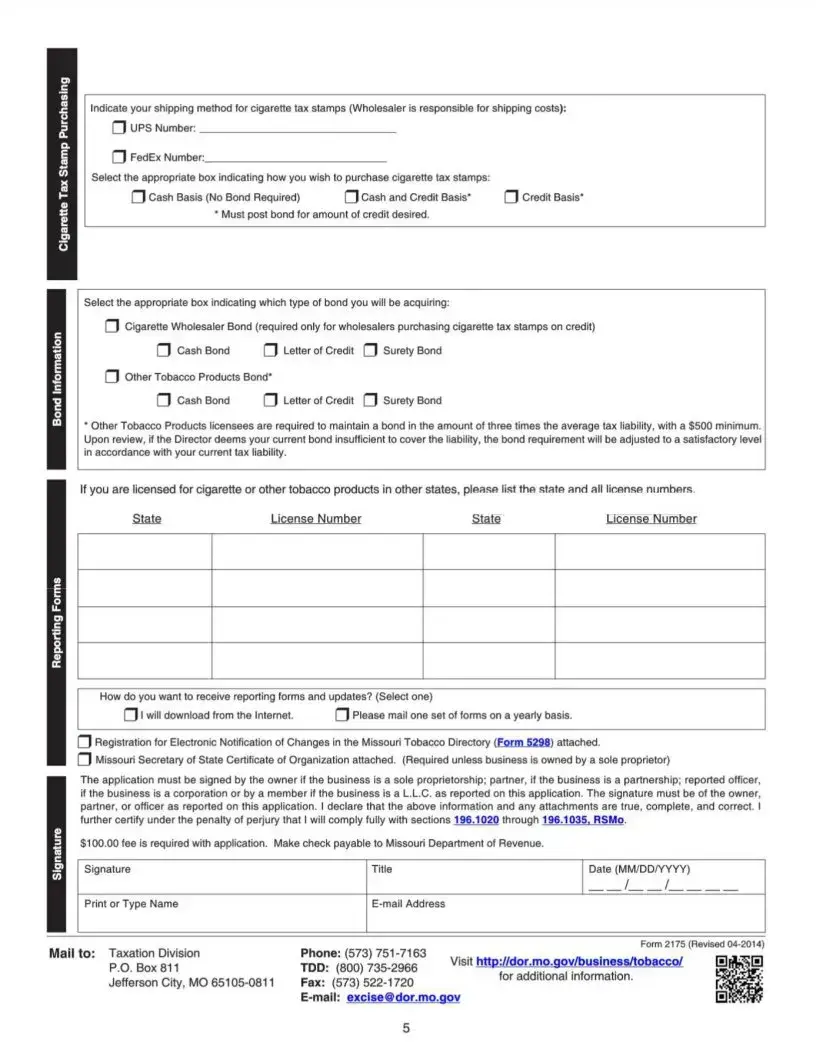

The Missouri 2175 form serves as a crucial tool for individuals and businesses looking to engage in the sale of cigarettes and other tobacco products within the state. This application, issued by the Missouri Department of Revenue, is essential for obtaining the necessary licenses to operate legally in this industry. Whether one is applying for a new license or renewing an existing one, the form requires detailed information about the business, including its legal structure, physical location, and ownership details. Applicants must provide their Missouri Tax Identification Number, business name, and contact information, as well as disclose any previous associations or ownerships with other tobacco-related businesses. The form also inquires about the specific activities the business will engage in, such as retail, wholesale, or manufacturing, and mandates the disclosure of suppliers and manufacturers involved in the tobacco supply chain. Furthermore, applicants must outline their methods for purchasing and selling tobacco products, including online and catalog sales, and provide details about their stamping and shipping processes for cigarette tax stamps. Understanding the intricacies of the Missouri 2175 form is vital for ensuring compliance with state regulations and for fostering a responsible tobacco business environment.

Missouri 2175 Preview

Common PDF Templates

What Age Can a Child Choose Which Parent to Live With in Missouri - The petitioner’s obligations regarding information disclosures are essential in the process.

Why Sign Hipaa Privacy Form - The form should clearly state who is authorized to receive your health information.

Having a well-prepared Arizona Last Will and Testament form is crucial for anyone seeking to ensure that their preferences are honored after their passing. This document serves not only to specify the distribution of assets but also to provide peace of mind to families by clearly outlining arrangements. To assist individuals in accessing necessary legal documentation, they can refer to All Arizona Forms, which simplifies the process of starting estate planning.

How to Get a Hardship License in Missouri - Applicants must ensure all sections are completed accurately.

Dos and Don'ts

When filling out the Missouri 2175 form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of recommended actions and common pitfalls to avoid.

- Do provide accurate business information, including the business name and physical location.

- Do include the correct Missouri Tax Identification Number.

- Do specify the type of ownership accurately, such as partnership or sole proprietorship.

- Do ensure all required signatures are obtained before submission.

- Do attach any necessary documents, such as letters from manufacturers or a completed Power of Attorney form.

- Don't use a P.O. Box for the record storage address; a physical address is required.

- Don't leave any sections blank; all fields must be filled out to avoid delays.

- Don't forget to list all associated persons accurately, including previous owners or partners.

- Don't neglect to check the form for errors before submission.

- Don't assume that the application will be processed without the necessary documentation; completeness is key.

Key takeaways

The Missouri 2175 form is essential for obtaining a Cigarette or Other Tobacco Products License. Completing this form accurately is crucial to ensure compliance with state regulations.

Ensure that all required information is provided, including your business name, physical location, and tax identification numbers. Missing details can delay the processing of your application.

Differentiate between the types of licenses you are applying for, such as a new license or a renewal. This clarity will help streamline the application process.

Be aware that all ownership types must be registered with the Missouri Secretary of State’s Office. This includes partnerships, corporations, and limited liability companies.

Confidentiality is paramount. The Missouri Department of Revenue protects your tax information. If you need to grant access to others, a power of attorney must be completed.

When describing your business activities, be specific about the nature of your operations, whether retail, wholesale, or manufacturing. This information helps the state understand your business model.

Keep records of all suppliers and manufacturers. You may need to provide detailed information about where you purchase your tobacco products, including names and addresses.

Misconceptions

Understanding the Missouri 2175 form is essential for anyone involved in the tobacco industry in the state. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- It's only for new businesses. Many believe the Missouri 2175 form is solely for new applicants. In reality, it is also required for renewals and changes in business structure or ownership.

- All tobacco businesses need the same license. There are different licenses for various types of tobacco businesses, such as cigarette wholesalers and other tobacco products. Each license has specific requirements and purposes.

- The form can be submitted without all supporting documents. Some people think they can submit the form without additional documentation. However, it is crucial to include all necessary information and attachments, such as manufacturer letters and tax identification numbers, to ensure a complete application.

- Confidentiality of tax information is not important. There is a misconception that tax information can be freely shared. In fact, the Missouri Department of Revenue maintains strict confidentiality regarding tax records, and access is limited to authorized individuals.

- Once submitted, the application cannot be changed. Some believe that after submitting the Missouri 2175 form, no changes can be made. However, applicants can update their information as needed, provided they follow the proper procedures.

By clearing up these misconceptions, businesses can navigate the licensing process more smoothly and ensure compliance with state regulations.

Similar forms

- Missouri Business Registration Form: Like the Missouri 2175 form, this document is essential for businesses operating in Missouri. It collects information about the business structure, ownership, and contact details. Both forms require accurate reporting to comply with state regulations.

- Missouri Sales Tax License Application: This application is necessary for businesses that sell tangible goods in Missouri. Similar to the Missouri 2175, it involves providing business identification, ownership details, and the nature of the business activities to ensure compliance with tax laws.

- Missouri Employer Identification Number (EIN) Application: This form is used to obtain a federal tax ID number. Like the Missouri 2175, it requires information about the business structure and ownership. Both forms help establish the business's legal identity for tax purposes.

- Missouri Business Entity Registration: This document registers a business entity with the state. It shares similarities with the Missouri 2175 in that both forms require detailed ownership information and business activities. They are both crucial for legal recognition and compliance.

- Missouri Certificate of Good Standing: This certificate verifies that a business is compliant with state regulations. Like the Missouri 2175, it requires accurate reporting of business activities and ownership. Both documents are vital for maintaining a good legal standing in Missouri.

- Durable Power of Attorney - This form provides a critical means for individuals to authorize someone to manage their financial affairs if they become incapacitated. For further preparation, templates can be accessed at smarttemplates.net.

- Power of Attorney Form: This form grants someone the authority to act on behalf of the business. Similar to the Missouri 2175, it requires specific details about the business and its representatives. Both documents ensure that the right individuals can manage important business affairs.