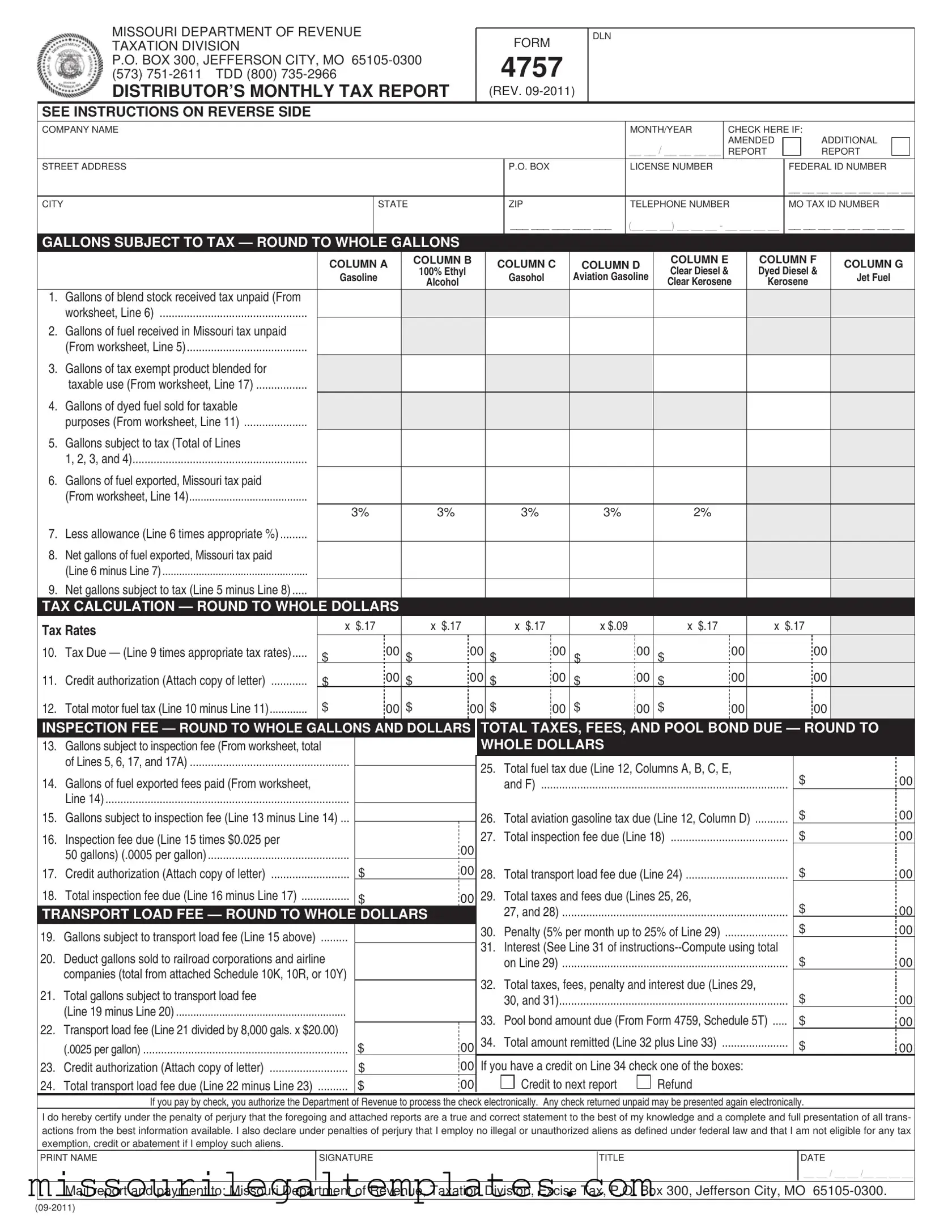

Fill in a Valid Missouri 4757 Template

The Missouri 4757 form, officially known as the Distributor’s Monthly Tax Report, is a crucial document for businesses involved in the distribution of motor fuels within the state. This form must be submitted to the Missouri Department of Revenue by the last day of each month, detailing the tax obligations for the preceding month. It encompasses a variety of essential components, including the reporting of gallons received, gallons sold, and the calculation of taxes owed based on specific fuel types such as gasoline, diesel, and aviation fuel. Additionally, the form allows for the reporting of tax-exempt products and includes provisions for credits and allowances. Businesses must ensure accuracy, as penalties may be imposed for late submissions or inaccuracies. The form requires a comprehensive breakdown of both taxable and exempt gallons, along with the corresponding tax calculations. It is imperative that the form is completed in full, as incomplete submissions can lead to delays in processing. Understanding the requirements and implications of the Missouri 4757 form is vital for compliance and for avoiding unnecessary financial penalties.

Missouri 4757 Preview

MISSOURI DEPARTMENT OF REVENUE |

FORM |

DLN |

TAXATION DIVISION |

|

|

P.O. BOX 300, JEFFERSON CITY, MO |

4757 |

|

(573) |

|

|

DISTRIBUTOR’S MONTHLY TAX REPORT |

(REV. |

|

SEE INSTRUCTIONS ON REVERSE SIDE

COMPANY NAME

STREET ADDRESS

CITY

|

|

MONTH/YEAR |

CHECK HERE IF: |

||||||

|

|

__ __ / __ __ __ __ |

AMENDED |

|

|

|

ADDITIONAL |

|

|

|

|

|

|

|

|

|

|||

|

|

REPORT |

|

|

|

REPORT |

|

|

|

|

P.O. BOX |

LICENSE NUMBER |

|

|

|

FEDERAL ID NUMBER |

|||

|

|

|

|

||||||

|

|

|

|

|

|

__ __ __ __ __ __ __ __ __ |

|||

STATE |

ZIP |

TELEPHONE NUMBER |

|

MO TAX ID NUMBER |

|||||

|

___ ___ ___ ___ ___ |

(__ __ __) __ __ __ - __ __ __ __ |

|

|

__ __ __ __ __ __ __ __ |

|

|||

|

|

|

|

|

|

|

|

|

|

GALLONS SUBJECT TO TAX — ROUND TO WHOLE GALLONS |

|

|

|

|

|

||||

|

|

|

COLUMN A |

COLUMN B |

COLUMN C |

COLUMN D |

COLUMN E |

COLUMN F |

COLUMN G |

|

|

|

100% Ethyl |

Clear Diesel & |

Dyed Diesel & |

||||

|

|

|

Gasoline |

Gasohol |

Aviation Gasoline |

Jet Fuel |

|||

|

|

|

Alcohol |

Clear Kerosene |

Kerosene |

||||

|

|

|

|

|

|

|

|||

1. |

Gallons of blend stock received tax unpaid (From |

|

|

|

|

|

|

||

|

worksheet, Line 6) |

|

|

|

|

|

|

|

|

2. |

Gallons of fuel received in Missouri tax unpaid |

|

|

|

|

|

|

||

|

(From worksheet, Line 5) |

|

|

|

|

|

|

|

|

3. |

Gallons of tax exempt product blended for |

|

|

|

|

|

|

|

|

|

taxable use (From worksheet, Line 17) |

|

|

|

|

|

|

|

|

4. |

Gallons of dyed fuel sold for taxable |

|

|

|

|

|

|

|

|

|

purposes (From worksheet, Line 11) |

|

|

|

|

|

|

|

|

5. |

Gallons subject to tax (Total of Lines |

|

|

|

|

|

|

||

|

1, 2, 3, and 4) |

|

|

|

|

|

|

|

|

6. |

Gallons of fuel exported, Missouri tax paid |

|

|

|

|

|

|

||

|

(From worksheet, Line 14) |

|

|

|

|

|

|

|

|

|

3% |

3% |

3% |

3% |

2% |

|

|

||

7. |

Less allowance (Line 6 times appropriate %) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

8.Net gallons of fuel exported, Missouri tax paid

(Line 6 minus Line 7) ....................................................

9.Net gallons subject to tax (Line 5 minus Line 8) .....

TAX CALCULATION — ROUND TO WHOLE DOLLARS

Tax Rates |

|

x |

$.17 |

x |

$.17 |

|

|

x $.17 |

x $.09 |

|

x $.17 |

x |

$.17 |

|

|

||

|

|

00 |

|

00 |

|

00 |

|

00 |

|

00 |

00 |

|

|

||||

10. |

Tax Due — (Line 9 times appropriate tax rates) |

|

$ |

$ |

$ |

$ |

$ |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

11. |

Credit authorization (Attach copy of letter) |

|

$ |

00 |

$ |

00 |

$ |

00 |

$ |

00 |

$ |

00 |

00 |

|

|

||

12. |

Total motor fuel tax (Line 10 minus Line 11) |

|

$ |

00 |

$ |

00 |

$ |

00 |

$ |

00 |

$ |

00 |

00 |

|

|

||

|

|

|

|

|

|

|

|||||||||||

INSPECTION FEE — ROUND TO WHOLE GALLONS AND DOLLARS |

TOTAL TAXES, FEES, AND POOL BOND DUE — ROUND TO |

|

|||||||||||||||

13. |

Gallons subject to inspection fee (From worksheet, total |

|

|

|

|

WHOLE DOLLARS |

|

|

|

|

|

|

|

||||

|

of Lines 5, 6, 17, and 17A) |

|

|

|

25. |

Total fuel tax due (Line 12, Columns A, B, C, E, |

|

$ |

|

|

|||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

14. |

Gallons of fuel exported fees paid (From worksheet, |

|

|

|

|

|

|

and F) |

|

|

|

|

|

00 |

|||

|

Line 14) |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15. |

Gallons subject to inspection fee (Line 13 minus Line 14) ... |

|

|

|

26. |

Total aviation gasoline tax due (Line 12, Column D) |

|

||||||||||

|

|

|

|||||||||||||||

16. |

Inspection fee due (Line 15 times $0.025 per |

|

|

|

|

27. |

Total inspection fee due (Line 18) |

|

$ |

|

00 |

||||||

|

|

|

00 |

|

|

|

|

||||||||||

|

50 gallons) (.0005 per gallon) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

$ |

|

00 |

|

|

|

|

|

|

|

|

$ |

|

|

|||

17. |

Credit authorization (Attach copy of letter) |

|

28. |

Total transport load fee due (Line 24) |

|

|

00 |

||||||||||

18. |

Total inspection fee due (Line 16 minus Line 17) |

$ |

|

00 |

29. |

Total taxes and fees due (Lines 25, 26, |

|

|

|

|

|

||||||

|

|

|

$ |

|

00 |

||||||||||||

TRANSPORT LOAD FEE — ROUND TO WHOLE DOLLARS |

|

|

|

27, and 28) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

$ |

|

00 |

||||||||

19. Gallons subject to transport load fee (Line 15 above) |

|

|

|

|

30. |

.....................Penalty (5% per month up to 25% of Line 29) |

|

|

|||||||||

|

|

|

31. |

Interest (See Line 31 of instructions Compute using total |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

20. Deduct gallons sold to railroad corporations and airline |

|

|

|

|

$ |

|

00 |

||||||||||

|

|

|

|

|

on Line 29) |

|

|

|

|

|

|||||||

|

companies (total from attached Schedule 10K, 10R, or 10Y) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

32. |

Total taxes, fees, penalty and interest due (Lines 29, |

|

|

|

|

||||||||

21. Total gallons subject to transport load fee |

|

|

|

|

|

$ |

|

00 |

|||||||||

|

|

|

|

|

|

30, and 31) |

|

|

|

|

|

||||||

|

(Line 19 minus Line 20) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

33. |

Pool bond amount due (From Form 4759, Schedule 5T) |

|

$ |

|

00 |

||||||||

22. Transport load fee (Line 21 divided by 8,000 gals. x $20.00) |

|

|

|

|

|||||||||||||

|

|

|

|||||||||||||||

$ |

|

00 |

34. |

Total amount remitted (Line 32 plus Line 33) |

|

|

$ |

|

00 |

||||||||

|

(.0025 per gallon) |

|

|

|

|||||||||||||

23. |

Credit authorization (Attach copy of letter) |

$ |

|

00 |

If you have a credit on Line 34 check one of the boxes: |

|

|

|

|

||||||||

24. |

Total transport load fee due (Line 22 minus Line 23) |

$ |

|

00 |

|

|

Credit to next report |

|

Refund |

|

|

|

|

|

|||

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

I do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my knowledge and a complete and full presentation of all trans- actions from the best information available. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

PRINT NAME

SIGNATURE

TITLE

DATE

__ __ / __ __ /__ __ __ __

Mail report and payment to: Missouri Department of Revenue, Taxation Division, Excise Tax, P.O. Box 300, Jefferson City, MO

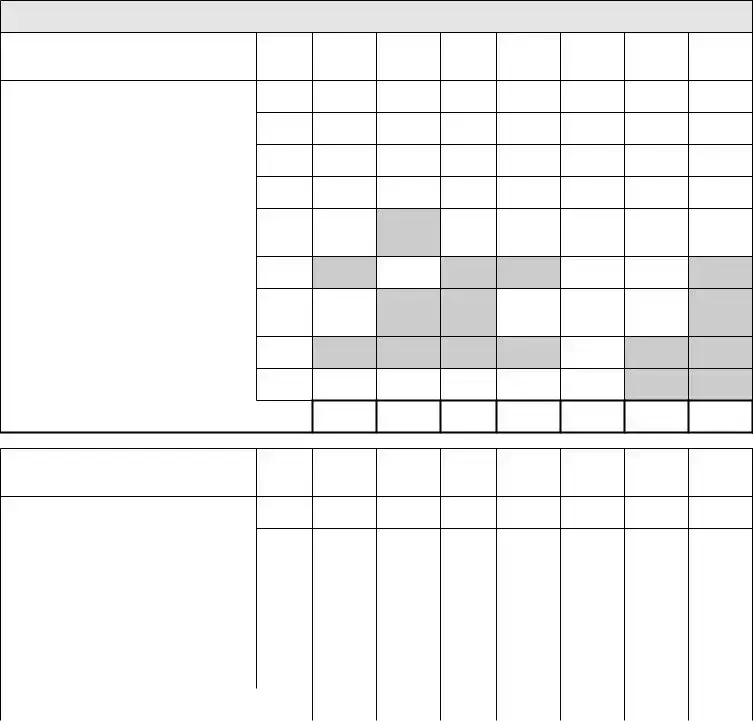

WORKSHEET OF MOTOR FUEL GALLONS

RECEIPTS |

From |

|

100% Ethyl |

|

Aviation |

Clear |

Dyed |

|

|

|

|

Diesel |

|

||||||

Gasoline |

Gasohol |

Diesel & |

Jet Fuel |

||||||

(INVOICED GALLONS) |

Schedule |

Alcohol |

Gasoline |

& Clear |

|||||

|

|

Kerosene |

|

||||||

|

|

|

|

|

|

Kerosene |

|

||

|

|

|

|

|

|

|

|

1. |

Gallons received in Missouri tax and/or fees paid |

1 |

|

||

2. |

Gallons received for export, destination state tax paid ... |

1B |

|

||

3. |

Gallons received tax and/or fee paid with an import |

1C |

|

payment voucher |

|

|

|

|

4. |

Gallons imported from another state, Missouri |

1E |

|

tax and/or fees paid |

|

|

|

|

5. |

Gallons received tax and/or fees unpaid (provide |

2A |

|

explanation on Schedule 2A) (Example: tank |

|

|

|

|

|

wagon imports) |

|

|

5a. Gallons received of tax exempt product |

2A |

|

(Example: alcohol, |

|

|

|

|

6. |

Gallons of blend stock received and/or fees unpaid |

|

|

(List type of blend stock) ____________ (Enter gallons |

2B |

|

under the appropriate product column) |

|

7. |

Gallons of clear kerosene received fees paid |

|

|

(For sale through barricaded pumps) |

2G |

|

|

|

8. |

Gallons received tax exempt fuel for sale to U.S. |

|

|

government (Attach copy of Form 4776) |

|

9. |

TOTAL RECEIPTS |

|

|

From |

|

100% Ethyl |

|

Aviation |

Clear |

Dyed |

|

|

|

|

Diesel |

|||||

DISBURSEMENTS |

Gasoline |

Gasohol |

Diesel & Jet Fuel |

|||||

Schedule |

Alcohol |

Gasoline |

& Clear |

|||||

|

|

|

Kerosene |

|||||

|

|

|

|

|

|

Kerosene |

||

|

|

|

|

|

|

|

10.Gallons sold or used by distributor

tax and/or fees paid...................................................

11. |

Gallons of dyed fuel sold for taxable purposes |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

12. |

Gallons of other authorized tax exempt sales |

10G |

|

|

|

|

|

|

|

|

(alcohol, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Gallons exported (Destination state tax |

7A |

|

|

|

|

|

|

|

|

paid to supplier) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Gallons exported (Missouri tax and/or fees paid) |

7B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15. |

Gallons of clear kerosene delivered to filling |

10J |

|

|

|

|

|

|

|

|

stations (Barricaded pumps only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

TOTAL DISBURSEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX EXEMPT PRODUCT REMOVED FROM |

From |

|

100% Ethyl |

|

Aviation |

Clear |

Dyed |

|

|

|

|

Diesel |

|

|||||

|

Gasoline |

Gasohol |

Diesel & |

Jet Fuel |

|||||

|

STORAGE FOR BLENDING |

Schedule |

Alcohol |

Gasoline |

& Clear |

||||

|

|

|

Kerosene |

|

|||||

|

|

|

|

|

|

|

Kerosene |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. Gallons of tax exempt product blended during |

5W |

|

|

|

|

|

|

|

|

|

reporting period tax and fees unpaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17A. Gallons of tax exempt product blended during |

10A |

|

|

|

|

|

|

|

|

|

reporting period fees unpaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR DISTRIBUTOR’S MONTHLY TAX REPORT

This report and its supporting schedules must be fully completed and mailed to the Missouri Department of Revenue along with any tax and/or fees due on the last day of each month for the purchases made in the preceding calendar month unless such day falls on a weekend or state holiday in which case the report, tax, and fees would be due the next succeeding business day. A report is due whether or not there were any activity during the month. You may access the due date schedule at http://dor.mo.gov/business/fuel/.

Original reports and schedules must contain all the required information. Computer generated reports and schedules, approved by the Department, must contain all the information required on the original reports and schedules.

Correcting Reports

Additional Report - adds or takes away any additional gallons from the original report. When filing an additional report, please report only those gallons in which you are changing.

Amended Report - filed when all or the majority of the information originally reported is incorrect. This type of report will replace all information that was first reported.

YOU MUST ROUND TO WHOLE GALLONS AND DOLLARS (Example: Round down if less than .50 and round up if .50 to .99)

Taxable Gallons (Round to whole gallons)

1.Gallons of blend stock received tax and/or fees unpaid (From worksheet, Line 6).

2.Gallons of fuel received in Missouri tax and/or fees unpaid. Attach an explanation with Schedule 2A (From worksheet, Line 5). Tank wagon operators report fuel imported into Missouri on this line.

3.Gallons of tax exempt product blended (For taxable use) (From worksheet, Line 17).

4.Gallons of dyed fuel sold for taxable purposes (From worksheet, Line 11).

5.Gallons subject to tax and/or fees (Total of Lines 1, 2, 3, and 4).

6.Gallons of fuel exported (Missouri tax and/or fees paid) (From worksheet, Line 14).

7.Calculate allowance. Line 6 times (X) the appropriate percentage. (Applies only when supplier passed allowance to purchaser of Missouri tax paid fuel.)

8.Net gallons exported of Missouri tax paid fuel. (Line 6 minus

9.Net gallons subject to tax and/or fees (Line 5 minus

Tax Calculation (Round to whole dollars)

Tax rate for gasoline, alcohol blended with gasoline, gasohol and other products blended with gasoline, clear diesel, clear kerosene and other products blended with clear diesel or clear kerosene is $0.17 per gallon. Aviation gasoline tax rate is $0.09 per gallon.

10.Tax due is based on the taxable gallons times (X) the appro- priate tax rates (Line 9 times (X) $0.17 or $0.09).

11.If you have a motor fuel tax credit from a previous report, you will receive a letter. Enter the amount of your motor fuel tax credit and attach a copy of the authorization.

12.Total motor fuel tax due (Line 10 minus Line 11).

Inspection Fee (Round to whole dollars)

13.Total gallons subject to inspection fee (From worksheet, Lines 5, 6, 17, and 17A).

14.Gallons of fuel exported fees paid (From worksheet, Line 14).

15.Gallons subject to inspection fee (Line 13 minus

16.Inspection fee due (Line 15 times (X) .0005).

17.If you have an inspection fee credit from a previous report, you will receive a letter. Enter the amount of your inspection fee credit and attach a copy of the authorization.

18.Total inspection fee due (Line 16 minus Line 17).

Transport Load Fee (Round to whole dollars)

19.Total gallons of fuel subject to transport load fee (Line 15 above).

20.Motor fuel gallons sold to railroad corporations, airline companies or used as bunker fuel in vessels are not subject to the transport load fee (Total from attached Schedule 10K, 10R, or 10Y).

21.Total gallons subject to transport load fee (Line 19 minus

22.Transport load fee (Line 21 times (X) 0.0025).

23.If you have a transport load fee credit from a previous report, you will receive a letter. Enter the amount of your transport load fee credit and attach a copy of the authorization.

24.Total transport load fee due (Line 22 minus Line 23).

Taxes and Fees Due (Round to whole dollars)

25.Total motor fuel tax due (total from Line 12 Columns A, B, C, E, and F).

26.Total aviation gasoline tax due (Total from Line 12 Column D).

27.Total inspection fee due (Total from Line 18).

28.Total transport load fee due (Total from Line 24).

29.Total taxes and fees due (Lines 25, 26, 27, and 28).

Penalty (Round to whole dollars)

30.If your report is not filed on a timely basis or taxes are not paid timely (filed and received by the United States Post Office cancellation stamped upon the envelope), you are subject to a penalty of five percent per month up to 25 percent of the total amount of tax (Line 29 times (X) penalty amount, 5 percent up to 25 percent).

Interest (Round to whole dollars)

31. Interest is due on any late payment (Line 29 times ( X ) t h e a n n u a l i n t e r e s t r a t e , m u l t i p l i e d b y (X ) t h e number of days late divided by 365 (366 for leap years)). The annual interest rate is subject to change each year. You may access the annual interest rate on the Department’s web site at: http://dor.mo.gov.intrates.php.

32. Total taxes, fees, penalty, and interest due (Lines 29, 30, and 31).

Pool Bond Payment (Participants Only) (Round to whole dollars)

33.Pool bond amount due. From Form 4759, Schedule 5T.

34.Total remittance due. Total fuel tax, fees, and pool bond amount due (Total Line 32 plus (+) Line 33).

The total of fuel tax, aviation gasoline fuel tax, inspection fee, transport load fee, and pool bond amount should equal Line 34.

Send your check or money order to the Missouri Depart- ment of Revenue. You may also charge the balance due to Mastercard, Discover, American Express, or Visa by calling

http://dor.mo.gov/tax/business/payonline.htm. A convenience fee will be charged to your account for processing. If you pay by check, you authorize the Department to process the check electroni- cally. Any returned check may be presented again electronically. Mail the report and schedules to: Missouri Department of Revenue, Taxation Division, P.O. Box 300, Jefferson City, Missouri 65105- 0300.

If you have questions or need assistance in completing this form, please call (573)

Please ensure that you sign, indicate your title, and date the report.

MOTOR FUEL TAX, AVIATION GASOLINE TAX, INSPECTION FEE, TRANSPORT LOAD FEE AND POOL BOND ARE FIVE SEPARATE ACCOUNTS. DO NOT USE A CREDIT ON ONE ACCOUNT TO PAY FOR ANOTHER ACCOUNT. (EXAMPLE: MOTOR FUEL TAX CREDIT CANNOT BE USED TO PAY AVIATION GASOLINE TAX.)

Common PDF Templates

Missouri State Tax Form - Your signature is required on this form to authorize the release of your tax documents.

In California, utilizing a Durable Power of Attorney form can significantly streamline the management of financial affairs during times of incapacity, as outlined in resources available at smarttemplates.net. This document not only grants essential authority for decision-making but also ensures that individuals' preferences are respected, making it a vital aspect of effective estate planning.

Missouri Department of Motor Vehicles Jefferson City - Information provided must adhere to Missouri state laws and regulations.

Dos and Don'ts

When filling out the Missouri 4757 form, consider the following guidelines:

- Ensure all required fields are completed accurately.

- Round all gallons and dollar amounts to whole numbers.

- Attach any necessary documentation, such as credit authorizations.

- Mail the report by the deadline, even if there is no activity for the month.

Avoid these common mistakes:

- Do not submit an incomplete form.

- Do not mix accounts; use credits only for the specific account they apply to.

- Avoid filing late to prevent penalties and interest charges.

- Do not forget to sign and date the report before submission.

Key takeaways

When filling out the Missouri 4757 form, keep the following key points in mind:

- Timeliness is crucial. Submit the form by the last day of each month for the previous month’s activity.

- Accuracy matters. Ensure all information is complete and correct to avoid penalties.

- Round all figures. Round gallons and dollar amounts to whole numbers as specified.

- Amended reports. Use these when significant errors occur in the original report.

- Additional reports. File these only to adjust specific gallon amounts from the original report.

- Attach required documentation. Include any necessary letters for credit authorizations.

- Understand tax calculations. Familiarize yourself with the tax rates for different fuel types to ensure accurate reporting.

- Inspection fees apply. Calculate these based on gallons subject to inspection, as outlined in the instructions.

- Transport load fees. Know how to calculate and report these based on the gallons subject to the fee.

- Separate accounts. Remember that motor fuel tax, aviation gasoline tax, inspection fees, transport load fees, and pool bonds are distinct; credits cannot be interchanged between them.

By adhering to these guidelines, you can navigate the Missouri 4757 form process more effectively and minimize potential issues.

Misconceptions

- Misconception 1: The Missouri 4757 form is only for large distributors.

- Misconception 2: You can skip filing if there were no sales during the month.

- Misconception 3: Filing an amended report is the same as filing an additional report.

- Misconception 4: You can pay any tax or fee with credits from different accounts.

- Misconception 5: The due date for the Missouri 4757 form is flexible.

- Misconception 6: You can submit the form electronically without prior approval.

- Misconception 7: Rounding off gallons and dollars is optional.

- Misconception 8: You do not need to attach supporting documentation.

This form is applicable to all distributors of motor fuel, regardless of size. Even small businesses must file if they sell fuel in Missouri.

Even if there were no sales, a report is still required. It is essential to file a report each month to remain compliant.

An amended report replaces the original information due to errors, while an additional report only adjusts specific gallons without changing the entire submission.

Each type of tax or fee must be paid from its respective account. For example, a motor fuel tax credit cannot be used to cover aviation gasoline tax.

The form must be filed by the last day of each month for the previous month’s activity. If that day falls on a weekend or holiday, it is due the next business day.

Computer-generated reports must be approved by the Department of Revenue. Ensure all required information is present before submission.

Rounding is mandatory. Gallons and dollar amounts must be rounded to whole numbers according to specified guidelines.

Supporting schedules and documentation are necessary for certain entries, such as tax-exempt sales or credits. Always attach relevant documents to ensure accuracy and compliance.

Similar forms

The Missouri 4757 form, known as the Distributor’s Monthly Tax Report, shares similarities with several other documents used in tax reporting and compliance. Here are five documents that are comparable:

- IRS Form 720: This form is used for reporting and paying federal excise taxes. Like the Missouri 4757, it requires detailed reporting of taxable activities and the calculation of taxes owed based on specific rates.

- State Fuel Tax Return: Many states have their own fuel tax return forms. These documents, similar to the Missouri 4757, require distributors to report gallons of fuel received and sold, along with the associated taxes due.

- Form 2290 (Heavy Highway Vehicle Use Tax Return): This IRS form is used by truck owners to report and pay taxes based on vehicle weight. Both forms involve calculations of tax liabilities and require submission on a regular basis.

- Monthly Sales Tax Return: Businesses submit this return to report sales tax collected from customers. It shares the monthly reporting requirement and the need for accurate calculations of taxes owed, akin to the Missouri 4757.

- Florida General Power of Attorney Form: For individuals seeking to delegate authority effectively, our necessary General Power of Attorney documentation ensures your interests are protected in various legal matters.

- Form 8849 (Claim for Refund of Excise Taxes): This form is used to claim refunds for certain excise taxes. Both the Missouri 4757 and Form 8849 involve tax calculations and require supporting documentation to substantiate claims or reports.