Fill in a Valid Missouri 4795 Template

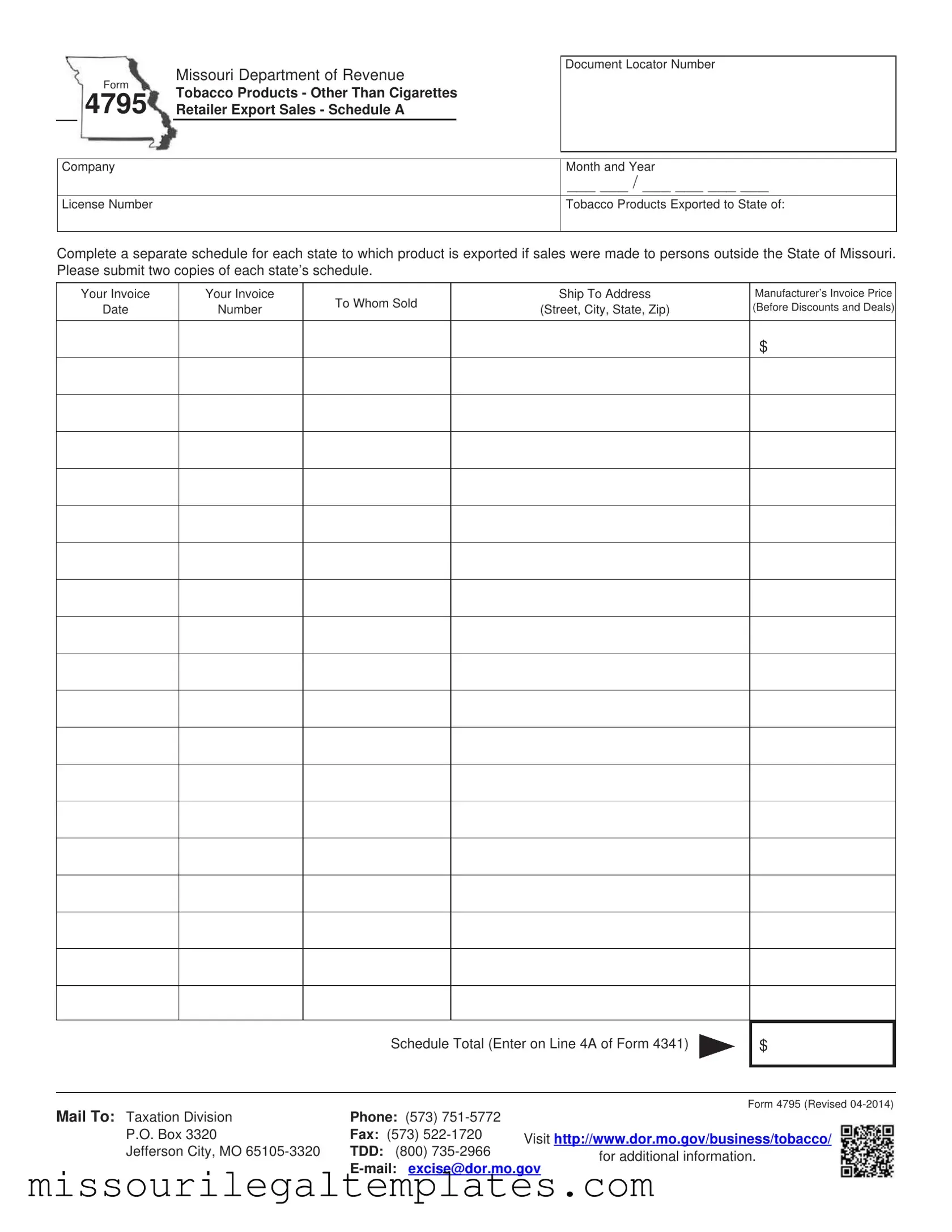

The Missouri 4795 form serves a critical function in the regulation of tobacco product sales, specifically focusing on transactions involving products other than cigarettes. Designed by the Missouri Department of Revenue, this form is essential for retailers engaged in exporting tobacco products to states outside of Missouri. It requires detailed information about the exported products, including the document locator number, company license number, and the month and year of the transaction. Retailers must complete a separate schedule for each state to which products are sold, ensuring compliance with state-specific regulations. Key components of the form include the invoice date, invoice number, and the recipient's shipping address, which must be accurately documented. Additionally, the form requires the manufacturer’s invoice price, before any discounts or deals, and mandates that the total from the schedule be entered on Line 4A of Form 4341. To facilitate processing, retailers must submit two copies of each state’s schedule. For any inquiries, the Taxation Division provides contact information, including a phone number, fax number, and email address, ensuring that retailers have access to necessary support and resources.

Missouri 4795 Preview

Form

Missouri Department of Revenue

Tobacco Products - Other Than Cigarettes

Document Locator Number

4795 Retailer Export Sales - Schedule A

Company

License Number

Month and Year

___ ___ / ___ ___ ___ ___

Tobacco Products Exported to State of:

Complete a separate schedule for each state to which product is exported if sales were made to persons outside the State of Missouri. Please submit two copies of each state’s schedule.

Your Invoice

Date

Your Invoice

Number

To Whom Sold

Ship To Address

(Street, City, State, Zip)

Manufacturer’s Invoice Price (Before Discounts and Deals)

$

Schedule Total (Enter on Line 4A of Form 4341)

$

|

|

Form 4795 (Revised |

|

Mail To: Taxation Division |

Phone: (573) |

|

|

P.O. Box 3320 |

Fax: (573) |

Visit http://www.dor.mo.gov/business/tobacco/ |

|

Jefferson City, MO |

TDD: (800) |

||

for additional information. |

|||

|

|

Common PDF Templates

Missouri Farm Tax Exemption Requirements - The 5060 form is a crucial step for tax-exempt purchases in Missouri’s construction sector.

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for recording the sale of items such as vehicles, furniture, and equipment. Using this document helps protect both the buyer and seller, ensuring that the transaction is clear and legally binding. For more information, you can refer to https://topformsonline.com/texas-bill-of-sale/.

Missouri Personalized Plates - A log of miles driven for personal use must be maintained by the owner of the historic vehicle.

Dos and Don'ts

When filling out the Missouri 4795 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do complete a separate schedule for each state to which tobacco products are exported.

- Do provide your invoice date and invoice number clearly.

- Do include the complete shipping address, including street, city, state, and zip code.

- Do ensure that the manufacturer's invoice price is accurate and reflects the amount before any discounts.

- Don't forget to submit two copies of each state's schedule along with the form.

- Don't leave any sections blank; every field must be filled out to avoid delays.

- Don't neglect to mail the form to the correct address provided in the instructions.

Key takeaways

When filling out the Missouri 4795 form, keep these key points in mind:

- Separate Schedules Required: For each state you export tobacco products to, a separate schedule must be completed. This is crucial for compliance with state regulations.

- Invoice Details Matter: Ensure that you accurately fill in the invoice date and number, as these details are essential for record-keeping and verification.

- Manufacturer’s Invoice Price: Report the price before any discounts. This amount is important for calculating taxes and must be entered correctly.

- Submission Requirements: Two copies of each state’s schedule need to be submitted. Be mindful of the mailing address and contact information provided for any inquiries.

By following these guidelines, you can ensure that your use of the Missouri 4795 form is both accurate and compliant with state regulations.

Misconceptions

Here are six common misconceptions about the Missouri 4795 form, along with clarifications for each.

- Only cigarette retailers need to use Form 4795. This is incorrect. The form is applicable to all retailers exporting tobacco products, not just cigarettes. If you sell any type of tobacco product, you need to complete this form.

- Form 4795 is only for in-state sales. This misconception is false. The form is specifically designed for reporting tobacco products exported to other states. You must complete a separate schedule for each state where products are sold.

- One copy of the schedule is sufficient. This is misleading. You must submit two copies of each state’s schedule. This ensures that the relevant authorities have the necessary documentation for their records.

- The invoice date is not important. This is a misunderstanding. The invoice date is crucial as it helps track the sale and ensures compliance with reporting requirements. Always include the correct date on the form.

- There are no penalties for late submission. This is incorrect. Failing to submit Form 4795 on time can lead to penalties. It’s essential to be aware of the submission deadlines to avoid any financial repercussions.

- Form 4795 can be submitted electronically. This is a misconception. Currently, Form 4795 must be mailed in; electronic submission is not an option. Ensure you send the completed form to the address provided to avoid delays.

Similar forms

-

Missouri Form 4341: This form is used for reporting tobacco products sold in Missouri. Like Form 4795, it requires details about sales and is essential for tax purposes.

-

Missouri Form 4796: Similar to Form 4795, this document is focused on tobacco products but specifically addresses refunds or credits for tobacco taxes paid.

-

Missouri Form 4797: This form is used for reporting sales of cigarettes and provides a detailed account of transactions, much like the 4795 form for other tobacco products.

- DL 44 Form: For those applying for a driver’s license, the California DMV DL 44 form is essential. Applicants can find more information and resources at smarttemplates.net, ensuring they have everything required for their DMV appointment.

-

Missouri Form 5403: This is a sales tax return for businesses. It requires detailed sales information, similar to the requirement for reporting tobacco exports on Form 4795.

-

Missouri Form 1099: This form reports income paid to independent contractors. While it serves a different purpose, it shares the need for accurate reporting of sales or income.

-

Missouri Form 1120: This corporate income tax return requires detailed financial reporting. Like Form 4795, it is vital for compliance with state tax regulations.

-

Missouri Form 941: This is a quarterly payroll tax return that requires detailed reporting of wages and taxes withheld, similar to the detailed reporting required on Form 4795.

-

Missouri Form 1040: This individual income tax return requires personal income reporting, paralleling the need for detailed sales information in Form 4795.

-

Missouri Form 150: This is a tax exemption certificate that businesses can use to claim exemptions. It shares the need for accurate documentation with Form 4795.

-

Missouri Form 4562: This form is used for depreciation and amortization. While focused on different aspects, it also requires detailed reporting similar to Form 4795.