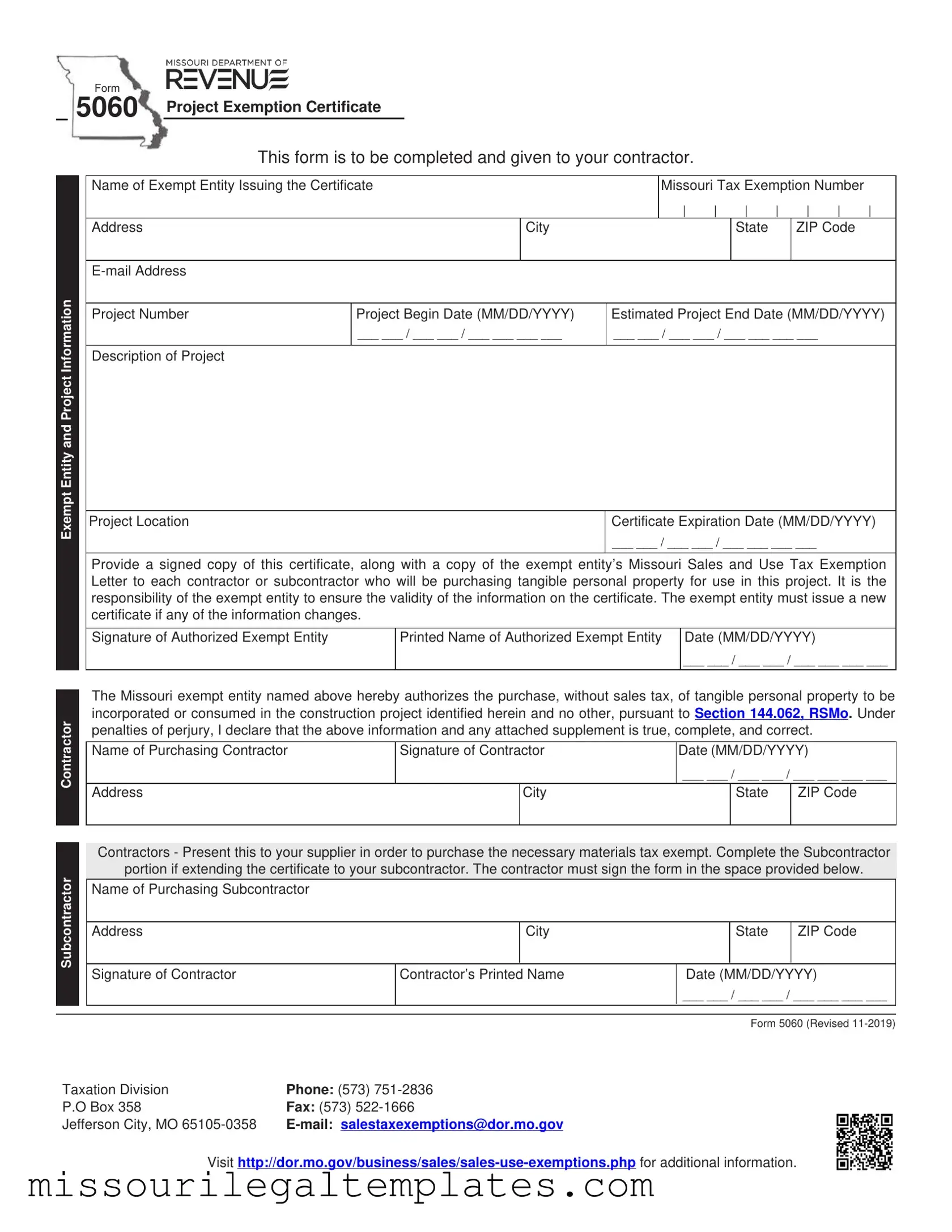

Fill in a Valid Missouri 5060 Exemption Template

The Missouri 5060 Exemption form, formally known as the Project Exemption Certificate, plays a crucial role in facilitating tax-exempt purchases for specific construction projects. This form is essential for exempt entities, such as non-profit organizations or government bodies, allowing them to bypass sales tax on tangible personal property used in their projects. To initiate the process, the exempt entity must fill out various details, including the contractor's name, project location, and the estimated project timeline. It is imperative that the exempt entity also provides a signed copy of this certificate, along with their Missouri Sales and Use Tax Exemption Letter, to each contractor or subcontractor involved in the project. The responsibility for ensuring the accuracy of the information rests with the exempt entity; should any details change, a new certificate must be issued. Notably, the form includes a declaration under penalties of perjury, emphasizing the importance of honesty and accuracy in the information provided. Contractors are encouraged to present this form to their suppliers to secure the necessary materials without incurring sales tax, thereby streamlining the procurement process for construction projects. Additionally, if the exemption is extended to subcontractors, specific sections of the form must be completed to maintain compliance with Missouri tax regulations.

Missouri 5060 Exemption Preview

Form |

|

5060 |

Project Exemption Certificate |

|

This form is to be completed and given to your contractor.

Exempt Entity and Project Information

Contractor

Subcontractor

Name of Exempt Entity Issuing the Certificate |

|

Missouri Tax Exemption Number |

|

|||||||

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

Address |

|

City |

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Project Number |

Project Begin Date (MM/DD/YYYY) |

Estimated Project End Date (MM/DD/YYYY) |

||||||||

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Description of Project |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Project Location |

|

|

Certificate Expiration Date (MM/DD/YYYY) |

|||||||

|

|

|

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Provide a signed copy of this certificate, along with a copy of the exempt entity’s Missouri Sales and Use Tax Exemption Letter to each contractor or subcontractor who will be purchasing tangible personal property for use in this project. It is the responsibility of the exempt entity to ensure the validity of the information on the certificate. The exempt entity must issue a new certificate if any of the information changes.

Signature of Authorized Exempt Entity |

Printed Name of Authorized Exempt Entity Date (MM/DD/YYYY) |

___ ___ / ___ ___ / ___ ___ ___ ___

The Missouri exempt entity named above hereby authorizes the purchase, without sales tax, of tangible personal property to be incorporated or consumed in the construction project identified herein and no other, pursuant to Section 144.062, RSMo. Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Name of Purchasing Contractor |

Signature of Contractor |

Date (MM/DD/YYYY) |

___ ___ / ___ ___ / ___ ___ ___ ___

Address |

City |

State |

ZIP Code |

|

|

|

|

Contractors - Present this to your supplier in order to purchase the necessary materials tax exempt. Complete the Subcontractor

portion if extending the certificate to your subcontractor. The contractor must sign the form in the space provided below.

Name of Purchasing Subcontractor

Address |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

Signature of Contractor |

Contractor’s Printed Name |

Date (MM/DD/YYYY) |

|||

___ ___ / ___ ___ / ___ ___ ___ ___

Form 5060 (Revised

Taxation Division |

Phone: (573) |

P.O Box 358 |

Fax: (573) |

Jefferson City, MO |

Visit

Common PDF Templates

Missouri Tax Forms - Standard deduction amounts vary depending on filing status.

Mo 149 - This certificate streamlines the purchasing process for eligible businesses.

For those looking to gain a deeper understanding of the Bill of Lading process, resources such as TopTemplates.info can provide valuable templates and insights to ensure all necessary details are captured accurately, making the shipping process smoother and more efficient.

Missouri Cdl - Maintaining a clean driving record is essential to qualify for the waiver successfully.

Dos and Don'ts

When filling out the Missouri 5060 Exemption form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are six things to do and avoid:

- Do provide complete and accurate information for the exempt entity, including the name, address, and Missouri Tax Exemption Number.

- Do include the project details such as the project number, start date, and estimated end date.

- Do sign and date the form in the designated areas to validate the certificate.

- Do ensure that a signed copy of the exemption certificate is provided to each contractor or subcontractor involved in the project.

- Don't leave any required fields blank; incomplete forms may lead to delays or rejection.

- Don't use the certificate for projects other than the one specified; it is only valid for the project identified on the form.

Key takeaways

When using the Missouri 5060 Exemption form, it is essential to keep the following key points in mind:

- Purpose of the Form: The Missouri 5060 Exemption form serves to authorize contractors and subcontractors to purchase tangible personal property without sales tax for specific construction projects.

- Information Required: Complete all sections accurately, including details about the exempt entity, project information, and contractor or subcontractor names. Any changes in this information necessitate issuing a new certificate.

- Distribution: Provide a signed copy of the exemption certificate along with the exempt entity’s Missouri Sales and Use Tax Exemption Letter to each contractor or subcontractor involved in the project.

- Responsibility: The exempt entity is responsible for ensuring the validity of the information provided. Misrepresentation or errors may lead to penalties.

Misconceptions

Understanding the Missouri 5060 Exemption form can be challenging. Here are four common misconceptions about this form:

- Misconception 1: The form can be used for any project.

- Misconception 2: Only the contractor needs to sign the form.

- Misconception 3: The exemption lasts indefinitely once issued.

- Misconception 4: The exempt entity does not need to provide supporting documentation.

This is incorrect. The Missouri 5060 Exemption form is specifically for projects that involve the purchase of tangible personal property for construction. It cannot be used for unrelated projects or purchases.

In reality, both the exempt entity and the contractor must sign the form. The exempt entity authorizes the purchase, while the contractor confirms their role in the project.

This is not true. The exemption is valid only for the specific project and has an expiration date. If any information changes, a new certificate must be issued.

In fact, the exempt entity must provide a signed copy of the exemption certificate along with a Missouri Sales and Use Tax Exemption Letter to each contractor or subcontractor involved in the project.

Similar forms

-

IRS Form W-9: Similar to the Missouri 5060 Exemption form, the W-9 is used to provide taxpayer information to businesses or individuals who will be paying you. Both forms require accurate details about the entity involved, ensuring that the correct information is shared for tax purposes.

-

Sales Tax Exemption Certificate: Like the Missouri 5060, this certificate allows certain organizations to make purchases without paying sales tax. Both documents require the purchaser to provide proof of their exempt status, emphasizing the importance of valid documentation.

-

Certificate of Exemption (California): This form serves a similar purpose in California, allowing exempt entities to purchase goods without sales tax. Both forms require details about the project and the exempt entity, underscoring the necessity for clarity in transactions.

- California Room Rental Agreement: For those engaging in residential leasing, the comprehensive Room Rental Agreement documentation ensures all terms are clearly defined and legally binding.

-

New York State ST-120 Exempt Use Certificate: This document is used in New York for tax-exempt purchases. Just like the Missouri 5060, it must be presented to suppliers to ensure that no sales tax is charged on eligible purchases.

-

Florida Sales Tax Exemption Certificate: This certificate allows qualifying organizations in Florida to make tax-exempt purchases. Both forms require the name and address of the exempt entity, highlighting the importance of proper identification in tax-exempt transactions.

-

Texas Sales and Use Tax Resale Certificate: In Texas, this certificate is used by businesses to purchase items for resale without paying sales tax. Like the Missouri 5060, it requires the purchaser to declare their exempt status and the purpose of the purchase.

-

Illinois ST-2 Exemption Certificate: This form is used in Illinois for similar tax-exempt purchases. Both documents require the buyer to provide specific information about the transaction and the exempt entity, ensuring compliance with state regulations.

-

Pennsylvania Exemption Certificate (REV-1220): In Pennsylvania, this certificate allows certain entities to make tax-exempt purchases. Both the REV-1220 and the Missouri 5060 require the purchaser to maintain accurate records of their exempt status.

-

Ohio Sales Tax Exemption Certificate: This document is utilized in Ohio for tax-exempt purchases. Similar to the Missouri 5060, it requires detailed information about the exempt entity and the nature of the purchase to ensure proper usage.

-

Virginia Sales and Use Tax Exemption Certificate: In Virginia, this certificate allows exempt organizations to make purchases without sales tax. Both forms emphasize the need for accurate and complete information to validate the exemption status.