Fill in a Valid Missouri 5092 Template

The Missouri 5092 form serves as an essential tool for dealers in the state, facilitating the monthly reporting of sales for motor vehicles and boats. This application is designed to streamline the process of filing sales reports, whether for new dealerships, changes to existing ones, or cancellations. Dealers can choose from various options to submit their sales data, including using the Internet Notice of Sale Reporting System or through a secure file transfer with their current front-end software. Each method requires specific technological capabilities, such as internet access and an updated browser, to ensure compliance with state regulations. The form also collects vital dealership information, including the name and contact details of the dealership and its representative, as well as unique dealer numbers for both motor vehicles and boats. By providing a clear structure for reporting, the Missouri 5092 form not only simplifies the administrative burden on dealers but also helps maintain accurate records for the Department of Revenue. Understanding the nuances of this form is crucial for dealers aiming to fulfill their legal obligations while effectively managing their sales operations.

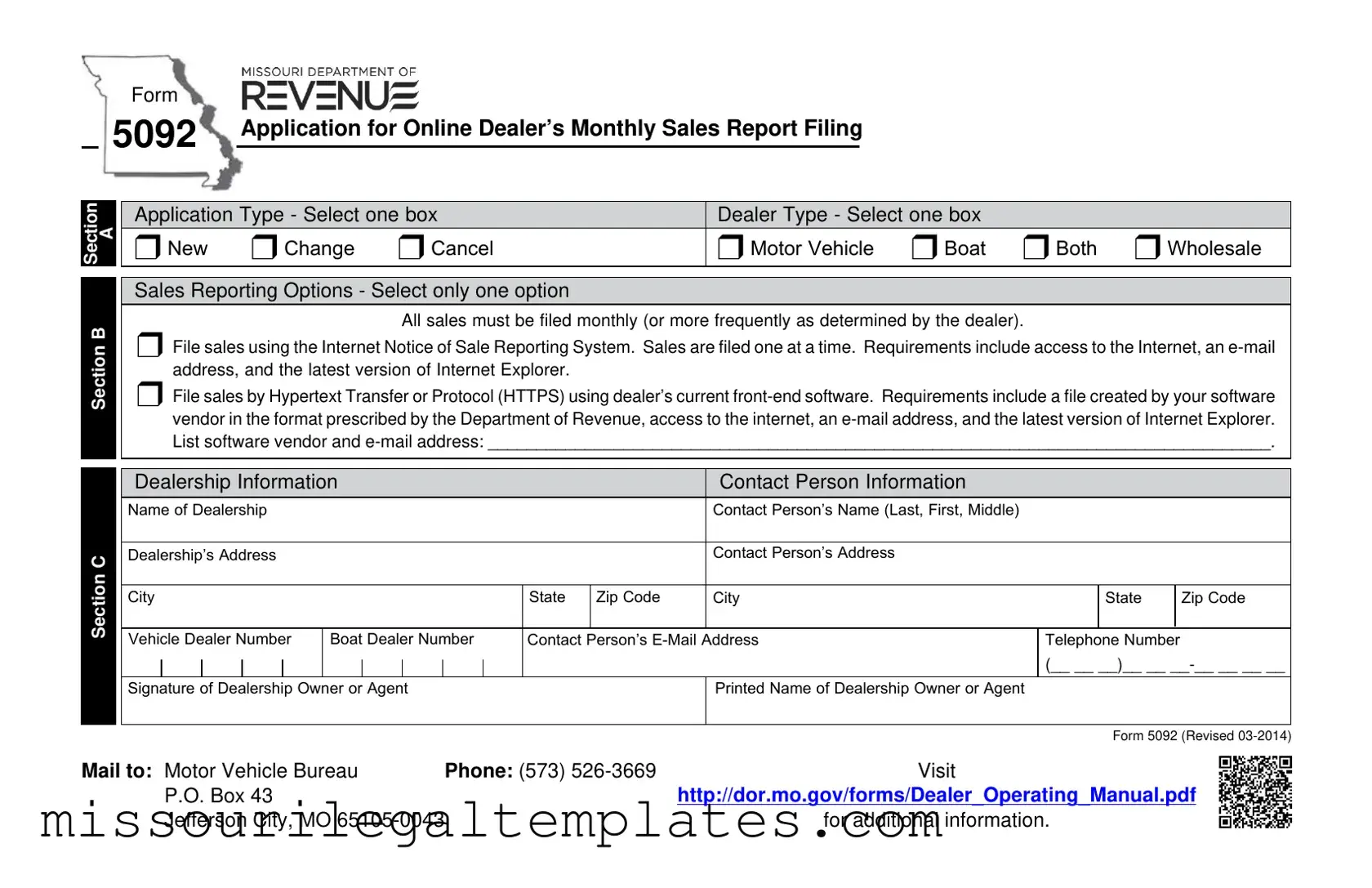

Missouri 5092 Preview

Form

5092 |

Application for Online Dealer’s Monthly Sales Report Filing |

|

Section Section BA

Section C

Application Type - Select one box |

|

|

Dealer Type - Select one box |

|

|

|

|

|

||||||||||

r New |

r Change |

r Cancel |

|

|

r Motor Vehicle |

r Boat |

r Both |

r Wholesale |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Reporting Options - Select only one option |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

All sales must be filed monthly (or more frequently as determined by the dealer). |

|

|

|

||||||||

r File sales using the Internet Notice of Sale Reporting System. Sales are filed one at a time. Requirements include access to the Internet, an |

||||||||||||||||||

|

address, and the latest version of Internet Explorer. |

|

|

|

|

|

|

|

|

|||||||||

r File sales by Hypertext Transfer or Protocol (HTTPS) using dealer’s current |

||||||||||||||||||

|

vendor in the format prescribed by the Department of Revenue, access to the internet, an |

|||||||||||||||||

|

List software vendor and |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dealership Information |

|

|

|

|

|

|

Contact Person Information |

|

|

|

|

|

||||||

Name of Dealership |

|

|

|

|

|

|

|

Contact Person’s Name (Last, First, Middle) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dealership’s Address |

|

|

|

|

|

|

|

Contact Person’s Address |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

State |

Zip Code |

City |

|

|

|

State |

|

Zip Code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Dealer Number |

Boat Dealer Number |

Contact Person’s |

|

|

Telephone Number |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(__ __ __)__ __ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Signature of Dealership Owner or Agent |

|

|

Printed Name of Dealership Owner or Agent |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 5092 (Revised

Mail to: Motor Vehicle Bureau |

Phone: (573) |

Visit |

P.O. Box 43 |

|

http://dor.mo.gov/forms/Dealer_Operating_Manual.pdf |

Jefferson City, MO |

|

for additional information. |

Common PDF Templates

How to Get a Dealers License Without a Car Lot in Va - Dealers need to report sales of motor vehicles, trailers, and powersport units.

Understanding the nuances of a Durable Power of Attorney form in California is essential for effective estate planning. This legal document not only allows one to appoint someone to handle financial decisions during incapacitation but also ensures that their intentions are honored in times of need. For those looking to create or learn more about this important document, resources such as smarttemplates.net can provide valuable insights and templates to facilitate the process.

Missouri Baptist University Rl007 - Approvals are based on availability and consideration of the students' circumstances.

Child Support Unemployment - This form reflects compliance with Rule 68.12 regarding mediation processes.

Dos and Don'ts

When filling out the Missouri 5092 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are eight key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do select the correct application type and dealer type to avoid processing delays.

- Do provide accurate contact information for both the dealership and the contact person.

- Do ensure you have the latest version of Internet Explorer if filing online.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to include the dealership owner or agent's signature before submitting.

- Don't use outdated software or methods for filing sales reports; adhere to the specified requirements.

- Don't hesitate to reach out to the Motor Vehicle Bureau for clarification if needed.

Key takeaways

Here are key takeaways regarding the Missouri 5092 form:

- The Missouri 5092 form is used for filing the Dealer’s Monthly Sales Report.

- Choose the correct application type: New, Change, or Cancel.

- Indicate the dealer type: Motor Vehicle, Boat, or Both.

- Sales must be reported monthly or more frequently, as determined by the dealer.

- Two options are available for filing sales: via the Internet Notice of Sale Reporting System or by using HTTPS with front-end software.

- Ensure you have access to the Internet and an email address for filing.

- For software filing, your vendor must provide a file in the required format.

- Complete the dealership information section accurately, including the name and address.

- Provide the contact person's information, including their name, address, and email.

- Remember to include the signature of the dealership owner or agent before submission.

For additional assistance, you may contact the Motor Vehicle Bureau at (573) 526-3669 or visit their website for more information.

Misconceptions

Understanding the Missouri 5092 form is crucial for dealers, yet several misconceptions can lead to confusion. Here are six common misunderstandings:

- Misconception 1: The 5092 form is only for new dealers.

- Misconception 2: All sales must be reported daily.

- Misconception 3: Only one method of filing is allowed.

- Misconception 4: Internet access is not necessary for filing.

- Misconception 5: The form does not require a signature.

- Misconception 6: The form can be mailed to any address.

This is not true. While new dealers do need to fill out the form, it is also applicable for existing dealers who want to change their information or cancel their registration.

In reality, all sales must be filed monthly or more frequently as determined by the dealer. This flexibility allows dealers to manage their reporting based on their sales volume.

Dealers have options. They can file sales using the Internet Notice of Sale Reporting System or by utilizing their own software to submit sales via HTTPS, depending on their preference and capabilities.

Internet access is indeed a requirement for filing. Whether using the online system or submitting via software, dealers must have internet connectivity to complete the process.

A signature from the dealership owner or agent is mandatory. This ensures that the information provided is verified and holds legal weight.

It is essential to send the completed form to the correct address: the Motor Vehicle Bureau in Jefferson City. Sending it to any other location may delay processing.

Being aware of these misconceptions can help ensure that the filing process goes smoothly and that all requirements are met. If there are any uncertainties, seeking clarification can provide peace of mind.

Similar forms

The Missouri 5092 form is an essential document for dealers who need to report their sales monthly. However, several other forms serve similar purposes in various contexts. Here’s a look at ten documents that share similarities with the Missouri 5092 form:

- Form 1099-MISC: This form is used for reporting miscellaneous income. Like the Missouri 5092, it requires accurate reporting of sales and transactions for tax purposes.

- Texas Motor Vehicle Bill of Sale: Essential for documenting vehicle ownership transfer, this form requires details like vehicle identification and sale price, ensuring compliance and protecting both buyer and seller in the transaction process. More information can be found at https://topformsonline.com/texas-motor-vehicle-bill-of-sale/.

- Form W-2: Employers use this form to report wages paid to employees. Similar to the 5092, it is filed annually and must include detailed information about earnings.

- Form 1040: This is the standard individual income tax return. Both forms require detailed reporting of financial activities, ensuring compliance with tax regulations.

- Form 990: Nonprofits use this form to report their financial activities. It shares the monthly reporting aspect, as it provides transparency about income and expenditures.

- Form 941: Employers file this quarterly form to report income taxes, Social Security tax, and Medicare tax withheld. Like the Missouri 5092, it requires timely submission and accuracy.

- Form 1065: Partnerships use this form to report income, deductions, gains, and losses. Both forms emphasize the importance of accurate reporting for legal compliance.

- Form 1041: This is the income tax return for estates and trusts. Similar to the 5092, it requires detailed financial information and is subject to strict filing deadlines.

- Form 720: This form is used to report and pay federal excise taxes. It shares the monthly filing requirement, ensuring that the government receives timely revenue.

- Form 8862: This form is used to claim the Earned Income Tax Credit after it has been denied. It requires accurate reporting of income, much like the Missouri 5092.

- Form 5500: Employee benefit plans use this form to report information about their financial condition. Similar to the Missouri 5092, it requires detailed financial reporting and compliance with regulations.

Understanding these forms can help you navigate the world of reporting and compliance more easily. Each document, while unique in its purpose, shares a common thread of ensuring accurate and timely reporting to the appropriate authorities.