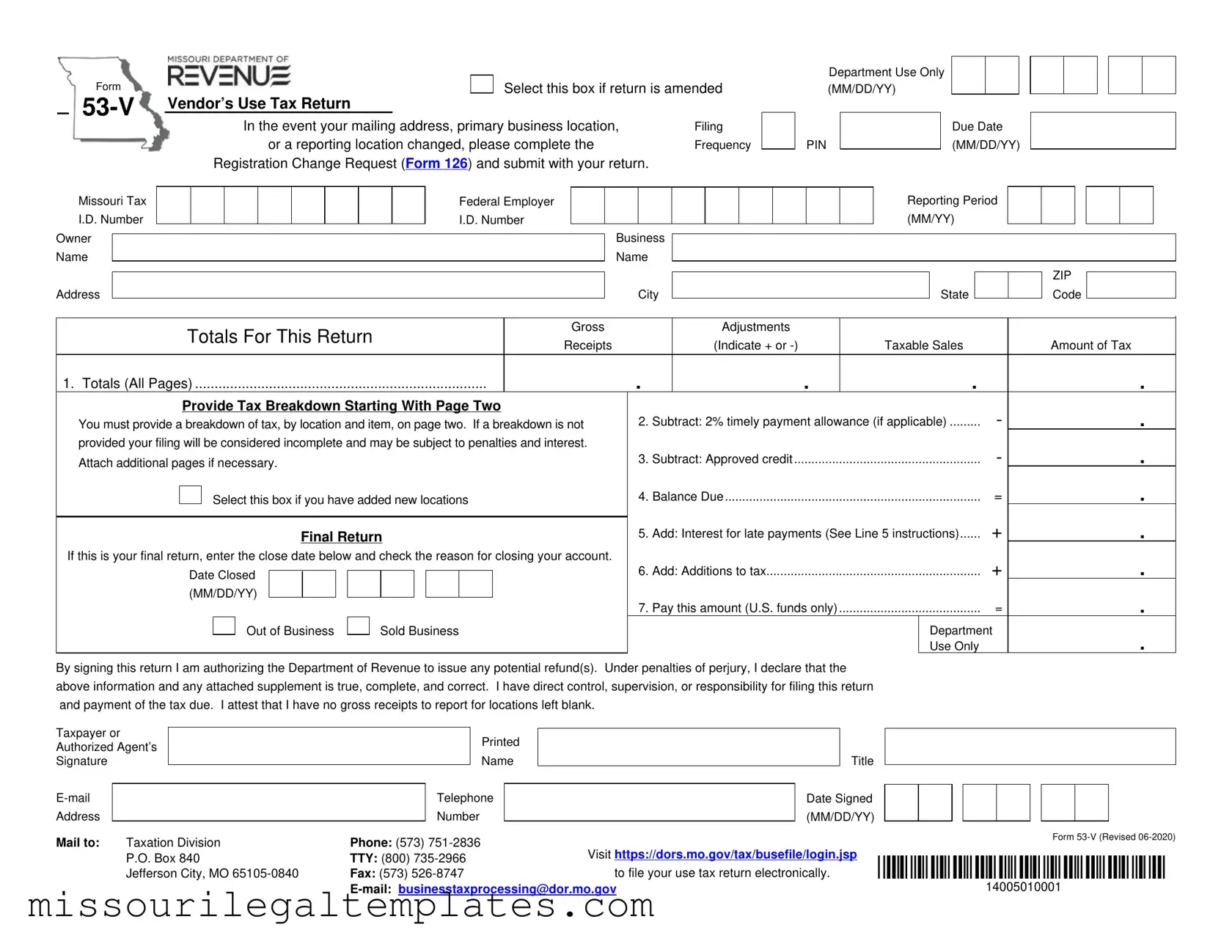

Fill in a Valid Missouri 53 V Template

The Missouri 53-V form, known as the Vendor’s Use Tax Return, serves as a crucial document for businesses operating within the state, particularly those engaged in sales that may be subject to use tax. This form is essential for reporting taxable sales and ensuring compliance with state tax laws. It requires businesses to detail their gross receipts, adjustments, and taxable sales for a specified reporting period. If a business has amended its previous return, it must check the appropriate box to indicate this change. Additionally, the form accommodates various scenarios, such as adding new business locations or filing a final return when ceasing operations. Proper completion of the 53-V form includes providing a breakdown of tax by location and item, which is vital for accurate tax assessment. Failure to provide this breakdown can result in penalties and interest. Businesses must also consider potential deductions, such as a timely payment allowance and approved credits, which can reduce the overall tax liability. The form emphasizes the importance of timely filing, as late submissions incur interest and additional penalties. Understanding the intricacies of the Missouri 53-V form is essential for business owners to navigate their tax obligations effectively and avoid unnecessary complications with the Department of Revenue.

Missouri 53 V Preview

Form |

|

|

|

Select this box if return is amended |

|

Vendor’s Use Tax Return |

|

|

|||

|

|

||||

|

In the event your mailing address, primary business location, |

Filing |

|||

|

or a reporting location changed, please complete the |

Frequency |

|||

|

Registration Change Request (Form 126) and submit with your return. |

|

|||

|

Department Use Only |

|

|

||

|

(MM/DD/YY) |

|

|

||

|

|

|

|

Due Date |

|

|

|

|

|

||

PIN |

|

|

|

(MM/DD/YY) |

|

Missouri Tax

I.D. Number Owner

Name

Address

Federal Employer

I.D. Number

Business

Name

City

Reporting Period (MM/YY)

|

|

|

ZIP |

State |

|

|

Code |

|

Totals For This Return |

|

|

|

|

|

Gross |

|

|

Adjustments |

|

|

|

|

|||||||||

|

|

|

|

|

|

Receipts |

|

|

(Indicate + or |

Taxable Sales |

|

Amount of Tax |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Totals (All Pages) |

|

|

|

|

|

|

. |

|

. |

|

|

. |

. |

||||||||||

|

Provide Tax Breakdown Starting With Page Two |

|

|

|

|

......... |

- |

. |

|||||||||||||||

You must provide a breakdown of tax, by location and item, on page two. If a breakdown is not |

2. |

Subtract: 2% timely payment allowance (if applicable) |

|||||||||||||||||||||

provided your filing will be considered incomplete and may be subject to penalties and interest. |

|

|

...................................................... |

|

|

- |

. |

||||||||||||||||

Attach additional pages if necessary. |

|

|

|

|

|

|

3. |

Subtract: Approved credit |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

. |

||||||||||||

|

|

|

Select this box if you have added new locations |

4. Balance Due |

|

|

= |

||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Add: Interest for late payments (See Line 5 instructions) |

+ |

. |

||||

|

|

|

|

|

Final Return |

||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||

If this is your final return, enter the close date below and check the reason for closing your account. |

|

|

|

|

|

+ |

. |

||||||||||||||||

|

Date Closed |

|

|

|

|

|

|

|

|

|

|

|

6. |

Add: Additions to tax |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

7. |

Pay this amount (U.S. funds only) |

|

|

= |

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

Out of Business |

|

|

Sold Business |

|

|

|

|

Department |

. |

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Only |

|||

By signing this return I am authorizing the Department of Revenue to issue any potential refund(s). Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I have direct control, supervision, or responsibility for filing this return and payment of the tax due. I attest that I have no gross receipts to report for locations left blank.

Taxpayer or |

|

|

|

|

Printed |

||

Authorized Agent’s |

|

|

|

||||

|

|

|

|

|

|||

Signature |

|

|

|

|

Name |

||

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

||

Address |

|

|

|

|

Number |

|

|

Mail to: |

Taxation Division |

Phone: (573) |

|||||

|

|

P.O. Box 840 |

TTY: (800) |

||||

|

|

Jefferson City, MO |

Fax: (573) |

||||

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

||

Visit https://dors.mo.gov/tax/busefile/login.jsp |

*14005010001* |

|||||||||||

to file your use tax return electronically. |

||||||||||||

14005010001 |

Missouri Tax I.D.

Number

Reporting Period

(MM/YY)

*14005020001*

14005020001 |

Page |

of

|

Business Location |

Jurisdiction Code |

|

Item |

|

Site |

Gross |

Adjustments |

|

Tax Rate (Do not |

|

|||||

Close |

(Street Address and City) |

(City, County, and District) |

|

Code |

|

Code |

Receipts |

(Indicate + or |

Taxable Sales |

include % symbol) |

Amount of Tax |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

Page

.

.

.

.

Vendor’s Use Tax Return (Form

Important: This return must be filed for the reporting period even though you have no tax to report.

Amended Return Check Box – This box should be checked to correct a previously filed return to show an increase or decrease in the amount of tax liability. A separate return must be filed for each period being amended. If the return and payment are being submitted after the period(s) due date, interest and penalty will apply to the additional amount being reported.

Please note if an overpayment has been authorized, the overpayment is subject to be used as an offset towards any debt. In addition, to receive a refund of the overpayment attach a Seller’s Claim for Sales or Use Tax Refund or Credit (Form 472S).

Filing Frequency - This is the frequency in which you are required to file your returns. Not a required field. If unknown leave blank.

PIN – This is a unique four digit number that is issued to you by the Department of Revenue. Not a required field. If unknown leave blank.

Due Date – Visit http://dor.mo.gov/taxcalendar/ for a list of due dates.

Missouri Tax I.D. Number – This is an eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered with the Department, complete the Missouri Tax Registration Application (Form 2643) or complete your registration online by going to https://dors.mo.gov/tax/coreg/index.jsp. If you have misplaced your Missouri Tax I.D Number, you can call (573)

Federal Employer I.D. Number – This is a nine digit identification number issued by the Internal Revenue Service to identify your business.

Reporting Period - This is the tax period you are required to file based on your filing frequency.

Owner and Business Name, Address, City, State and ZIP Code – Enter the name, address, city, state and ZIP code. Note: In the event your mailing address, primary business location, or a reporting location has changed you will need to complete the Missouri Registration Change Request (Form 126) and submit it with your return.

Line 1- Totals (All Pages) – Enter the total gross receipts, adjustments, taxable sales, and tax due for all pages.

Each page must have a breakdown per business location identifying the item code, site code, gross receipts, adjustment, taxable sales, and amount of tax. See the page two instructions for more information. If a breakdown is not provided, your filing will be considered incomplete and may be subject to penalties and interest. Attach additional pages if

necessary.

Adding New Locations – This box should be checked when adding a new business location(s). The location information (street address and city) on page two or subsequent pages must be completed when this box is checked. A breakdown per location which identifies the item code, gross receipts, adjustments, taxable sales, and amount of tax must also be

provided. See page two instructions for more information.

Final Return – If this is your final return, enter the close date and check the reason for closing your account. Missouri law requires any person selling or discontinuing business to make a final sales tax return within 15 days of the sale or closing.

Line 2 – Subtract: 2% Timely Payment Allowance – Multiply total amount of tax by 2% and enter the amount on this line. If the return is late the discount is not allowed.

Line 3 – Subtract: Approved Credit – This is a credit that has been approved by the Department of Revenue.

Line 4 – Balance Due – Amount of Tax from line 1 minus line 2, and 3 (if applicable).

Line 5 – Add Interest for late payments – If tax is not paid by the due date, (A) multiply Line 4 by the daily interest rate*. Then (B) multiply this amount by the number of days late. See example below. Note: The number of days late is counted from the due date to the postmark date.

For example, if the due date is March 20, and the postmark date is April 9, the payment is 20 days late. The example below is based on an annual interest rate of 4% and a daily rate of .0001096.

Example Line 3 is $480

(A)$480 x .0001096 = .05261

(B).05261 x 20 days late = 1.05

1.05is the interest for late payment

*The annual interest rate is subject to change each year. Visit http://dor.mo.gov/intrates.php to access the annual interest rate. Visit http://dor.mo.gov/calculators/interest/ for assistance calculating the appropriate interest.

*14000000001*

14000000001

Vendor’s Use Tax Return (Form

Lines 6 – Add Additions to Tax – For failure to pay sales tax on or before the due date, 5% of Line 4. For failure to file a sales tax return on or before the due date, 5% of Line 4 for each month late up to a maximum of 25% (5 months late in filing = 25%). Note: If additions to tax for failure to file apply, do not pay additions to tax for failure to pay.

For example, if a return due March 20 is filed any time between March

Example: Return is due March 20, but is filed (postmarked) April 10 |

Example: Return is due March 20, but is filed (postmarked) April 21 |

Line 5 is $480 |

Line 5 is $480 |

$480 x 5% = $24 |

$480 x 10% = $48 |

$24 is the additions to tax |

$48 is the additions to tax |

Access http://dor.mo.gov/calculators/interest/ to help you calculate the appropriate additions. |

|

Line 7 – Pay This Amount – Enter total amount due (Line 4 “plus” Line 5 “plus” Line 6). Send a check for the total amount. Make check, draft, or money order payable to Director of Revenue (U.S. funds only). Do not send cash or stamps. Visit http://dor.mo.gov/business/payonline.php to pay your vendors use tax online using a credit card or

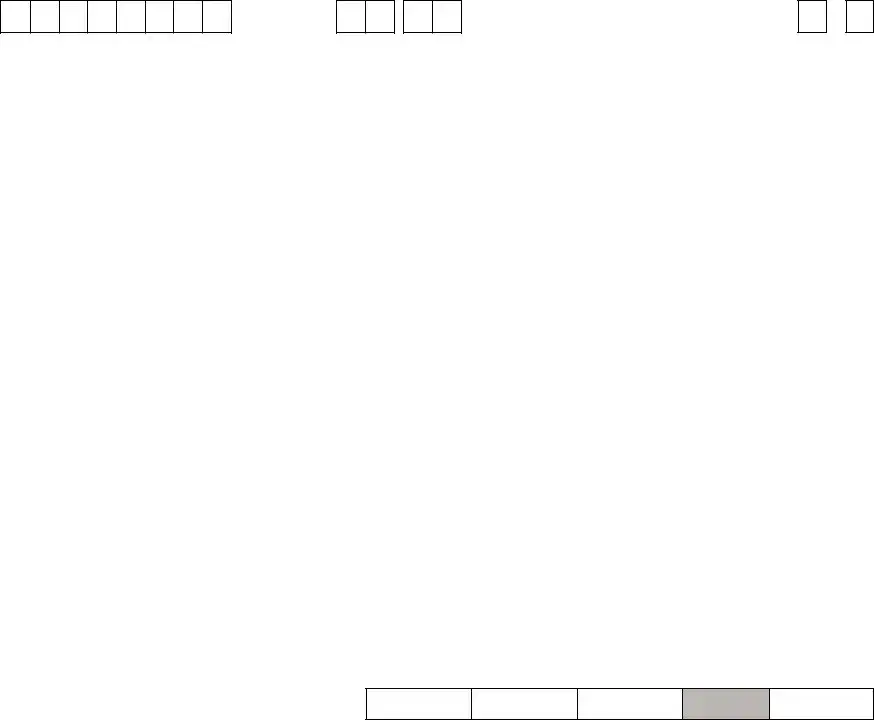

Page 2 Instructions

Missouri Tax I.D. Number – Enter your Missouri I.D. Number from page 1.

Reporting Period – Enter reporting period from page 1

Page _ of __ – The front page acts as page 1. Any sequent pages start with page 2. Please indicate total to ensure all pages are received.

Business Locations – Vendors whose sales to Missouri purchasers are not subject to sales tax are subject to use tax. Report your sales to customers located in every city, county or district that has enacted a local use tax on a separate location on your use tax return. Report sales to customers that are not located within a city, county or district that has enacted a local use tax on a “State Only” line on your return at a state rate of 4.225%. Report item taxes, such as the qualifying food tax, on a second line for each location. Clearly write the word “food” on that second line. If you have discontinued operation of a business location, check the “Close” box in front of the location.

Jurisdiction Code – Enter the jurisdiction code of each location from which you made sales. This is a numeric code that is assigned by the Missouri Department of Revenue to each city, county, and district. If unknown, leave blank.

Item Code – Enter the four digit item code that is assigned by the Department. Item taxes, such as the food tax, are reported on a separate line for each business location. If unknown, clearly indicate what the item tax is. For example, if you are reporting food sales at the lower food tax rate, write “Food”.

Site Code – Enter the one to four digit site code that is assigned by the Department. If unknown, leave blank.

Gross Receipts – Enter gross receipts from all sales of tangible personal property and taxable services made during the reporting period for each business location. If none, enter “zero” (0).

Adjustments – Make any adjustments for each location for which you are reporting. Indicate “plus” or “minus” for the total adjustment claimed for each location. A negative figure may be exempt sales or nontaxable receipts. Positive adjustments are items that were purchased exempt, but subsequently used by the seller.

Taxable Sales – Enter the amount of taxable sales for each business location. Gross Receipts (+) or

Rate – The rate percentage must include the combined state, conservation, parks and soils, and local option use tax rate for this “reporting location”. Tax rates for city “reporting locations” include any applicable county local option use tax. Vendors are responsible for collecting the correct local tax (where applicable) based on where the Missouri purchaser stores, uses, or consumes the tangible personal property. If you are unsure of the correct tax rate, access the Department’s website at http://dor.mo.gov/business/sales/rates or contact the Taxation Division at (573)

Amount of Tax – Multiply your taxable sales for each location by the applicable tax rate percent and enter the amount of tax.

Page Totals – Enter the total gross receipts, adjustments, taxable sales and tax due for each page.

*14000000001* |

Form |

14000000001

Common PDF Templates

How Long Can Someone Leave Their Belongings on Your Property Missouri - Each section of the form must be filled out thoroughly to ensure a smooth processing experience.

For those looking to navigate the complexities of the California DMV, it's essential to familiarize oneself with the necessary paperwork, such as the DL 44 form. This application process becomes more efficient when individuals utilize resources like smarttemplates.net, which can provide helpful templates and guidance to streamline the completion of this important documentation.

Missouri Title App - Missouri's Lien form can be submitted by mail or at a local license office.

What Paperwork Do I Need to Sell My Car Privately in Missouri - This form is essential for compliance with Missouri’s sales reporting regulations.

Dos and Don'ts

When filling out the Missouri 53 V form, careful attention to detail is essential. Here are five important guidelines to follow, along with five common pitfalls to avoid.

- Do ensure accuracy: Double-check all entries for correctness, including your Missouri Tax I.D. Number and business details.

- Do provide a tax breakdown: On page two, include a detailed breakdown of tax by location and item. This is crucial to avoid penalties.

- Do check the amended return box: If you are correcting a previously filed return, make sure to indicate that this is an amended return.

- Do submit on time: Be aware of the due date and ensure that your return is postmarked by that date to avoid late fees.

- Do attach necessary documents: If you have additional pages or need to report new locations, ensure these are included with your submission.

- Don’t leave fields blank: If certain information is unknown, such as your PIN or jurisdiction code, it is better to write “unknown” than to leave it blank.

- Don’t forget to sign: Ensure that the return is signed by you or an authorized agent. A missing signature can result in processing delays.

- Don’t ignore penalties: Be aware of potential penalties for late payments or filings. These can accumulate quickly if not addressed.

- Don’t send cash: Always pay by check or electronic means. Cash payments are not accepted and can complicate your filing.

- Don’t overlook the final return option: If this is your final return, mark it accordingly and provide the necessary closure date to avoid future tax obligations.

Key takeaways

Filing the Missouri 53 V form is a crucial process for businesses subject to use tax. Here are key takeaways to ensure compliance and accuracy:

- Amended Returns: Check the box for an amended return if correcting a previously filed return. Each amended period requires a separate return.

- Breakdown Requirement: A detailed tax breakdown by location and item is mandatory on page two. Failure to provide this may result in penalties and interest.

- Timely Payment Allowance: If applicable, subtract a 2% timely payment allowance from your total tax. This discount is not available for late submissions.

- Final Return Notification: If this is your final return, indicate the closing date and reason. Missouri law mandates filing a final return within 15 days of closing.

- Calculating Interest: If payments are late, calculate interest based on the daily rate. Be aware that the annual interest rate may change yearly.

- Business Location Reporting: Report sales to customers in cities or counties with local use taxes separately. Use the correct jurisdiction and item codes for accuracy.

- Payment Methods: Payments must be made in U.S. funds. Options include checks, drafts, or electronic payments through the Department’s website.

- Contact Information: For questions or assistance, contact the Missouri Department of Revenue. Ensure you have your Missouri Tax I.D. number readily available.

Understanding these points can help streamline the filing process and avoid potential issues. Stay compliant to prevent unnecessary penalties.

Misconceptions

- Misconception 1: The Missouri 53 V form is only for businesses with tax liabilities.

- Misconception 2: You can submit the form without a breakdown of tax by location.

- Misconception 3: The timely payment allowance is automatically applied.

- Misconception 4: You don’t need to report sales from locations that are out of business.

- Misconception 5: The form can be submitted without a signature.

- Misconception 6: You can use cash or stamps to pay your tax due.

- Misconception 7: You can submit multiple returns for the same period.

- Misconception 8: The form is not affected by changes in business address.

- Misconception 9: You can ignore the due date if you have no tax to report.

- Misconception 10: The Missouri Tax I.D. Number is optional.

This form must be filed even if there are no taxes to report. Failing to file can lead to penalties.

A detailed breakdown of tax by location and item is required. Without it, the filing may be deemed incomplete.

The 2% timely payment allowance must be calculated and entered manually. Late submissions forfeit this discount.

If a business location is closed, it still needs to be reported on the form. Check the “Close” box next to that location.

A signature is necessary to authorize the Department of Revenue to process any potential refunds and to affirm the accuracy of the information provided.

Payments must be made via check, draft, or money order in U.S. funds only. Cash and stamps are not accepted.

Each reporting period requires a separate return. If you need to amend a return, check the appropriate box and file a new form.

If your mailing address or primary business location changes, you must complete the Frequency Registration Change Request (Form 126) and submit it with your return.

Filing by the due date is crucial, even if there are no taxes to report. Late filings may incur penalties.

This number is essential for identifying your business. If you haven't registered, you must complete the Missouri Tax Registration Application.

Similar forms

The Missouri 53 V form, known as the Vendor’s Use Tax Return, shares similarities with several other tax-related documents. Here’s a breakdown of four forms that are comparable:

- Form 472S - Seller’s Claim for Sales or Use Tax Refund or Credit: Like the 53 V form, this document is used to report tax-related information. It specifically addresses situations where a seller seeks a refund or credit for overpaid sales or use tax, similar to how the 53 V calculates tax due or credits for timely payments.

- Form 2643 - Missouri Tax Registration Application: This form is essential for businesses registering for a Missouri Tax I.D. Number. It parallels the 53 V form in that both require accurate business information and are necessary for compliance with state tax regulations.

- Bill of Sale: A Texas Bill of Sale is crucial for documenting the legal transfer of ownership of personal property, ensuring protection for both parties involved in the transaction. For more information, visit https://topformsonline.com/texas-bill-of-sale/.

- Form 126 - Frequency Registration Change Request: If a business changes its mailing address or reporting frequency, this form is required. It is similar to the 53 V in that it must be submitted alongside other tax documents to ensure all information is current and accurate.

- Form 1040 - U.S. Individual Income Tax Return: Although targeted at individuals rather than businesses, both forms require detailed reporting of financial information. Each form calculates tax liability based on reported income, ensuring compliance with tax obligations.