Fill in a Valid Missouri 5435 Template

The Missouri 5435 form is an essential document for individuals and businesses looking to apply for a sales tax exemption on commercial motor vehicles or trailers that exceed 54,000 pounds. This form must be submitted alongside a title application at the local license office when titling a qualifying vehicle or trailer. Notably, vehicles registered over this weight limit, as well as trailers that regularly transport loads greater than 54,000 pounds, are exempt from motor vehicle sales tax. To ensure compliance, applicants must provide specific information, including their name, address, and details about the vehicle or trailer, such as the year, make, and vehicle identification number. Additionally, the form requires a certification of facts, where the applicant affirms ownership and confirms that the vehicle is used for business purposes related to hauling property on public highways. Proper completion and submission of the Missouri 5435 form can facilitate significant tax savings for eligible commercial operations.

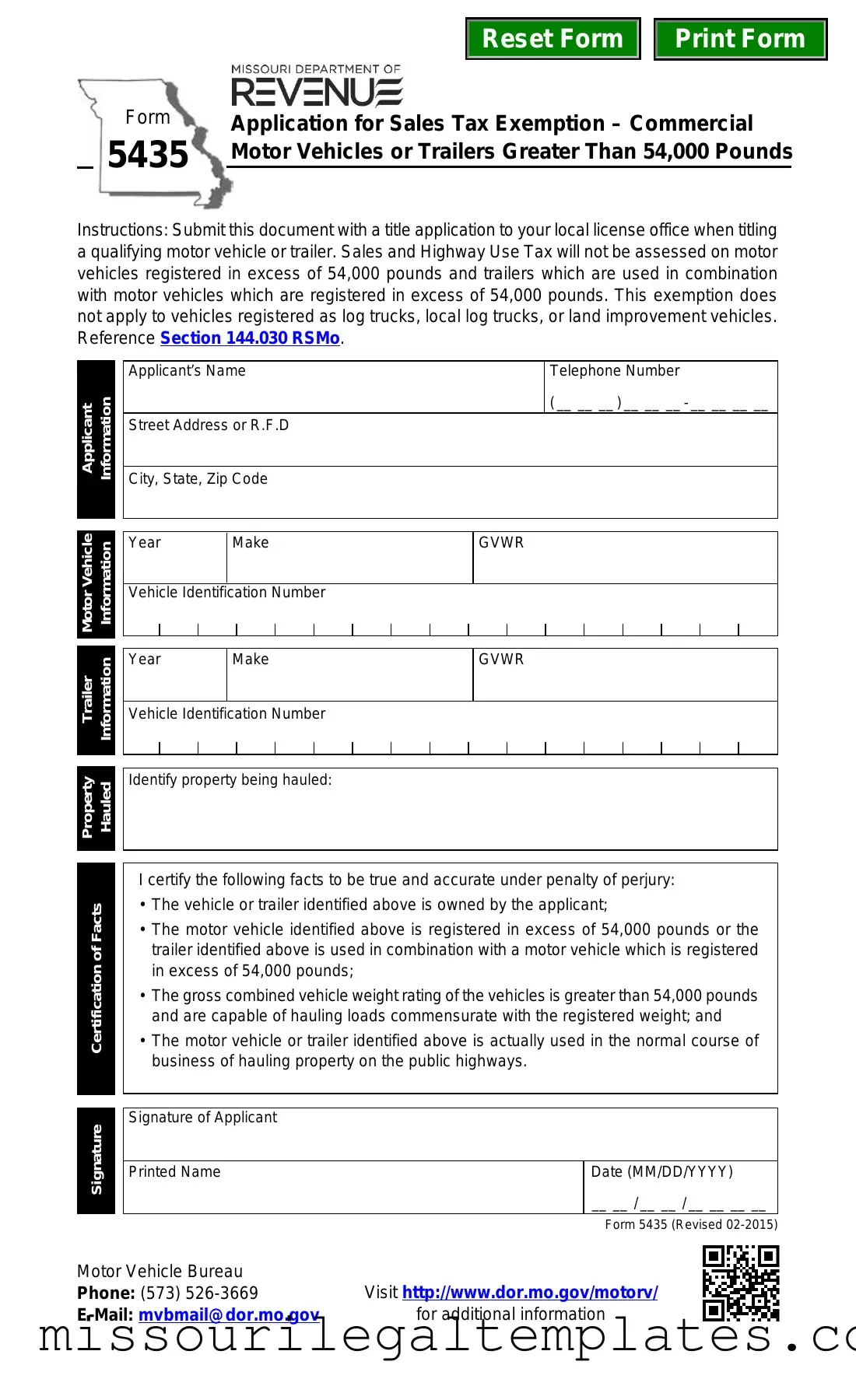

Missouri 5435 Preview

Reset Form

Print Form

Form |

Application for Sales Tax Exemption – Commercial |

5435 |

Motor Vehicles or Trailers Greater Than 54,000 Pounds |

Instructions: Submit this document with a title application to your local license office when titling a qualifying motor vehicle or trailer. Sales and Highway Use Tax will not be assessed on motor vehicles registered in excess of 54,000 pounds and trailers which are used in combination with motor vehicles which are registered in excess of 54,000 pounds. This exemption does not apply to vehicles registered as log trucks, local log trucks, or land improvement vehicles. Reference Section 144.030 RSMo.

Applicant |

Information |

|

|

|

|

Motor Vehicle |

Information |

|

|

Trailer |

Information |

|

|

|

|

Property |

Hauled |

|

|

Applicant’s Name

Street Address or R.F.D

City, State, Zip Code

Year Make

Vehicle Identification Number

Year |

Make |

|

|

Vehicle Identification Number

Identify property being hauled:

Telephone Number

( __ __ __ ) __ __ __

GVWR

GVWR

Signature Certification of Facts

Signature Certification of Facts

I certify the following facts to be true and accurate under penalty of perjury:

•The vehicle or trailer identified above is owned by the applicant;

•The motor vehicle identified above is registered in excess of 54,000 pounds or the trailer identified above is used in combination with a motor vehicle which is registered in excess of 54,000 pounds;

•The gross combined vehicle weight rating of the vehicles is greater than 54,000 pounds and are capable of hauling loads commensurate with the registered weight; and

•The motor vehicle or trailer identified above is actually used in the normal course of business of hauling property on the public highways.

Signature of Applicant

Printed Name |

Date (MM/DD/YYYY) |

__ __ / __ __ / __ __ __ __

Form 5435 (Revised

Motor Vehicle Bureau |

Visit http://www.dor.mo.gov/motorv/ |

Phone: (573) |

|

for additional information |

Common PDF Templates

Laboratory Analysis Request Missouri - Each request must specify the nature of the crime and evidence related to it.

Missouri Gas Tax Refund 2024 - A line is provided for the signature of the declarant, certifying the report's accuracy.

A Florida Cease and Desist Letter is a formal document used to demand that an individual or organization stop certain actions that are believed to be harmful or unlawful. This letter serves as a warning before legal action may be pursued, allowing the recipient an opportunity to comply with the request. If you need to address a situation, consider filling out the Cease and Desist Letter form by clicking the button below.

Mo Income Tax - Tax records can be requested for any period specified by the taxpayer on the form.

Dos and Don'ts

When filling out the Missouri 5435 form, it is important to adhere to specific guidelines to ensure accuracy and compliance. Below are five recommendations on what to do and what to avoid during the process.

- Do provide accurate information about the vehicle or trailer, including the Vehicle Identification Number (VIN).

- Do ensure that the gross vehicle weight ratings (GVWR) are clearly stated and exceed 54,000 pounds.

- Do sign and date the form to certify the facts under penalty of perjury.

- Do submit the form along with the title application to your local license office.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; all required information must be filled out completely.

- Don't provide incorrect or misleading information regarding the use of the vehicle or trailer.

- Don't forget to check the certification of facts to ensure all statements are accurate.

- Don't submit the form without verifying that it is the most current version.

- Don't ignore the submission deadlines or requirements set by your local license office.

Key takeaways

Understanding the Missouri 5435 form is crucial for anyone looking to apply for a sales tax exemption on commercial motor vehicles or trailers exceeding 54,000 pounds. Here are some key takeaways to help you navigate the process smoothly:

- Purpose of the Form: The Missouri 5435 form is used to apply for a sales tax exemption on qualifying commercial motor vehicles and trailers that meet specific weight criteria.

- Eligibility Requirements: To qualify, the vehicle must be registered in excess of 54,000 pounds, and the trailer must regularly haul loads greater than 54,000 pounds.

- Submission Location: This form should be submitted to your local license office along with your title application when titling a qualifying vehicle or trailer.

- Information Needed: You will need to provide detailed information, including the applicant’s name, address, vehicle identification numbers, and gross vehicle weight ratings (GVWR).

- Certification of Facts: By signing the form, you certify that the information provided is true and accurate. This is important as false statements can lead to penalties.

- Usage Requirement: The vehicle or trailer must be used in the normal course of business for hauling property on public highways to qualify for the exemption.

- Contact Information: For any questions or additional guidance, you can reach the Motor Vehicle Bureau at (573) 526-3669 or via email at mvbmail@dor.mo.gov.

- Additional Resources: More information can be found on the Missouri Department of Revenue's website, which offers further details on the exemption process and requirements.

Filling out the Missouri 5435 form correctly can save you money and ensure compliance with state regulations. Take your time, gather all necessary information, and don’t hesitate to reach out for help if needed.

Misconceptions

Here are six common misconceptions about the Missouri 5435 form:

- Only trucks qualify for the exemption. Many believe that only large trucks can use this form. In reality, any commercial motor vehicle or trailer over 54,000 pounds can qualify for the sales tax exemption.

- The form is only for new vehicles. Some think that the Missouri 5435 form is only applicable to new purchases. However, it can also be used for used vehicles that meet the weight criteria.

- All trailers are exempt. A common misunderstanding is that all trailers automatically qualify for the exemption. To be eligible, trailers must regularly haul loads greater than 54,000 pounds and have a gross vehicle weight rating above that threshold.

- There is no penalty for inaccurate information. Some people believe they can submit the form without concern for accuracy. In fact, applicants certify the information under penalty of perjury, which means false claims can lead to serious consequences.

- The form can be submitted anytime. Many assume they can submit the form whenever they like. It's important to remember that it must be submitted alongside a title application at the local license office.

- Filing the form guarantees exemption. Some think that just filling out the form ensures the exemption will be granted. The application is subject to review, and meeting the criteria does not guarantee approval.

Similar forms

The Missouri 5435 form serves as an application for sales tax exemption specifically for commercial motor vehicles or trailers exceeding 54,000 pounds. Similar forms exist across various jurisdictions and contexts, each designed to facilitate tax exemptions or special registrations. Here are nine documents that share similarities with the Missouri 5435 form:

- Form ST-2 (Missouri Sales Tax Exemption Certificate): This form allows businesses to claim sales tax exemption on purchases of goods used in their operations, similar to how the 5435 form exempts specific vehicles from sales tax.

- California DMV DL 44 Form: This form is essential for California residents applying for or renewing their driver's license. Similar to the Missouri forms mentioned, it necessitates accurate personal details and can be found at smarttemplates.net.

- Form 2290 (Heavy Highway Vehicle Use Tax Return): This federal form is used to report and pay taxes for heavy vehicles, like those covered under the Missouri 5435, emphasizing the weight criteria for tax considerations.

- Form 85 (Application for Exemption from Property Tax): This form is used in various states to claim exemptions for property taxes, focusing on specific criteria such as usage and weight, akin to the requirements in the Missouri 5435.

- Form 1040 (U.S. Individual Income Tax Return): While primarily for income reporting, certain deductions can be claimed for business vehicles, paralleling the exemption purpose of the Missouri 5435.

- Form 941 (Employer's Quarterly Federal Tax Return): This form requires businesses to report payroll taxes, including those for vehicles used in business operations, similar to the business-use requirement in the Missouri 5435.

- Form 990 (Return of Organization Exempt from Income Tax): Nonprofits use this form to report their financial activities, including vehicle use for exempt purposes, reflecting the exemption aspect of the Missouri 5435.

- Form DR-1 (Application for Sales Tax Exemption in Florida): This Florida form allows for sales tax exemptions on specific purchases, similar to the Missouri 5435's focus on commercial vehicles.

- Form MV-1 (Application for Title and Registration): Used in many states, this form registers vehicles and may include exemptions for certain types of vehicles, much like the Missouri 5435.

- Form TR-1 (Tax Exemption Certificate for Motor Vehicles): This form, used in various states, provides tax exemptions for specific vehicles based on their use, paralleling the purpose of the Missouri 5435.

Understanding these forms can help clarify the broader context of tax exemptions related to vehicles and trailers, aiding in compliance and financial planning.