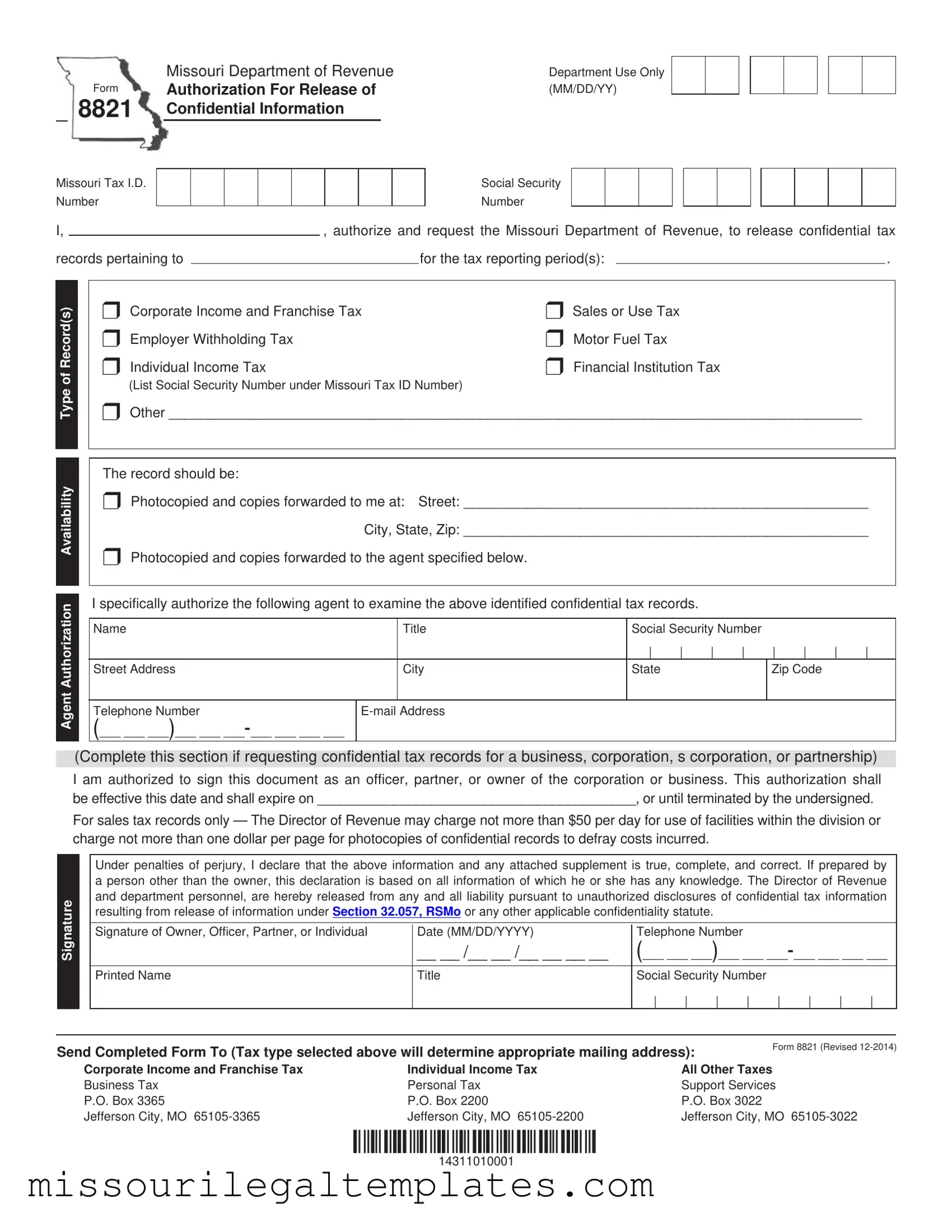

Fill in a Valid Missouri 8821 Template

The Missouri 8821 form, officially known as the Authorization for Release of Confidential Information, plays a crucial role in the realm of tax management. This form allows individuals or businesses to request the Missouri Department of Revenue to release their confidential tax records for specific reporting periods. Whether you're dealing with corporate income tax, sales tax, or individual income tax, this form is essential for ensuring that authorized agents can access necessary tax information. It requires the taxpayer's identification, such as a Missouri Tax ID number or Social Security number, to validate the request. Additionally, the form outlines the types of records available for release, including employer withholding tax and financial institution tax, among others. Taxpayers can choose to receive photocopies of their records directly or have them sent to an authorized agent. Notably, the form also includes provisions regarding potential fees for accessing these records, emphasizing the importance of understanding the costs involved. With a signature, the taxpayer affirms the accuracy of the information provided and acknowledges the release of liability for the Department of Revenue regarding unauthorized disclosures. Understanding the Missouri 8821 form is essential for anyone looking to manage their tax records efficiently and ensure compliance with state regulations.

Missouri 8821 Preview

|

Missouri Department of Revenue |

|

Form |

Authorization For Release of |

|

8821 |

Confidential Information |

|

Missouri Tax I.D.

Number

Department Use Only (MM/DD/YY)

Social Security

Number

I, |

|

|

, authorize and request the Missouri Department of Revenue, to release confidential tax |

|||

records pertaining to |

|

|

for the tax reporting period(s): |

|

. |

|

Type of Record(s)

Agent AuthorizationAvailability

r Corporate Income and Franchise Tax |

r Sales or Use Tax |

r Employer Withholding Tax |

r Motor Fuel Tax |

r Individual Income Tax |

r Financial Institution Tax |

(List Social Security Number under Missouri Tax ID Number) |

|

rOther _________________________________________________________________________________________

The record should be:

rPhotocopied and copies forwarded to me at: Street: ____________________________________________________

City, State, Zip: ____________________________________________________

rPhotocopied and copies forwarded to the agent specified below.

I specifically authorize the following agent to examine the above identified confidential tax records.

Name |

|

Title |

Social Security Number |

|

|

|

|

|||

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

Street Address |

|

City |

State |

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

||

(___ ___ ___)___ ___ |

|

|

|

|

|

|

|

|

|

|

(Complete this section if requesting confidential tax records for a business, corporation, s corporation, or partnership)

I am authorized to sign this document as an officer, partner, or owner of the corporation or business. This authorization shall be effective this date and shall expire on __________________________________________, or until terminated by the undersigned.

For sales tax records only — The Director of Revenue may charge not more than $50 per day for use of facilities within the division or charge not more than one dollar per page for photocopies of confidential records to defray costs incurred.

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. If prepared by a person other than the owner, this declaration is based on all information of which he or she has any knowledge. The Director of Revenue and department personnel, are hereby released from any and all liability pursuant to unauthorized disclosures of confidential tax information resulting from release of information under Section 32.057, RSMo or any other applicable confidentiality statute.

Signature of Owner, Officer, Partner, or Individual |

Date (MM/DD/YYYY) |

Telephone Number |

|

|

|

|

|

||

|

__ __ /__ __ /__ __ __ __ |

(___ ___ ___)___ ___ |

|||||||

|

|

|

|

|

|

|

|||

Printed Name |

Title |

Social Security Number |

|

|

|

|

|||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

Send Completed Form To (Tax type selected above will determine appropriate mailing address):

Form 8821 (Revised

Corporate Income and Franchise Tax |

Individual Income Tax |

All Other Taxes |

Business Tax |

Personal Tax |

Support Services |

P.O. Box 3365 |

P.O. Box 2200 |

P.O. Box 3022 |

Jefferson City, MO |

Jefferson City, MO |

Jefferson City, MO |

14311010001

14311010001

Common PDF Templates

What Makes a Subpoena Invalid California - All parties involved must retain a copy of the subpoena for reference.

When dealing with vehicle sales in California, it's essential to be familiar with the California Form Reg 262, a document that facilitates the transfer of ownership. For a comprehensive breakdown of this form, including its requirements and implications, you can visit https://smarttemplates.net/. Understanding the nuances of this form is vital for ensuring that your transaction adheres to all legal requirements and avoids potential disputes.

Missouri Farm Tax Exemption Requirements - Consider consulting with tax professionals when navigating exemptions and construction projects.

Dos and Don'ts

When filling out the Missouri 8821 form, there are important dos and don’ts to keep in mind. Here’s a helpful list to guide you through the process.

- Do provide accurate information. Make sure all names, addresses, and numbers are correct.

- Do sign the form. An unsigned form may be rejected.

- Do specify the tax reporting periods clearly. This helps in processing your request.

- Do include your contact information. This ensures the Department can reach you if needed.

- Do check the mailing address for the tax type you selected. This prevents delays.

- Don't leave any sections blank. Incomplete forms can lead to rejection.

- Don't forget to include your Social Security Number if required. This is crucial for identification.

- Don't submit the form without reviewing it. Errors can cause issues down the line.

- Don't use a previous version of the form. Always use the most recent version available.

- Don't ignore the expiration date of the authorization. Make sure it is clear and valid.

Key takeaways

Here are some important points to consider when filling out and using the Missouri 8821 form:

- Purpose of the Form: The Missouri 8821 form is used to authorize the release of confidential tax records from the Missouri Department of Revenue.

- Tax Identification: Make sure to include the correct Missouri Tax I.D. Number and Social Security Number where indicated.

- Type of Records: Specify the type of tax records you need, such as Corporate Income Tax or Individual Income Tax.

- Agent Authorization: If you want to authorize someone else to access your records, provide their name, title, and contact information clearly.

- Delivery Method: Indicate whether you want the records sent to yourself or directly to your authorized agent.

- Expiration Date: The authorization remains effective until the date you specify or until you terminate it.

- Fees: Be aware that there may be fees for accessing certain records, such as $50 per day for facility use or $1 per page for photocopies.

- Signature Requirement: Ensure that the form is signed by an authorized individual, such as an owner or officer, to validate the request.

By keeping these key takeaways in mind, you can navigate the process of using the Missouri 8821 form more effectively.

Misconceptions

Understanding the Missouri 8821 form is crucial for anyone needing to authorize the release of confidential tax information. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The Missouri 8821 form can only be used for individual tax records.

- Misconception 2: Completing the form guarantees immediate access to tax records.

- Misconception 3: Only the person whose tax records are being requested can fill out the form.

- Misconception 4: There are no costs associated with using the Missouri 8821 form.

This is not true. The form can be used to authorize the release of various types of tax records, including corporate income, sales tax, and employer withholding tax. It is versatile and applicable to both individuals and businesses.

While the form authorizes the release of records, access may depend on processing times and the specific circumstances surrounding the request. It’s essential to allow for some time for the Missouri Department of Revenue to fulfill the request.

In fact, an authorized representative can complete the form on behalf of the individual or business. However, the person completing the form must have the legal authority to do so, such as being an officer or partner of a corporation.

This is misleading. The Director of Revenue may charge fees for photocopying records or for the use of facilities. For example, there may be a charge of up to $50 per day for facility use or $1 per page for photocopies.

Similar forms

-

IRS Form 4506: This form allows taxpayers to request a copy of their tax return from the IRS. Similar to the Missouri 8821, it requires personal information to identify the tax records being requested and can be sent to a third party for review.

-

Texas Bill of Sale - This document serves as proof of the transfer of ownership of personal property in Texas. It protects both parties involved in the transaction and can be crucial for items like vehicles and equipment, providing clarity in legal terms. More information can be found at https://topformsonline.com/texas-bill-of-sale.

-

IRS Form 8821: Known as the Tax Information Authorization form, it enables taxpayers to authorize an individual or organization to receive confidential tax information from the IRS. Like the Missouri 8821, it requires the taxpayer's identification and specifies the records to be accessed.

-

State Tax Agency Power of Attorney: This document allows an individual to designate someone to act on their behalf regarding tax matters. It shares similarities with the Missouri 8821 in that it grants access to confidential information and requires the taxpayer's signature.

-

Form 1040, Schedule C: While primarily used for reporting income from self-employment, this form can also include authorizations for tax record requests. It aligns with the Missouri 8821 in that both forms pertain to the handling of tax information and require accurate identification of the taxpayer.