Fill in a Valid Missouri 943 Template

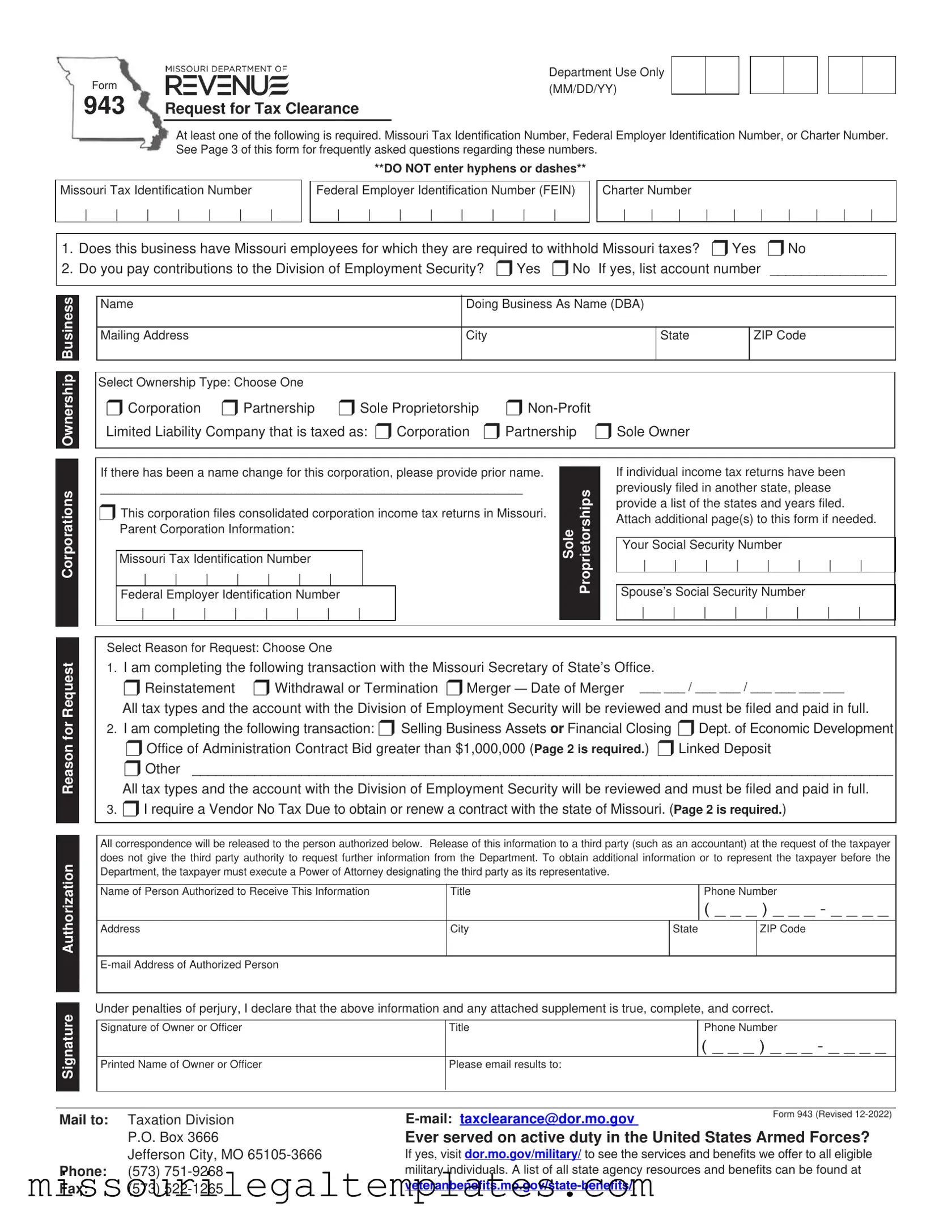

The Missouri 943 form, also known as the Request for Tax Clearance, serves a crucial role for businesses operating within the state. This form is primarily utilized to confirm that a business has fulfilled its tax obligations, which is essential for various transactions, including reinstatement, withdrawal, or merger with the Missouri Secretary of State’s Office. It is also necessary for businesses seeking to obtain or renew contracts with the state, particularly those exceeding $1,000,000. To complete the form, businesses must provide several key pieces of information, including their Missouri Tax Identification Number, Federal Employer Identification Number (FEIN), and ownership details. The form includes specific questions regarding employee withholding and contributions to the Division of Employment Security, which help determine the business's tax compliance status. Furthermore, businesses must indicate the reason for their request, ensuring that all tax types are reviewed and any outstanding taxes are settled. The form also emphasizes the importance of accurate representation, requiring a signature from the owner or corporate officer to validate the information provided. Understanding the Missouri 943 form is essential for any business looking to navigate the state's regulatory landscape effectively.

Missouri 943 Preview

Department Use Only

Form |

(MM/DD/YY) |

|

943 Request for Tax Clearance

At least one of the following is required. Missouri Tax Identification Number, Federal Employer Identification Number, or Charter Number. See Page 3 of this form for frequently asked questions regarding these numbers.

**DO NOT enter hyphens or dashes**

Missouri Tax Identification Number

| |

| |

| |

| |

| |

| |

| |

Federal Employer Identification Number (FEIN)

| |

| |

| |

| |

| |

| |

| |

| |

Charter Number

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

1. |

Does this business have Missouri employees for which they are required to withhold Missouri taxes? r Yes |

r No |

2. |

Do you pay contributions to the Division of Employment Security? r Yes r No If yes, list account number |

_______________ |

|

|

|

Business

Name

Mailing Address

Doing Business As Name (DBA)

City |

State |

ZIP Code |

|

|

|

Ownership

Select Ownership Type: Choose One |

|

r Corporation r Partnership r Sole Proprietorship |

r |

Limited Liability Company that is taxed as: r Corporation |

r Partnership r Sole Owner |

|

|

Corporations

If there has been a name change for this corporation, please provide prior name.

_____________________________________________________________

rThis corporation files consolidated corporation income tax returns in Missouri. Parent Corporation Information:

Missouri Tax Identification Number

| |

| |

| |

| |

| |

| |

| |

|

Federal Employer Identification Number |

|

||||||

| |

| |

| |

| |

| |

| |

| |

| |

Sole Proprietorships

If individual income tax returns have been previously filed in another state, please provide a list of the states and years filed. Attach additional page(s) to this form if needed.

Your Social Security Number

| |

| |

| |

| |

| |

| |

| |

| |

Spouse’s Social Security Number

| |

| |

| |

| |

| |

| |

| |

| |

Reason for Request

SignatureAuthorization

Select Reason for Request: Choose One

1.I am completing the following transaction with the Missouri Secretary of State’s Office.

r Reinstatement r Withdrawal or Termination r Merger — Date of Merger

All tax types and the account with the Division of Employment Security will be reviewed and must be filed and paid in full.

2.I am completing the following transaction: r Selling Business Assets or Financial Closing r Dept. of Economic Development r Office of Administration Contract Bid greater than $1,000,000 (Page 2 is required.) r Linked Deposit

r Other __________________________________________________________________________________________

All tax types and the account with the Division of Employment Security will be reviewed and must be filed and paid in full.

3.r I require a Vendor No Tax Due to obtain or renew a contract with the state of Missouri. (Page 2 is required.)

All correspondence will be released to the person authorized below. Release of this information to a third party (such as an accountant) at the request of the taxpayer does not give the third party authority to request further information from the Department. To obtain additional information or to represent the taxpayer before the Department, the taxpayer must execute a Power of Attorney designating the third party as its representative.

Name of Person Authorized to Receive This Information |

Title |

|

Phone Number |

|

|

|

|

( _ _ _ ) _ _ _ - _ _ _ _ |

|

Address |

City |

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature of Owner or Officer |

Title |

Phone Number |

( _ _ _ ) _ _ _ - _ _ _ _

Printed Name of Owner or Officer |

Please email results to: |

Mail to: Taxation Division P.O. Box 3666

Jefferson City, MO

Phone: (573)

Fax: (573)

Form 943 (Revised |

|

|

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources and benefits can be found at

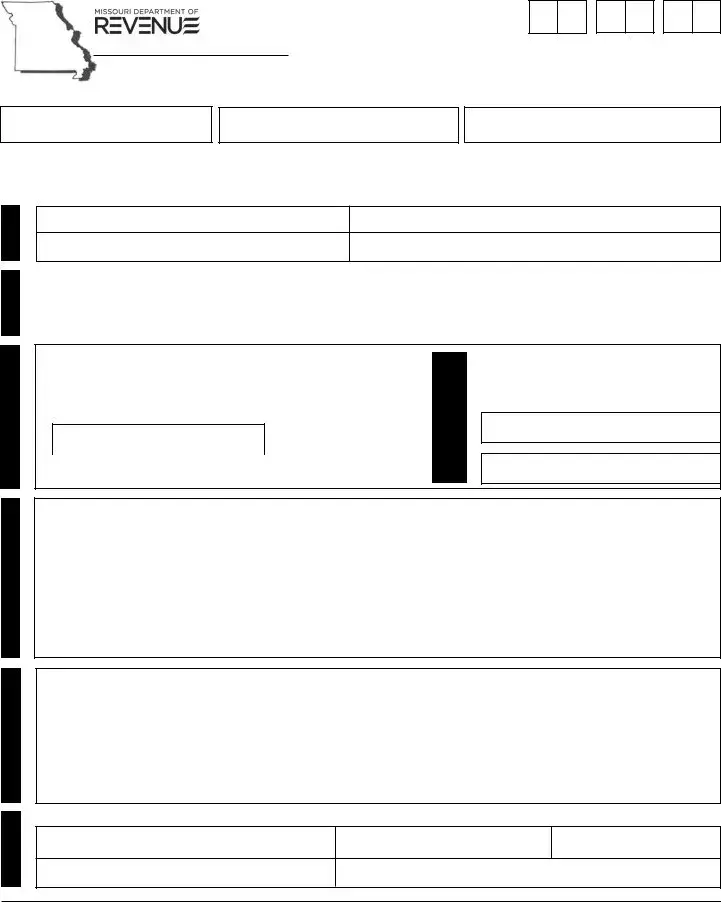

Complete this page and attach to form 943 if Reason for Request on page 1 is for a Vendor No Tax Due or Office of Administration contract or bid greater than $1,000,000. All applicable identification numbers must be completed on page 1 in order to process your request.

Requestfor |

|

|

|

|

|

|

1. |

I am requesting a Vendor No Tax Due for a |

r Bid |

r Contract |

|||

|

|

|||||

|

|

|

|

|

|

|

Reason |

|

2. |

Is the bid or contract for a |

r Individual |

r Business |

|

|

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

|

Information

1.Name of state agency or university that the bid or contract is with. ___________________________________________________________

_______________________________________________________________________________________________________________

2.What service(s) or item(s) will be supplied in the bid or contract? ____________________________________________________________

3. |

Does the business or individual make taxable sales to Missouri customers? |

. . . . . . r Yes |

rNo |

4. |

Does the business or individual have any affiliates (any person or entity that is controlled or under common |

|

|

|

control with the vendor) in the state of Missouri? |

. . . . . r Yes |

rNo |

|

If yes, please list the FEIN(s) and Missouri Tax Identification Number(s). Attach a second sheet if needed. ___________________________ |

||

|

_______________________________________________________________________________________________________________ |

||

5. |

Do any of the affiliates make taxable sales? |

r Yes r No |

r N/A |

Comments

Form 943 (Revised

Frequently Asked Questions

1.What if I don’t know my Missouri tax identification number?

The Missouri tax identification number is assigned by the Missouri Department of Revenue at the time you register for the reporting of sales, use, withholding, corporation income, or corporation franchise tax. If you have not registered your business or need to check on the status of a registration, please contact Business Tax Registration at (573)

2.What is my federal employer identification number?

The Internal Revenue Service issues your federal employer identification number when you register to file federal taxes. If you do not have this number, we will review the account based on the information provided.

3.What is my corporation charter number or certificate of authority number?

Your corporate charter number is issued to a Missouri corporation, limited liability company or limited partnership, by the Missouri Secretary of State’s Office, authorizing your company to transact business in the State of Missouri. The certificate of authority number is issued by the Missouri Secretary of State’s Office to foreign entities. Questions concerning these numbers should be directed to the Missouri Secretary of State’s Office at (573)

4.I am a foreign corporation. Am I required to register with the Missouri Secretary of State’s Office?

If you are a corporation, you must be authorized to transact business in the State of Missouri with the Missouri Secretary of State’s Office. Some foreign corporations may not be required to obtain a certificate of authority number in Missouri. If your corporation is not required, indicate so and the reason why. You may review Section 351.572.2, RSMo, for possible reasons a corporation may not be required to register.

5.What are the reasons a corporation is dissolved?

A corporation can be dissolved for failure to file the Annual Report, failure to file and or pay required taxes, failure to maintain a registered agent, and practicing fraud against the state.

6.What are the consequences of being administratively dissolved versus voluntarily dissolved?

If the corporation voluntarily dissolves, it indicates the corporation requested the dissolution. If it is administratively dissolved, the Secretary of State’s Office has dissolved the corporation. If the corporation is administratively dissolved, it could have difficulty when bidding a job in the state, trying to obtain a loan, or when completing a financial closing through a bank. The Secretary of State’s website is: www.sos.mo.gov, and may be viewed for additional information, forms, and the current status of the corporation.

7.Does this request have to be signed by the owner or corporate officer?

Yes, an officer or the owner must sign the request.

8.Is there a fee to request a tax clearance?

No. There is no fee to submit a Request for Tax Clearance.

9.Can I send my Secretary of State application with my tax clearance request form?

No, once you receive the clearance letter it is sent with all required information to the Secretary of State’s Office.

10.Will the Secretary of State’s Office accept a faxed copy of the tax clearance?

Yes, as long as it is within the allotted 60 day timeframe indicated on the clearance letter. Because the letter is only valid for 60 days, you may need to take this into consideration when completing the request for tax clearance and not request it too soon.

If you are requesting a No Tax Due use No Tax Due Request (Form 5522).

If you have questions concerning the tax clearance, please contact the Missouri Department of Revenue, Tax Clearance Unit at (573)

If you have questions concerning reinstatements, please contact the Missouri Secretary of State’s Office at (573)

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue (Department) to inform taxpayers of the Department’s legal authority for requesting identifying information, including social security numbers, and to explain why the information is needed and how the information will be used.

Chapter 143 of the Missouri Revised Statutes authorizes the Department to request information necessary to carry out the tax laws of the state of Missouri. Federal law 42 U.S.C. Section 405 (c)(2)(C) authorizes the states to require taxpayers to provide social security numbers.

The Department uses your social security number to identify you and process your tax returns and other documents, to determine and collect the correct amount of tax, to ensure you are complying with the tax laws, and to exchange tax information with the Internal Revenue Service, other

states, and the Multistate Tax Commission (Chapter 32 and 143, RSMo). In addition, statutorily provided

You are required to provide your social security number on your tax return. Failure to provide your social security number or providing a false social security number may result in criminal action against you.

Form 943 (Revised

Common PDF Templates

Missouri Parenting Plan - Keeping parents informed about the suggested schedule can foster cooperation and understanding.

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for recording the sale of items such as vehicles, furniture, and equipment. For more information and to obtain the necessary forms, you can visit topformsonline.com/texas-bill-of-sale/. Using this document helps protect both the buyer and seller, ensuring that the transaction is clear and legally binding.

Missouri Title App - Be proactive in filing the lien to protect your financial interests.

Dos and Don'ts

Things You Should Do:

- Fill in all applicable identification numbers, including your Missouri Tax Identification Number and Federal Employer Identification Number.

- Double-check your information for accuracy before submitting the form.

- Sign the form to validate your request; an unsigned form will not be processed.

- Provide a clear reason for your request to avoid delays.

- Attach any necessary additional pages if required for your specific situation.

Things You Shouldn't Do:

- Do not enter hyphens or dashes in the identification number fields.

- Do not leave any required fields blank; this can lead to processing delays.

- Avoid submitting the form too early, as the clearance letter is only valid for 60 days.

- Do not forget to include your contact information for any follow-up.

- Do not send your Secretary of State application with the tax clearance request form.

Key takeaways

When filling out the Missouri 943 form, it is essential to follow specific guidelines to ensure your request for tax clearance is processed smoothly. Here are seven key takeaways to keep in mind:

- Do not use hyphens or dashes. When entering your Missouri Tax Identification Number and other identification numbers, ensure that you do not include any hyphens or dashes, as this may cause processing delays.

- Provide accurate business information. Clearly fill in the business name, mailing address, and any "Doing Business As" (DBA) names. This information helps the Department of Revenue to correctly identify your business.

- Indicate your business structure. Select the appropriate ownership type from the options provided, such as corporation, partnership, sole proprietorship, or limited liability company. This classification is crucial for tax purposes.

- Complete all relevant sections. Make sure to answer all questions, including whether your business has Missouri employees or if you pay contributions to the Division of Employment Security. Incomplete forms may be returned for additional information.

- Attach necessary documentation. If your reason for request involves a Vendor No Tax Due or a contract bid greater than $1,000,000, be prepared to complete additional pages and attach them to your submission.

- Sign and date the form. The form must be signed by the owner or an authorized officer of the business. A signature is required to validate the information provided.

- Submit your request promptly. After completing the form, mail it to the Taxation Division at the specified address. Keep in mind that the tax clearance letter is valid for only 60 days, so timing is important.

By adhering to these guidelines, you can help ensure that your request for tax clearance is processed efficiently and without unnecessary complications.

Misconceptions

- Misconception 1: The Missouri 943 form is only for corporations.

- Misconception 2: There is a fee to submit the Missouri 943 form.

- Misconception 3: You cannot submit the form if you don't have a Missouri tax identification number.

- Misconception 4: The form must be submitted in person.

- Misconception 5: The clearance letter is valid indefinitely.

- Misconception 6: You can submit the form alongside other applications, such as for the Secretary of State.

- Misconception 7: You do not need to provide personal information.

This form is applicable to various business structures, including sole proprietorships, partnerships, and limited liability companies. Any business entity with tax obligations in Missouri may need to complete it.

Contrary to popular belief, there is no fee required to request a tax clearance through this form. It is a free service provided by the state.

If you don’t have a Missouri tax identification number, you can leave that section blank. However, it is advisable to register your business to obtain one for future tax compliance.

The Missouri 943 form can be submitted via mail, fax, or email, making it convenient for businesses to complete their requests without needing to visit a physical location.

The tax clearance letter is only valid for 60 days. It is important to plan accordingly and request the letter when you are close to needing it for your business transactions.

It is essential to submit the Missouri 943 form separately. The clearance letter will be sent directly to the Secretary of State's Office after processing, so combining requests is not allowed.

The form requires personal information, such as social security numbers, to ensure accurate identification and processing. This information is used strictly for tax-related purposes.

Similar forms

- Form 5522 - No Tax Due Request: This form is used when a business needs to certify that it has no tax liabilities in order to obtain or renew a contract with the state. Similar to the Missouri 943 form, it requires detailed business information and tax identification numbers.

- Form 1120 - U.S. Corporation Income Tax Return: Corporations file this form to report their income, gains, losses, deductions, and credits. Like the Missouri 943, it serves as a formal request for tax compliance and involves similar identification requirements.

- Form 941 - Employer's Quarterly Federal Tax Return: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Both forms focus on tax obligations and compliance for businesses.

- Form W-9 - Request for Taxpayer Identification Number and Certification: This form is used by businesses to provide their taxpayer identification number to another party. It shares similarities with the Missouri 943 in that it requires accurate identification information for tax purposes.

- Form 1065 - U.S. Return of Partnership Income: Partnerships file this form to report their income, deductions, and other financial information. Like the Missouri 943, it involves compliance with tax laws and requires detailed business information.

- BBB Complaint Form: This essential document is utilized by consumers to file complaints with the Better Business Bureau, helping to maintain accountability in the marketplace. For more information, visit OnlineLawDocs.com.

- Form 990 - Return of Organization Exempt from Income Tax: Nonprofits use this form to provide information about their activities, governance, and financials. Similar to the Missouri 943, it emphasizes transparency and compliance with tax regulations.