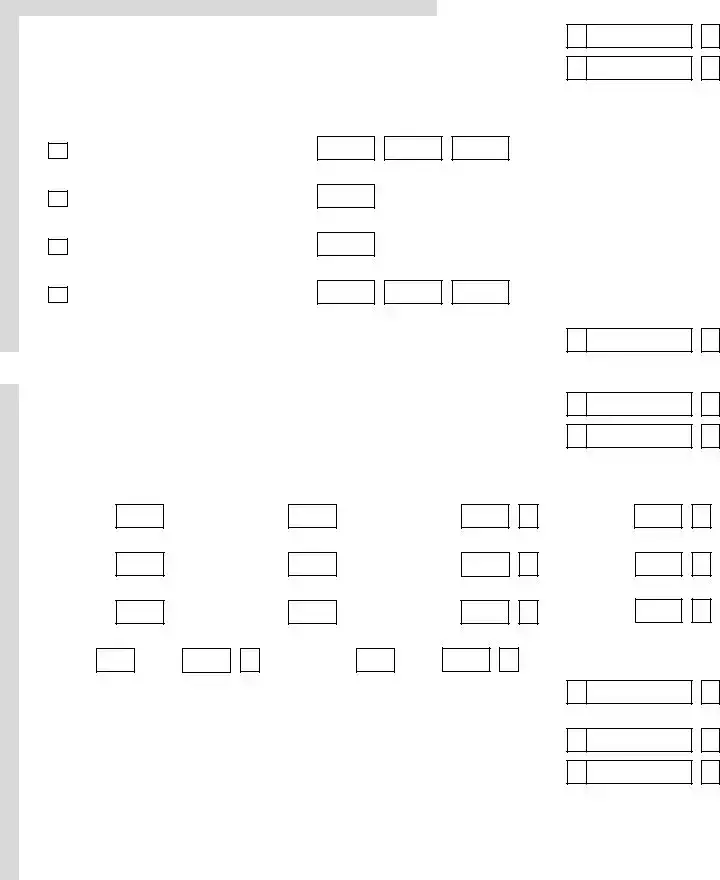

Fill in a Valid Missouri Mo 1040 Template

The Missouri Mo 1040 form is an essential document for individuals filing their state income tax returns. Designed for the calendar year or a fiscal year, it captures vital information such as personal details, income sources, and deductions. Taxpayers must provide their Social Security numbers, address, and filing status, which can significantly impact the overall tax liability. The form allows for various deductions, including standard and itemized options, as well as credits for dependents and specific exemptions for seniors and disabled individuals. Moreover, it provides the opportunity for taxpayers to contribute to trust funds that support various community initiatives. Understanding the structure and requirements of the Mo 1040 form is crucial for accurate filing and compliance with state tax laws. Completing this form correctly can help ensure that taxpayers receive any refunds owed or minimize their tax liabilities.

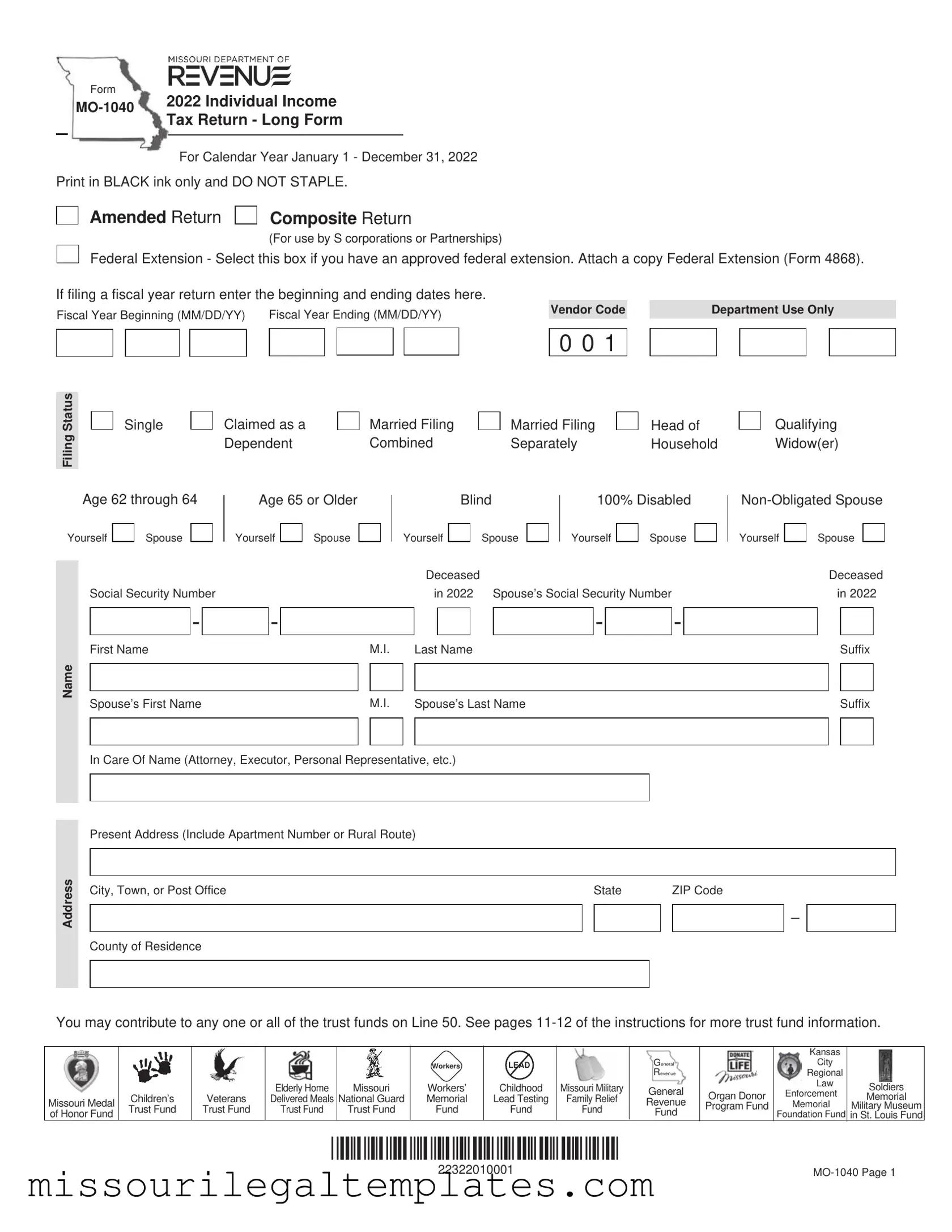

Missouri Mo 1040 Preview

Form

2022 Individual Income |

||

Tax Return - Long Form |

||

|

||

|

|

For Calendar Year January 1 - December 31, 2022

Print in BLACK ink only and DO NOT STAPLE.

Amended Return

Composite Return

(For use by S corporations or Partnerships)

Federal Extension - Select this box if you have an approved federal extension. Attach a copy Federal Extension (Form 4868). If filing a fiscal year return enter the beginning and ending dates here.

Federal Extension - Select this box if you have an approved federal extension. Attach a copy Federal Extension (Form 4868). If filing a fiscal year return enter the beginning and ending dates here.

Fiscal Year Beginning (MM/DD/YY) |

Fiscal Year Ending (MM/DD/YY) |

Vendor Code |

|

Department Use Only |

|

|

|

Filing Status

Single

Claimed as a Dependent

Married Filing Combined

0 0 1

Married Filing Separately

Head of Household

Qualifying Widow(er)

Age 62 through 64

Age 65 or Older

Blind

100% Disabled

Yourself

Spouse

Yourself

Spouse

Yourself

Spouse

Yourself

Spouse

Yourself

Spouse

Name

Address

|

|

|

|

|

|

|

|

Deceased |

|

|

|

Deceased |

|||||||

Social Security Number |

|

|

|

|

|

in 2022 Spouse’s Social Security Number |

|

|

|

in 2022 |

|||||||||

|

- |

|

- |

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

First Name |

|

|

|

M.I. |

Last Name |

|

|

|

|

Suffix |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s First Name |

|

|

|

M.I. |

Spouse’s Last Name |

|

|

|

|

Suffix |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Care Of Name (Attorney, Executor, Personal Representative, etc.)

Present Address (Include Apartment Number or Rural Route)

City, Town, or Post Office |

State |

ZIP Code |

_

County of Residence

You may contribute to any one or all of the trust funds on Line 50. See pages

Missouri Medal of Honor Fund

Children’s Trust Fund

Veterans

Trust Fund

Elderly Home |

Missouri |

Delivered Meals |

National Guard |

Trust Fund |

Trust Fund |

|

|

Workers

Workers’

Memorial

Fund

LEAD

Childhood

Lead Testing

Fund

Missouri Military

Family Relief

Fund

General

Revenue

General

Revenue

Fund

Organ Donor Program Fund

Kansas

City

Regional

Law

Enforcement

Memorial

Foundation Fund

Soldiers

Memorial

Military Museum

in St. Louis Fund

*22322010001*

22322010001 |

|

|

|

|

|

|

|

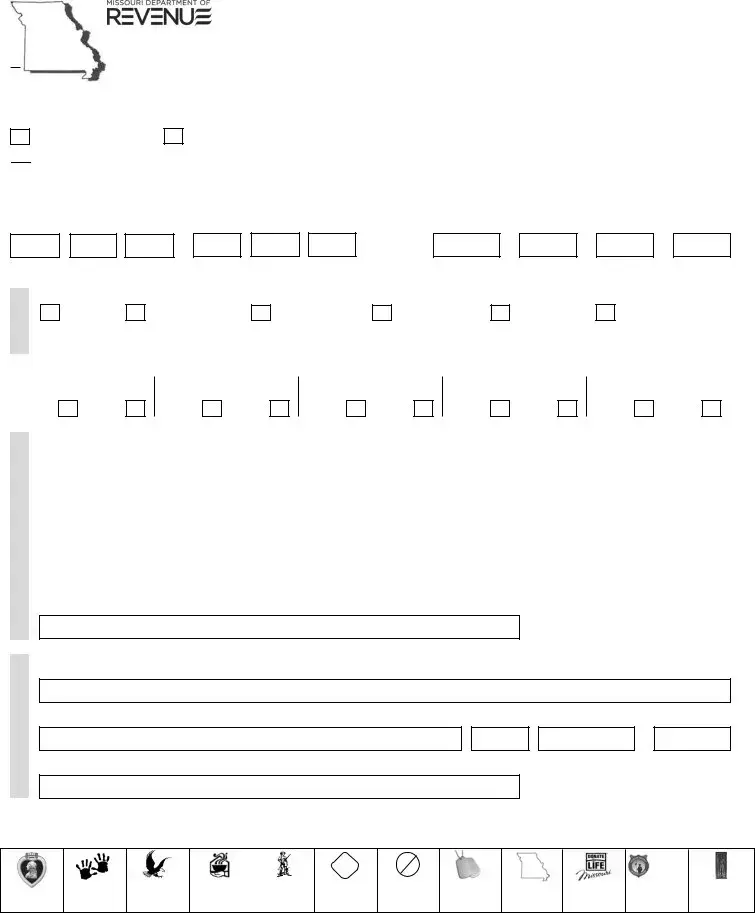

Yourself (Y) |

|

|

|

|

|

|

|

|

|

Spouse (S) |

|||

|

1. |

Federal adjusted gross income from federal return |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

1Y |

|

|

|

|

00 |

|

1S |

|

|

|

|

||||||

|

|

(see worksheet on page 7 of the instructions) |

|

|

|

|

|

|

||||||||||||

|

|

|

|

. |

|

|

|

|

||||||||||||

|

2. |

Total additions (from Form |

|

|

2Y |

|

|

00 |

|

2S |

|

|||||||||

|

|

|

|

. |

|

|

|

|

||||||||||||

Income |

3. |

Total income - Add Lines 1 and 2 |

|

|

3Y |

|

|

00 |

|

3S |

|

|||||||||

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

4. |

Total subtractions (from Form |

|

|

4Y |

|

|

00 |

|

4S |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

. |

|

|

|

|

||||||||||||

|

5. |

Missouri adjusted gross income - Subtract Line 4 from Line 3 . . |

|

|

5Y |

|

|

00 |

|

5S |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

6. |

Total Missouri adjusted gross income - Add columns 5Y and 5S |

. . |

. . |

. . . . . . . |

6 |

|

|

|

|

|

|

|

|

|

00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

7. Income percentages - Divide columns 5Y and 5S by total on |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|||

|

|

7Y |

|

|

|

|

|

|

7S |

|

|

|

|

|

||||||

|

|

Line 6. (Must equal 100%) |

|

|

|

|

|

|

|

|||||||||||

|

8. Pension, Social Security and Social Security Disability exemption (from Form |

|

|

|

|

|

|

|

||||||||||||

|

|

8 |

|

|

|

|

||||||||||||||

|

|

Section D) |

. |

. . . . . . . . . |

. . . |

. . . . |

. |

|

. . . |

. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

.00

.00

.00

.00

.00

%

.00

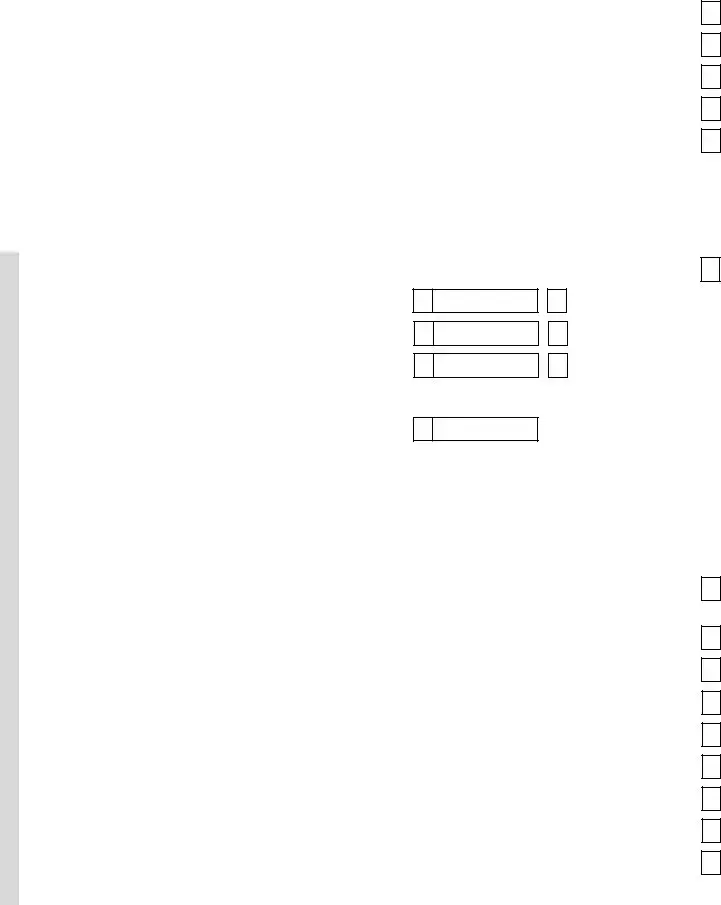

9.Tax from federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.Other tax from federal return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.Total tax from federal return. Do not enter federal income tax withheld.

12.Federal tax percentage – Enter the percentage based on your Missouri Adjusted Gross Income, Line 6. Use the chart below to find your percentage . . . . . . . . . . . . . . . . . . . . . . . .

9

10

11

12

.

.

.

00

00

00

%

|

|

Missouri Adjusted Gross Income Range, Line 6: |

Federal Tax Percentage: |

|

|

|||||||

|

|

$25,000 or less |

35% |

|

|

|

|

|||||

Deductionsand |

13. |

$25,001 to $50,000 |

25% |

|

|

|

|

|||||

Federal income tax deduction – Multiply Line 11 by the percentage on Line 12. Enter this |

|

|

||||||||||

|

|

$50,001 to $100,000 |

15% |

|

|

|

|

|||||

|

|

$100,001 to $125,000 |

5% |

|

|

|

|

|||||

|

|

$125,001 or more |

0% |

|

|

|

|

|||||

Exemptions |

|

|

|

|

|

|

||||||

|

|

• Married Filing Combined or Qualifying |

14 |

|

||||||||

|

|

amount not to exceed $5,000 for an individual or $10,000 for combined filers |

13 |

|

||||||||

|

|

|

|

|||||||||

|

14. |

Missouri standard deduction or itemized deductions. (If itemizing, See Form |

|

|

||||||||

|

|

|

• Single or Married Filing |

• Head of |

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||||||

|

15. |

Additional Exemption for Head of Household and Qualified Widow(er) |

15 |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

. . . . . . . . . |

. . . . . . . . . . . . . . . . |

. . |

. . . . . . . . . . . . . . . . . . |

16 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Health care sharing ministry deduction |

. . . . . . . . . . . . . . . . |

. . |

. . . . . . . . . . . . . . . . . . |

17 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Active Duty Military income deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . |

. . |

. . . . . . . . . . . . . . . . . . |

18 |

|

||||

|

|

|

|

|

|

|

|

|||||

|

19. |

Inactive Duty Military income deduction |

. . . . . . . . . . . . . . . . |

. . |

. . . . . . . . . . . . . . . . . . |

19 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Bring jobs home deduction |

. . |

. . . . . . . . . . . . . . . . . . |

20 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Transportation facilities deduction |

. . . . . . . . . . . . . . . . . . |

21 |

|

|||||||

|

|

|

|

A. Port Cargo Expansion |

|

|

B. International Trade Facility |

|

C. Qualified Trade Activities |

|||

|

|

|

|

|

|

|

||||||

.00

.00

.00

.00

.00

.00

.00

.00

.00

*22322020001*MO-1040 Page 2

22322020001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

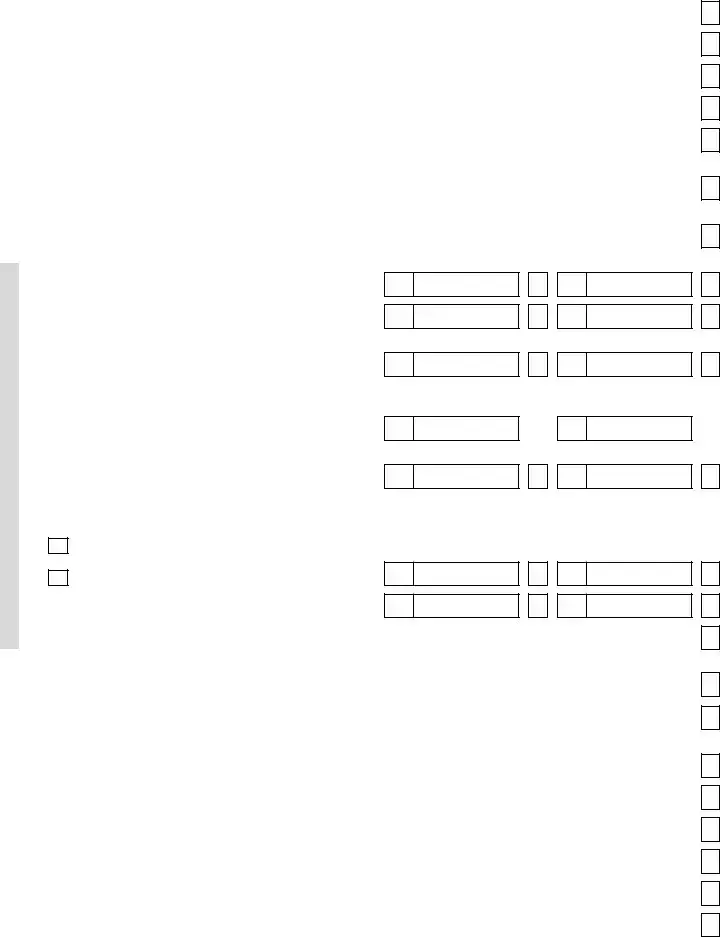

22. |

First time home buyers deduction. |

A. |

|

|

B. |

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Long term dignity savings account deduction |

. . . . . |

. |

. . . . . . . . . . . . . |

. |

. . |

. . . |

|

|

23 |

|

|||

Continued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Foster parent tax deduction |

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

. . . |

. . . . . . . . . . . . |

. |

. . . . |

. . |

. . . . . . . . . . . . . |

. |

. . |

. . . |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions |

25. |

Total deductions - Add Lines 8 and 13 through 24 |

. . . . . |

. |

. . . . . . . . . . . . . |

. |

. . |

. . . |

|

|

25 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Subtotal - Subtract Line 25 from Line 6 |

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

. . . |

. . . . . . . . . . . . |

. |

. . . . . |

. |

. . . . . . . . . . . . . |

. |

. . |

. . . |

|

|

|

|||

|

27. |

Multiply Line 26 by appropriate percentages (%) on |

|

|

|

|

. |

|

|

|

|

|

|||

|

27Y |

|

|

|

00 |

|

27S |

|

|||||||

|

|

Lines 7Y and 7S |

. . . . |

. . . . . . . . . . . |

|

|

|

|

|

|

|||||

|

28. |

Enterprise zone or rural empowerment zone income |

|

|

|

|

. |

|

|

|

|

|

|||

|

28Y |

|

|

|

00 |

|

28S |

|

|||||||

|

|

modification |

. . . . |

. . . . . . . . . . . |

|

|

|

|

|

|

|||||

.00

.00

.00

.00

.00

.00

.00

Tax

29. Taxable income - Subtract Line 28 from Line 27 . . . . . . . . . . .

30. Tax (see tax chart on page 26 of the instructions). . . . . . . . . .

31. Resident credit - Attach Form

32. Missouri income percentage - Enter 100% unless you are completing Form

33. Balance - Subtract Line 31 from Line 30; OR

multiply Line 30 by percentage on Line 32 . . . . . . . . . . . . . . .

34. Other taxes - Select box and attach federal form indicated.

Lump sum distribution (Form 4972)

Recapture of low income housing credit (Form 8611)

35. Subtotal - Add Lines 33 and 34 . . . . . . . . . . . . . . . . . . . . . . . .

29Y

30Y

31Y

32Y

33Y

34Y

35Y

.00

.00

.00

%

.00

.00

.00

29S

30S

31S

32S

33S

34S

35S

.00

.00

.00

%

.00

.00

.00

|

36. |

Total Tax - Add Lines 35Y and 35S |

36 |

|

|

|

|

|

|

|

37. |

MISSOURI tax withheld - Attach Forms |

37 |

|

|

|

|

|

|

|

38. |

2022 Missouri estimated tax payments - Include overpayment from 2021 applied to 2022 |

38 |

|

Creditsand |

40. |

Missouri tax payments for nonresident entertainers - Attach Form |

40 |

|

|

39. |

Missouri tax payments for nonresident partners or S corporation shareholders - Attach Forms |

39 |

|

Payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. |

Amount paid with Missouri extension of time to file (Form |

41 |

|

|

|

|

|

|

|

|

42. |

Miscellaneous tax credits (from Form |

42 |

|

|

|

|

|

|

|

43. |

Property tax credit - Attach Form |

43 |

|

|

|

|

|

|

|

44. |

Total payments and credits - Add Lines 37 through 43 |

44 |

|

*22322030001*

.00

.00

.00

.00

.00

.00

.00

.00

.00

22322030001 |

|

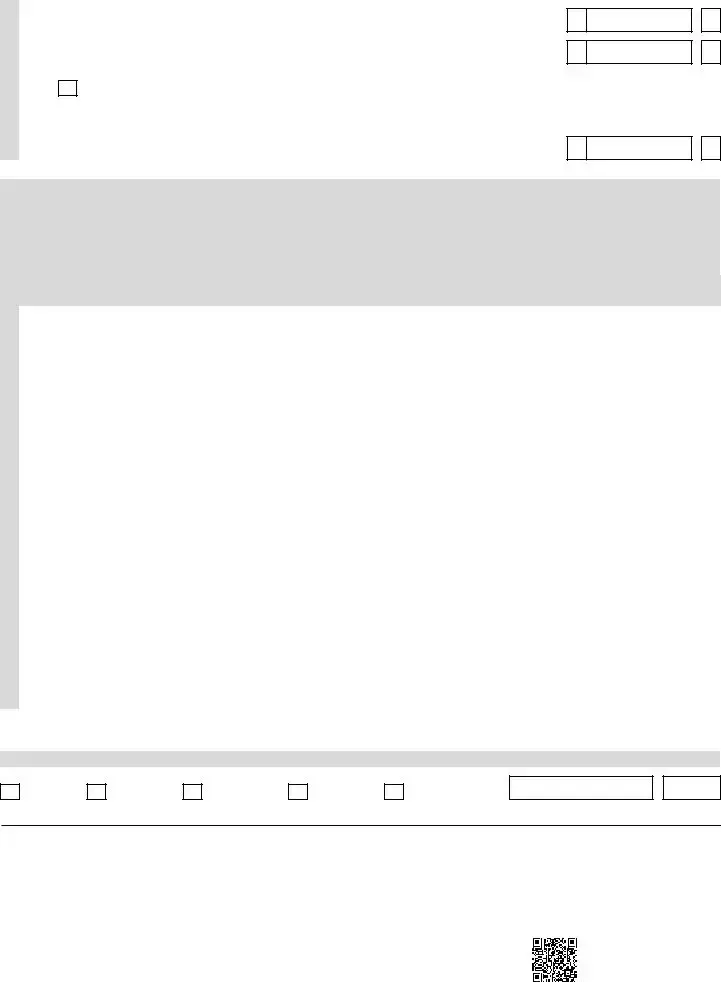

Skip Lines 45 through 47 if you are not filing an amended return. |

|

|

45. Amount paid on original return |

45 |

|

46. Overpayment as shown (or adjusted) on original return |

46 |

|

Indicate Reason for Amending |

|

|

Enter date of IRS report (MM/DD/YY) |

|

Return |

|

|

|

A. Federal audit |

|

|

Enter year of loss (YY) |

|

Amended |

|

|

|

B. Net Operating Loss carryback |

|

|

Enter year of credit (YY) |

|

|

C. Investment tax credit carryback |

|

|

Enter date of federal amended return, if filed. (MM/DD/YY) |

|

|

D. Correction other than A, B, or C |

|

|

47. Amended return total payments and credits - Add Lines 44 and 45; subtract Line 46. |

|

|

Enter on Line 47 |

47 |

48. If Line 44, or if amended return, Line 47, is larger than Line 36, enter the difference.

Amount of OVERPAYMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49. Amount of Line 48 to be applied to your 2023 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50. Enter the amount of your donation in the trust fund boxes below. See instructions for additional trust fund codes.

.00

.00

.00

.00

.00

Refund

Children’s

50a. Trust Fund

Workers’

50e. Memorial Fund

Organ Donor

50i. Program Fund

Additional

Fund

50m. Code

. |

00 |

. |

|

00 |

|

. |

|

00 |

Additional

Fund

Amount

Veterans

50b. Trust Fund

Childhood

Lead

50f. Testing Fund

Kansas City

Regional Law

Enforcement

Memorial

50j. Foundation Fund

.00

. |

00 |

. |

|

00 |

|

. |

|

00 |

Additional

Fund

50n. Code

50c.

50g.

50k.

Elderly Home

Delivered Meals

Trust Fund

Missouri

Military Family

Relief Fund

Soldiers

Memorial

Military

Museum in

St. Louis Fund

Additional

Fund

Amount

.

.

.

.

00

00

00

00

50d.

50h.

50l.

Missouri

National Guard

Trust Fund

General Revenue Fund

MIssouri

Medal of

Honor Fund

.

.

.

00

00

00

Total Donation - Add amounts from Boxes 50a through 50n and enter here . . . . . . . . . . . . . . . . 50

51. Amount of Line 48 to be deposited into a Missouri 529 Education Plan (MOST)

account. Enter the total deposit amount from Form 5632 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

52. REFUND - Subtract Lines 49, 50, and 51 from Line 48 and enter here |

52 |

Reserved

*22322040001*

.00

.00

.00

22322040001 |

Amount Due

53. |

If Line 36 is larger than Line 44 or Line 47, enter the difference. |

|

|

Amount of UNDERPAYMENT |

53 |

54. |

Underpayment of estimated tax penalty - Attach Form |

54 |

Select this box if you are a farmer exempt from the underpayment of estimated tax penalty.

55.AMOUNT DUE - Add Lines 53 and 54.

If you pay by check, you authorize the Department of Revenue to process the check

electronically. Any returned check may be presented again electronically |

55 |

.

.

.

00

00

00

Signature

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete. By signing or entering my name in the “Signature” field(s) below, I am providing the Department of Revenue with my signature as required under Section 143.561, RSMo. Declaration of preparer (other than taxpayer) is based on all information of which he or she has knowledge. As provided in Chapter 143, RSMo., a penalty of up to $500 shall be imposed on any individual who files a frivolous return. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit, or abatement if I employ such aliens. I am aware of any applicable reporting requirements of Section 135.805, RSMo, and the penalty provisions of Section 135.810, RSMo.

Signature |

|

Date (MM/DD/YY) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Signature (If filing combined, BOTH must sign) |

|

Date (MM/DD/YY) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime Telephone |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Signature |

|

Date (MM/DD/YY) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s FEIN, SSN, or PTIN |

|

Preparer’s Telephone |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Address |

|

State |

ZIP Code |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer |

|

|

|

|

or any member of the preparer’s firm |

|

Yes |

|

No |

Did you pay a tax return preparer to complete your return, but the preparer failed to sign the return or provide |

|

|

|

|

an Internal Revenue Service preparer tax identification number? If you marked yes, please insert the |

|

|

|

|

preparer’s name, address, and phone number in the applicable sections of the signature block above |

|

Yes |

|

No |

*22322050001*

22322050001

Department Use Only

A

FA

E10

DE

F

.

|

|

Form |

Mail to: Balance Due: |

Refund or No Amount Due: |

Fax: (573) |

Missouri Department of Revenue |

Missouri Department of Revenue |

Email: incometaxprocessing@dor.mo.gov |

P.O. Box 329 |

P.O. Box 500 |

Submission of Individual Income Tax Returns |

Jefferson City, MO |

Jefferson City, MO |

Email: income@dor.mo.gov |

Phone: (573) |

Phone: (573) |

Inquiry and correspondence |

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources and benefits can be found at

Visit

Common PDF Templates

Circuit Breaker Application Missouri - It's important to check for any state-specific requirements when submitting exports.

For those looking to ensure a proper transfer of ownership, the accurate completion of a thorough Florida Firearm Bill of Sale is vital. This document not only legitimizes the transaction but also safeguards the interests of both parties involved.

Missouri Sales Tax Filing Frequency - Indicate gross receipts for each location separately; zero must be reported if applicable.

Machs - A completed form is required to schedule a fingerprint appointment online.

Dos and Don'ts

When filling out the Missouri Mo 1040 form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn’t do:

- Do: Carefully read all instructions provided with the form to understand the requirements.

- Do: Double-check all personal information, such as names and Social Security numbers, for accuracy.

- Do: Use the correct tax year when reporting income and deductions.

- Do: Sign and date the form before submitting it to the Department of Revenue.

- Do: Keep a copy of your completed form and all supporting documents for your records.

- Don’t: Ignore the deadlines for filing your tax return to avoid penalties.

- Don’t: Forget to include all necessary attachments, such as W-2 forms or other income documentation.

- Don’t: Leave any required fields blank; this could delay processing or result in rejection.

- Don’t: Use a pencil or any ink color other than black or blue when filling out the form.

- Don’t: Submit your return without checking for any potential errors or omissions.

Key takeaways

When filling out the Missouri Mo 1040 form, keep these key points in mind:

- Personal Information: Ensure that all names, addresses, and Social Security numbers are accurate. This information is crucial for processing your return.

- Filing Status: Choose the correct filing status. This affects your tax rate and the deductions you can claim.

- Income Calculation: Start with your federal adjusted gross income. This is the basis for calculating your Missouri income.

- Deductions: Decide between the standard deduction or itemizing your deductions. The amount varies based on your filing status and age.

- Tax Credits: Look for available tax credits. These can reduce your tax liability and may include credits for dependents or specific situations.

- Payments and Refunds: Report any Missouri tax withheld and estimated payments. This will help determine if you owe money or are due a refund.

- Signature Requirement: Don’t forget to sign the form. If filing jointly, both spouses must sign to validate the return.

By following these guidelines, you can complete the Mo 1040 form accurately and efficiently.

Misconceptions

Understanding the Missouri MO 1040 form can be a bit tricky. Here are some common misconceptions that people often have about this important tax document:

- Misconception 1: The MO 1040 is only for residents of Missouri.

- Misconception 2: You can only claim standard deductions.

- Misconception 3: You don’t need to file if you owe no tax.

- Misconception 4: All income is taxed the same way.

Many believe that only those who live in Missouri can file this form. However, non-residents who earn income in Missouri must also file the MO 1040 to report their earnings and pay any applicable taxes.

Some people think they are limited to standard deductions on the MO 1040. In reality, taxpayers have the option to choose between standard deductions and itemized deductions, depending on which benefits them more financially.

It’s a common belief that if you owe no tax, there’s no need to file. However, even if you don’t owe taxes, filing the MO 1040 can be beneficial. It allows you to claim potential refunds or credits that you may be eligible for.

Many assume that all types of income are taxed uniformly. In fact, different types of income, such as wages, pensions, and Social Security benefits, may be subject to different tax treatments. Understanding these differences can help in accurately completing the form.

Similar forms

The Missouri Mo 1040 form shares similarities with several other tax-related documents. Each of these forms serves a distinct purpose but often contains overlapping information regarding income, deductions, and tax calculations. Below are five documents that are similar to the Missouri Mo 1040 form:

- Federal Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Like the Missouri Mo 1040, it requires details about income, deductions, and tax liability. Both forms aim to assess the taxpayer's total income and applicable tax obligations.

- California Deed Form: A California Deed form is a legal document used to transfer ownership of real property from one party to another. This form is essential for ensuring that the transfer is recognized by the state and protects the rights of both the buyer and seller. If you're ready to take the next step in your property transaction, fill out the Deed form by clicking the button below.

- State Income Tax Returns from Other States: Each state has its own income tax return form, similar to Missouri's Mo 1040. These forms typically require similar information, such as income sources, deductions, and credits, allowing states to calculate individual tax liabilities based on their specific tax laws.

- Form 1040A: This is a simplified version of the Federal Form 1040. It includes less complex income situations and allows for specific deductions. The structure of both forms is similar, as they both require taxpayers to report income and determine tax liability, albeit with different levels of detail.

- Form 1040EZ: This is the simplest federal tax return form available for individuals with straightforward tax situations. It shares the Mo 1040's focus on income reporting and tax calculation but is designed for those who meet specific eligibility criteria, making it less comprehensive.

- Missouri Form MO-A: This form is used to report additions and subtractions to income for Missouri tax purposes. It is often filed alongside the Mo 1040, and both forms work together to determine the taxpayer's adjusted gross income and overall tax liability.