Fill in a Valid Missouri Mo 1Nr Template

The Missouri MO-1NR form plays a crucial role in the state's tax system, specifically designed for nonresident individual partners and S corporation shareholders. This form is essential for reporting income tax payments that these individuals owe to Missouri. Partnerships and S corporations must withhold Missouri income tax for nonresident partners or shareholders unless certain exceptions apply. These exceptions can include scenarios where the nonresident individual has opted for composite returns or has income below a specified threshold. The MO-1NR form requires detailed information, including the entity's name, tax identification numbers, and the total amount of tax withheld. Additionally, it mandates the attachment of Form MO-2NR, which provides a statement of income tax payments for each nonresident partner or shareholder. Timely filing is critical; the form must be submitted by the due date for the partnership or S corporation return, or an extension must be indicated. Understanding the nuances of the MO-1NR form is vital for compliance and ensuring accurate tax reporting in Missouri.

Missouri Mo 1Nr Preview

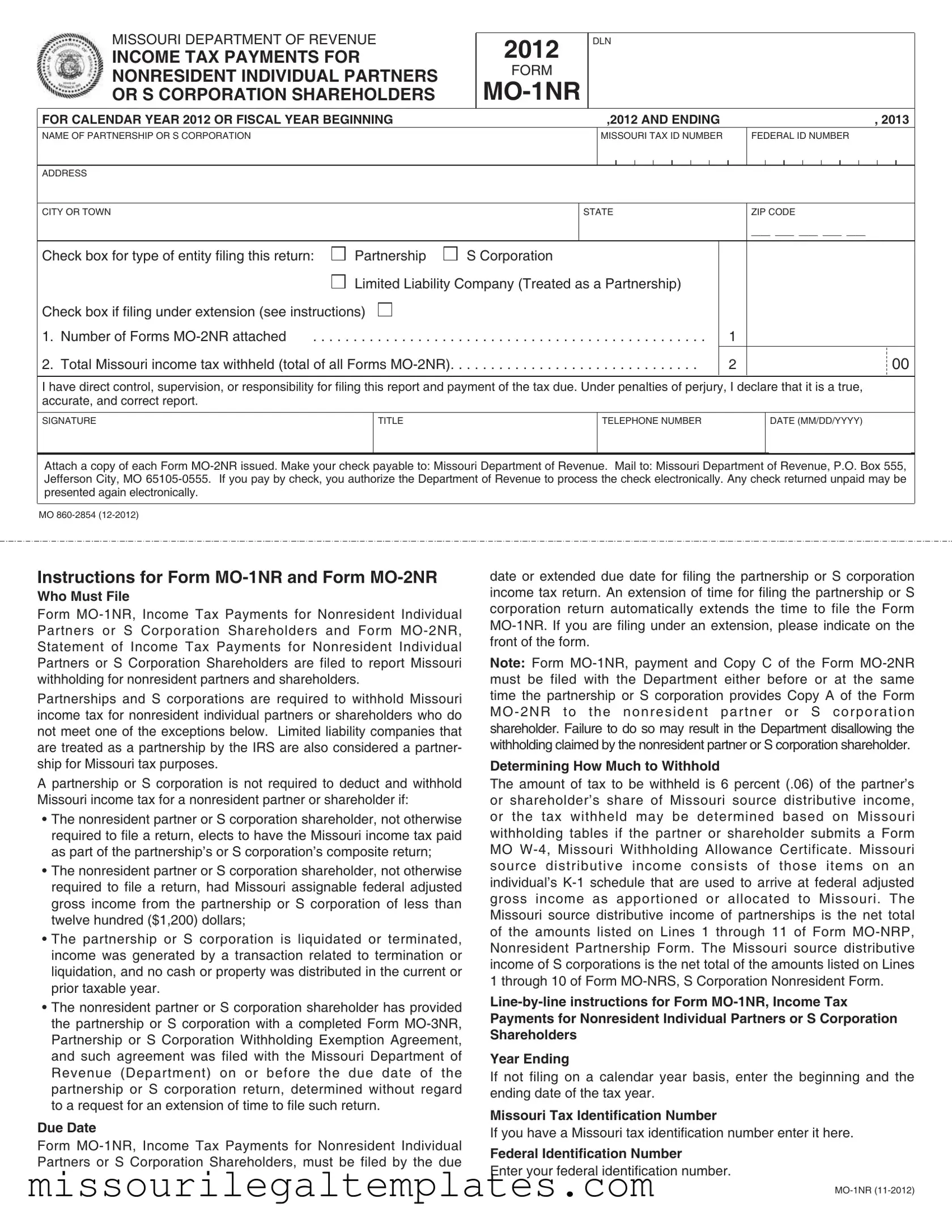

MISSOURI DEPARTMENT OF REVENUE

INCOME TAX PAYMENTS FOR NONRESIDENT INDIVIDUAL PARTNERS OR S CORPORATION SHAREHOLDERS

2012

FORM

DLN

FOR CALENDAR YEAR 2012 OR FISCAL YEAR BEGINNING |

,2012 AND ENDING |

, 2013 |

NAME OF PARTNERSHIP OR S CORPORATION

MISSOURI TAX ID NUMBER

FEDERAL ID NUMBER

ADDRESS

CITY OR TOWN |

|

|

STATE |

ZIP CODE |

||

|

|

|

|

|

|

__ __ __ __ __ |

Check box for type of entity filing this return: |

Partnership |

S Corporation |

|

|

||

|

|

Limited Liability Company (Treated as a Partnership) |

|

|

||

Check box if filing under extension (see instructions) |

|

|

|

|

||

1. |

Number of Forms MO‑2NR attached |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . |

1 |

|

2. |

Total Missouri income tax withheld (total of all Forms MO‑2NR). . |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . |

2 |

00 |

|

I have direct control, supervision, or responsibility for filing this report and payment of the tax due. Under penalties of perjury, I declare that it is a true, accurate, and correct report.

SIGNATURE

TITLE

TELEPHONE NUMBER |

DATE (MM/DD/YYYY) |

(_ _ _) _ _ _ ‑ _ _ _ _ _ _ / _ _ / _ _ _ _

Attach a copy of each Form MO‑2NR issued. Make your check payable to: Missouri Department of Revenue. Mail to: Missouri Department of Revenue, P.O. Box 555, Jefferson City, MO 65105‑0555. If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

MO 860‑2854 (12‑2012)

Instructions for Form

Who Must File

Form MO‑1NR, Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders and Form MO‑2NR, Statement of Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders are filed to report Missouri withholding for nonresident partners and shareholders.

Partnerships and S corporations are required to withhold Missouri income tax for nonresident individual partners or shareholders who do not meet one of the exceptions below. Limited liability companies that are treated as a partnership by the IRS are also considered a partner‑ ship for Missouri tax purposes.

A partnership or S corporation is not required to deduct and withhold Missouri income tax for a nonresident partner or shareholder if:

•The nonresident partner or S corporation shareholder, not otherwise required to file a return, elects to have the Missouri income tax paid as part of the partnership’s or S corporation’s composite return;

•The nonresident partner or S corporation shareholder, not otherwise required to file a return, had Missouri assignable federal adjusted gross income from the partnership or S corporation of less than twelve hundred ($1,200) dollars;

•The partnership or S corporation is liquidated or terminated, income was generated by a transaction related to termination or liquidation, and no cash or property was distributed in the current or prior taxable year.

•The nonresident partner or S corporation shareholder has provided the partnership or S corporation with a completed Form MO‑3NR, Partnership or S Corporation Withholding Exemption Agreement, and such agreement was filed with the Missouri Department of Revenue (Department) on or before the due date of the partnership or S corporation return, determined without regard to a request for an extension of time to file such return.

Due Date

Form MO‑1NR, Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders, must be filed by the due

date or extended due date for filing the partnership or S corporation income tax return. An extension of time for filing the partnership or S corporation return automatically extends the time to file the Form MO‑1NR. If you are filing under an extension, please indicate on the front of the form.

Note: Form MO‑1NR, payment and Copy C of the Form MO‑2NR must be filed with the Department either before or at the same time the partnership or S corporation provides Copy A of the Form MO‑2NR to the nonresident partner or S corporation shareholder. Failure to do so may result in the Department disallowing the withholding claimed by the nonresident partner or S corporation shareholder.

Determining How Much to Withhold

The amount of tax to be withheld is 6 percent (.06) of the partner’s or shareholder’s share of Missouri source distributive income, or the tax withheld may be determined based on Missouri withholding tables if the partner or shareholder submits a Form MO W‑4, Missouri Withholding Allowance Certificate. Missouri source distributive income consists of those items on an individual’s K‑1 schedule that are used to arrive at federal adjusted gross income as apportioned or allocated to Missouri. The Missouri source distributive income of partnerships is the net total of the amounts listed on Lines 1 through 11 of Form MO‑NRP, Nonresident Partnership Form. The Missouri source distributive income of S corporations is the net total of the amounts listed on Lines 1 through 10 of Form MO‑NRS, S Corporation Nonresident Form.

Year Ending

If not filing on a calendar year basis, enter the beginning and the ending date of the tax year.

Missouri Tax Identification Number

If you have a Missouri tax identification number enter it here.

Federal Identification Number

Enter your federal identification number.

MO‑1NR (11‑2012)

Type of Entity Filing This Return

Check the box indicating whether you are a partnership, S corporation, or limited liability company treated as a partnership.

Filing Under Extension

Check this box if you are filing under an extension. You may file this return under an extension only if you are filing your Form MO‑1065, Partnership Return of Income, or Form MO‑1120S, S Corporation Income Tax Return, under an extension.

Line 1

Number of Forms MO‑2NR, Statement of Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders Enclosed — Fill in the total number of Forms MO‑2NR issued to nonresident partners or shareholders. You are required to include a copy of each Form MO‑2NR issued.

Line 2

Missouri Income Tax Withheld — Enter the total amount of Missouri income tax you withheld from the nonresident partners or shareholders. This is the amount to be remitted.

Make your check payable to: Missouri Department of Revenue

Mail to: Missouri Department of Revenue P.O. Box 555

Jefferson City, MO 65105‑0555

Only individual nonresident partners or S corporation shareholders are subject to withholding. Do not withhold for any partners or S corporation shareholders who are partnerships, corporations, trusts, or estates. Grantor trusts that file or can file in accordance with IRC Reg. Section 1.671.4(b) are considered individuals. Do not withhold for any partners or shareholders who include their Missouri income on a composite return.

Line 4

Type of Entity — Check the appropriate box to indicate whether you are filing for a partnership, an S corporation, or limited liability company treated as a partnership.

Line 7

Income Subject to Withholding — Enter the partner’s or shareholder’s share of Missouri source distributive income.

Line 8

Missouri Income Tax Withheld — Enter the amount withheld for the non‑resident partner or shareholder. The amount withheld is 6 percent (.06) of the amount on Line 7 or as determined by the Missouri withholding tax tables.

Form MO‑2NR is to be given to each partner or shareholder who is subject to withholding. Issue Form MO‑2NR even if no tax is withheld because of an exemption certificate. Do not issue a Form MO‑2NR to a partner or shareholder who includes their Missouri income on a composite return.

Attach copies of each Form MO‑2NR to the Form MO‑1NR, Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders.

Each nonresident partner or shareholder not included on a composite return should claim the payment made on Line 34 of his or her Form MO‑1040, Missouri Individual Income Tax Return.

NOTE: If you have technical questions regarding the withholding or reporting requirements, contact the Taxation Division at (573) 751‑1467.

If you have questions regarding completion of the forms, contact the Department at (573) 751‑5862.

Speech and hearing impaired may reach a voice user through the Dual Party Relay Service at (800) 735‑2966 or fax (573) 526‑1881.

For additional information, visit http://dor.mo.gov/

MO‑1NR (11‑2012)

Common PDF Templates

Judgment of Possession Form - It helps maintain an official record of the court’s decision.

Missouri Tax Forms - Providing clear answers and necessary documentation can support a favorable review outcome.

Understanding the importance of establishing a Durable Power of Attorney is crucial for anyone looking to secure their financial future. This legal document not only allows for the management of financial affairs in times of incapacity but also provides peace of mind to families. For more detailed information, you can visit https://smarttemplates.net, which offers resources to help in creating an effective plan.

Food Stamps Income Limit Missouri - If you have no phone number or cannot respond during the scheduled call, you can reach out directly to the Family Support Division for assistance.

Dos and Don'ts

When filling out the Missouri Mo 1Nr form, there are several important considerations to keep in mind. Below is a list of things you should and shouldn't do to ensure accurate completion of the form.

- Do check the appropriate box for the type of entity filing the return.

- Do include a copy of each Form MO-2NR issued to nonresident partners or shareholders.

- Do ensure that the total Missouri income tax withheld is accurately reported.

- Do indicate if you are filing under an extension on the front of the form.

- Do provide your Missouri and federal identification numbers where required.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank; ensure all information is complete.

- Don't file the form late; adhere to the due dates for filing.

- Don't issue Form MO-2NR to partners or shareholders who are not subject to withholding.

Key takeaways

When filling out and using the Missouri Mo 1Nr form, there are several important considerations to keep in mind:

- Eligibility: The Mo 1Nr form is specifically for reporting Missouri income tax payments for nonresident individual partners or S corporation shareholders.

- Withholding Requirements: Partnerships and S corporations must withhold Missouri income tax for nonresident partners or shareholders, unless certain exceptions apply.

- Filing Deadlines: The Mo 1Nr form must be filed by the due date or extended due date of the partnership or S corporation income tax return.

- Tax Calculation: The amount to withhold is generally 6 percent of the partner’s or shareholder’s share of Missouri source distributive income.

- Attachments Required: Each Form MO-2NR issued to nonresident partners or shareholders must be attached to the Mo 1Nr form when filing.

- Contact Information: For assistance, individuals can reach the Taxation Division or the Department of Revenue for questions regarding the form or its completion.

Misconceptions

Understanding the Missouri Mo 1Nr form can be challenging, especially with the many misconceptions that surround it. Here are nine common misunderstandings, along with clarifications to help you navigate this important tax form.

- Only residents need to file the Mo 1Nr form. Many people think that only Missouri residents are subject to this form. In reality, it applies to nonresident individual partners or S corporation shareholders who earn income from Missouri sources.

- The Mo 1Nr form is optional. Some believe that filing this form is a choice. However, partnerships and S corporations are required to file it when they have nonresident partners or shareholders, unless specific exceptions apply.

- All nonresident partners must have taxes withheld. It’s a common misconception that every nonresident partner or shareholder will have taxes withheld. In certain cases, such as when income is below $1,200 or if an exemption agreement is filed, withholding may not be necessary.

- The Mo 1Nr form is only for partnerships. While partnerships are a primary focus, S corporations and limited liability companies treated as partnerships also need to file this form if they have nonresident partners or shareholders.

- Filing an extension for the partnership return does not affect the Mo 1Nr form. Some people think that extensions are separate. In fact, if a partnership or S corporation files for an extension, it automatically extends the time to file the Mo 1Nr form as well.

- The amount withheld is a flat rate for everyone. Many assume that the withholding amount is the same for all partners or shareholders. However, it can vary based on the individual’s share of Missouri source distributive income or based on Missouri withholding tables if a Form MO W-4 is submitted.

- Filing the Mo 1Nr form is the last step. Some believe that submitting the Mo 1Nr form is the end of the process. In reality, partnerships and S corporations must also provide each nonresident partner or shareholder with a Form MO-2NR, which details the income tax payments made on their behalf.

- All income is subject to Missouri tax. There is a misconception that any income earned by nonresidents is taxable in Missouri. However, only Missouri source distributive income is subject to withholding.

- Technical questions can only be answered through formal channels. While many think they must go through official processes for questions, it’s important to know that the Department of Revenue provides assistance for any inquiries regarding the Mo 1Nr form and its requirements.

By understanding these misconceptions, individuals and businesses can better navigate their tax obligations and ensure compliance with Missouri tax laws. If you have further questions, consider reaching out to the Missouri Department of Revenue for assistance.

Similar forms

The Missouri MO-1NR form is designed for reporting income tax payments for nonresident individual partners or S corporation shareholders. Several other documents serve similar purposes in the context of tax reporting and withholding. Here are five documents that share similarities with the MO-1NR form:

- Form MO-1065: This is the Partnership Return of Income. Like the MO-1NR, it is used by partnerships to report income and tax obligations. It also requires information about partners, including their shares of income.

- Form MO-1120S: This is the S Corporation Income Tax Return. Similar to the MO-1NR, it reports the income and tax responsibilities of S corporations, including details about shareholders and their income distributions.

- Georgia ATV Bill of Sale Form: When buying or selling an all-terrain vehicle, make sure to use the essential ATV Bill of Sale resources to ensure the transaction is properly documented.

- Form MO-2NR: This is the Statement of Income Tax Payments for Nonresident Individual Partners or S Corporation Shareholders. It directly complements the MO-1NR by detailing the income tax withheld from nonresident partners or shareholders, which must be attached to the MO-1NR form.

- Form MO W-4: The Missouri Withholding Allowance Certificate is used to determine the amount of tax to be withheld. It is similar in that it helps calculate withholding amounts for nonresident partners or shareholders, ensuring compliance with state tax laws.

- Form MO-3NR: This is the Partnership or S Corporation Withholding Exemption Agreement. Like the MO-1NR, it is used to establish whether certain nonresident partners or shareholders are exempt from withholding, providing necessary documentation for tax compliance.