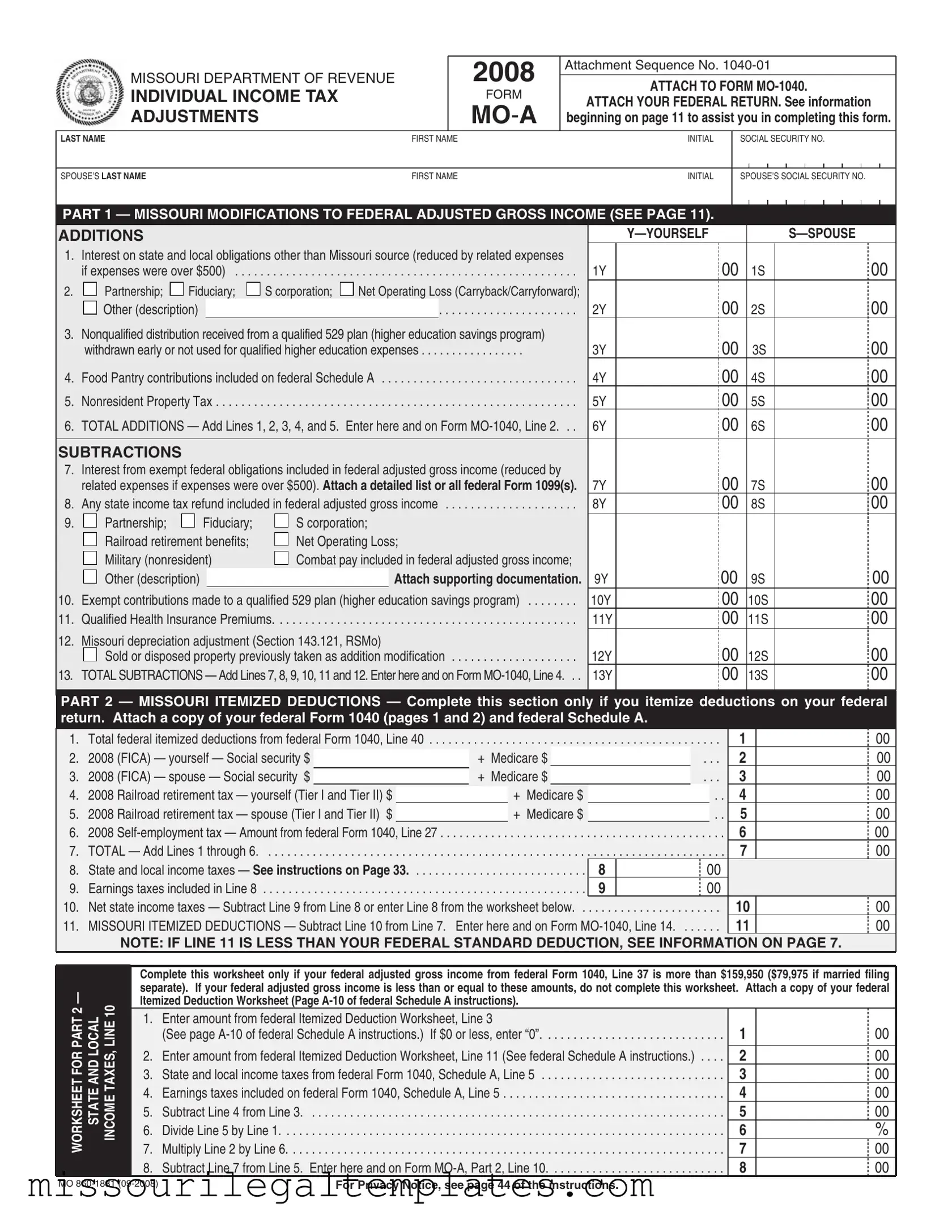

Fill in a Valid Missouri Mo A Template

The Missouri MO-A form serves as an essential document for individuals filing their state income tax returns, specifically those who need to make adjustments to their federal adjusted gross income. This form is particularly relevant for taxpayers who have specific additions and subtractions that affect their taxable income in Missouri. It includes sections for reporting various modifications, such as interest from state and local obligations, contributions to food pantries, and details regarding partnerships or S corporations. Additionally, the form provides a space for itemized deductions, allowing filers to detail their federal itemized deductions and calculate their Missouri-specific deductions. Notably, the MO-A also addresses pension and social security exemptions, ensuring that taxpayers can appropriately account for these income sources. By carefully completing this form, individuals can accurately determine their state tax obligations and potentially reduce their overall tax liability.

Missouri Mo A Preview

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX ADJUSTMENTS

2008

FORM

Attachment Sequence No.

ATTACH TO FORM

ATTACH YOUR FEDERAL RETURN. See information

beginning on page 11 to assist you in completing this form.

LAST NAME |

FIRST NAME |

INITIAL |

SOCIAL SECURITY NO.

SPOUSE’S LAST NAME |

FIRST NAME |

INITIAL |

SPOUSE’S SOCIAL SECURITY NO.

PART 1 — MISSOURI MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME (SEE PAGE 11).

ADDITIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

1. |

Interest on state and local obligations other than Missouri source (reduced by related expenses |

|

|

00 |

|

00 |

||||||||||||||||

|

if expenses were over $500) . . . . |

. . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

1Y |

|

1S |

|||||||||||||||

2. |

|

|

Partnership; |

|

Fiduciary; |

|

S corporation; |

|

Net Operating Loss (Carryback/Carryforward); |

|

|

00 |

|

00 |

||||||||

|

|

|

Other (description) |

|

|

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . |

2Y |

|

2S |

||||||

3. Nonqualified distribution received from a qualified 529 plan (higher education savings program) |

|

|

00 |

|

00 |

|||||||||||||||||

|

|

withdrawn early or not used for qualified higher education expenses |

3Y |

|

3S |

|||||||||||||||||

4. |

. . . . . . . . .Food Pantry contributions included on federal Schedule A |

4Y |

|

00 |

4S |

00 |

||||||||||||||||

5. |

Nonresident Property Tax |

. . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

5Y |

|

00 |

5S |

00 |

|||||||||||||

6. |

TOTAL ADDITIONS — Add Lines 1, 2, 3, 4, and 5. Enter here and on Form |

6Y |

|

00 |

6S |

00 |

||||||||||||||||

SUBTRACTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

7. |

Interest from exempt federal obligations included in federal adjusted gross income (reduced by |

|

|

00 |

|

00 |

||||||||||||||||

|

related expenses if expenses were over $500). Attach a detailed list or all federal Form 1099(s). |

7Y |

|

7S |

||||||||||||||||||

8. |

Any state income tax refund included in federal adjusted gross income |

8Y |

|

00 |

8S |

00 |

||||||||||||||||

9. |

|

|

Partnership; |

|

|

Fiduciary; |

|

|

S corporation; |

|

|

|

|

|

||||||||

|

|

|

Railroad retirement benefits; |

|

|

Net Operating Loss; |

|

|

|

|

|

|||||||||||

|

|

|

Military (nonresident) |

|

|

Combat pay included in federal adjusted gross income; |

|

|

00 |

|

00 |

|||||||||||

|

|

|

Other (description) |

|

|

|

|

|

|

|

Attach supporting documentation. |

9Y |

|

9S |

||||||||

10. |

Exempt contributions made to a qualified 529 plan (higher education savings program) |

10Y |

|

00 |

10S |

00 |

||||||||||||||||

11. |

Qualified Health Insurance Premiums |

. . . . . . . . . . . . . . . . . . . . . . |

11Y |

|

00 |

11S |

00 |

|||||||||||||||

12. |

Missouri depreciation adjustment (Section 143.121, RSMo) |

|

|

00 |

|

00 |

||||||||||||||||

|

|

|

. . . . . . . . . . . . . . . . . . . .Sold or disposed property previously taken as addition modification |

12Y |

|

12S |

||||||||||||||||

13. |

TOTAL SUBTRACTIONS — Add Lines 7, 8, 9, 10, 11 and 12. Enter here and on Form |

13Y |

|

00 |

13S |

00 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 2 — MISSOURI ITEMIZED DEDUCTIONS — Complete this section only if you itemize deductions on your federal return. Attach a copy of your federal Form 1040 (pages 1 and 2) and federal Schedule A.

1. |

. . . .Total federal itemized deductions from federal Form 1040, Line 40 |

. . . |

. . . |

. . . . . |

. . . . . . . . . . |

. . . . . |

. . . . . . . . . . |

. |

. . . |

. . |

1 |

00 |

|||||

2. |

2008 |

(FICA) — yourself — Social security $ |

|

|

|

+ |

Medicare $ |

|

|

|

|

. . . |

2 |

00 |

|||

3. |

2008 |

(FICA) — spouse — Social security $ |

|

|

|

+ |

Medicare $ |

|

|

|

|

. . . |

3 |

00 |

|||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

00 |

4. |

2008 |

Railroad retirement tax — yourself (Tier I and Tier II) $ |

|

|

|

|

+ |

Medicare $ |

|

|

|

. . |

|||||

5. |

2008 |

Railroad retirement tax — spouse (Tier I and Tier II) $ |

|

|

|

|

+ |

Medicare $ |

|

|

|

|

. . |

5 |

00 |

||

6. |

2008 |

. . . |

. . . |

. . . |

. . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . |

. . . . . . . |

6 |

00 |

||||||

7. |

TOTAL — Add Lines 1 through 6 |

7 |

00 |

||||||||||||||

8. |

State and local income taxes — See instructions on Page 33 |

. . . |

. . . |

. . . . . |

. . . . . . . . . . |

8 |

|

00 |

|

|

|||||||

9. |

Earnings taxes included in Line 8 |

. . . |

. . . |

. . . . . |

. . . . . . . . . . |

9 |

|

00 |

|

|

|||||||

10. |

Net state income taxes — Subtract Line 9 from Line 8 or enter Line 8 from the worksheet below |

. . |

10 |

00 |

|||||||||||||

11. |

MISSOURI ITEMIZED DEDUCTIONS — Subtract Line 10 from Line 7. |

Enter here and on Form |

. . . . . . |

11 |

00 |

||||||||||||

NOTE: IF LINE 11 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INFORMATION ON PAGE 7.

2 — 10

Complete this worksheet only if your federal adjusted gross income from federal Form 1040, Line 37 is more than $159,950 ($79,975 if married filing separate). If your federal adjusted gross income is less than or equal to these amounts, do not complete this worksheet. Attach a copy of your federal Itemized Deduction Worksheet (Page

WORKSHEET FOR PART STATE AND LOCAL INCOME TAXES, LINE

1.Enter amount from federal Itemized Deduction Worksheet, Line 3

(See page

2.Enter amount from federal Itemized Deduction Worksheet, Line 11 (See federal Schedule A instructions.) . . . .

3.State and local income taxes from federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Earnings taxes included on federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.Subtract Line 4 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.Divide Line 5 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.Multiply Line 2 by Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.Subtract Line 7 from Line 5. Enter here and on Form

1

2

3

4

5

6

7

8

00

00

00

00

00

%

00

00

MO |

For Privacy Notice, see page 44 of the instructions. |

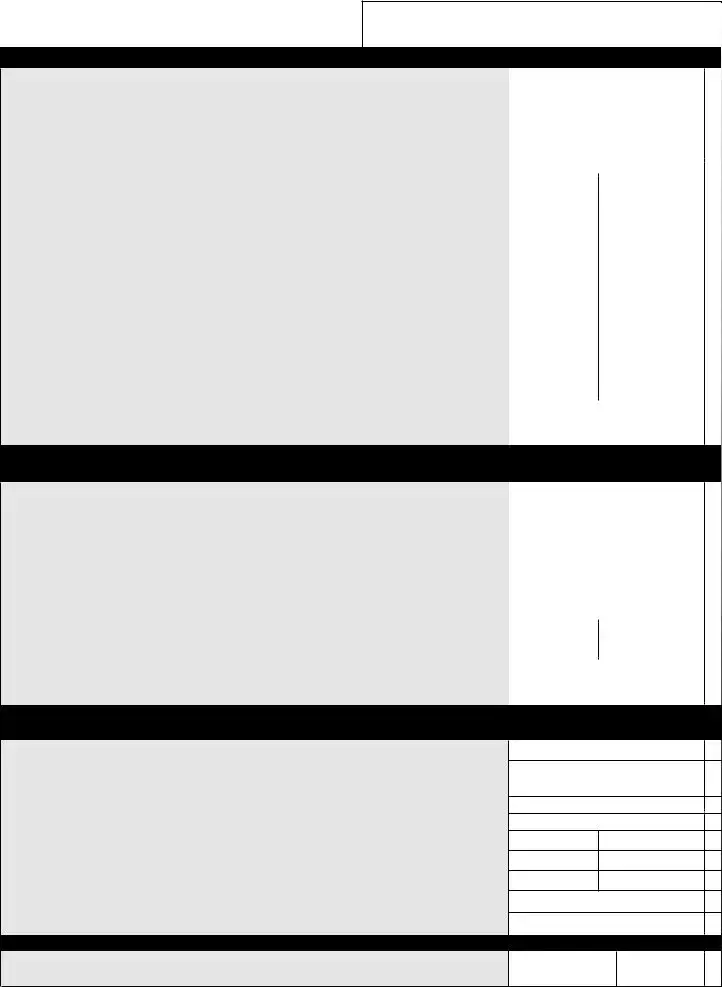

PART 3

IF YOU CLAIM A PENSION OR SOCIAL SECURITY/SOCIAL SECURITY DISABILITY EXEMPTION, YOU MUST ATTACH A COPY OF YOUR FEDERAL RETURN (PAGES 1 AND 2) AND

PUBLIC PENSION CALCULATION — Public pensions are pensions received from any federal, state, or local government.

1. Enter your Missouri Adjusted Gross Income from Form

2. Select the appropriate filing status and enter amount on Line 2. Married filing combined — $100,000; Single, Head of Household, Married Filing Separate, and Qualifying Widower — $85,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Subtract Line 2 from Line 1 and enter on Line 3. If Line 2 is greater than Line 1, enter $0. . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Enter your total social security benefits from federal Form 1040A, Line 14a or federal Form 1040, Line 20a . . . . . . . . . . . . .

5. Enter your taxable social security benefits from federal Form 1040A, Line 14b or federal Form 1040, Line 20b . . . . . . . . . .

6. Non taxable social security benefits, subtract Line 5 from Line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Enter taxable pension for each spouse from public sources from federal Form 1040A, Line 12b or federal Form 1040, Line 16b (public pensions and pensions from other than private sources) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Multiply Line 7 by 35%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. If amount on Line 8 is greater than $33,703 (maximum social security benefit), enter $33,703. If amount on Line 8

is less than $33,703, enter amount from Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Subtract Line 6 from Line 9. If Line 6 is greater than Line 9, enter $0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Enter pension amount from Line 7 or $6,000, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Enter Line 10 or Line 11, whichever is greater . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Add amounts on Lines 12Y and 12S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Total public pension, subtract Line 3 from Line 13. If Line 3 is greater than Line 13, enter $0 . . . . . . . . . . . . . . . . . . . . . . .

1 |

|

|

|

00 |

|

|

|

|

|

2 |

|

|

|

00 |

|

|

|

|

|

3 |

|

|

|

00 |

|

|

|

|

|

|

Y - YOURSELF |

|

|

S - SPOUSE |

4Y |

|

00 |

4S |

00 |

|

|

|

|

|

5Y |

|

00 |

5S |

00 |

|

|

|

|

|

6Y |

|

00 |

6S |

00 |

|

|

|

|

|

7Y |

|

00 |

7S |

00 |

|

|

|

|

|

8Y |

|

00 |

8S |

00 |

|

|

|

|

|

9Y |

|

00 |

9S |

00 |

|

|

|

|

|

10Y |

|

00 |

10S |

00 |

|

|

|

|

|

11Y |

|

00 |

11S |

00 |

|

|

|

|

|

12Y |

|

00 |

12S |

00 |

|

|

|

|

|

13 |

|

|

|

00 |

|

|

|

|

|

14 |

|

|

|

00 |

|

|

|

|

|

PRIVATE PENSION CALCULATION — Private pensions are annuities, pensions, 401(K) plans, deferred compensation plans, self- employed retirement plans, and IRA’s funded by a private source.

1.Enter your Missouri Adjusted Gross Income from Form

2.Enter your taxable social security benefits from federal Form 1040A, Line 14b or federal Form 1040, Line 20b . . . . . . . . . .

3.Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Select the appropriate filing status and enter the amount on Line 4: Married filing combined: $32,000; Single, Head of

Household and Qualifiying Widower: $25,000; Married Filing Separate: $16,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.Subtract Line 4 from Line 3. If Line 4 is greater than Line 3, enter $0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.Enter taxable pension for each spouse from private sources from federal Form 1040A, Lines 11b and 12b, or federal Form 1040, Lines 15b and 16b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.Enter the amounts from Line 6Y and 6S or $6,000, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.Add Lines 7Y and 7S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.Total private pension, subtract Line 5 from Line 8. If Line 5 is greater than Line 8, enter $0 . . . . . . . . . . . . . . . . . . . . . . . .

1 |

|

|

|

00 |

|

|

|

|

|

2 |

|

|

|

00 |

3 |

|

|

|

00 |

4 |

|

|

|

00 |

5 |

|

|

|

00 |

|

Y - YOURSELF |

|

|

S - SPOUSE |

|

|

|

|

|

6Y |

|

00 |

6S |

00 |

7Y |

|

00 |

7S |

00 |

8 |

|

|

|

00 |

9 |

|

|

|

00 |

SOCIAL SECURITY OR SOCIAL SECURITY DISABILITY CALCULATION — To be eligible for social security deduction you must be 62 years of age by December 31 and have marked the 62 and older box on page 1 of Form

1.Enter your Missouri Adjusted Gross Income from Form

2.Select the appropriate filing status and enter the amount on Line 2. Married filing combined - $100,000

Single, Head of Household, Married Filing Separate, and Qualifying Widower - $85,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.Subtract Line 2 from Line 1 and enter on Line 3. If Line 2 is greater than Line 1, enter $0 . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Enter taxable social security benefits for each spouse from federal Form 1040A, Line 14b or federal Form 1040, Line 20b .

5.Enter taxable social security disability benefits for each spouse from federal Form 1040A, Line 14b or federal Form 1040, Line 20b.

6.Multiply Line 4 or Line 5 by 35%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.Add Lines 6Y and 6S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.Total social security/social security disability, subtract Line 3 from Line 7. If Line 3 is greater than Line 7, enter $0. . . .

TOTAL PENSION AND SOCIAL SECURITY / SOCIAL SECURITY DISABILITY EXEMPTION

1 |

|

|

|

00 |

2 |

|

|

|

00 |

3 |

|

|

|

00 |

Y - YOURSELF |

|

|

S - SPOUSE |

|

4Y |

|

00 |

4S |

00 |

5Y |

|

00 |

5S |

00 |

6Y |

|

00 |

6S |

00 |

7 |

|

|

|

00 |

8 |

|

|

|

00 |

|

|

|

|

|

Total Pension Exemption and Social Security / Social Security Disability Exemption. Add Line 14 (Public Pension Calculation), Line 9 (Private Pension Calculation), and Line 8 (Social Security Calculation) and enter here and on Form

TOTAL

EXEMPTION

00

Common PDF Templates

Missouri Baptist University Rl007 - The form is part of Missouri Baptist University's commitment to student satisfaction within resident life.

When preparing for your boat transaction, it's important to understand the necessary documentation. A reliable resource for this process is our guide on the essential aspects of the Boat Bill of Sale form, which outlines crucial steps for a successful sale. You can learn more by visiting this page about the Boat Bill of Sale.

Do You Have to Have a Front License Plate in Missouri - Specific identification information is required to accurately link the request to the vehicle records.

Missouri State Tax Form - Make sure to send the form to the correct mailing address to avoid delays in processing.

Dos and Don'ts

When filling out the Missouri Mo A form, it is essential to approach the process with care and attention to detail. Here are five important do's and don'ts to keep in mind:

- Do ensure that all personal information, such as your name and Social Security number, is accurate and matches your federal return.

- Don't leave any sections blank. If a question does not apply to you, indicate that clearly, rather than skipping it.

- Do attach your federal return and any required documentation, such as Form 1099s, to support your claims.

- Don't forget to double-check your calculations. Errors in addition or subtraction can lead to delays or issues with your return.

- Do read the instructions thoroughly, especially the sections on specific modifications and deductions, to ensure compliance.

Taking these steps can help facilitate a smoother filing process and minimize potential complications. Your attention to detail will serve you well as you complete the form.

Key takeaways

When filling out the Missouri Mo A form, keep these key takeaways in mind:

- Understand the Purpose: The Mo A form is used to report adjustments to your federal adjusted gross income for Missouri state tax purposes. It is essential to attach it to your Form MO-1040 along with your federal return.

- Complete All Relevant Sections: Make sure to fill out both the additions and subtractions sections accurately. This includes reporting items such as interest on state obligations and nonqualified distributions from 529 plans.

- Itemized Deductions: If you choose to itemize deductions on your federal return, you must also complete the Missouri itemized deductions section. Attach your federal Form 1040 and Schedule A to support your claims.

- Documentation is Key: Always attach the necessary documentation, such as federal Form 1099s or any other supporting documents, especially when claiming exemptions or deductions. This will help ensure your form is processed smoothly.

Misconceptions

Understanding the Missouri Mo A form can be challenging, especially with the various details involved. Here are six common misconceptions that may lead to confusion:

- Misconception 1: The Missouri Mo A form is only for residents of Missouri.

- Misconception 2: You do not need to attach your federal return.

- Misconception 3: All income adjustments are automatically accepted.

- Misconception 4: The form only applies to individual taxpayers.

- Misconception 5: You can skip the itemized deductions section if you take the standard deduction.

- Misconception 6: The form is the same every year.

This form is applicable to both residents and non-residents who earn income in Missouri. Non-residents must report their Missouri-sourced income, and the form provides necessary adjustments to federal income tax.

In fact, it is mandatory to attach a copy of your federal return when submitting the Missouri Mo A form. This helps ensure accurate calculations and adjustments to your state income tax.

Not all adjustments will be accepted without proper documentation. It is crucial to provide supporting documentation for any additions or subtractions claimed on the form.

While it is primarily designed for individual income tax adjustments, married couples filing jointly must also use this form to report their combined income and adjustments.

If you choose to take the standard deduction on your federal return, you do not need to complete the itemized deductions section of the Missouri Mo A form. However, it is essential to ensure that this choice aligns with your overall tax strategy.

The Missouri Mo A form may change from year to year, reflecting updates in tax laws or regulations. Always check for the most current version and instructions to ensure compliance.

Similar forms

- Form 1040 - This is the standard individual income tax return form used by U.S. taxpayers. Like the Missouri MO-A form, it requires personal information, income details, and deductions. Both forms aim to determine tax liability based on income and eligible deductions.

- Form MO-1040 - This is the primary income tax form for Missouri residents. Similar to the MO-A form, it includes sections for income, adjustments, and deductions. The MO-A form serves as an attachment to the MO-1040, specifically for reporting adjustments to federal income.

-

The Texas Bill of Sale is an important legal document necessary for proving the transfer of ownership of personal property, such as vehicles or equipment. This form is designed to protect both the buyer and seller during the transaction, ensuring clarity and legal validity. For more information, visit topformsonline.com/texas-bill-of-sale.

- Schedule A (Form 1040) - This form is used for itemizing deductions on the federal tax return. It parallels the itemized deductions section of the MO-A form, where taxpayers can report specific deductions that may lower their taxable income.

- Form 1099 - This form reports various types of income other than wages, salaries, and tips. Similar to the MO-A form, it requires the reporting of income sources and is used to determine tax obligations. Both forms necessitate accurate reporting of income received during the tax year.

- Form MO-CR - This form is used for claiming tax credits in Missouri. Like the MO-A, it requires detailed information about income and adjustments. Both forms are integral to accurately calculating tax liability and ensuring compliance with state tax regulations.