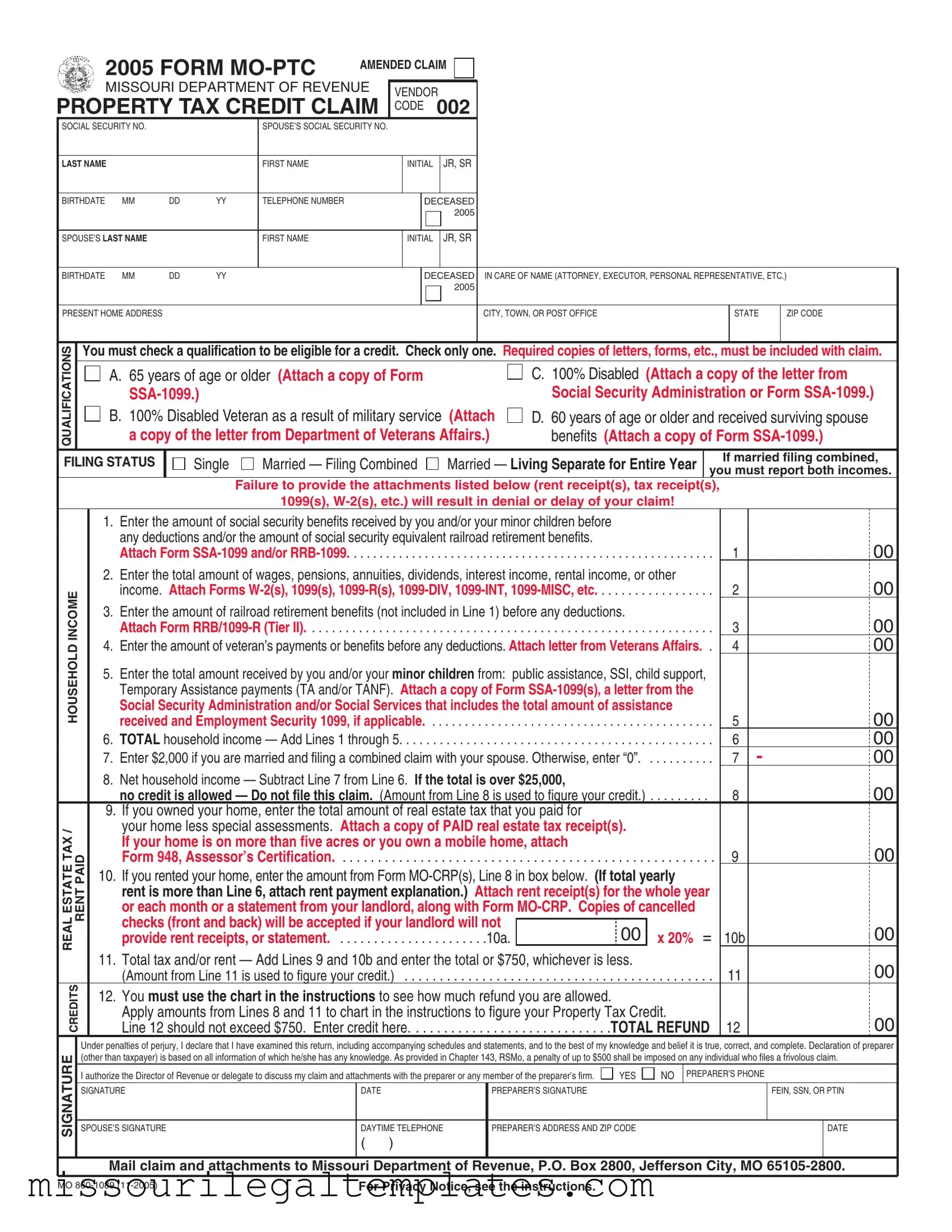

Fill in a Valid Missouri Mo Ptc Template

The Missouri Mo PTC form is a crucial document for residents seeking property tax credits, particularly for seniors and disabled individuals. This form, officially known as the Vendor Property Tax Credit Claim, allows eligible applicants to claim a credit based on their household income and property taxes paid. To qualify, individuals must meet specific criteria, such as being 65 years or older, being a 100% disabled veteran, or being a surviving spouse of a qualifying individual. The form requires detailed information, including social security numbers, income sources, and tax receipts. Applicants must provide supporting documents, such as Form SSA-1099 for Social Security benefits or letters from the Department of Veterans Affairs. The filing status—whether single, married filing combined, or married living separately—also plays a role in determining eligibility. It is essential to accurately report household income and ensure all necessary attachments are included, as missing information can lead to claim denial or delays. The Mo PTC form ultimately aims to alleviate some financial burdens by offering credits up to $750, depending on the applicant's financial situation and tax payments.

Missouri Mo Ptc Preview

2005 FORM

AMENDED CLAIM

MISSOURI DEPARTMENT OF REVENUE |

VENDOR |

|

|

|

|

||||||||

PROPERTY TAX CREDIT CLAIM |

CODE |

002 |

|

|

|

|

|||||||

SOCIAL SECURITY NO. |

|

|

SPOUSE’S SOCIAL SECURITY NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

|

|

|

FIRST NAME |

|

INITIAL |

|

JR, SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIRTHDATE |

MM |

DD |

YY |

TELEPHONE NUMBER |

|

|

DECEASED |

|

|

|

|

||

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S LAST NAME |

|

|

FIRST NAME |

|

INITIAL |

|

JR, SR |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIRTHDATE |

MM |

DD |

YY |

|

|

|

DECEASED |

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REPRESENTATIVE, ETC.) |

|

||||

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRESENT HOME ADDRESS |

|

|

|

|

|

|

|

|

CITY, TOWN, OR POST OFFICE |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUALIFICATIONS

You must check a qualification to be eligible for a credit. Check only one. Required copies of letters, forms, etc., must be included with claim.

A. |

65 years of age or older (Attach a copy of Form |

C. 100% Disabled (Attach a copy of the letter from |

|

Social Security Administration or Form |

|

B. |

100% Disabled Veteran as a result of military service (Attach |

D. 60 years of age or older and received surviving spouse |

|

a copy of the letter from Department of Veterans Affairs.) |

benefits (Attach a copy of Form |

FILING STATUS

Single

Married — Filing Combined

Married — Living Separate for Entire Year

If married filing combined,

you must report both incomes.

Failure to provide the attachments listed below (rent receipt(s), tax receipt(s),

1099(s),

HOUSEHOLD INCOME

REAL ESTATE TAX / CREDITSRENT PAID

1. |

Enter the amount of social security benefits received by you and/or your minor children before |

|

|

any deductions and/or the amount of social security equivalent railroad retirement benefits. |

|

|

Attach Form |

1 |

2. |

Enter the total amount of wages, pensions, annuities, dividends, interest income, rental income, or other |

|

|

income. Attach Forms |

2 |

3. |

Enter the amount of railroad retirement benefits (not included in Line 1) before any deductions. |

|

|

Attach Form |

3 |

4. |

Enter the amount of veteran’s payments or benefits before any deductions. Attach letter from Veterans Affairs. . |

4 |

5.Enter the total amount received by you and/or your minor children from: public assistance, SSI, child support, Temporary Assistance payments (TA and/or TANF). Attach a copy of Form

Social Security Administration and/or Social Services that includes the total amount of assistance

|

received and Employment Security 1099, if applicable |

5 |

|

6. |

TOTAL household income — Add Lines 1 through 5 |

6 |

|

7. |

Enter $2,000 if you are married and filing a combined claim with your spouse. Otherwise, enter “0” |

7 |

- |

8. |

Net household income — Subtract Line 7 from Line 6. If the total is over $25,000, |

|

|

|

no credit is allowed — Do not file this claim. (Amount from Line 8 is used to figure your credit.) |

8 |

|

9.If you owned your home, enter the total amount of real estate tax that you paid for

your home less special assessments. Attach a copy of PAID real estate tax receipt(s).

|

If your home is on more than five acres or you own a mobile home, attach |

|

|

|

Form 948, Assessor’s Certification |

. . . . . . . . . . . . . . |

9 |

10. |

If you rented your home, enter the amount from Form |

|

|

|

rent is more than Line 6, attach rent payment explanation.) Attach rent receipt(s) for the whole year |

|

|

|

or each month or a statement from your landlord, along with Form |

|

|

|

checks (front and back) will be accepted if your landlord will not |

|

|

|

provide rent receipts, or statement. . . . . . . . . . . . . . . . . . . . . . .10a. |

00 x 20% = |

10b |

11. |

Total tax and/or rent — Add Lines 9 and 10b and enter the total or $750, whichever is less. |

|

|

|

(Amount from Line 11 is used to figure your credit.) |

. . . . . . . . . . . . . . |

11 |

12.You must use the chart in the instructions to see how much refund you are allowed.

Apply amounts from Lines 8 and 11 to chart in the instructions to figure your Property Tax Credit.

Line 12 should not exceed $750. Enter credit here |

TOTAL REFUND 12 |

00

00

00

00

00

00

00

00

00

00

00

00

00

SIGNATURE

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has any knowledge. As provided in Chapter 143, RSMo, a penalty of up to $500 shall be imposed on any individual who files a frivolous claim.

I authorize the Director of Revenue or delegate to discuss my claim and attachments with the preparer or any member of the preparer’s firm. |

|

YES |

|

NO |

PREPARER’S PHONE |

|||

|

|

|||||||

|

|

|||||||

SIGNATURE |

DATE |

PREPARER’S SIGNATURE |

|

|

|

|

|

FEIN, SSN, OR PTIN |

|

|

|

|

|

|

|

||

SPOUSE’S SIGNATURE |

DAYTIME TELEPHONE |

PREPARER’S ADDRESS AND ZIP CODE |

|

|

|

DATE |

||

( )

Mail claim and attachments to Missouri Department of Revenue, P.O. Box 2800, Jefferson City, MO

MO |

For Privacy Notice, see the instructions. |

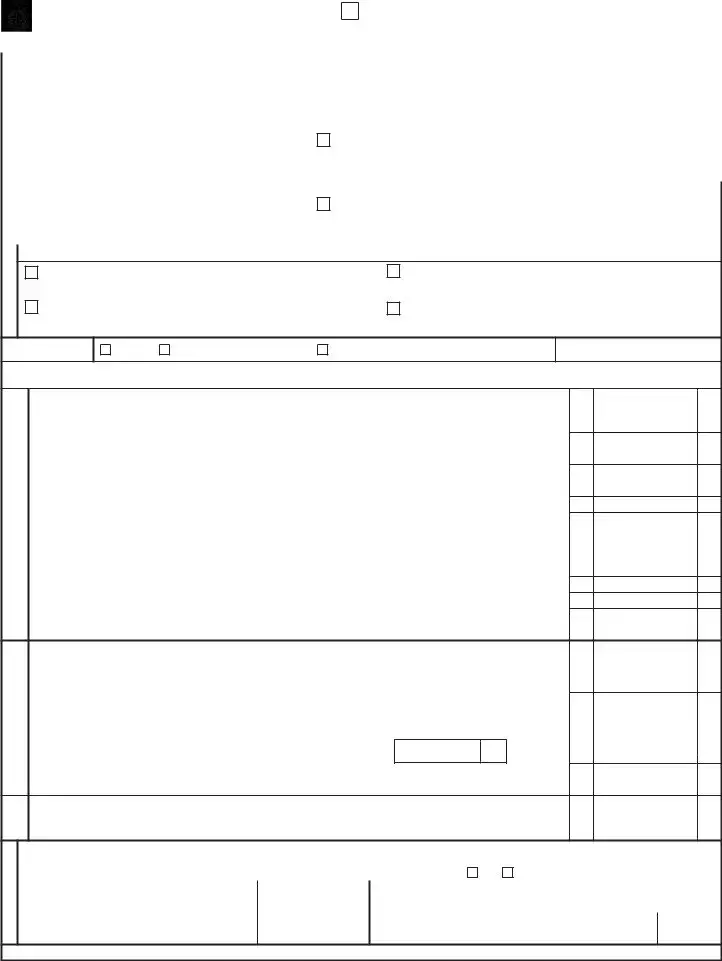

MISSOURI DEPARTMENT OF REVENUE

CERTIFICATION OF RENT PAID FOR 2005

2005

FORM

• Read instructions. • Print or type.

Failure to provide landlord information will result in denial or delay of your claim.

1. SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

ARE YOU RELATED TO YOUR LANDLORD? IF YES, EXPLAIN.

YES

NO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. NAME |

3. LANDLORD’S NAME, SOCIAL SECURITY NO., OR FEIN (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF RENTAL UNIT (DO NOT LIST P.O. BOX) |

LANDLORD’S ADDRESS, CITY, STATE, AND ZIP CODE (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

4. LANDLORD’S PHONE NUMBER (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.RENTAL PERIOD DURING YEAR

FROM: MONTH |

DAY |

YEAR |

— |

— |

2005 |

TO: MONTH |

DAY |

YEAR |

— |

— |

2005 |

6.Enter your gross rent paid. Attach rent receipt(s) for each rent payment or the entire year, a statement from your landlord,

or copies of cancelled checks (front and back). If receiving housing assistance, enter the amount of rent YOU paid. . . . |

6 |

7.Check the appropriate box and enter the corresponding percentage on Line 7.

A. APARTMENT, HOUSE, MOBILE HOME, OR DUPLEX — 100%

A. APARTMENT, HOUSE, MOBILE HOME, OR DUPLEX — 100%

B. MOBILE HOME LOT — 100%

B. MOBILE HOME LOT — 100%

C. BOARDING HOME / RESIDENTIAL CARE — 50%

C. BOARDING HOME / RESIDENTIAL CARE — 50%

D. SKILLED OR INTERMEDIATE CARE NURSING HOME — 45%

D. SKILLED OR INTERMEDIATE CARE NURSING HOME — 45%

E. HOTEL If meals are included, enter — 50%; Otherwise, enter — 100%

E. HOTEL If meals are included, enter — 50%; Otherwise, enter — 100%

F. LOW INCOME HOUSING — 100% (Rent cannot exceed 40% of total household income.)

F. LOW INCOME HOUSING — 100% (Rent cannot exceed 40% of total household income.)

G. SHARED RESIDENCE — If you shared your rent with relatives and/or friends (other than your spouse or children under 18), check the appropriate box and enter percentage.

G. SHARED RESIDENCE — If you shared your rent with relatives and/or friends (other than your spouse or children under 18), check the appropriate box and enter percentage.

Additional persons sharing rent/percentage to be entered: |

1 (50%) |

2 (33%) |

3 (25%) . . . . . 7 |

|

8. Net rent paid — Multiply Line 6 by the percentage on Line 7. ENTER HERE AND IN THE BOX ON |

|

|||

FORM |

. . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . 8 |

|

MO |

For Privacy Notice, see the instructions. |

|

||

00

00

%

00

00

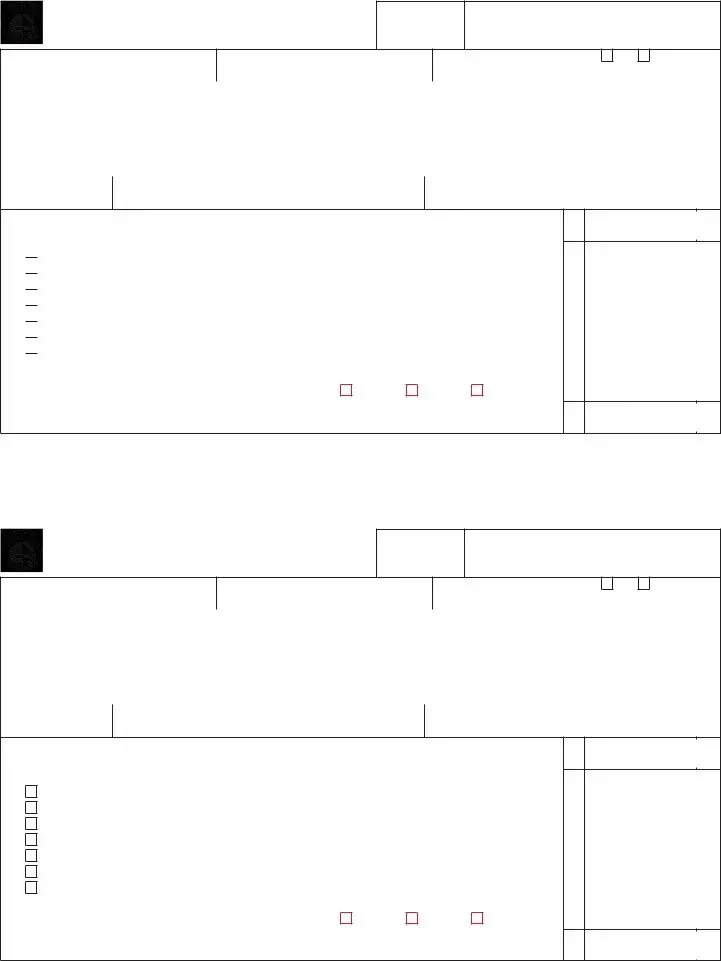

MISSOURI DEPARTMENT OF REVENUE

CERTIFICATION OF RENT PAID FOR 2005

2005

FORM

• Read instructions. • Print or type.

Failure to provide landlord information will result in denial or delay of your claim.

1. SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

ARE YOU RELATED TO YOUR LANDLORD? IF YES, EXPLAIN.

YES

NO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. NAME |

3. LANDLORD’S NAME, SOCIAL SECURITY NO., OR FEIN (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF RENTAL UNIT (DO NOT LIST P.O. BOX) |

LANDLORD’S ADDRESS, CITY, STATE, AND ZIP CODE (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

4. LANDLORD’S PHONE NUMBER (MUST BE COMPLETED) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.RENTAL PERIOD DURING YEAR

FROM: MONTH |

DAY |

YEAR |

— |

— |

2005 |

TO: MONTH |

DAY |

YEAR |

— |

— |

2005 |

6.Enter your gross rent paid. Attach rent receipt(s) for each rent payment or the entire year, a statement from your landlord, or copies of cancelled checks (front and back). If receiving housing assistance, enter the amount of rent YOU paid. . . .

7.Check the appropriate box and enter the corresponding percentage on Line 7.

A. APARTMENT, HOUSE, MOBILE HOME, OR DUPLEX — 100%

B. MOBILE HOME LOT — 100%

C. BOARDING HOME / RESIDENTIAL CARE — 50%

D. SKILLED OR INTERMEDIATE CARE NURSING HOME — 45%

E. HOTEL If meals are included, enter — 50%; Otherwise, enter — 100%

F. LOW INCOME HOUSING — 100% (Rent cannot exceed 40% of total household income.)

G. SHARED RESIDENCE — If you shared your rent with relatives and/or friends (other than your spouse

or children under 18), check the appropriate box and enter percentage. |

|

|

|

Additional persons sharing rent/percentage to be entered: |

1 (50%) |

2 (33%) |

3 (25%) |

8. Net rent paid — Multiply Line 6 by the percentage on Line 7. ENTER HERE AND IN THE BOX ON

FORM

6

7

8

00

00

%

00

00

MO |

For Privacy Notice, see the instructions. |

Common PDF Templates

Kansas Mechanics Lien - Applicants must also include work orders or storage bills as evidence of the debt.

Taking the time to prepare your estate is crucial, and understanding the importance of the Last Will and Testament is essential for anyone looking to ensure their wishes are honored. With this legal document, individuals can clearly state their intentions regarding asset distribution and the care of their loved ones. For those in Arizona, one helpful resource is the collection of templates available through All Arizona Forms, which can simplify the process of creating this critical document.

Missouri Sales Tax Filing Frequency - The due date for filing can be verified on the Missouri Department of Revenue website.

Dos and Don'ts

When filling out the Missouri Mo Ptc form, it is essential to follow specific guidelines to ensure a smooth application process. Below are seven important do's and don'ts:

- Do check one qualification that applies to you before submitting the form.

- Do attach required documents, such as Form SSA-1099 or letters from the Department of Veterans Affairs, as specified.

- Do report all sources of income accurately, including wages and social security benefits.

- Do ensure your household income does not exceed $25,000 if you want to qualify for the credit.

- Don't leave any sections of the form blank; provide all necessary information, including social security numbers.

- Don't forget to include your real estate tax receipts or rent receipts; failure to do so may delay your claim.

- Don't submit the form without reviewing it for accuracy and completeness, as errors may lead to denial of your claim.

Key takeaways

Understanding the Missouri Mo Ptc Form is essential for those seeking a property tax credit. Here are four key takeaways to consider:

- Eligibility Requirements: To qualify for the property tax credit, applicants must meet specific criteria. These include being 65 years or older, being a 100% disabled veteran, or being 60 years or older and receiving surviving spouse benefits. It is crucial to check only one qualification and provide the necessary documentation.

- Filing Status: The form requires you to indicate your filing status, such as single, married filing combined, or married living separately. If filing combined, both incomes must be reported, which can affect eligibility for the credit.

- Documentation is Key: Failure to attach required documents, such as rent receipts, tax receipts, or Social Security forms, can lead to delays or denial of your claim. Ensure all supporting documents are included when submitting the form.

- Income Limits: The total household income must not exceed $25,000 to qualify for the credit. If the calculated net income exceeds this amount, the claim should not be filed. This figure is crucial in determining the amount of the property tax credit.

Misconceptions

- Misconception 1: The Missouri Mo Ptc form is only for homeowners.

- Misconception 2: You don’t need to provide any documentation.

- Misconception 3: Only seniors can apply for the credit.

- Misconception 4: You can file the form without checking your income.

- Misconception 5: You can submit the form without a signature.

This form is applicable to both homeowners and renters. Renters can qualify for property tax credits based on their rent payments, so it’s important not to overlook this option if you don’t own a home.

Documentation is crucial for your claim. You must attach required forms like the SSA-1099 for Social Security benefits or real estate tax receipts. Failing to provide these can lead to delays or denial of your claim.

While individuals aged 65 and older are eligible, younger people can also qualify if they are 100% disabled or a 100% disabled veteran. Age is not the only factor for eligibility.

Your signature is required to validate the claim. Without it, the form is incomplete and will not be processed. Make sure to sign and date your form before submitting it.

Similar forms

Missouri Form MO-CRP: This form is used to certify rent paid, similar to the MO PTC form, which also requires documentation of rent payments to qualify for a tax credit. Both forms necessitate proof of income and rental history.

Federal Form 1040: The 1040 is the standard individual income tax return form. Like the MO PTC, it requires personal information and income details to determine eligibility for credits and deductions.

Missouri Form MO-A: This is the Missouri Individual Income Tax Return. It shares similarities with the MO PTC in that both require detailed income reporting and can affect tax liabilities.

Missouri Form MO-PTS: The Property Tax Credit Schedule, which is used alongside the MO PTC. It helps calculate the amount of property tax credit based on income and property taxes paid.

Missouri Form MO-PTC-CR: This form is specifically for claiming a credit for property taxes paid by renters. It parallels the MO PTC by focusing on property tax credits.

Federal Form 8862: This form is used to claim the Earned Income Tax Credit after it has been denied in the past. Both forms require proof of eligibility and income verification.

Missouri Form MO-ITCR: The Individual Tax Credit Refund form is similar in that it allows for the claiming of tax credits based on specific qualifications, including income limits.

Federal Form 8863: This form is used to claim education credits. Like the MO PTC, it requires detailed income information and eligibility documentation.

- California Durable Power of Attorney: This important legal document enables one person to manage another's financial affairs in times of need. For more details, visit https://smarttemplates.net.

Missouri Form MO-CR: The Credit for Taxes Paid form is similar as it allows individuals to claim credits based on taxes already paid, requiring similar documentation and personal information.

Missouri Form MO-PTC-2: This form serves as a supplemental claim for property tax credits, similar to the MO PTC in its focus on property tax relief for qualifying individuals.