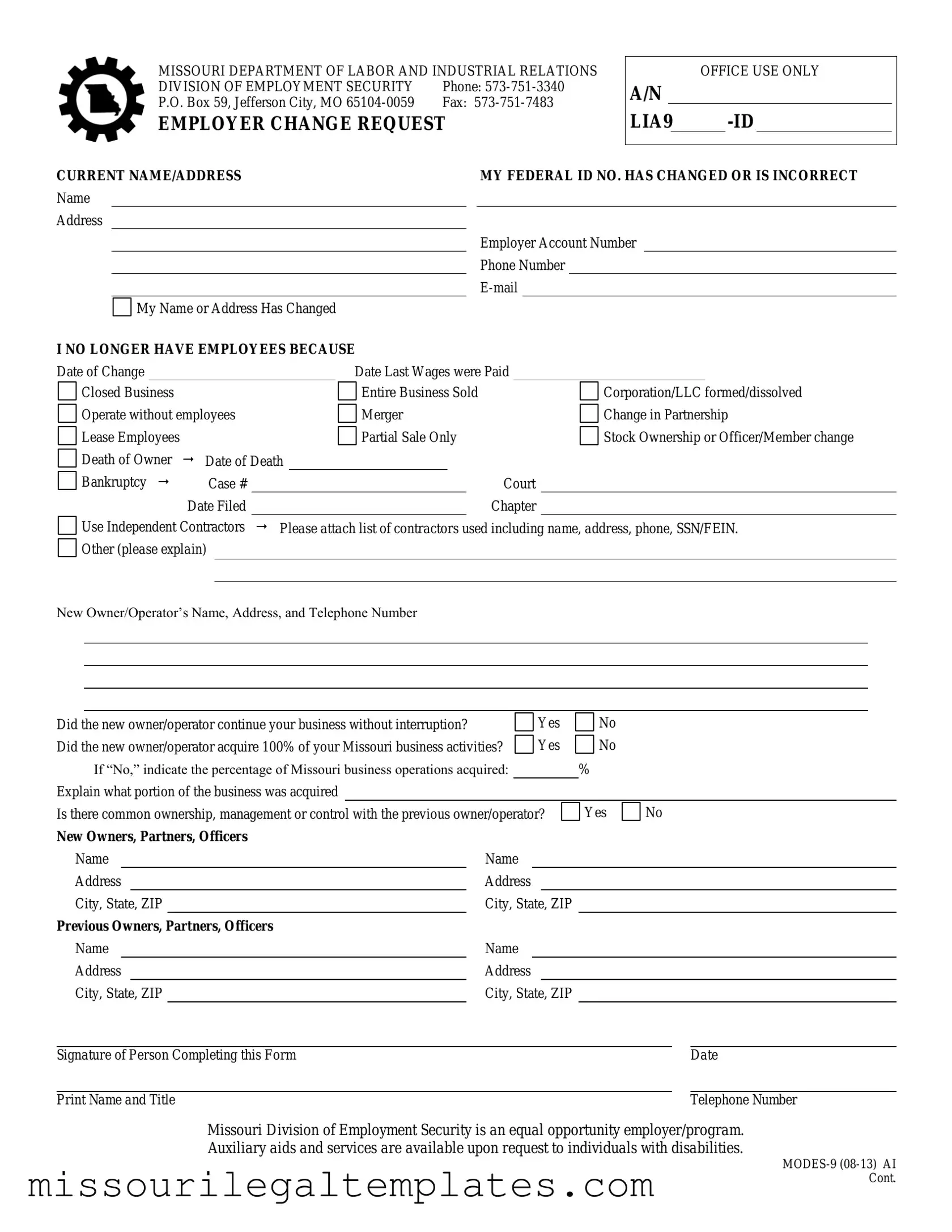

Fill in a Valid Missouri Modes 9 Template

The Missouri Modes 9 form serves as a crucial tool for employers who need to update their information with the Missouri Department of Labor and Industrial Relations. This form is primarily used to request changes related to an employer’s name, address, or federal identification number. It also accommodates various scenarios such as the closure of a business, changes in ownership, or the transition to operating without employees. Employers must provide essential details, including their current contact information, the nature of the change, and relevant dates. Additionally, if a business has been sold or merged, the new owner's information must be included, along with a confirmation of whether the new entity continues the previous operations without interruption. The form also allows for the reporting of independent contractors and requires a list of their details if applicable. By ensuring that this information is accurately captured and submitted, employers can maintain compliance and facilitate smooth communication with state agencies.

Missouri Modes 9 Preview

MISSOURI DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS

DIVISION OF EMPLOYMENT SECURITY |

Phone: |

P.O. Box 59, Jefferson City, MO |

Fax: |

EMPLOYER CHANGE REQUEST

OFFICE USE ONLY

A/N

LIA9

CURRENT NAME/ADDRESS |

MY FEDERAL ID NO. HAS CHANGED OR IS INCORRECT |

Name

Address

Employer Account Number

Phone Number

My Name or Address Has Changed

I NO LONGER HAVE EMPLOYEES BECAUSE |

|

|

|

|||||||||||||

Date of Change |

|

|

|

|

|

|

Date Last Wages were Paid |

|

|

|

|

|||||

|

Closed Business |

|

|

|

|

|

|

Entire Business Sold |

|

Corporation/LLC formed/dissolved |

||||||

|

|

|

|

|

|

|

|

|||||||||

|

Operate without employees |

|

|

|

|

Merger |

|

Change in Partnership |

||||||||

|

|

|

|

|

|

|||||||||||

|

Lease Employees |

|

|

|

|

|

|

Partial Sale Only |

|

Stock Ownership or Officer/Member change |

||||||

|

|

|

|

|

|

|

|

|||||||||

|

Death of Owner |

Date of Death |

|

|

|

|||||||||||

|

|

|

|

|||||||||||||

|

Bankruptcy |

Case # |

|

|

|

|

|

|

Court |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Filed |

|

|

|

|

|

|

Chapter |

|

|

|

|

||

|

Use Independent Contractors |

Please attach list of contractors used including name, address, phone, SSN/FEIN. |

||||||||||||||

|

||||||||||||||||

|

Other (please explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Owner/Operator’s Name, Address, and Telephone Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did the new owner/operator continue your business without interruption? |

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|||||

Did the new owner/operator acquire 100% of your Missouri business activities? |

|

|

|

|

|

|

|

|

|||||||||||||

|

If “No,” indicate the percentage of Missouri business operations acquired: |

|

|

|

% |

|

|

|

|

|

|

||||||||||

Explain what portion of the business was acquired |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Is there common ownership, management or control with the previous owner/operator? |

|

|

Yes |

|

No |

|

|||||||||||||||

|

|

|

|

||||||||||||||||||

New Owners, Partners, Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||||||

Address |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|||||||

City, State, ZIP |

|

|

City, State, ZIP |

|

|

|

|

|

|

|

|

||||||||||

Previous Owners, Partners, Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||||||

Address |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|||||||

City, State, ZIP |

|

|

City, State, ZIP |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Signature of Person Completing this Form |

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Print Name and Title |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|||||||

Missouri Division of Employment Security is an equal opportunity employer/program.

Auxiliary aids and services are available upon request to individuals with disabilities.

Common PDF Templates

Missouri Car Title - It's necessary to sign the application in front of a notary public.

Missouri Department of Corrections Visitation Form - Check if DOC employee, volunteer, or intern.

A California Deed form is a legal document used to transfer ownership of real property from one party to another. This form is essential for ensuring that the transfer is recognized by the state and protects the rights of both the buyer and seller. If you're ready to take the next step in your property transaction, you can find the necessary documentation here: Deed form.

How to Get a Hardship License in Missouri - Applicants may need to follow up after submitting the application.

Dos and Don'ts

When filling out the Missouri Modes 9 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do provide accurate information regarding your current name and address.

- Do include your federal ID number to avoid processing delays.

- Do clearly indicate the reason for the change in your business status.

- Do ensure that all names and addresses of new owners or partners are complete and correct.

- Don't leave any sections blank; every part of the form must be filled out.

- Don't forget to sign and date the form before submission.

- Don't provide incomplete information about independent contractors, if applicable.

- Don't submit the form without reviewing it for errors or omissions.

Key takeaways

When filling out the Missouri Modes 9 form, keep the following key takeaways in mind:

- Accurate Information: Ensure that all details, such as your name, address, and federal ID number, are correct. Inaccurate information can delay processing.

- Timeliness: Submit the form as soon as there are changes to your business status. This includes changes in ownership or if you no longer have employees.

- Required Documentation: If you are using independent contractors, attach a list that includes their names, addresses, phone numbers, and SSNs or FEINs.

- Ownership Changes: Clearly indicate if the new owner/operator has continued the business without interruption and whether they acquired 100% of the operations.

- Signature Requirement: The form must be signed by the person completing it. Make sure to include your printed name, title, and contact number.

- Contact Information: If you have questions, you can reach out to the Missouri Department of Labor and Industrial Relations at 573-751-3340.

Following these guidelines will help ensure that your submission is processed smoothly and efficiently.

Misconceptions

Here are six common misconceptions about the Missouri Modes 9 form, along with clarifications for each:

- Misconception 1: The Modes 9 form is only for businesses that have closed.

- Misconception 2: Only the owner can fill out the Modes 9 form.

- Misconception 3: The form is optional if there are no employees.

- Misconception 4: You can submit the Modes 9 form without documentation.

- Misconception 5: The Modes 9 form only needs to be submitted once.

- Misconception 6: There is no deadline for submitting the Modes 9 form.

This form is not limited to businesses that have ceased operations. It is also used for updating information such as name or address changes, as well as changes in ownership or structure.

While it is often the owner who completes the form, anyone authorized to act on behalf of the business can fill it out. This includes partners or designated representatives.

Even if a business no longer has employees, it is crucial to submit the Modes 9 form to ensure that the state has accurate records regarding the business's status and ownership.

In some cases, supporting documentation is required. For instance, if there is a change in ownership, a list of new owners and their details must be provided.

Changes in business structure, ownership, or contact information may require multiple submissions over time. Each significant change should be reported promptly.

Timely submission is important. Delays in reporting changes can lead to complications, including issues with tax responsibilities or unemployment insurance.

Similar forms

The Missouri Modes 9 form is a document used for notifying the state about changes in employer information. Several other forms share similarities with the Modes 9 form, particularly in their purpose of updating or requesting information related to employment and business operations. Below is a list of seven similar documents:

- IRS Form 8822 - This form is used to notify the IRS of a change of address. Like the Modes 9, it ensures that the correct information is on file for tax purposes, helping avoid issues with correspondence.

- Missouri Employer Registration Form - This document is necessary for new businesses to register as employers in Missouri. Similar to the Modes 9, it collects essential information about the business and its owners.

- Missouri Unemployment Insurance Employer Registration Form - This form registers employers for unemployment insurance. It shares the objective of informing the state about employer status, much like the Modes 9 form does.

- Form 941 (Employer's Quarterly Federal Tax Return) - This IRS form reports income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is similar in that it requires accurate employer information for tax compliance.

- Change of Ownership Form (for LLCs) - This document is used when there is a change in ownership of a limited liability company. Like the Modes 9, it addresses ownership changes and their implications for business operations.

- Florida Firearm Bill of Sale: For those involved in firearm transactions, the detailed Florida firearm bill of sale form resources document the transfer of ownership and protect both parties in the transaction.

- Business License Update Form - This form is used to update business license information with local authorities. Similar to the Modes 9, it ensures that the business's operational details are current and accurate.

- Notice of Business Closure Form - This document is filed when a business ceases operations. It parallels the Modes 9 form in that it communicates critical changes regarding the business's status to the appropriate authorities.