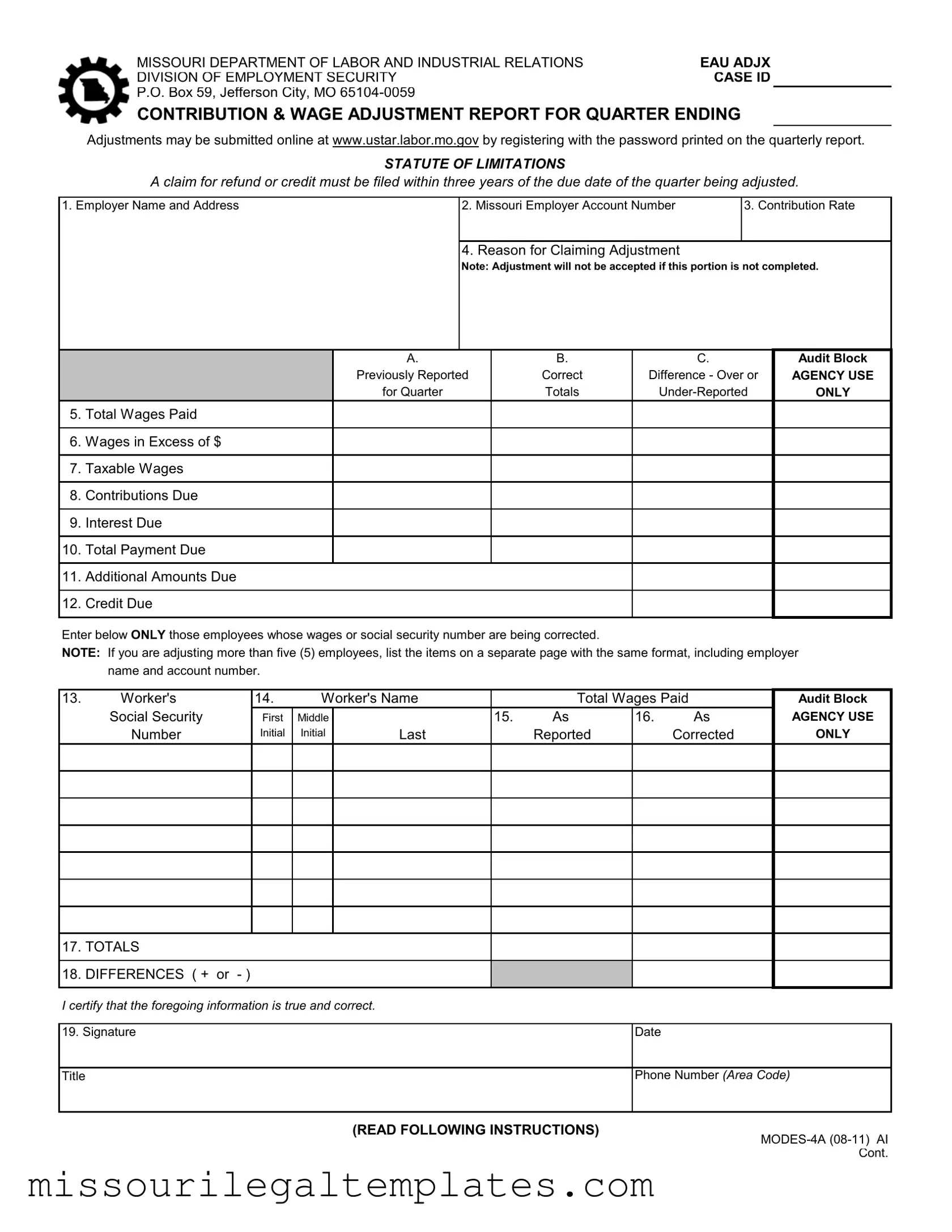

Fill in a Valid Missouri Quarterly Contribution Template

The Missouri Quarterly Contribution form is an essential document for employers in the state, designed to facilitate the adjustment of wage and contribution data reported for each quarter. This form allows employers to correct any discrepancies in their previously submitted reports, ensuring that the information on file is accurate and up-to-date. Key components of the form include the employer's name and address, the Missouri Employer Account Number, and the contribution rate applicable for the quarter in question. Employers must provide a detailed reason for the adjustment, as incomplete submissions may be rejected. Additionally, the form requires a breakdown of total wages paid, taxable wages, and any contributions or interest due. The importance of timely submission cannot be overstated; employers have a three-year statute of limitations to file claims for refunds or credits. For those adjusting more than five employees' wages, it is necessary to submit a separate page, maintaining the same format. Completing this form accurately not only helps maintain compliance with state regulations but also ensures that employers are not overpaying or underpaying their contributions.

Missouri Quarterly Contribution Preview

MISSOURI DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS |

EAU ADJX |

DIVISION OF EMPLOYMENT SECURITY |

CASE ID |

P.O. Box 59, Jefferson City, MO |

|

CONTRIBUTION & WAGE ADJUSTMENT REPORT FOR QUARTER ENDING

Adjustments may be submitted online at www.ustar.labor.mo.gov by registering with the password printed on the quarterly report.

STATUTE OF LIMITATIONS

A claim for refund or credit must be filed within three years of the due date of the quarter being adjusted.

1. Employer Name and Address |

2. Missouri Employer Account Number |

3. Contribution Rate |

|

|

|

4. Reason for Claiming Adjustment

Note: Adjustment will not be accepted if this portion is not completed.

|

|

A. |

B. |

C. |

Audit Block |

|

|

Previously Reported |

Correct |

Difference - Over or |

AGENCY USE |

|

|

for Quarter |

Totals |

ONLY |

|

5. |

Total Wages Paid |

|

|

|

|

|

|

|

|

|

|

6. |

Wages in Excess of $ |

|

|

|

|

|

|

|

|

|

|

7. |

Taxable Wages |

|

|

|

|

|

|

|

|

|

|

8. |

Contributions Due |

|

|

|

|

|

|

|

|

|

|

9. |

Interest Due |

|

|

|

|

|

|

|

|

|

|

10. |

Total Payment Due |

|

|

|

|

|

|

|

|

|

|

11. |

Additional Amounts Due |

|

|

|

|

|

|

|

|

|

|

12. |

Credit Due |

|

|

|

|

|

|

|

|

|

|

Enter below ONLY those employees whose wages or social security number are being corrected.

NOTE: If you are adjusting more than five (5) employees, list the items on a separate page with the same format, including employer name and account number.

13. |

Worker's |

14. |

Worker's Name |

|

Total Wages Paid |

Audit Block |

||||

|

Social Security |

First |

Middle |

|

|

15. |

As |

16. |

As |

AGENCY USE |

|

Number |

Initial |

Initial |

|

Last |

|

Reported |

|

Corrected |

ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. DIFFERENCES ( + or - ) |

|

|

|

|

|

|

|

|

|

|

I certify that the foregoing information is true and correct. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

19. Signature |

|

|

|

|

|

|

Date |

|

|

|

Title

Phone Number (Area Code)

(READ FOLLOWING INSTRUCTIONS)

Cont.

Instructions for Preparation of Contribution and Wage Adjustment Report

This adjustment report is to be used for the purpose of adjusting summary total and wage data previously reported. A separate report is to be used for each quarter to be adjusted and for each separate account number assigned.

Enter at the top of form the ending date of the calendar quarter for which the report is being filed. It is recommended Items 13 through 18 be completed prior to completing Items 5 through 12.

1.Type or print employer’s name and address.

2.Enter the

3.Enter the contribution rate for the calendar quarter being adjusted.

4.Enter the full facts to support the claim for adjustment. As an example, do not say “reported in error” but explain why the wages were reported in error.

5, 6, 7, 8, 9 & 10. Column A. Enter the totals previously reported on the employer’s Quarterly Contribution and Wage Report, or latest Contribution and Wage Adjustment Report for the quarter.

Column B. Enter the correct totals which should have been reported for the quarter. Column C. Enter the difference between Column A and Column B.

The first $11,000 in wages paid to a worker by an employer is taxable in 2006 & 2007. The wage base for calendar year 2008 is $12,000.00. For 2009 the wage base is $12,500.00. For 2010 the wage base is $13,000.

SAMPLE WORKSHEET FOR COMPUTING EXCESS WAGES (Sample based on $13,000)

|

|

FIRST QUARTER |

|

SECOND QUARTER |

THIRD QUARTER |

|

FOURTH QUARTER |

||||||

Social |

|

Total |

Excess |

|

Total |

Excess |

|

Total |

Excess |

|

Total |

Excess |

|

Security |

|

Wages for |

of |

Taxable |

Wages for |

of |

Taxable |

Wages for |

of |

Taxable |

Wages for |

of |

Taxable |

Number |

Name |

Quarter |

$13,000 |

Wages |

Quarter |

$13,000 |

Wages |

Quarter |

$13,000 |

Wages |

Quarter |

$13,000 |

Wages |

John Doe |

12,000.00 |

12,000.00 |

12,000.00 |

11,000.00 |

1.000.00 |

12,000.00 |

12,000.00 |

12,000.00 |

12,000.00 |

||||

Mary Doe |

4,000.00 |

4,000.00 |

4,000.00 |

4,000.00 |

4,000.00 |

4,000.00 |

4,000.00 |

3,000.00 |

1,000.00 |

||||

Totals for Qtr. |

16,000.00 |

16,000.00 |

16,000.00 |

11,000.00 |

5.000.00 |

16,000.00 |

12,000.00 |

4,000.00 |

16,000.00 |

15,000.00 |

1,000.00 |

||

Enter on Line: |

(4) |

(6) |

(4) |

(6) |

(4) |

(6) |

(4) |

(5) |

|||||

11.If this report indicates additional contributions are due, this figure would be Item 10, Column B less Column A. (Make remittance payable to the Division of Employment Security.)

12.If this report indicates a credit is due, this figure would be Item 10, Column A less Column B.

13.Enter the worker’s social security number.

14.Enter the worker’s name (first initial, middle initial and surname) whose wages are being adjusted.

15.Enter the Total Wages Paid previously reported for the worker for the quarter.

16.Enter the correct Total Wages Paid to the worker for the quarter.

17.Enter the total of all entries made in Items 15 & 16.

18.Enter the difference between Items 15 & 16. If Item 15 is more than Item 16, a minus sign should precede the difference. If Item 15 is less than Item 16, a plus sign should precede the difference.

19.This form must be signed by a responsible and duly authorized person.

If there are more than seven workers’ wages to be adjusted, a separate page with the same format as above, including employer name and account number, should be completed. For assistance in completing this form, please call (573)

Mail original of this form to: |

ATTN: Employer Accounts Unit |

|

Division of Employment Security |

|

P.O. Box 59 |

|

Jefferson City, MO |

Common PDF Templates

Prevailing Wage - Sections of the form focus on contractor and contact person details.

Child Support Unemployment - Take note of your local jurisdiction’s specific requirements for filing.

For those interested in buying or selling, a streamlined process can be achieved with a reliable necessary ATV Bill of Sale document. This form is pivotal in ensuring that both parties are protected during the transaction.

Mo 149 - Sellers must exercise care to determine if the claimed exemption is valid.

Dos and Don'ts

When filling out the Missouri Quarterly Contribution form, it’s essential to follow specific guidelines to ensure accuracy and compliance. Here’s a helpful list of things you should and shouldn’t do:

- Do type or print your employer’s name and address clearly.

- Do enter your 14-digit Missouri Employer Account Number accurately.

- Do provide a detailed reason for any adjustments. Avoid vague statements.

- Do double-check all figures before submitting to prevent errors.

- Don’t leave any required fields blank, especially the reason for adjustments.

- Don’t forget to sign the form; it must be signed by an authorized person.

- Don’t submit adjustments for multiple quarters on the same form; use separate forms.

- Don’t ignore the statute of limitations; ensure claims are filed within three years of the due date.

By following these guidelines, you can help ensure a smooth process when submitting your Missouri Quarterly Contribution form. Accuracy is key, and taking the time to review your entries can save you from potential issues down the road.

Key takeaways

When filling out the Missouri Quarterly Contribution form, there are several important points to keep in mind. Here are key takeaways that can help ensure a smooth process:

- Understand the Purpose: This form is specifically for adjusting summary totals and wage data that were previously reported.

- Quarterly Submission: A separate report is required for each quarter and each account number. Be diligent about this to avoid confusion.

- Accurate Information: Enter the employer's name, address, and Missouri employer account number accurately at the top of the form.

- Contribution Rate: Make sure to include the correct contribution rate for the quarter you are adjusting. This is crucial for accurate calculations.

- Provide Detailed Explanations: When claiming an adjustment, explain the reasons clearly. Avoid vague statements like "reported in error." Specificity is key.

- Follow the Format: If adjusting wages for more than five employees, list them on a separate page using the same format, including the employer name and account number.

- Timely Filing: Remember, any claim for refund or credit must be filed within three years of the due date of the quarter being adjusted.

By keeping these points in mind, you can navigate the process more effectively and ensure compliance with Missouri's requirements. If you need assistance, don't hesitate to reach out to the appropriate authorities.

Misconceptions

Misconceptions about the Missouri Quarterly Contribution form can lead to confusion and errors in reporting. The following list addresses six common misconceptions and provides clarifications.

- Only large employers need to file this form. All employers, regardless of size, must file the Missouri Quarterly Contribution form if they have employees. This includes small businesses and those with only a few employees.

- Adjustments can be submitted at any time without limits. There is a statute of limitations for filing claims for refunds or credits. Claims must be submitted within three years of the due date of the quarter being adjusted.

- The form can be submitted without a detailed explanation of adjustments. It is essential to provide full facts supporting any claim for adjustment. Simply stating "reported in error" is not sufficient. A clear explanation is necessary to avoid delays.

- Adjustments for multiple employees can be reported on the same line. If adjustments involve more than five employees, a separate page must be completed. Each page should maintain the same format, including the employer's name and account number.

- Only wage amounts need to be adjusted. The form requires adjustments for both wages and contributions. Employers must accurately report total wages paid, taxable wages, contributions due, and any interest owed.

- The form does not need to be signed. A responsible and duly authorized person must sign the form. This signature confirms that the information provided is true and correct, which is a critical requirement for processing the adjustment.

Understanding these misconceptions can help ensure accurate and timely submissions of the Missouri Quarterly Contribution form. For further assistance, employers are encouraged to reach out to the Division of Employment Security.

Similar forms

The Missouri Quarterly Contribution form plays a crucial role in reporting and adjusting wage data for employers. Several other documents serve similar purposes, each with its own specific focus. Here are six documents that share similarities with the Missouri Quarterly Contribution form:

- IRS Form 941: This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the Missouri form, it requires accurate reporting of wages and taxes, ensuring compliance with federal tax obligations.

- The BBB Complaint Form is an essential document for consumers seeking resolution for their grievances, and more information can be found at TopTemplates.info.

- State Unemployment Insurance (SUI) Forms: Each state has its own SUI form that employers must submit to report wages and calculate unemployment insurance contributions. These forms, much like the Missouri Quarterly Contribution form, require detailed information about wages paid and adjustments made.

- W-2 Forms: Employers use W-2 forms to report an employee's annual wages and the taxes withheld. While the W-2 focuses on individual employee data for the entire year, it also requires accuracy in wage reporting, similar to the adjustment process outlined in the Missouri form.

- Form 1099-MISC: This form is used to report payments made to independent contractors. It shares the need for precise reporting of payments, much like the adjustments made on the Missouri Quarterly Contribution form, ensuring that all income is accurately documented.

- State Payroll Reports: Many states require employers to submit periodic payroll reports, detailing employee wages and taxes withheld. These reports, akin to the Missouri form, help states track compliance with payroll tax laws and ensure that employers are contributing the correct amounts.

- Employee Benefit Adjustment Forms: These forms are used to adjust contributions to employee benefits like health insurance or retirement plans. Similar to the Missouri Quarterly Contribution form, they require detailed information about adjustments and the reasons for those changes.

Understanding these documents can help employers navigate their reporting obligations effectively. Each one plays a vital role in ensuring compliance with tax and employment laws, ultimately benefiting both employers and employees.