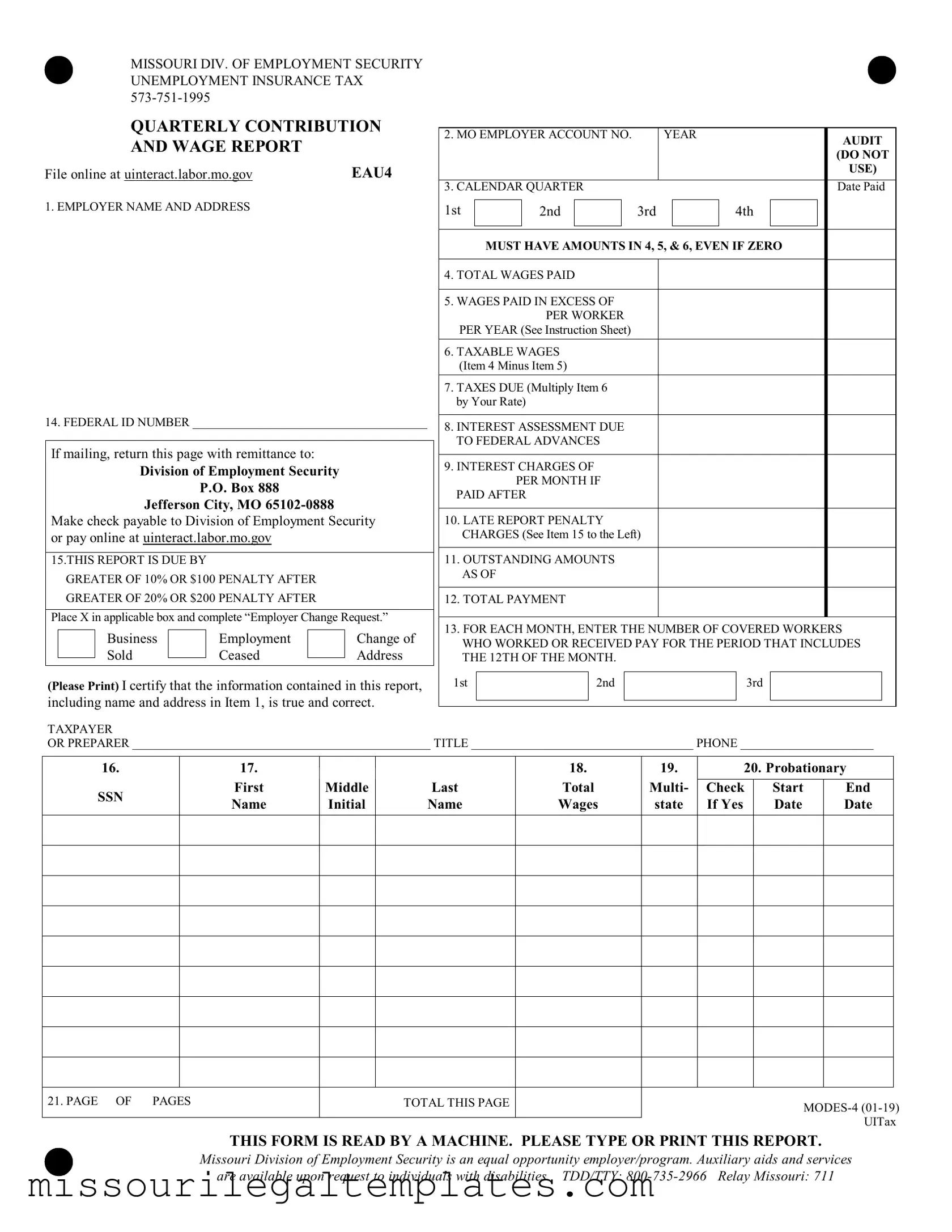

Fill in a Valid Missouri Quarterly Wage Report Template

The Missouri Quarterly Wage Report form is a critical document for employers in the state, serving as a means to report wages paid to employees and calculate unemployment insurance taxes. Each quarter, businesses must complete this form, providing essential information such as the employer's name, address, and federal ID number. Employers must also detail the total wages paid, any wages exceeding the set limit per worker, and the resulting taxable wages. This information is vital for determining the taxes due, which are calculated by applying the employer's tax rate to the taxable wages. Additionally, the form includes sections for reporting late penalties, interest charges, and the number of covered workers for each month. Timely submission is crucial, as penalties apply for late filings. Employers can file online or submit the form via mail, ensuring compliance with state regulations. Understanding the nuances of this form is essential for maintaining accurate records and fulfilling tax obligations.

Missouri Quarterly Wage Report Preview

MISSOURI DIV. OF EMPLOYMENT SECURITY UNEMPLOYMENT INSURANCE TAX

QUARTERLY CONTRIBUTION

AND WAGE REPORT

File online at uinteract.labor.mo.gov |

EAU4 |

1. EMPLOYER NAME AND ADDRESS

14. FEDERAL ID NUMBER _____________________________________

If mailing, return this page with remittance to:

Division of Employment Security

P.O. Box 888

Jefferson City, MO

15.THIS REPORT IS DUE BY

GREATER OF 10% OR $100 PENALTY AFTER

GREATER OF 20% OR $200 PENALTY AFTER

Place X in applicable box and complete “Employer Change Request.”

Business |

|

Employment |

|

Change of |

Sold |

|

Ceased |

|

Address |

|

|

(Please Print) I certify that the information contained in this report, including name and address in Item 1, is true and correct.

2. MO EMPLOYER ACCOUNT NO. |

YEAR |

AUDIT |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(DO NOT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. CALENDAR QUARTER |

|

|

|

|

|

|

|

|

|

Date Paid |

||||||

1st |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

2nd |

|

|

|

3rd |

|

|

4th |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

MUST HAVE AMOUNTS IN 4, 5, & 6, EVEN IF ZERO |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4. TOTAL WAGES PAID |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

5. WAGES PAID IN EXCESS OF |

|

|

|

|

|

|

|

|

||||||||

|

|

|

PER WORKER |

|

|

|

|

|

|

|

|

|||||

PER YEAR (See Instruction Sheet) |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6. TAXABLE WAGES |

|

|

|

|

|

|

|

|

|

|

|

|||||

(Item 4 Minus Item 5) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

7. TAXES DUE (Multiply Item 6 |

|

|

|

|

|

|

|

|

||||||||

by Your Rate) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

8. INTEREST ASSESSMENT DUE |

|

|

|

|

|

|

|

|

||||||||

TO FEDERAL ADVANCES |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. INTEREST CHARGES OF |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

PER MONTH IF |

|

|

|

|

|

|

|

|

||||||

PAID AFTER |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

10. LATE REPORT PENALTY |

|

|

|

|

|

|

|

|

||||||||

|

CHARGES (See Item 15 to the Left) |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

11. OUTSTANDING AMOUNTS |

|

|

|

|

|

|

|

|

||||||||

|

AS OF |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. TOTAL PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||||

13. FOR EACH MONTH, ENTER THE NUMBER OF COVERED WORKERS |

||||||||||||||||

|

WHO WORKED OR RECEIVED PAY FOR THE PERIOD THAT INCLUDES |

|||||||||||||||

|

THE 12TH OF THE MONTH. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st |

|

|

|

|

2nd |

|

|

|

|

3rd |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER

OR PREPARER _______________________________________________ TITLE ___________________________________ PHONE _____________________

16.

SSN

17.

First

Name

Middle

Initial

Last

Name

18.

Total

Wages

19.

Multi-

state

20. Probationary

Check |

Start |

End |

If Yes |

Date |

Date |

|

|

|

21. PAGE OF PAGES

TOTAL THIS PAGE

THIS FORM IS READ BY A MACHINE. PLEASE TYPE OR PRINT THIS REPORT.

Missouri Division of Employment Security is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities. TDD/TTY:

Common PDF Templates

How to Get Child's Birth Certificate Missouri - An option for indicating the county of death is included in the form.

Missouri Cd 147 - Inclusion of attendance records is mandatory for each child listed.

If you're facing legal issues, utilizing a proper Cease and Desist Letter template can be beneficial. For guidance, visit the link for a comprehensive understanding: important Cease and Desist Letter resources.

Tax Clearance Certificate Missouri - This form assists in validating that businesses align with state tax regulations before engaging in new contracts or projects.

Dos and Don'ts

When filling out the Missouri Quarterly Wage Report form, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below are seven things to do and not do during this process.

- Do verify that all employer information, including name and address, is accurate and complete.

- Do ensure that you include the correct Federal ID number on the form.

- Do report total wages paid, even if the amount is zero.

- Do calculate taxable wages correctly by subtracting wages paid in excess of the per worker limit from total wages.

- Do file the report online or mail it to the specified address before the due date to avoid penalties.

- Don't forget to include the number of covered workers for each month in the reporting period.

- Don't submit the form without double-checking for any errors or omissions that could lead to delays or penalties.

Key takeaways

Filling out the Missouri Quarterly Wage Report form is an important task for employers. Here are some key takeaways to keep in mind:

- Accuracy is essential. Ensure that all information, including employer name, address, and wages, is correct. Inaccuracies can lead to penalties or delays.

- Submit on time. The report is due quarterly. Late submissions may incur penalties. Be aware of the deadlines to avoid extra charges.

- Understand the wage calculations. You must report total wages paid, wages exceeding the limit per worker, and taxable wages. Knowing how to calculate these amounts is crucial.

- Online filing is available. You can file the report online at uinteract.labor.mo.gov. This option can save time and streamline the process.

Misconceptions

Understanding the Missouri Quarterly Wage Report form can be challenging. Here are nine common misconceptions that people often have about this important document:

- It's only for large employers. Many believe that only large companies need to file this report. In reality, all employers with employees in Missouri must submit it, regardless of size.

- Filing online is complicated. Some think that filing online is a cumbersome process. However, the online platform is user-friendly and designed to simplify the submission of the report.

- Penalties are rare. There is a misconception that penalties for late filing are seldom enforced. In fact, penalties can be significant, and timely submission is crucial to avoid extra fees.

- Only wages paid in the last quarter need to be reported. Many assume that only the most recent quarter's wages are relevant. However, all wages paid during the quarter must be included, even if they seem minor.

- Independent contractors are included in the report. Some individuals mistakenly think that payments to independent contractors should be reported. This is not the case; only wages paid to employees are included.

- The form is optional if there are no employees. A common belief is that the report is not necessary if no wages were paid. However, employers must still file a report indicating zero wages.

- It's okay to estimate wages. Some think that they can estimate the wages if they don’t have exact figures. Accurate reporting is essential; estimates can lead to penalties and complications.

- All employers have the same tax rate. There is a misconception that tax rates are uniform across all employers. In reality, tax rates vary based on several factors, including the employer's experience rating.

- Once submitted, the report cannot be changed. Some believe that after filing, there is no way to make corrections. In fact, employers can amend their reports if errors are discovered.

By dispelling these misconceptions, employers can better navigate the requirements of the Missouri Quarterly Wage Report form and ensure compliance with state regulations.

Similar forms

The Missouri Quarterly Wage Report form shares similarities with several other documents used for employment and tax reporting. Below is a list of nine such documents, highlighting how they are alike:

- Federal Form 941: This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the Missouri Quarterly Wage Report, it requires information on wages paid and the number of employees.

- State Unemployment Insurance (UI) Report: Similar to the Missouri form, this report is filed by employers to report wages and employment data to state agencies for unemployment insurance purposes.

- W-2 Form: Employers use this form to report annual wages and taxes withheld for each employee. Both the W-2 and the Quarterly Wage Report include total wages and employee information.

- Form 1099-MISC: This form is used to report payments made to independent contractors. Like the Missouri report, it tracks payments made but focuses on non-employee compensation.

- State Payroll Tax Report: This report is similar in that it provides state tax authorities with information on wages paid and taxes withheld, similar to the information required in the Missouri Quarterly Wage Report.

- Employer's Annual Federal Unemployment (FUTA) Tax Return (Form 940): Employers file this form to report their annual FUTA tax liability. It also requires information on wages and employee counts, paralleling the quarterly reporting requirements.

- State Income Tax Withholding Report: This document is used to report state income taxes withheld from employee wages. It shares the focus on wages and employee data with the Missouri Quarterly Wage Report.

- Employee Benefit Plan Report: Employers may need to report on employee benefits provided, including wages associated with those benefits. This report often overlaps in wage reporting aspects.

- BBB Complaint Form: The BBB Complaint Form allows consumers to express grievances about businesses failing to meet expectations, with TopTemplates.info offering guidance on its use.

- Workers' Compensation Insurance Report: This report provides data on employee wages and hours worked for insurance purposes. It is similar in that it tracks employee-related information crucial for compliance.