Fill in a Valid Missouri Real Estate Contract Template

The Missouri Real Estate Contract form is a vital document that outlines the terms and conditions for the sale and purchase of real estate without the involvement of a broker. This contract is designed to protect the interests of both the seller and the buyer, ensuring clarity and mutual understanding throughout the transaction. Key components include the agreement to sell and purchase, where the property is clearly identified along with any included items such as appliances or fixtures. The contract also specifies the sales price and the earnest money deposit required from the buyer, which demonstrates their commitment to the purchase. Financing options are detailed, allowing for cash sales, owner financing, or loan assumptions, with provisions for contingencies based on the buyer's ability to secure financing. Additionally, the form addresses property condition disclosures, including lead-based paint requirements for older homes, and allows for inspections to be conducted at the buyer's expense. Closing procedures, title insurance, and the allocation of closing costs are also outlined, ensuring both parties are aware of their responsibilities. Overall, this contract serves as a comprehensive framework that facilitates a smooth real estate transaction in Missouri.

Missouri Real Estate Contract Preview

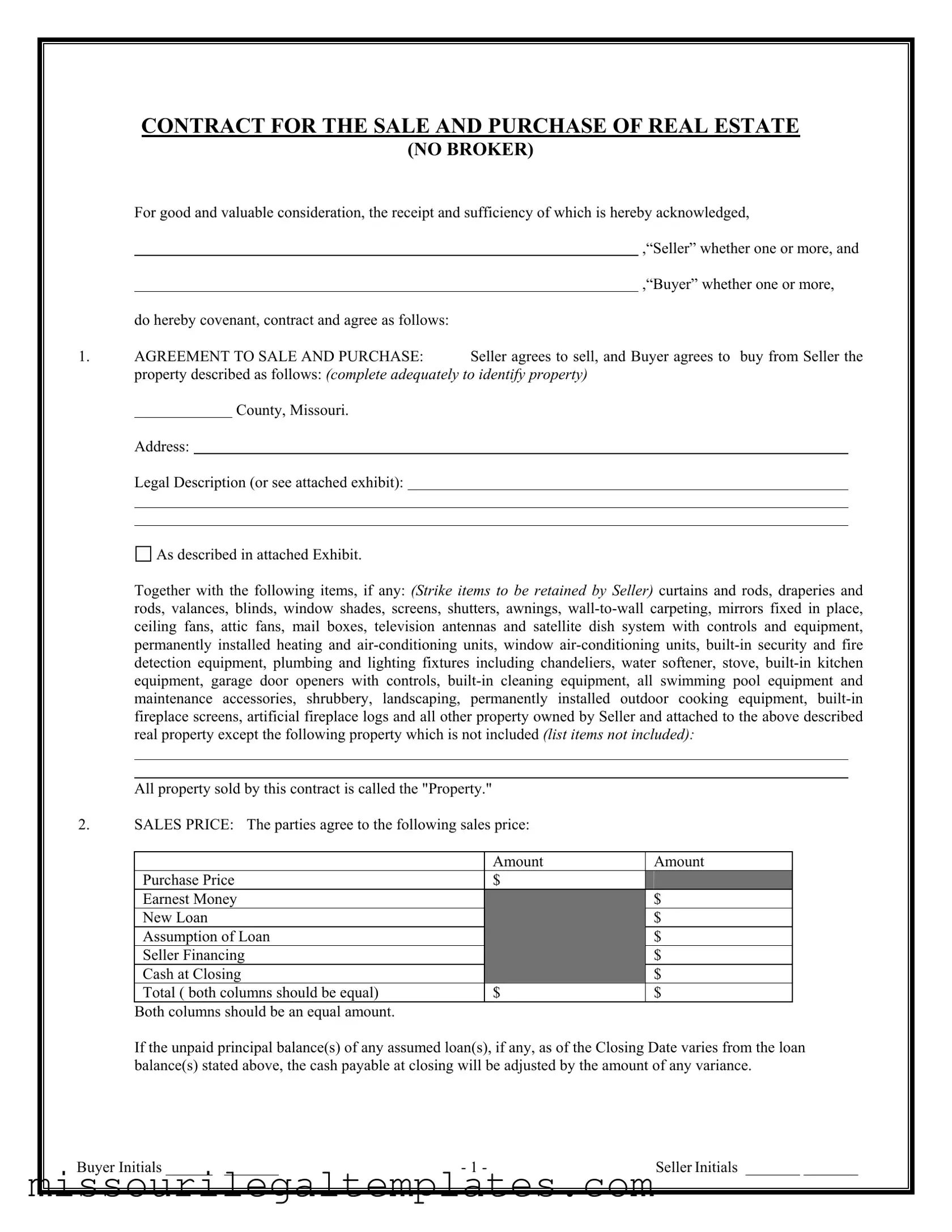

CONTRACT FOR THE SALE AND PURCHASE OF REAL ESTATE

(NO BROKER)

|

For good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, |

||

|

|

|

,“Seller” whether one or more, and |

|

|

|

,“Buyer” whether one or more, |

|

do hereby covenant, contract and agree as follows: |

|

|

1. |

AGREEMENT TO SALE AND PURCHASE: |

Seller agrees to sell, and Buyer agrees to buy from Seller the |

|

property described as follows: (complete adequately to identify property) County, Missouri.

Address:

Legal Description (or see attached exhibit):

As described in attached Exhibit.

Together with the following items, if any: (Strike items to be retained by Seller) curtains and rods, draperies and rods, valances, blinds, window shades, screens, shutters, awnings,

All property sold by this contract is called the "Property."

2.SALES PRICE: The parties agree to the following sales price:

|

Amount |

Amount |

Purchase Price |

$ |

|

Earnest Money |

|

$ |

New Loan |

|

$ |

Assumption of Loan |

|

$ |

Seller Financing |

|

$ |

Cash at Closing |

|

$ |

Total ( both columns should be equal) |

$ |

$ |

Both columns should be an equal amount. |

|

|

If the unpaid principal balance(s) of any assumed loan(s), if any, as of the Closing Date varies from the loan balance(s) stated above, the cash payable at closing will be adjusted by the amount of any variance.

Buyer Initials ______ _______ |

- 1 - |

Seller Initials _______ _______ |

|

|

|

3.FINANCING: The following provisions apply with respect to financing:

CASH SALE: This contract is not contingent on financing.

OWNER FINANCING: Seller agrees to finance |

|

|

|

|

dollars of the purchase price pursuant |

||||||||

to a promissory note from Buyer to Seller of $ |

|

, bearing |

|

|

% interest per annum, payable |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

over a term of |

|

years with even monthly payments, secured by a deed of trust or mortgage lien |

|||||||||||

with the first payment to begin on the |

|

day of |

|

, 20 |

|

. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW LOAN OR ASSUMPTION: This contract is contingent on Buyer obtaining financing. Within

days after the effective date of this contract Buyer shall apply for all financing or noteholder's approval of any assumption and make every reasonable effort to obtain financing or assumption approval. Financing or assumption approval will be deemed to have been obtained when the lender determines that Buyer has satisfied all of lender's financial requirements (those items relating to Buyer's net worth, income and

creditworthiness). If financing or assumption approval is not obtained within days after the effective date hereof, this contract will terminate and the earnest money will be refunded to Buyer. If Buyer intends to obtain a new loan, the loan will be of the following type:

Conventional

VA

FHA

Other:

The following provisions apply if a new loan is to be obtained:

FHA. It is expressly agreed that notwithstanding any other provisions of this contract, the Purchaser (Buyer) shall not be obligated to complete the purchase of the Property described herein or to incur any penalty by forfeiture of earnest money deposits or otherwise unless the Purchaser (Buyer) has been given in accordance with HUD/FHA or VA requirements a written statement by the Federal Housing Commissioner, Veterans Administration, or a Direct Endorsement lender setting forth the appraised value of the Property of

not less than $. The Purchaser (Buyer) shall have the privilege and option of proceeding with consummation of the contract without regard to the amount of the appraised valuation. The appraised valuation is arrived at to determine the maximum mortgage the Department of Housing and Urban Development will insure. HUD does not warrant the value nor the condition of the Property. The Purchaser (Buyer) should satisfy himself/herself that the price and condition of the Property are acceptable.

VA. If Buyer is to pay the purchase price by obtaining a new

Existing Loan Review. If an existing loan is not to be released at closing, Seller shall provide copies of the loan documents (including note, deed of trust or mortgage, modifications) to Buyer within

calendar days from acceptance of this contract. This contract is conditional upon Buyer's review and approval of the provisions of such loan documents. Buyer consents to the provisions of such loan

documents if no written objection is received by Seller from Buyer withincalendar days from Buyer's receipt of such documents. If the lender's approval of a transfer of the Property is required, this contract is conditional upon Buyer's obtaining such approval without change in the terms of such loan, except as may be agreed by Buyer. If lender's approval is not obtained on or before

|

|

|

|

, |

|

|

this contract shall be terminated on such date. The |

|

Seller |

shall |

hall not, be released from liability under such existing loan. If Seller is to be released and |

||||

|

release approval is not obtained, Seller may nevertheless elect to proceed to closing, or terminate this |

||||||

|

agreement in the sole discretion of Seller. |

|

|

||||

|

Credit Information. If Buyer is to pay all or part of the purchase price by executing a promissory note in |

||||||

Buyer Initials ______ _______ |

|

|

|

- 2 - |

Seller Initials _______ _______ |

||

|

|

|

|

|

|

|

|

favor of Seller or if an existing loan is not to be released at closing, this contract is conditional upon Seller's approval of Buyer's financial ability and creditworthiness, which approval shall be at Seller's sole and

absolute discretion. In such case: (l) Buyer shall supply to Seller on or before |

|

, |

,at, Buyer's expense, information and documents concerning Buyer's financial, employment and credit condition; (2) Buyer consents that Seller may verify Buyer's financial ability and creditworthiness; (3) any such information and documents received by Seller shall be held by Seller in confidence, and not released to others except to protect Seller's interest in this transaction; (4) if Seller does

|

not provide written notice of Seller's disapproval to Buyer on or before |

, |

, |

||||||

|

then Seller waives this condition. |

|

|

|

|

|

|

|

|

4. |

EARNEST MONEY: Buyer shall deposit $ |

|

as earnest money with |

|

|

|

upon execution of this |

||

|

contract by both parties. |

|

|

|

|

|

|

|

|

5.PROPERTY CONDITION:

SELLER’S DISCLOSURE OF

Federal law for a residential dwelling constructed prior to 1978. An addendum providing such disclosure |

is |

|

attached |

is not applicable. |

|

Buyer hereby represents that he has personally inspected and examined the

Buyer accepts the property in its

Buyer may have the property inspected by persons of Buyer's choosing and at Buyer's expense. If the inspection report reveals defects in the property, Buyer shall notify Seller within 5 days of receipt of the report and may cancel this contract and receive a refund of earnest money, or close this agreement notwithstanding the defects, or Buyer and Seller may renegotiate this contract, in the

discretion of Seller. All inspections and notices to Seller shall be complete within days after execution of this agreement.

Buyer accepts the Property in its present condition; provided Seller, at Seller’s expense, shall complete the following repairs and treatment:

Buyer agrees that he will not hold Seller or its representatives responsible or liable for any present or future structural problems or damage to the foundation or slab of said property. If the subject residential dwelling was constructed prior to 1978, Buyer may conduct a risk assessment or inspection for the presence of

paint and/or

MECHANICAL EQUIPMENT AND BUILT IN APPLIANCES: All such equipment is sold

"as-is"

"as-is"

shall be in good working order on the date of closing. Any repairs needed to mechanical equipment or appliances, if any, shall be the responsibility of

shall be in good working order on the date of closing. Any repairs needed to mechanical equipment or appliances, if any, shall be the responsibility of

Seller

Seller

Buyer.

Buyer.

UTILITIES: Water is provided to the property by |

|

, Sewer is provided |

||||||

by |

|

|

. Gas is provided by |

. |

||||

|

|

|

|

|

|

|

|

|

Electricity is provided by |

|

. |

|

|

|

|

|

|

Other:

Buyer Initials ______ _______ |

- 3 - |

Seller Initials _______ _______ |

|

|

|

|

The present condition of all utilities is accepted by Buyer. |

|

|

|

|

6. |

CLOSING: The closing of the sale will be on or before |

|

, 20 |

|

, unless extended pursuant |

|

to the terms hereof. |

|

|

|

|

Closing may be extended to within 7 days after objections to matters disclosed in the title abstract, certificate or Commitment or by the survey have been cured.

If financing or assumption approval has been obtained, the Closing Date will be extended up to 15 days if necessary to comply with lender's closing requirements (for example, appraisal, survey, insurance policies,

7.DEED AND TITLE INSURANCE: Seller is to convey title to Buyer by Warranty Deed or

(as appropriate). Within a reasonable time after the effective date of the Contract, but not less than 14 days prior to the Closing Date, Seller agrees to deliver to Buyer a title insurance commitment from a company authorized to insure titles in the State of Missouri. Unless there is a defect in the title to the Property that is not corrected prior to the Closing Date, Buyer may not object to the untimely delivery of the title commitment.

The title commitment shall commit to insure a marketable fee simple title in the Buyer upon the recording of the deed or other document of conveyance. However, title to the Property shall be subject to the conditions in the Contract and to customary covenants, declarations, restrictions, zoning laws, easements, party wall agreements, special assessments, and community contracts of record as of the effective date of the title commitment.

Buyer shall have 10 days after receipt of the title commitment to notify Seller in writing of any valid objections to title to the Property. Seller shall then make a good faith effort to remedy the defects in the title. If Seller does not remedy the title defects before the Closing Date, Buyer may: elect to waive the objections, extend the Closing Date for a reasonable time in order for the Seller remedy the defects, or cancel this Contract. Provided that if the effective date of the Contract and the Closing Date are too close together to allow for the time periods specified above, then the title commitment shall be delivered to the Buyer as soon as possible but in no case later than the Closing Date.

Seller agrees to provide and pay for an owner’s title insurance policy in the amount of the purchase price insuring marketable fee simple title in the Buyer, subject to the permitted exceptions and with the exception of any liens, encumbrances, or other matters affecting title to the Property created by Buyer or arising by virtue of Buyer’s activities or ownership. The policy shall also insure Buyer as of the date of recording of the deed or other document of conveyance, against any lien or right to a lien for services, labor or material imposed by law and not shown by the public records. Seller agrees to comply with the requirements of the title company for issuance of this coverage.

UNLESS OTHERWISE PROVIDED IN THIS CONTRACT, THE OWNER’S TITLE POLICY WILL INCLUDE MECHANIC’S LIEN COVERAGE.

8.APPRAISAL, SURVEY AND TERMITE INSPECTION: Any appraisal of the property shall be the responsibility

of

Buyer

Buyer

Seller. A survey is:

Seller. A survey is:

not required

not required

required, the cost of which shall be paid by

required, the cost of which shall be paid by

Seller

Seller

Buyer. A termite inspection is

Buyer. A termite inspection is

not required

not required

required, the cost of which shall be paid by

required, the cost of which shall be paid by

Seller

Seller

Buyer. If a survey is required it shall be obtained within 5 days of closing.

Buyer. If a survey is required it shall be obtained within 5 days of closing.

9.POSSESSION AND TITLE: Seller shall deliver possession of the Property to Buyer at closing. Title shall be

conveyed to Buyer, if more than one as |

Joint tenants with rights of survivorship, |

tenants in common, |

||

Other: |

|

Prior to closing the property shall remain in the possession of Seller and Seller shall deliver the |

||

property to Buyer in substantially the same condition at closing, as on the date of this contract, reasonable wear and tear excepted.

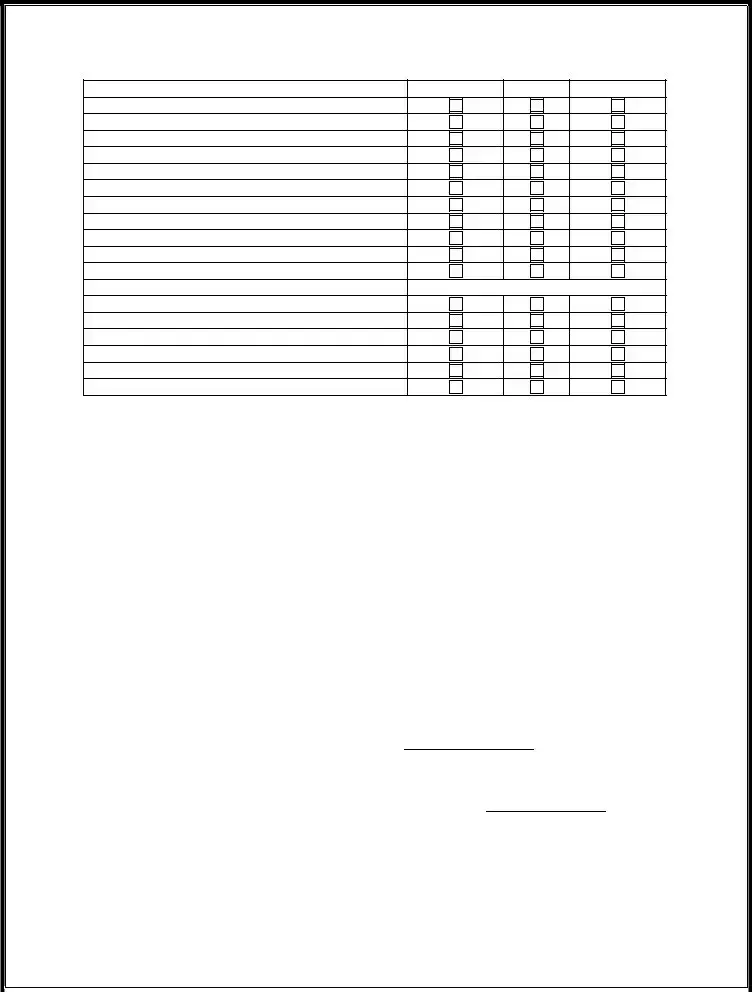

10.CLOSING COSTS AND EXPENSES: The following closing costs shall be paid as provided. (Leave blank if the closing cost does not apply.)

Buyer Initials ______ _______ |

- 4 - |

Seller Initials _______ _______ |

|

|

|

Closing Costs |

Buyer |

Seller |

Both* |

Attorney Fees

Title Insurance

Title Abstract or Certificate

Property Insurance

Recording Fees

Appraisal

Survey

Termite Inspection

Origination fees

Discount Points

If contingent on rezoning, cost and expenses of rezoning

Other:

All other closing costs

* 50/50 between buyer and seller.

11.PRORATIONS: Taxes for the current year, interest, maintenance fees, assessments, dues and rents, if any, will be prorated through the Closing Date. If taxes for the current year vary from the amount prorated at closing, the parties shall adjust the prorations when tax statements for the current year are available. If a loan is assumed and the lender maintains an escrow account, the escrow account must be transferred to Buyer without any deficiency. Buyer shall reimburse Seller for the amount in the transferred account. Buyer shall pay the premium for a new insurance policy. If taxes are not paid at or prior to closing, Buyer will be obligated to pay taxes for the current year.

12.CASUALTY LOSS: If any part of the Property is damaged or destroyed by fire or other casualty loss after the effective date of the contract, Seller shall restore the Property to its previous condition as soon as reasonably possible. If Seller fails to do so due to factors beyond Seller’s control, Buyer may either (a) terminate this contract and the earnest money will be refunded to Buyer, (b) extend the time for performance and the Closing Date will be extended as necessary, or (c) accept the Property in its damaged condition and accept an assignment of insurance proceeds.

13.EARNEST MONEY AND ADDITIONAL DEPOSITS: Upon acceptance of this Contract, unless otherwise agreed, any earnest money references in Paragraph 4 shall be deposited within 10 banking days of the effective date of the

Contract, in an insured escrow account maintained by the Escrow Agent or |

|

. Any additional |

||

deposits shall be deposited within 10 banking days of receipt by Escrow Agent or |

|

|

. If this |

|

Contract is terminated by the express conditions of the Contract, the earnest money shall be returned to the Buyer and neither party shall have any other rights or obligations under this Contract, except as otherwise stated in this

Contract. The parties understand that the Escrow Agent (or) cannot distribute said earnest

money in the even of termination until receiving a written agreement to do so, signed by the parties. If no such agreement can be reached, the money must be handed over to the relevant court clerk for disposition as the court may direct. Buyer and Seller agree that, in the absence of a dispute or written consent to distribution, the failure by

either party to respond in writing to a certified letter from Escrow Agent orwithin 15 days of

receipt thereof or failure to make written demand for return or forfeiture of the earnest money within 60 days of notice of cancellation/termination of this Contract shall constitute consent to the distribution of the earnest money as suggested in such certified letter.

14.DEFAULTS AND REMEDIES: Seller or Buyer shall be in default under this contract if either fails to comply with any material covenant, agreement or obligation within any time limits required by this Contract. Following a default by either Seller or Buyer under this Contract, the other party shall have the following remedies, subject to the other

Buyer Initials ______ _______ |

- 5 - |

Seller Initials _______ _______ |

|

|

|

provisions of this Contract:

a). If Seller defaults, Buyer may either: specifically enforce this Contract and recover damages suffered by Buyer as a result of the delay in the acquisition of the Property; or terminate this Contract by written notice to Seller and, at Buyer’s option, pursue any remedy and damages available at law or in equity. If Buyer elects to terminate this Contract, the earnest money shall be returned to Buyer.

b). If Buyer defaults, Seller may either: specifically enforce this Contract and recover damages suffered by Seller as a result of the delay in the acquisition of the Property; or terminate this Contract by written notice to Buyer and, at Seller’s option, either retain the earnest money as liquidated damages as Seller’s sole remedy (the parties recognizing that it would be extremely difficult to ascertain the extent of actual damages caused by the Buyer’s breach, and that the earnest money represents as fair an approximation of such actual damages as the parties can now determine), or pursue any other remedy and damages available at law or in equity.

15.ATTORNEY'S FEES: The prevailing party in any legal proceeding brought under or with respect to the transaction described in this contract is entitled to recover from the

16.REPRESENTATIONS: Seller represents that as of the Closing Date (a) there will be no liens, assessments, or security interests against the Property which will not be satisfied out of the sales proceeds unless securing payment of any loans assumed by Buyer and (b) assumed loans will not be in default. If any representation in this contract is untrue on the Closing Date, this contract may be terminated by Buyer and the earnest money will be refunded to Buyer. All representations contained in this contract will survive closing.

17.FEDERAL TAX REQUIREMENT: If Seller is a "foreign person", as defined by applicable law, or if Seller fails to deliver an affidavit that Seller is not a "foreign person", then Buyer shall withhold from the sales proceeds an amount sufficient to comply with applicable tax law and deliver the same to the Internal Revenue Service together with appropriate tax forms. IRS regulations require filing written reports if cash in excess of specified amounts is received in the transaction.

17.AGREEMENT OF PARTIES: This contract contains the entire agreement of the parties and cannot be changed except by their written agreement.

18.NOTICES: All notices from one party to the other must be in writing and are effective when mailed to, hand- delivered at, or transmitted by facsimile machine as follows:

To Buyer at:

Telephone ( )

Facsimile ( )

To Seller at:

Telephone ( )

Facsimile ( )

19.ASSIGNMENT: This agreement may not be assigned by Buyer without the consent of Seller. This agreement may be assigned by Seller and shall be binding on the heirs and assigns of the parties hereto.

20.PRIOR AGREEMENTS: This contract incorporates all prior agreements between the parties, contains the entire and final agreement of the parties, and cannot be changed except by their written consent. Neither party has relied upon any statement or representation made by the other party or any sales representative bringing the parties together. Neither party shall be bound by any terms, conditions, oral statements, warranties, or representations not herein contained. Each party acknowledges that he has read and understands this contract. The provisions of this contract

Buyer Initials ______ _______ |

- 6 - |

Seller Initials _______ _______ |

|

|

|

shall apply to and bind the heirs, executors, administrators, successors and assigns of the respective parties hereto. When herein used, the singular includes the plural and the masculine includes the feminine as the context may require.

21.NO BROKER OR AGENTS: The parties represent that neither party has employed the services of a real estate broker or agent in connection with the property, or that if such agents have been employed, that the party employing said agent shall pay any and all expenses outside the closing of this agreement.

22.EMINENT DOMAIN: If the property is condemned by eminent domain after the effective date hereof, the Seller and Buyer shall agree to continue the closing, or a portion thereof, or cancel this Contract. If the parties cannot agree,

this contract shall |

remain valid with Buyer being entitled to any condemnation proceeds at or after closing, or |

be cancelled and the earnest money returned to Buyer.

23.OTHER PROVISIONS

24.TIME IS OF THE ESSENCE IN THE PERFORMANCE OF THIS AGREEMENT.

25.GOVERNING LAW: This contract shall be governed by the laws of the State of Missouri.

26.DEADLINE LIST (Optional) (complete all that apply). Based on other provisions of Contract.

Deadline |

Date |

Loan Application Deadline, if contingent on loan

Loan Commitment Deadline

Buyer(s) Credit Information to Seller

Disapproval of Buyers Credit Deadline

Survey Deadline

Title Objection Deadline

Survey Deadline

Appraisal Deadline

Property Inspection Deadline

Whether or not listed above, deadlines contained in this Contract may be extended informally by a writing signed by the person granting the extension except for the closing date which must be extended by a writing signed by both Seller and Buyer.

EXECUTED the |

|

|

day of |

|

|

, 20 |

|

(THE EFFECTIVE DATE). |

Buyer Initials ______ |

_______ |

- 7 - |

|

Seller Initials _______ _______ |

||||

|

|

|

|

|

|

|

|

|

Buyer |

Seller |

|

|

|

|

Buyer |

Seller |

|

Buyer Initials ______ _______ |

- 8 - |

Seller Initials _______ _______ |

|

|

|

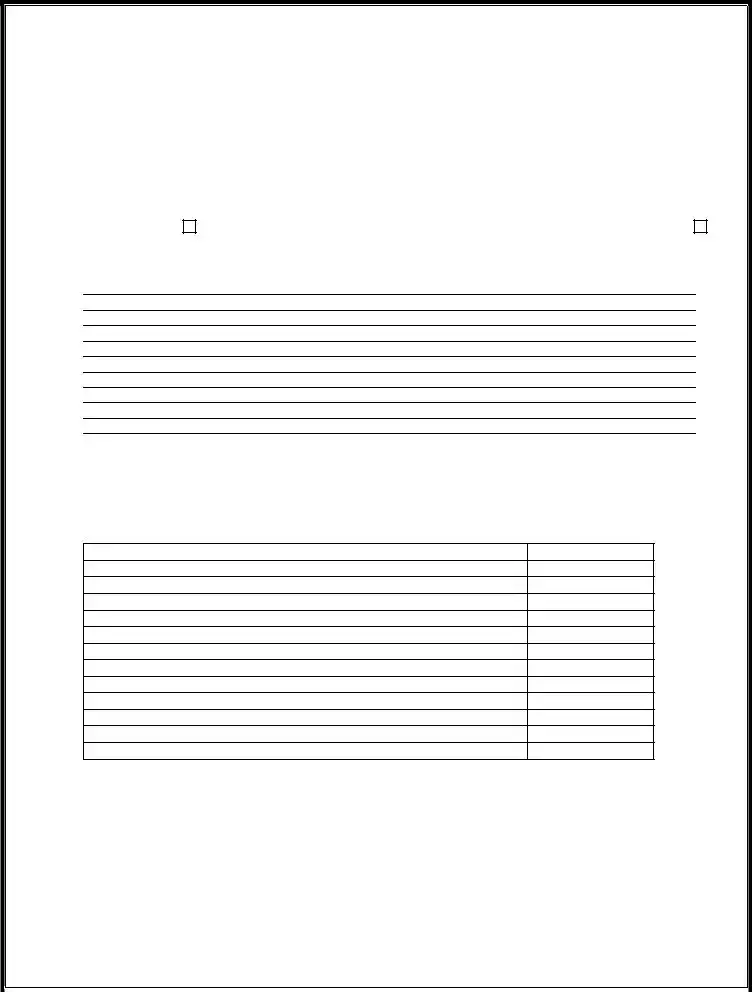

EXHIBIT FOR DESCRIPTION OR ATTACH SEPARATE DESCRIPTION

|

|

|

|

|

RECEIPT |

|

|

|

|

|

|

|||

Receipt of Earnest Money is acknowledged. |

|

|

|

|

|

|

||||||||

Signature: |

|

|

Date: |

, 20 |

|

|||||||||

By: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone ( |

) |

|

|

||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Facsimile ( |

) |

|

|

|

|

||||

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

||||

Buyer Initials ______ _______ |

- 9 - |

Seller Initials _______ _______ |

|

|

|

Common PDF Templates

Missouri Cdl - The waiver is an important tool for streamlining the CDL licensing process for veterans.

Tax Clearance Certificate Missouri - Business owners must maintain updated contact information as required on the form to avoid processing issues.

The BBB Complaint Form not only facilitates the resolution of disputes but is also crucial for educating consumers on their rights and responsibilities. For those looking to understand the process better, resources are available at OnlineLawDocs.com, which provides valuable insights into filing a complaint and navigating the system.

Machs - Applicant citizenship information is required for completion of the form.

Dos and Don'ts

When filling out the Missouri Real Estate Contract form, there are important dos and don'ts to keep in mind. Adhering to these guidelines can help ensure a smooth transaction and protect your interests.

- Do provide complete and accurate information about the property, including the legal description and address.

- Do ensure that the sales price is clearly stated and that both columns (total amounts) are equal.

- Do disclose any known issues with the property to avoid future disputes.

- Do specify any items that are not included in the sale to prevent misunderstandings.

- Don't leave any sections blank; incomplete forms can lead to delays or complications.

- Don't ignore the importance of obtaining financing approval if the contract is contingent on it.

Key takeaways

Understand the Agreement: The Missouri Real Estate Contract form clearly outlines the agreement between the seller and buyer regarding the sale and purchase of real estate. Ensure that all property details are accurately filled out to avoid any misunderstandings.

Sales Price Clarity: Both parties must agree on the sales price and ensure that the amounts in the purchase price and other financial sections match. Discrepancies can lead to complications at closing.

Financing Contingencies: If the buyer requires financing, they must apply for it promptly after the contract's effective date. Be aware of the timelines and requirements for obtaining financing to avoid contract termination.

Property Condition Acceptance: Buyers should be prepared to accept the property in its current condition, unless otherwise agreed. Inspections can be conducted at the buyer's expense, and any defects must be reported within a specified timeframe.

Closing Process: The closing date is crucial and can be extended under certain conditions. Both parties should be aware of their responsibilities regarding closing costs and any necessary documentation to ensure a smooth transaction.

Misconceptions

1. Misunderstanding the Purpose of the Form: Many believe that the Missouri Real Estate Contract form is only for transactions involving real estate agents. In fact, this form is designed for use in transactions without a broker, making it suitable for private sales.

2. Assumption of Loans is Mandatory: Some think that assuming the seller's existing loan is a requirement. However, the contract allows for various financing options, including cash sales and seller financing.

3. Earnest Money is Non-Refundable: A common misconception is that earnest money cannot be refunded. The contract clearly states conditions under which the earnest money will be returned to the buyer if the contract is terminated.

4. Property Condition is Guaranteed: Buyers often assume the property is in perfect condition. The contract specifies that the property is sold "as-is," and buyers should conduct their own inspections.

5. Closing Date is Fixed: Many believe that the closing date is set in stone. In reality, the contract allows for extensions under certain circumstances, such as financing approvals or title issues.

6. Title Insurance is Optional: Some think that title insurance is not necessary. However, the contract requires the seller to provide a title insurance commitment, ensuring a marketable title for the buyer.

7. Buyer Cannot Negotiate Repairs: There's a belief that buyers cannot negotiate repairs after inspections. The contract allows buyers to notify sellers of defects and negotiate repairs or cancel the contract.

8. All Closing Costs are Paid by the Buyer: Many assume that buyers are responsible for all closing costs. The contract specifies which costs are to be paid by the seller, buyer, or shared between both parties.

9. The Seller is Always Liable for Property Damage: Some think sellers are liable for any damage to the property until closing. The contract states that if the property is damaged, the seller must restore it unless circumstances beyond their control prevent them from doing so.

10. Financing Approval is Automatic: There is a misconception that financing approval will always be granted. The contract emphasizes that buyers must actively apply for financing and meet the lender's requirements to avoid contract termination.

Similar forms

- Purchase Agreement: Similar to the Missouri Real Estate Contract, a purchase agreement outlines the terms and conditions under which a buyer agrees to purchase property from a seller. It includes details like the purchase price, closing date, and contingencies.

- Lease Agreement: A lease agreement is a contract between a landlord and tenant. Like the real estate contract, it specifies the terms of occupancy, payment, and responsibilities for maintenance and repairs.

- Bill of Sale: A Texas Bill of Sale is vital for formally transferring ownership of personal property and can be found at https://topformsonline.com/texas-bill-of-sale/, ensuring legal protection for both the buyer and seller involved in the transaction.

- Option to Purchase Agreement: This document gives a buyer the right to purchase a property at a later date. It shares similarities with the Missouri Real Estate Contract in its detailed terms regarding price and conditions.

- Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent. It outlines the terms under which the agent will market the property, akin to how the Missouri Real Estate Contract specifies the sale terms.

- Seller Financing Agreement: This document allows the seller to finance the buyer's purchase. It includes terms similar to those found in the Missouri Real Estate Contract regarding payment plans and interest rates.

- Closing Disclosure: This document outlines the final terms of a mortgage loan. It is similar to the Missouri Real Estate Contract in that it details costs associated with the transaction and the obligations of both parties.

- Deed of Trust: A deed of trust secures a loan on real estate. It parallels the Missouri Real Estate Contract by establishing obligations and rights related to property ownership and financing.

- Title Insurance Policy: This policy protects against defects in title. Like the Missouri Real Estate Contract, it provides assurances about ownership and the condition of the property being sold.

- Property Disclosure Statement: This document requires sellers to disclose known issues with the property. It complements the Missouri Real Estate Contract by ensuring transparency about the property’s condition.