Fill in a Valid Missouri Template

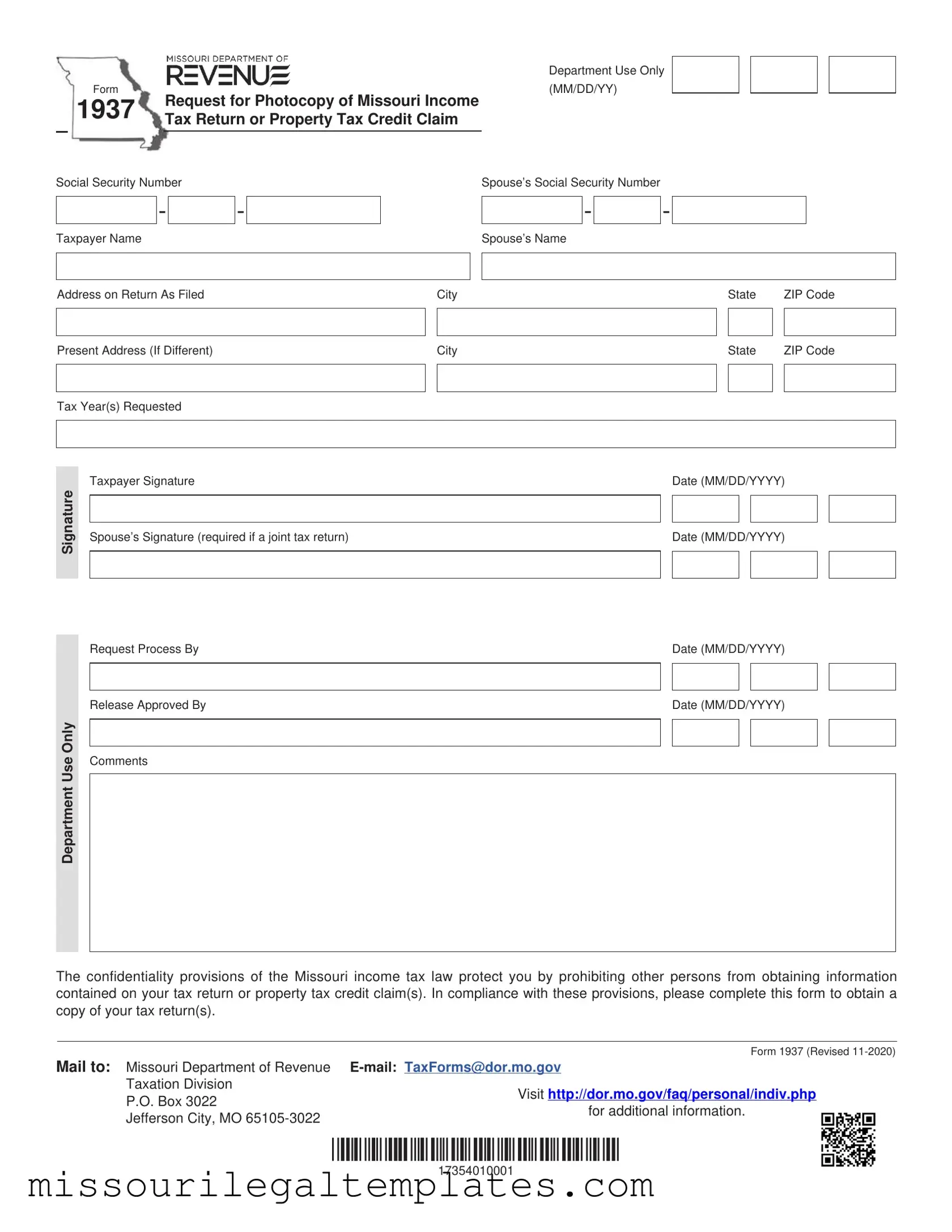

The Missouri form, specifically designed for requesting a photocopy of an income tax return or property tax credit claim, serves as a crucial tool for taxpayers seeking to access their financial records. This form requires essential information such as the taxpayer's name, Social Security number, and the tax year(s) for which records are requested. If the tax return was filed jointly, the spouse's details must also be provided. This ensures that the request complies with the confidentiality provisions of Missouri tax law, which safeguards personal information from unauthorized access. Completing the form accurately is vital, as it allows the Missouri Department of Revenue to process the request efficiently. The form also includes spaces for signatures, confirming the identity of the requester and, when applicable, the spouse. Once filled out, it can be mailed or emailed to the appropriate department, ensuring that taxpayers can retrieve their important financial documents with relative ease. For those needing further assistance, additional resources are available through the Missouri Department of Revenue's website.

Missouri Preview

|

|

|

Department Use Only |

|

Form |

Request for Photocopy of Missouri Income |

(MM/DD/YY) |

1937 |

|

||

Tax Return or Property Tax Credit Claim |

|

||

|

|

|

|

|

|

|

|

Social Security Number |

Spouse’s Social Security Number |

||

|

- |

|

- |

|

Taxpayer Name

Address on Return As Filed

Present Address (If Different)

Tax Year(s) Requested

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

Spouse’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP Code |

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

Department Use Only

Taxpayer Signature

Spouse’s Signature (required if a joint tax return)

Request Process By

Release Approved By

Comments

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

The confidentiality provisions of the Missouri income tax law protect you by prohibiting other persons from obtaining information contained on your tax return or property tax credit claim(s). In compliance with these provisions, please complete this form to obtain a copy of your tax return(s).

Form 1937 (Revised

Mail to: Missouri Department of Revenue

Taxation Division |

Visit http://dor.mo.gov/faq/personal/indiv.php |

|

P.O. Box 3022 |

||

for additional information. |

||

Jefferson City, MO |

||

|

*17354010001*

17354010001

Common PDF Templates

Missouri Teaching Certificate - Documentation should exhibit transparency and legitimacy in experience claims.

To successfully navigate the application process, businesses should ensure they have all necessary information ready before submitting the Florida Lottery DOL-129 form. This comprehensive application not only initiates the acquisition of a Florida Lottery ID, but also includes important background checks for compliance. For those looking for detailed guidance on the application, you can find the document here, which outlines all requirements and expectations clearly.

Prevailing Wage - Section 290.210 through 290.340 RSMo governs the use of this form.

Dos and Don'ts

When filling out the Missouri form for a request for a photocopy of your income tax return or property tax credit claim, it is important to follow certain guidelines to ensure a smooth process. Below is a list of things to do and avoid.

- Do provide accurate Social Security Numbers for both the taxpayer and spouse, if applicable.

- Do include the correct tax year(s) you are requesting.

- Do sign the form where indicated, ensuring both taxpayer and spouse signatures are present if it is a joint return.

- Do use the address as it appears on your return to avoid any discrepancies.

- Don't forget to check for any missing information before submitting the form.

- Don't use an outdated version of the form; ensure you have the latest revision.

- Don't provide false information, as this could lead to delays or legal issues.

- Don't neglect to mail the form to the correct address: Missouri Department of Revenue, P.O. Box 3022, Jefferson City, MO 65105-3022.

By adhering to these guidelines, individuals can facilitate a more efficient request process for their tax documents.

Key takeaways

When filling out the Missouri form for obtaining a photocopy of your income tax return or property tax credit claim, keep the following key takeaways in mind:

- Accurate Information: Ensure that you provide your Social Security Number and the Social Security Number of your spouse, if applicable. This information is crucial for processing your request.

- Signature Requirement: If you are filing a joint tax return, both you and your spouse must sign the form. Missing signatures can delay the processing of your request.

- Confidentiality Protection: The Missouri income tax law protects your information. Only authorized individuals can access the details contained in your tax return or property tax credit claims.

- Submission Details: Mail the completed form to the Missouri Department of Revenue at the specified address. For additional inquiries, you can email or visit the provided website.

Misconceptions

Understanding the Missouri form can be challenging, and there are several misconceptions that people often have. Here are four common misunderstandings:

- Misconception 1: The form is only for individuals who owe taxes.

- Misconception 2: Only the taxpayer can request a copy of the tax return.

- Misconception 3: The process takes a long time.

- Misconception 4: The form is complicated and difficult to fill out.

This is not true. The Missouri form, specifically the Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim, can be used by anyone who needs a copy of their tax return, regardless of their tax status. Whether you are expecting a refund, owe taxes, or simply need a record for personal reasons, this form is applicable.

While it is true that the taxpayer must sign the form, spouses can also request a copy if they filed a joint return. The signature of the spouse is required in such cases, ensuring that both parties have access to the information.

The processing time for obtaining a copy of your tax return can vary, but many requests are handled promptly. Submitting the form correctly and providing all necessary information can help expedite the process. It is advisable to allow some time for processing but do not assume it will take an excessive amount of time.

In reality, the form is designed to be straightforward. It requires basic information such as names, Social Security numbers, and addresses. By following the instructions carefully, most individuals can complete it without difficulty. If you have questions, resources are available to assist you.

By addressing these misconceptions, individuals can navigate the process of obtaining their tax documents more effectively. Understanding the purpose and requirements of the Missouri form is crucial for anyone needing access to their tax information.

Similar forms

- IRS Form 4506: This form allows taxpayers to request a copy of their federal tax return from the IRS. Similar to the Missouri form, it requires personal information, including Social Security numbers and addresses, to verify identity and process the request.

- IRS Form 4506-T: This is a request for a transcript of a tax return rather than a full copy. Like the Missouri form, it protects taxpayer information and is used to confirm income for various purposes, such as loans or financial aid.

- California Form Reg 262 - This form is essential for documenting the transfer of vehicles and vessels in California. Similar to the Missouri form, it requires detailed personal information and is vital for ensuring all sales comply with legal standards, making resources like smarttemplates.net invaluable for completing it accurately.

- State Tax Return Request Forms: Many states have similar forms for requesting copies of state tax returns. These forms typically ask for taxpayer identification details and the tax year, mirroring the structure of the Missouri form.

- Property Tax Credit Claim Forms: These forms are used to apply for property tax credits. They often require similar information, such as Social Security numbers and property details, reflecting the intent to provide tax relief.

- Taxpayer Identification Number (TIN) Request Forms: These forms allow individuals to request a TIN for tax purposes. They also require personal information and serve to protect taxpayer privacy, akin to the Missouri form's confidentiality provisions.

- Income Verification Request Forms: These are often used by lenders to verify income for loans. They require taxpayer information and are designed to ensure that sensitive data remains confidential, similar to the Missouri form.

- Financial Aid Tax Documentation Forms: When applying for financial aid, students may need to provide tax return copies. These forms ask for similar information as the Missouri form, emphasizing the importance of confidentiality and proper identification.