Blank Operating Agreement Template for Missouri

In the realm of business formation, the Missouri Operating Agreement form stands as a critical document for limited liability companies (LLCs). This agreement serves as the backbone of an LLC, outlining the internal operations, management structure, and financial arrangements among members. It addresses key elements such as the distribution of profits and losses, voting rights, and the procedures for adding or removing members. By providing clarity on these essential aspects, the Operating Agreement helps prevent misunderstandings and disputes among members. Moreover, it can also specify the roles and responsibilities of each member, ensuring that everyone is on the same page regarding their contributions and obligations. While not legally required in Missouri, having a well-drafted Operating Agreement is highly advisable, as it not only reinforces the limited liability status of the business but also enhances its credibility in the eyes of potential investors and partners. Understanding the nuances of this form can empower LLC members to operate with confidence and foresight.

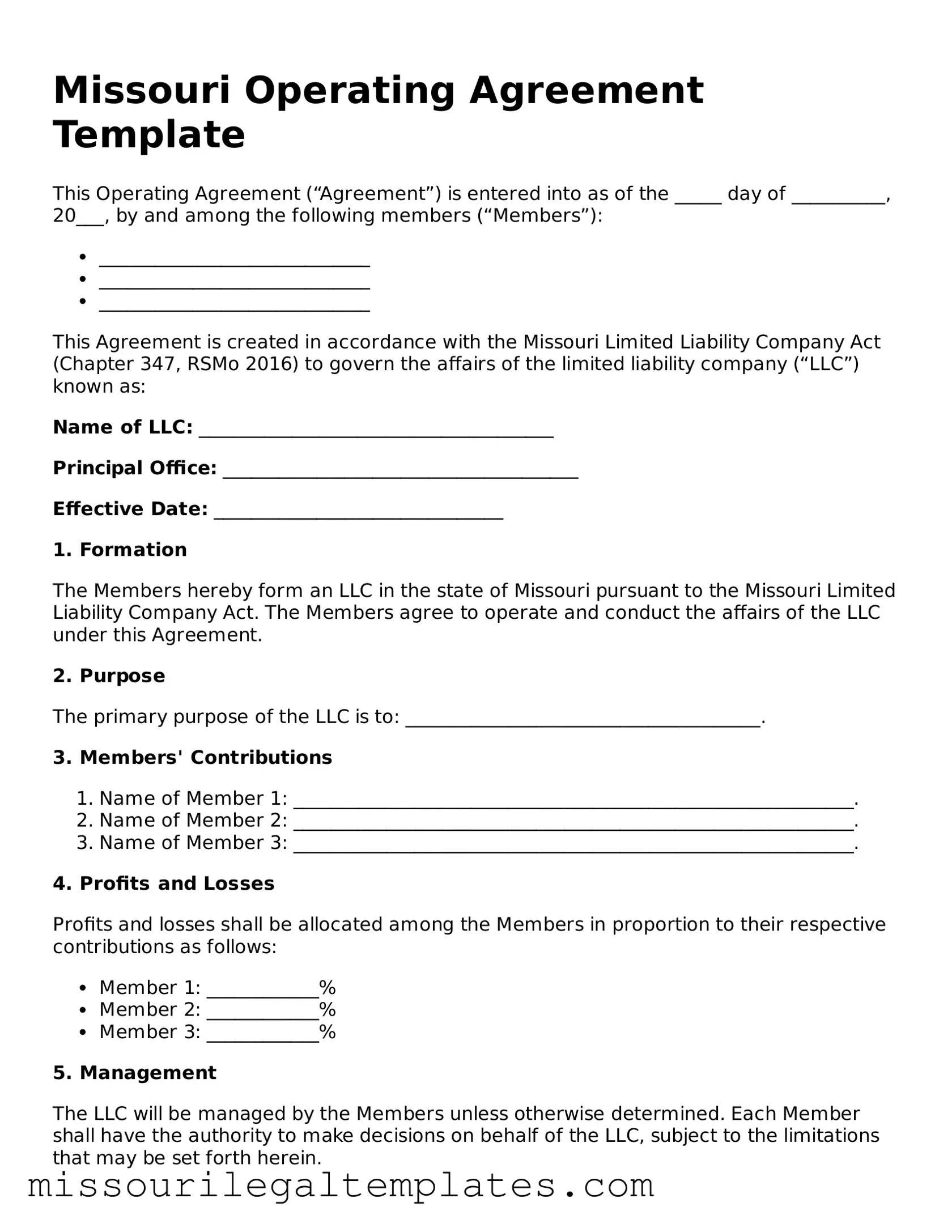

Missouri Operating Agreement Preview

Missouri Operating Agreement Template

This Operating Agreement (“Agreement”) is entered into as of the _____ day of __________, 20___, by and among the following members (“Members”):

- _____________________________

- _____________________________

- _____________________________

This Agreement is created in accordance with the Missouri Limited Liability Company Act (Chapter 347, RSMo 2016) to govern the affairs of the limited liability company (“LLC”) known as:

Name of LLC: ______________________________________

Principal Office: ______________________________________

Effective Date: _______________________________

1. Formation

The Members hereby form an LLC in the state of Missouri pursuant to the Missouri Limited Liability Company Act. The Members agree to operate and conduct the affairs of the LLC under this Agreement.

2. Purpose

The primary purpose of the LLC is to: ______________________________________.

3. Members' Contributions

- Name of Member 1: ____________________________________________________________.

- Name of Member 2: ____________________________________________________________.

- Name of Member 3: ____________________________________________________________.

4. Profits and Losses

Profits and losses shall be allocated among the Members in proportion to their respective contributions as follows:

- Member 1: ____________%

- Member 2: ____________%

- Member 3: ____________%

5. Management

The LLC will be managed by the Members unless otherwise determined. Each Member shall have the authority to make decisions on behalf of the LLC, subject to the limitations that may be set forth herein.

6. Meetings

Regular meetings of the Members shall be held at least annually. Special meetings may be called as needed by any Member.

7. Indemnification

The LLC shall indemnify each Member to the fullest extent permitted by law against any losses or expenses arising from the conduct of the LLC's business.

8. Amendments

This Agreement may be amended only by a written agreement signed by all Members.

9. Dissolution

The LLC may be dissolved with the unanimous consent of the Members or as otherwise required by law.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

_______________________________ _______________________________

Name of Member 1 Name of Member 2

_______________________________

Name of Member 3

Other Missouri Templates

How to Write an Employee Handbook - Understand the importance of workplace safety and emergency procedures.

Missouri Form 768 Instructions - A Motor Vehicle Power of Attorney can prevent delays in crucial vehicle transactions.

Free Rental Lease Agreement Template - Describes the rights of entry for the landlord to inspect the property.

Dos and Don'ts

When filling out the Missouri Operating Agreement form, it is crucial to approach the task with care. Here are nine essential do's and don'ts to consider:

- Do read the entire form carefully before starting.

- Do ensure that all members' names and addresses are accurately listed.

- Do clarify the roles and responsibilities of each member.

- Do include a clear outline of how profits and losses will be distributed.

- Do consult with legal counsel if you have questions about specific provisions.

- Don't leave any sections blank; incomplete forms may cause delays.

- Don't use vague language; be as specific as possible in your descriptions.

- Don't forget to date and sign the agreement once completed.

- Don't overlook the importance of keeping a copy for your records.

Key takeaways

When filling out and using the Missouri Operating Agreement form, keep these key takeaways in mind:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your business. It serves as an internal document that clarifies roles and responsibilities.

- Identify Members: Clearly list all members of the LLC. Include their names and addresses to ensure everyone involved is documented.

- Define Management Structure: Specify whether your LLC will be member-managed or manager-managed. This distinction is important for decision-making processes.

- Outline Profit Distribution: Describe how profits and losses will be allocated among members. This section helps prevent disputes later on.

- Include Voting Rights: Establish the voting rights of each member. This ensures that everyone knows how decisions will be made within the LLC.

- Address Amendments: Include a process for amending the Operating Agreement. This allows flexibility as your business evolves.

- Consult Professionals: While the form can be filled out independently, consider consulting a legal professional for guidance. Their expertise can help ensure compliance with state laws.

Misconceptions

Understanding the Missouri Operating Agreement form can be challenging, especially with the various misconceptions that exist. Here are nine common misconceptions that individuals may have:

- Operating Agreements Are Only for Large Businesses: Many believe that only large corporations need an operating agreement. In reality, any business entity, including small LLCs, benefits from having one. It provides a clear structure and guidelines, regardless of size.

- Operating Agreements Are Not Legally Required: While Missouri law does not mandate an operating agreement for LLCs, having one is crucial. It protects the members' interests and outlines the management structure, helping to prevent disputes.

- All Operating Agreements Are the Same: Some think that a generic template will suffice for any business. However, each operating agreement should be tailored to fit the specific needs and goals of the business and its members.

- Once Created, the Agreement Cannot Be Changed: This is a common myth. Operating agreements can be amended as needed. Regularly reviewing and updating the agreement ensures it remains relevant to the business's evolving needs.

- Only Lawyers Can Draft Operating Agreements: While legal advice can be beneficial, many business owners can draft their own operating agreements. However, it is advisable to consult a professional to ensure that all necessary elements are included.

- Operating Agreements Are Only for Multi-Member LLCs: Some believe that single-member LLCs do not need an operating agreement. In fact, having one is still beneficial as it provides clarity on management and operations, even for a sole owner.

- Operating Agreements Are Only About Finances: While financial aspects are important, operating agreements cover much more. They also address management roles, decision-making processes, and procedures for adding or removing members.

- Filing the Operating Agreement with the State Is Necessary: Many assume that they must file their operating agreement with the state. In Missouri, this is not required. The agreement should be kept on file for internal purposes only.

- Operating Agreements Are Not Important for Liability Protection: Some individuals underestimate the role of an operating agreement in protecting personal assets. A well-drafted agreement helps maintain the limited liability status of the LLC, safeguarding personal assets from business liabilities.

Addressing these misconceptions can help ensure that business owners in Missouri are better informed about the importance and functionality of the Operating Agreement form. Understanding its significance can lead to better management and protection of their business interests.

Similar forms

- Bylaws: Bylaws serve as the internal rules and procedures for managing a corporation. Like an Operating Agreement, they outline the roles of officers, procedures for meetings, and voting rights. Both documents establish the governance structure of an organization.

- Partnership Agreement: A Partnership Agreement details the relationship between partners in a business. Similar to an Operating Agreement, it defines each partner's contributions, responsibilities, and profit-sharing arrangements. Both documents aim to clarify the expectations and obligations of each party involved.

- Shareholder Agreement: This document is used by corporations to outline the rights and obligations of shareholders. Much like an Operating Agreement, it addresses issues such as the transfer of shares and decision-making processes, ensuring that all parties understand their roles and rights within the company.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of a partnership between two or more entities for a specific project. Similar to an Operating Agreement, it specifies the contributions, responsibilities, and profit distribution among the parties, thereby providing a clear framework for collaboration.

- Limited Liability Company (LLC) Articles of Organization: These articles are filed with the state to officially form an LLC. While the Operating Agreement governs internal operations, the Articles of Organization establish the existence of the LLC and include basic information about the business, such as its name and address.

- Non-Disclosure Agreement (NDA): An NDA is designed to protect sensitive information shared between parties. While it serves a different purpose, both an NDA and an Operating Agreement establish clear expectations regarding confidentiality and the handling of proprietary information within a business context.