Blank Transfer-on-Death Deed Template for Missouri

In the realm of estate planning, the Missouri Transfer-on-Death Deed (TODD) form serves as a valuable tool for property owners looking to simplify the transfer of real estate upon their death. This legal document allows individuals to designate one or more beneficiaries who will automatically receive ownership of the property without the need for probate. By utilizing a TODD, property owners can maintain control over their assets during their lifetime while ensuring a seamless transition for their heirs. The form requires specific information, including the names of the property owner(s) and the designated beneficiary(ies), as well as a legal description of the property. Importantly, the TODD must be properly executed and recorded with the appropriate county office to be valid. This process not only helps to avoid potential disputes among heirs but also minimizes the costs and complexities often associated with traditional estate transfers. Understanding the nuances of the Missouri Transfer-on-Death Deed can empower property owners to make informed decisions about their estates and provide peace of mind for themselves and their loved ones.

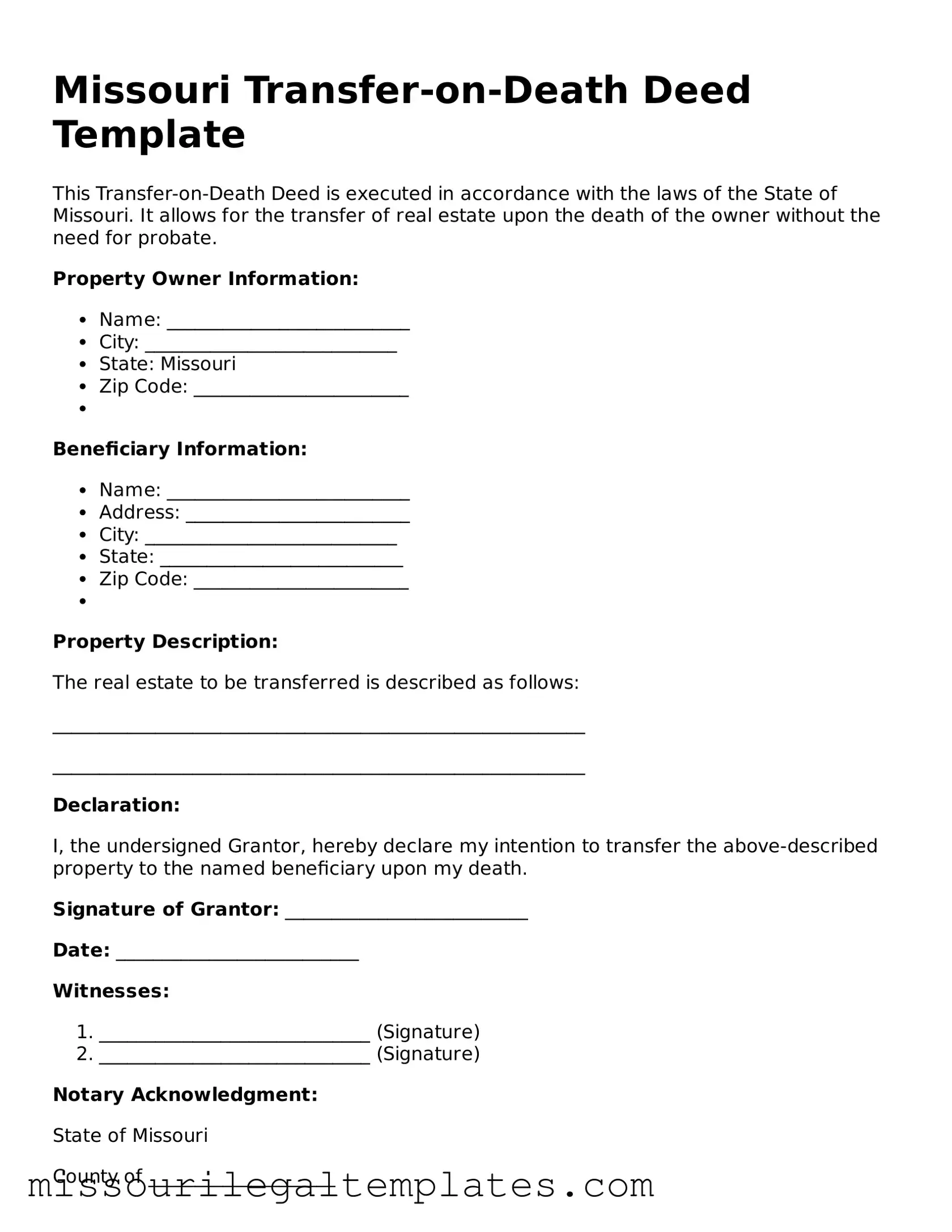

Missouri Transfer-on-Death Deed Preview

Missouri Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of the State of Missouri. It allows for the transfer of real estate upon the death of the owner without the need for probate.

Property Owner Information:

- Name: __________________________

- City: ___________________________

- State: Missouri

- Zip Code: _______________________

Beneficiary Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: _______________________

Property Description:

The real estate to be transferred is described as follows:

_________________________________________________________

_________________________________________________________

Declaration:

I, the undersigned Grantor, hereby declare my intention to transfer the above-described property to the named beneficiary upon my death.

Signature of Grantor: __________________________

Date: __________________________

Witnesses:

- _____________________________ (Signature)

- _____________________________ (Signature)

Notary Acknowledgment:

State of Missouri

County of ____________________

On this _____ day of ____________, 20____, before me, a notary public, personally appeared ____________________________, known to me (or proved to me on the oath of ________________) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

____________________________ (Notary Public)

My commission expires: ______________________

Other Missouri Templates

Non-disclosure - The NDA helps define the scope of confidentiality in business dealings.

Missouri Form 1957 - Commonly used in private sales where no dealer or intermediary is involved.

Dos and Don'ts

When filling out the Missouri Transfer-on-Death Deed form, it is essential to approach the task with care. Here are some important guidelines to follow:

- Do ensure that you have the correct legal description of the property.

- Do clearly identify the beneficiaries by full name.

- Do sign the deed in the presence of a notary public.

- Do record the deed with the appropriate county office.

- Don't use vague terms when describing the property.

- Don't forget to check for any local regulations that may apply.

Following these guidelines can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose.

Key takeaways

The Missouri Transfer-on-Death Deed form allows property owners to designate beneficiaries to receive their property upon their death without going through probate.

- Eligibility: Only individuals who own real property in Missouri can create a Transfer-on-Death Deed.

- Beneficiary Designation: The deed must clearly name one or more beneficiaries who will inherit the property.

- Revocation: The property owner can revoke or change the deed at any time before their death.

- Execution Requirements: The deed must be signed by the property owner and notarized to be valid.

- Filing: The completed deed must be filed with the local county recorder’s office to take effect.

- Effect on Taxes: The property remains part of the owner’s estate for tax purposes until their death.

- Impact on Creditors: The property may still be subject to claims from creditors after the owner's death.

- No Immediate Transfer: The property does not transfer to the beneficiary until the owner passes away.

- Legal Advice: It is advisable to consult with a legal professional to ensure the deed meets all requirements and reflects the owner’s intentions.

Misconceptions

Understanding the Missouri Transfer-on-Death Deed form can be challenging due to several misconceptions. Here are five common misunderstandings:

-

It automatically transfers property upon death.

The Transfer-on-Death Deed does not transfer property immediately. The transfer occurs only after the death of the owner, provided the deed is properly recorded and valid.

-

All property can be transferred using this deed.

This deed can only be used for real estate. It does not apply to personal property, such as vehicles or bank accounts.

-

It eliminates the need for a will.

While a Transfer-on-Death Deed can help avoid probate for the property it covers, it does not replace the need for a will. A will is still necessary for other assets and to address other estate matters.

-

The property cannot be sold after the deed is executed.

Property owners can sell or mortgage the property at any time after executing a Transfer-on-Death Deed. The deed does not restrict their ownership rights during their lifetime.

-

All heirs must agree to the transfer.

The property owner has the right to designate beneficiaries without needing consent from other heirs. The designated beneficiaries receive the property directly upon the owner's death.

Similar forms

- Will: A will allows individuals to specify how their assets will be distributed upon their death. Like a Transfer-on-Death Deed, it provides a way to transfer property, but it typically requires probate, whereas a Transfer-on-Death Deed does not.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It allows individuals to name beneficiaries who will receive assets directly upon death, similar to how a Transfer-on-Death Deed designates heirs for real property.

- Living Trust: A living trust is a legal entity that holds assets during a person's lifetime and specifies how they will be distributed after death. Both a living trust and a Transfer-on-Death Deed facilitate the transfer of property outside of probate, ensuring a smoother transition.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. Upon the death of one owner, the property automatically passes to the surviving owner, similar to how a Transfer-on-Death Deed transfers property upon death without going through probate.